On tablescapes, in kitchens and baths, garden and great rooms, green seems to be having a moment.

Photo courtesy of marvin Windows and Doors

Extensive windows and doors link to greenery outside and bring nature inside.

©istockphoto.com / martinwimmer

Photo JORDAN STEAD / Amazon

Not too long ago, it was difficult to spy even a vestige of green in a room. Today, it’s almost impossible to find new interior scheme without a spark of green. “We’re seeing emerald green used on everything from walls to cabinetry to tile and even lighting,” observes Sue Wadden, director of color marketing at Sherwin-Williams.

Green hues, especially deep vibrant shades, seem to be everywhere along with living greenery and plants. But rather than a fleeting color preference, the passion for green might also be the first sprouts, indications of a more transformative movement — biophilic design — edging into residential design and architecture.

Biophilia, according to consultants Terrapin Bright Green, refers to humankind’s innate biological connection with nature. Although social psychologist Eric Fromm first coined the phrase “biophilia,” the concept wasn’t popularized until the 1980s when biologist Edward O. Wilson took up the mantle. Biophilic design introduces natural elements, organic forms, light and water into the built environment. Research shows integrating natural elements increases productivity, enhances creativity and improves mental health. “We’re getting evidence-based design, especially in the healthcare industry, that just by having a view of the outside a patient recovers quicker and requires less medication and attention after surgery,” observes Miami designer B. Pila.

“The use of green in home interiors is picking up steam,” explains Stephanie Pierce, director of design for MasterBrand Cabinets. “There are a variety of shades cropping up today, particularly in the kitchen and bath from deep emeralds to soft sages and dark ivies. Deep, moody hues are making a bold impact on these spaces. The effect is as cozy as a warm blanket.”

“Touches of rich, verdant green can make it feel as though you’ve escaped to the outdoors and are soaking up the invigorating effects of nature — without even leaving your home,” shares Wadden.

“With the growing interest in wellbeing in all aspects of our lives, including the home, people are using nature-inspired lush greens to bring comfort into spaces,” explains Christine Marvin, director of corporate strategy and design at Marvin Windows and Doors. “Emerald green is a bold color that perfectly balances glamour with calmness, evoking a sense of relaxation and inspiration.”

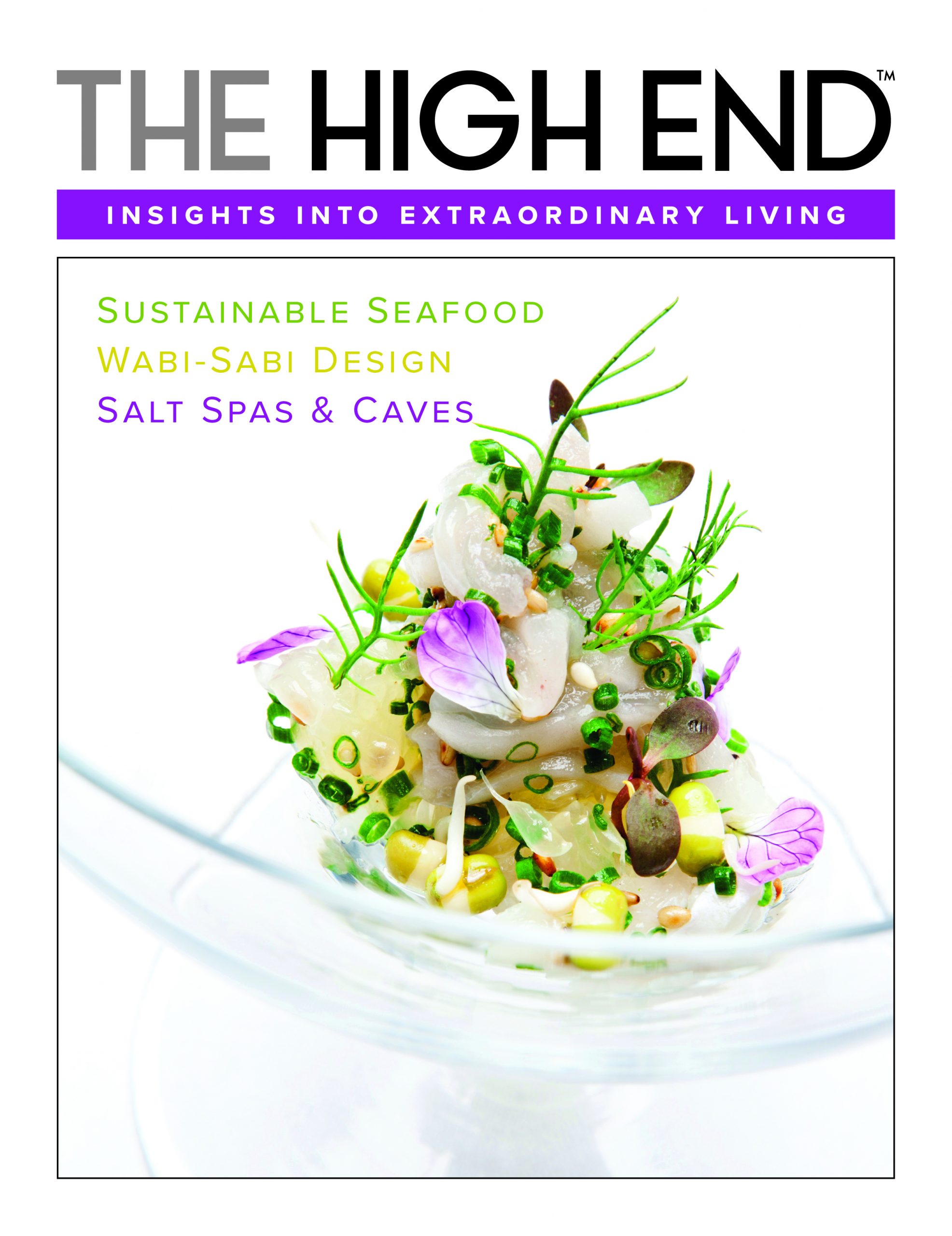

Three spherical conservatories forested with more than 40,000 plants and trees allow Amazon employees to work while surrounded by nature.

Photo courtesy of sherwin-williams

Green, whether an accent or main course, is a mainstay on design menus.

Until recently, biophilic principles were utilized primarily in commercial structures, and the inclusion of nature — living plants, park-like oases, organic forms, natural materials including wood and stone, water and light — is revamping corporate settings including Amazon, Apple and Google. Last year, Amazon’s long-awaited biophilic project, The Spheres, opened on the site of its original headquarters. The three glass and steel domes are forested with more than 40,000 plants. Along with plants and a four-story-tall green wall, there are waterfalls, a river, walkways and meeting spaces. Hotels and other commercial spaces are implementing biophilic design practices but with more modest expressions.

For residential buildings, the addition of natural elements and connections with the outside has been an ongoing evolution, partially in response to consumer attitudes rather than a dedication to biophilia. Designers are just catching on. “Consumers are more educated in wanting healthier lifestyle choices,” says Angela Harris, creative director and principal of TRIO, an award-winning interior design firm in Denver.

Current residential design merges indoors and out, organic and humanmade, using visual and real connections. The integration of outdoor spaces is a response to consumer lifestyle demands, but the end result potentially delivers the cognitive, psychological and physiological benefits biophilia advocates tout.

“We’ve noticed an increase in demand for bigger windows over the past five years, as more people want to feel connected to the world around us while we’re indoors,” comments Marvin. “In a world that’s become fast paced and where our living and workspaces are merging, letting light in allows us to feel alive and connected to space outside our homes. Incorporating large windows into the home plays a significant role in achieving this ‘outdoors in’ feel and connecting to nature. We’re also seeing a pull towards large window walls, or many windows that are mulled together to create a wall of light that heightens the experience of light in a home.”

It may seem biophilia is just another quick moving fad, but more than one organization is promoting the concept and actively formulating certifications for buildings under the auspices of groups such as the International Living Future Institute, a Seattle-based nonprofit that encourages sustainable practices and wellness. In 2016, a cadre of architects, builders and researchers formed the Biophilic Design Initiative to further the movement. Biophilia is also part of the U.S. Green Building Council’s WELL Building Standard.

Whether or not biophilia will exert a long-term influence on design remains to be seen, but there is a good chance wellness and nature will be an important aspect of design’s new normal.