Who’s Who in Luxury Real Estate Members Recognized More Than 150 Times in REAL Trends 500

REAL Trends recently published their 33rd Annual REAL Trends 500, a leading report ranking the performance of the top residential real estate firms in the United States.

The list ranks the Top 500 firms ranked by both closed transactions sides as well as closed sales volume throughout 2019. Additionally, they acknowledged firms that closed at least one billion dollars’ worth of residential real estate in the surveyed year.

This year, Who’s Who in Luxury Real Estate members were recognized more than 150 times in the REAL Trends 500. Many members were included more than once and ranked among the top ten in their respective categories!

Congratulations to all Who’s Who in Luxury Real Estate members who made this prestigious list!

Residential real estate leaders have been looking to REAL Trends for more than 30 years for timely and trusted information and analysis through their monthly newsletter, conferences and publications. They provide vital data and insight into market trends that are imperative to the luxury real estate community, and inclusion in the REAL Trends 500 is a high honor.

Please visit REAL Trends 500 to view the entire report; keep an eye out for our latest LRE® promotion on page 3.

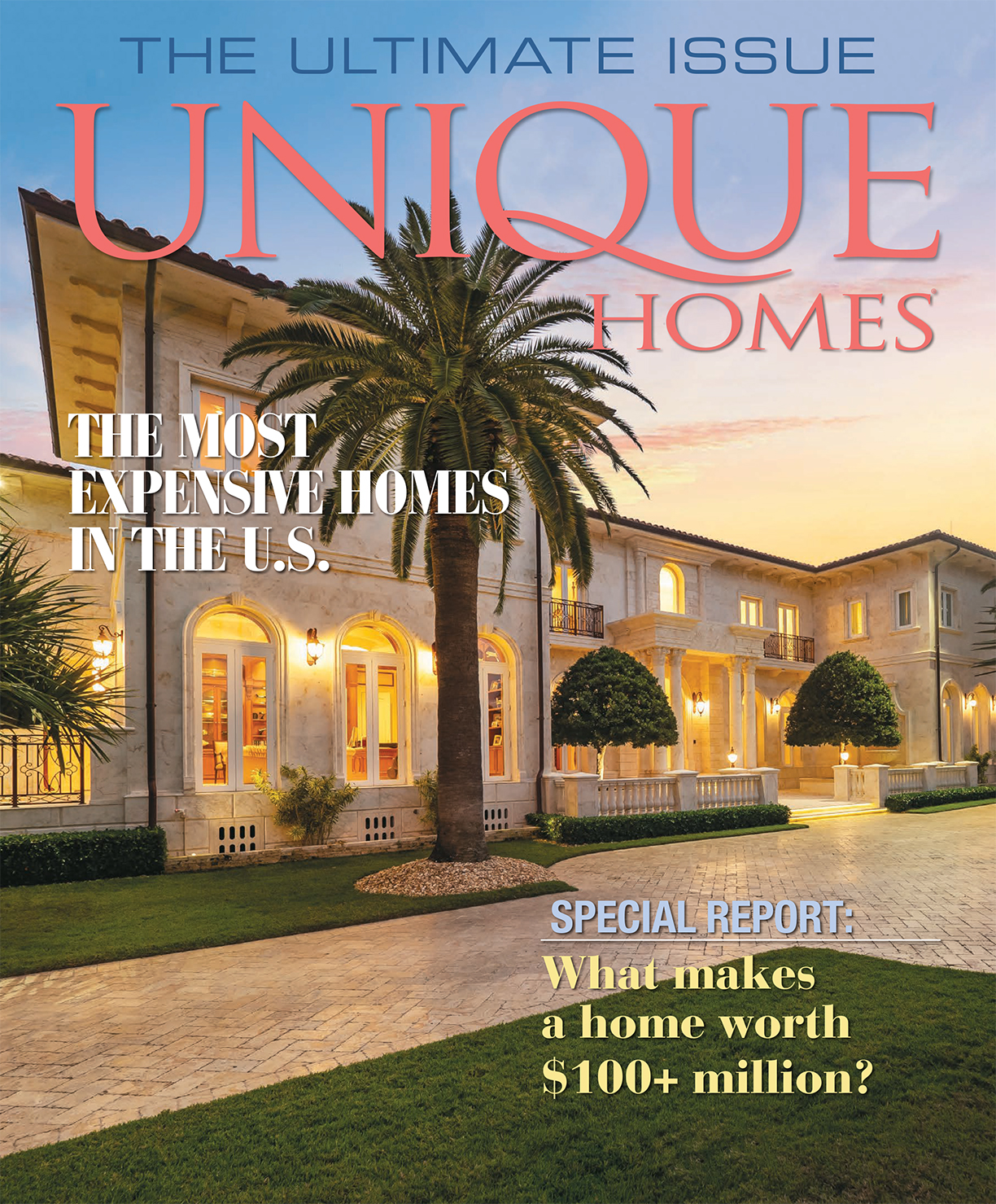

Photo at left provided by Who’s Who in Luxury Real Estate.

Featured photo by Luan Oosthuizen.

Stacy Gottula, one of the premier luxury real estate brokers with the Agency, a firm located in Beverly Hills, has officially redirected her career toward working with the Eklund and Gomes team associated with Douglas Elliman.

This is just three months after the Eklund-Gomes team expanded into Los Angeles, where Frederik Eklund, the long-time star of the hit TV series “Million Dollar Listing New York,” moved in order to dominate the West Coast.

“I’ve been chasing her and we’ve been talking for a long time,” he said of Gottula to The Real Deal. “What she’s bringing, which is something I really need at this point is the experience pitching big, big listings.”

Photo courtesy of Tigran Tovmasyan, One Sixty Studios

Gottula credits her decision to transfer onto the Eklund-Gomes to wanting to work in a team atmosphere again. At the Agency, she worked solo on most projects — and she told The Real Deal that after seeing the team at Douglas Elliman, “it felt right.”

This is another big hit for the Agency, as Stacy Gottula brings the firms’ lost brokers to a count of 45 in Los Angeles.

Inman News names Joyce Rey, a Coldwell Banker Global Luxury Property Specialist affiliated with the Beverly Hills South office of Coldwell Banker Residential Brokerage, to the inaugural Golden I Hall of Fame, the highest honor in luxury real estate presented to the top luxury agents and brokers in the United States.

“I am so honored to join the Golden I Hall of Fame,” said Rey. “I have an energetic spirit and am always committed to excellence in everything I do. I could not have achieved this honor without my wonderful clientele, fabulous staff and colleagues, and sensational friends and family.”

Over her more than four-decade career, Rey has amassed more than $4 billion in career sales. With a dazzling list of accolades, awards and sales records, she is known, most of all, for her incomparable knowledge of the luxury marketplace, her acute ability to negotiate even the most complex transactions and her particular talent for putting clients at ease.

No stranger to success, Rey is designated one of “The Los Angeles 500 Most Influential People” by the Los Angeles Business Journal, named the “First Lady of Luxury Real Estate” by the Chinese media, described as the “Billionaire’s Broker” by Luxury Real Estate and called the “Grand Dame of Real Estate” by the Los Angeles Times. She is also ranked in the Top 20 Luxury Brokers in L.A. County by “The Real Deal” Los Angeles. Passionate about helping others, she serves on the Southern California Executive Board for UNICEF, the Los Angeles Library Foundation Advisory Board and the Coldwell Banker Community Foundation Board. She has also is a member of the Women’s Presidents Organization and served on the Board of the Blue Ribbon Support Group for the Music Center.

The Ultra High End’s new story: No longer is ultra high-end real estate in the U.S. just about NYC and LA.

Beverly Hills, Manhattan and Miami, along with one or two other cities, have traditionally been the locus of the most expensive and most exclusive real estate in the U.S. Now, in an increasingly diverse geographic mix from Boston to Boulder, more properties align with what the industry calls the ultra or premier market. Uber prices in these locations might not number in the hundreds of millions of dollars, but they are the highest of that market. And, no matter the ZIP code, it’s likely that properties at the very top share similar attributes.

Worldwide, the number of millionaires and billionaires continues to grow, with the U.S. still accounting for the largest share of mega wealthy. “I think the change we are seeing in the growth in the ultra high-end is directly correlated to the growth of significant wealth in the world. More people have more significant money,” says Stephanie Anton, president of Luxury Portfolio International.

“Interestingly,” she says, “it’s diversifying too. In the U.S., no longer is the story just about NYC and LA. Bottom line, the shift in location is a change that influences the high end of the housing market and the demand for significant properties in a way we have never seen before.”

Photo courtesy iStockPhoto.com / Sean Pavone

Traditionally, the very top of the market in Boston was the purview of the city’s legendary Brahmins. But the revitalization of downtown neighborhoods and growth of tech and finance, along with globally recognized educational institutions, are revamping the high end in both the city and suburbs. In 2018, there were 82-percent more luxury property sales than in 2014. Not only are more properties considered high end, but new luxury towers mix with traditional blue-chip estates.

Photo courtesy of iStockPhoto / MattGush

Jonathan Radford with Coldwell Banker Residential Brokerage in New England is representing the highest priced estate outside Central Boston. Woodland Manor is a $38 million property on more than 7 acres, five miles from the city centerline in Brookline. Photo courtesy of Boston Virtual Imaging.

The highest listing in the city is a $45 million penthouse occupying the entire 60th floor of the new Millennium Tower. Jonathan Radford with Coldwell Banker Residential Brokerage in New England is representing the highest priced estate outside Central Boston. Woodland Manor is a $38 million property on more than 7 acres, five miles from city center in Brookline. “Over the ast 5 years, we have seen consistent growth in the number of luxury property transactions outside of the city of Boston, in the range of 10 percent to 30 percent per year, with the exception of 2016, when a shortage of inventory resulted in a 2.7-percent decline in the number of luxury sales. In 2018, there were 58-percent more luxury property sales than in 2014,” explains Radford. “In the city, growth in the number of luxury transactions has exceeded 25 percent a year.”

Beverly Hills agent Joyce Rey, head of the Estates Division of Coldwell Banker Global Luxury, has brokered a number of record-setting transactions both regionally and nationally. “I never cease to be amazed at the constant ascension of real estate values. Any look in the rearview mirror at real estate values is always surprising because people realize and regret not buying more real estate. And it seems shocking today because when I founded Rodeo Realty in 1979, $1 million was a pretty major property.” The customary benchmark for luxury in many places has been $1 million. Now, in many locales, including Boulder, Colorado, the $1 million home is basically a redo. Boulder agents say luxury doesn’t begin until $2.5 million,

but even then, as Megan Bach with Colorado Landmark Realtors points out, “some homes are not necessarily luxury.” A more reliable gauge in Boulder, she says, is price per square foot, a measure often applied to premier markets in New York and California. She estimates luxury in Boulder begins at approximately $1,000 per square foot. The highest priced home currently on the market is a $9 million property on 15.42 acres outside of town with extensive views and strong indoor/outdoor connections. Having “great indoor views typically price bumps any home in any neighborhood here, as is the case in any view locale,” says Bach, emphasizing what might be a universal truth for uber luxury: No matter the location, the better the views and outdoor connections, the higher the price.

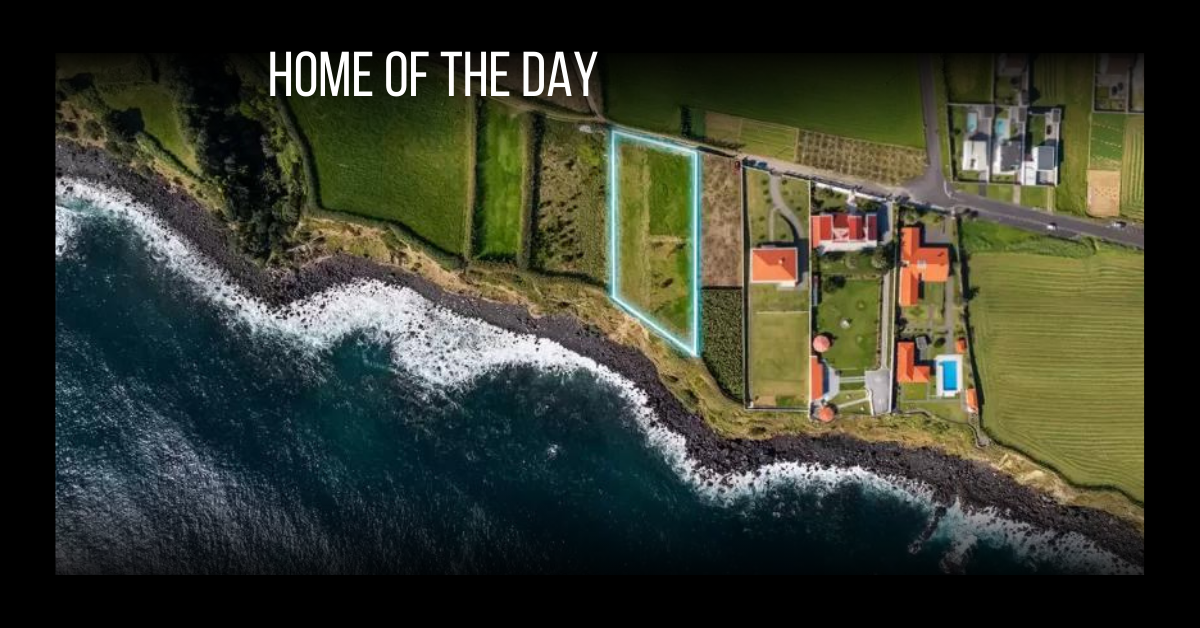

Utah ay seem an unlikely spot for the ultra high-end, but prices now approach $10 million with the highest residential listing $26 million. Photo courtesy of Summit Sotheby’s International Realty.

“Sales over $10 million are very rare, but I think they are coming,” observes Debra Johnston, with Berkshire Hathaway HomeServices Georgia Properties. Photo courtesy of Debra Johnston.

Along Florida’s west coast, values in upscale resort locales traditionally trailed Miami or Palm Beach. Now, “prices for beachfront in Naples begin at $20 million,” says Tade Bua Bell of John R. Wood Properties. The recent sale of a gulf-front property in the exclusive Port Royal for $48 million illustrates how much demand has changed. The home was eventually torn down and replaced with new construction. Another property also in Port Royal and destined for a tear down sold for $28 million. In the ultra-sphere, a $10 million or $20 million tear down is not an anomaly.

The uber market in Atlanta starts around $5 million to $7 million for new construction. “Sales over $10 million are very rare, but I think they are coming,” observes Debra Johnson, with Berkshire Hathaway HomeServices Georgia Properties. “Buckhead is running out of large land lots, which is driving up the cost to build a dream house. The time it takes to build a new luxury home in the $5 million range could take up to 2 years. Many prospective buyers are instead buying the best flat lot they can find in a resale, and renovating the house to their taste level,” observes Johnson. In Atlanta, Los Angeles and other cities, lots suitable for prestige properties are at a premium.

In New York City, ultra luxury starts at $10 million, but Martin Eiden of Compass Real Estate says if you are looking for the “Wow factor” you have to be in the $18 to $40 million range. And anyone considering a trophy — what Eiden calls “I made it big” — property, generally has to look at $60 million and up. In the ultra-sphere, trophy properties often have over-the-top list prices. Greenwich, Connecticut, is a blue-chip bastion for prestige properties. Topping price points is a mid-country European style estate offered at $29.5 million, followed by a $22.5 million property, also in a premier estate setting. Old money locales tend to be timeless. In the Washington, D.C., metropolitan area, uber prices currently do not exceed

the $20 million mark. The exception is a $62 million estate in McLean, Virginia, on 3.2 acres overlooking the Potomac and comprised of a main residence and The Marden House, which was designed and constructed by Frank Lloyd Wright in 1959. Also extraordinary is underground parking for 30 cars, bespoke interiors by Thomas Pheasant and some of the finest views of the river in the region. In the ultra realm, truly singular properties, particularly those with provenance, often merit singular list prices. Parking for dozens of cars might seem over the top, but garage space and parking are both important to high net worth buyers, according to Rey. What else is considered a must-have? Smart home tech, larger closets, a gym, kitchens and great rooms that flow, screening and media rooms. But, Rey emphasizes, “Location is still the number one consideration for buyers.”

The increasing diversity of locations in properties at the highest price points is basically a numbers game: more buyers, greater degrees of wealth, and price appreciation in the overall market. Simply, there are more people in more locations with greater net worth. Utah is an unlikely spot for the ultra high-end, but prices now approach $10 million with the highest residential listing at $26 million. The market changed in 2016, according to Kerry Oman, with Summit Sotheby’s International Realty in Park City, who brokered the sale of a $13.5 million property in Provo Canyon, the highest-priced transaction in recent years. For the ultra market, the $5 million to $7 million range is typical, and $7 million to $10 million is no longer the exception, says Oman. In spite of growing national interest in Park City, demand for uber properties is most likely to come from home-grown wealth. In the ultra-realm, U.S. buyers dominate a majority of locations today.

“A lot of money is coming out of Silicon Valley, and Seattle now. And we’re seeing a great migration of significant wealth to more resort markets like Hawaii, Florida and Texas, due to an aging affluent population and also attractive tax laws,” shares Anton. Taxes are only one driver for a new geographic mix of buyers in Florida and Georgia. Even before the tax law was passed, brokers like Bua Bell were reporting more interest from Colorado and California. Brokers in Naples and other cities are also seeing buyers from New York, New Jersey, Massachusetts and Connecticut. Johnson says there has been a big increase in out-of-state buyers in Georgia in the last year. Ultra-luxury buyers in Greenwich have broadened in terms of their use of these properties and what they are looking for, observes Robin Kencel with Compass Real Estate. Some plan to make Greenwich their fulltime residence. Others are looking for a weekend or a summer retreat. “As people discover Greenwich’s natural beauty, from having four beaches to 600-plus nature trails to a breadth of year-round activities and its sophisticated, diverse and wholesome vibe, it is becoming an attractive alternative to the Hamptons,” she says.

In the Washington D.C., metropolitan area, uber prices currently do not exceed the $20 million mark. The exception is a $62 million estate in McLean, Virginia. Photo courtesy of Gordon Beal.

Sui generis is how some characterize the ultra market, but as distant and disconnected as it may seem, the ultra sector does not exist in a separate vacuum. “Everything’s fluid in luxury real estate,” says Gary Gold with Hilton & Hyland in Beverly Hills, noting it’s not like the stock market where there is a definite price at the closing bell. “It doesn’t work that way. There are so many nuances. In general, when you have record sales, when you have record numbers of sales, when you have lots of positive activity, it has an overall significant effect on everything,” he explains.

“The rise in significant prices is a reflection of demand but also is consistent with the rise we’re seeing in luxury prices across the board,” says Anton. “According to Realtor.com, in Q4 of 2018, prices in the top 5 percent of markets in 1,000 U.S. cities closed at an increase of 4.7 percent year over year. It’s a bit of that old saying, ‘a rising tide lifts all boats.’” With pricing heading into the stratosphere, an ultra purchase might seem capricious — a product of desire rather than a well thought

out choice. Instead, no matter the price, it’s still a question of value. Every once in a while a buyer might make a crazy purchase, but agents say that’s a very rare occurrence. Even though prices might be well into the tens of millions, Gold says, “It’s not about the money. It’s about how everyone wants to make a smart purchase, and no one wants to be a chump. For the most part, when they make that purchase, people want to feel they have made a prudent, valuable purchase. People who are worth a lot of money are very used to making very very expensive acquisitions, whether it’s in business or personal.

They know how to wrap their head around these very large purchases.” “These buyers are highly sophisticated consumers and active in multiple luxury asset classes, from cars to art to jewelry. They want to know that beyond enjoying their property, they have made a sound business decision,” says Kencel. Ultra properties might be extravgent and indulgent, but the ultra buyer’s focus is still value and investment. When there are several properties on the market at the highest prices, agents often say, “When one sells, the others will to.” Surprisingly, experience does validate this claim. “If you see homes that are setting new precedent, I think it definitely is an endorsement in an area and a price range,” says Gold. Several years ago, Gold broke the $100 million price point in Los Angeles with the sale of the Playboy Mansion. “No one ever sold something well over a $100 million. Since then, we’ve seen more really big sales than ever before. It’s definitely a validation of an area, and people get more comfortable spending more money, so it’s a good sign.” And the impact trickles down. “The second I sold something for $100 million, all of a sudden the $5 million listings are now worth more.”

This editorial originally appeared in Unique Homes Ultimate ’19 Issue.

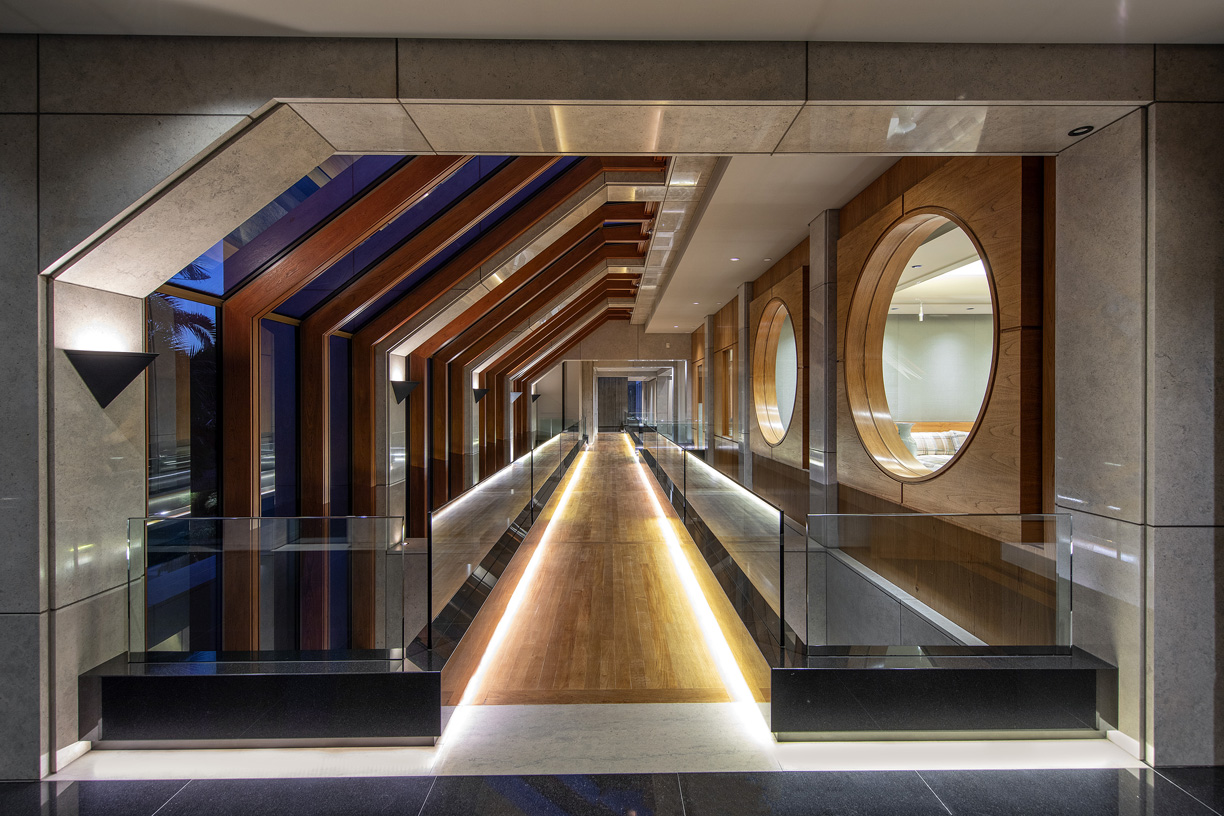

This home in Bellevue, Washington, is redefining what it means to live in luxury. This stunning new construction is the perfect modern home for an individual or family.

Walk into through the solid mahogany doors to the foyer and see the unique and custom-made staircase to your right. The 5-bed, 6-bath home has the master suite on the main level and four en suite bedrooms on the upper level as well.

On the main level is also a home office, patio with a built-in barbecue and heaters a chef’s kitchen and so much more. Meanwhile, the upper level features an entertainment room with all the bells and whistles, convenient laundry room and cozy reading nook.

The chef’s kitchen with quartz countertops & backsplash, 14-foot island, a Wolf stove and Miele appliances.

This home has been thoughtfully designed with luxury and efficiency in mind, and is the ultimate form of luxury for its owner.

Investment is a great way to grow wealth over time and can be a game-changer for most people. It can help you generate cash, providing you an additional source of income and even have you covered with regard to retirement. Either way, if done right, investment builds wealth. Naturally, investing your hard-earned money can be an overwhelming challenge since there are a wide range of investment options to choose from. At this point, assessing your personal risk tolerance and time horizon helps you to decide where and how to allocate your investments.

Condominiums

As with any investment, there are several variables that can influence the outcome of your investments. Condos are in high demand among millennials, and so, investing in them can be a great move if you make smart decisions and purchases. Unlike most housing options, the management of the condominium tends to its maintenance and upkeep, meaning you save time, energy and money. Condos typically come with premium amenities such as swimming pools and gym, yet the purchase price is generally cheaper than single-family homes. When it comes to investing to provide future income, investing condominiums tend to be a safe bet. Head on over to get a listing in this location.

Photo courtesy of Unsplash

Dividend Stocks

If you’re open to taking on a little more risk, dividend stocks may be an option for you. Including both common and preferred stocks, the equity market can provide great possibilities for future income. Invest in companies that have safe dividend payout ratios and, in return, the portion of profit for shareholders is distributed among the shareholders. Generate income on the basis of the number of shares you own.

An often underrated way to style a room with is the flooring, which often ends up as a simple hardwood or tile design. While adding neutral tones to floors can allow other statement pieces in a room to pop, sometimes a bold flooring can be just what the space needs.

With that, here are some tips and tricks to designing a room around a bold floor or rug:

Photo courtesy of Lithos Design

Photo courtesy of Chaplins Furniture

1. Matching Colors

When wanting to design a room with a statement piece, it’s always important to choose the piece that will pop before designing anything else. This way, you’ll know the colors and fabrics involved with the statement piece, and can design around that. In terms of flooring, a bold rug can make or break a room. Choosing the bold rug before anything else can ensure whatever you choose for the rest of the room will complement it.

With this space, the bold rug has two main colors, with gold being its secondary color. Instead of choosing another blue for the chairs, the designer chose to use the rug’s secondary color. This way, the blue rug still adds a pop, rather than being one of pieces with a similar color in the room. By using one of the more minor colors on the floor, there is still a wide variety of hues to have a creative and comfortable style.

Photo courtesy of RugSociety

Photo courtesy of WOW Design

2. Sleek and Airy

By allowing the bold floor pattern to be the centerpiece of the room, the designer creates a light and airy atmosphere. Instead of cluttering the room with more designs and colors, the simple designs allow for the bold floor to stand out. The minimalist look along with various plants adds a sleek and refined style to the room while also adding just enough color to keep it vibrant.

The chevron floor interlocking tile and hardwood floors adds a one-of-a-kind design for the individual to enjoy. With the only other colors in the room being a hint of black and green, the minimalist design keeps the style interesting while also comforting in its simplicity. Keep this design in mind if you’re looking for a minimalist style with an added statement piece.

3. Eclectic Style

Don’t be afraid of flooring that gets colorful and different. When styled correctly, this can be the selling-point of the home. Its uniqueness never fails to impress those who are looking for something different yet clean and airy.

While this tile may look busy and complicated close up, take a step back and see the beauty it adds to the home. The mid-century modern design adds a flair unlike any other, while also staying sleek and refined.

Photo courtesy of Lithos Design

Jeff Hyland and Drew Fenton are thrilled to present The Glazer Estate, located in Beverly Hills, California. Totaling approximately 27,500 square feet, the massive concrete home with a modern museum-style aesthetic was completed in 1995, and has since replaced the longtime home Dean Martin originally purchased in the 1950s. The property was most recently owned by late real estate developer Guilford Glazer and his wife, Diane Glazer.

“Offering an exclusive Beverly Hills lifestyle, this rare gem is the ultimate in refinement and architectural prowess,” Hyland says.

Beautifully situated on 1.6+ acres in the most prime neighborhood of Beverly Hills real estate, Mountain Drive is arguably the best street in the city, making The Glazer Estate a world-class home in a world-class location.

Guests are instantly greeted by a long, private driveway surrounded by park-like grounds. With no expense spared, The Glazer Estate makes entertaining on a grand-scale seamless, with the ability to host over 1,000 guests.

From large teak doors to a two-story atrium and theatrical water elements, only the highest level of quality is showcased throughout the residence. The open floor plan allows guests to flow between the grand formal dining room to the glass-enclosed junior dining room, formal living room, and an exceptional water lounge surrounded by ponds on all sides.

The lavish master retreat is a world unto itself, with dual baths and closets. Other standout amenities include indoor and outdoor pools as well as a ballroom.

Photos courtesy of Jim Bartsch

Inventories, consumer confidence, growing worldwide wealth, the stock market, tax changes and local dynamics are affecting how hot each luxury real estate market is throughout the U.S.

By Camilla McLaughlin

“Fasten your seatbelt, 2018 will be a fun and scary, but prosperous ride,” is how Brad Inman, founder of Inman News, assesses the outlook for real estate this year. On the other hand, developers and planners tapped by the Urban Land Institute (ULI) call for “a long glide path to a soft landing” for the economy and the real estate sector. They expect the current cycle to extend into 2018 and even beyond.

These comments perfectly illustrate the divergent opinions on the outlook for real estate this year, especially luxury real estate.

For real estate overall, it’s not an overstatement to say 2017 was a very good year. The National Association of Realtors (NAR) expects sales of existing homes in 2017 to tally at 5.81 million transactions, the best number since 2006, and 3.8 percent higher than 2016. Home prices grew by almost 6 percent, a pace NAR expects to be duplicated in 2018. Looking ahead, the forecast calls for an increase of 3.7 percent in the number of sales as more new construction amps up the number of homes on the market. December sales soared 5.6 percent, with most activity at the upper end of the market fueled by move-up buyers with considerable down payments, cash buyers and easing of inventory shortages.

For luxury real estate, the narrative, while positive, revolves around locations and price brackets, depicting a market beginning to settle into a sustainable pace after a protracted recovery. “Bottom line, we’re going to have a strong year,” says Philip White, president and CEO of Sotheby’s International Realty Affiliates. “The one difference this year is the up-wind market is having a better 17 versus 16. We are going to have more transactions and a higher average sales price this year than last year.”

In cities such as Seattle, San Francisco or Denver, demand for upscale properties outpaces supply. “Chicago now has 60 cranes in the air which has only happened twice in my 25 years here,” says Craig Hogan, vice president of luxury at Coldwell Banker Real Estate.

New York City is often portrayed as being in the doldrums. Although there has been a slow down in the ultra high end, other price points and neighborhoods all over the city are far from flat. Most active, according to Ellie Johnson, president at Berkshire Hathaway HomeServices New York Properties, is the $1 million to $5 million range, where multiple offers are not uncommon. From Dec. 11 through the 17, 18 properties went under contract above $4 million, which she says is a much larger number than the same period a year ago. When New Yorkers confront change, they often put buying plans on hold. Johnson says the upper price brackets are in a “strong hold pattern” right now, but she expects it to be short lived. Also, Wall Street bonuses should translate into “a very nice first quarter.”

“I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm.”

— Bob Hurwitz, founder and CEO of

The Hurwitz James Company

image courtesy istockphoto.com / Meinzahn

Traditional luxury markets in New York, California and Florida are still strong, but brokers also see big plays in smaller markets. Lesli Akers, president of Keller Williams Luxury Homes International, illustrates with a recent $22 million transaction in Austin, “the biggest sale in the history of that market.” ULI forecasts a shift in interest and investment dollars to smaller metros such as Seattle, Austin and even Salt Lake City as well as close-in suburbs of New York and Washington, D.C. In New York, Diane Ramirez, chairman and CEO of Halstead, says new buildings, both residential and rental, with views of the Hudson River, extensive amenities and a short commute to the city are generating interest from younger consumers in White Plains, New Rochelle and Tarrytown.

“Luxury is starting to move into every market. As neighborhoods change, the buyers change,” says Diane Hartley, president of the Institute for Luxury Home Marketing, noting it’s important for agents to understand this new buyer, new price points and new expectations.

For agents, “it’s no longer enough just to be a local expert, they have to have global knowledge as well. Most of the affluent are looking to see what is happening in the global market. But it’s also who agents are bringing to look at the home,” says Anne Miller, director of business alliances for RE/MAX.

At LuxuryRealEstate.com’s fall conference, comments about local markets were all positive, something Publisher John Brian Losh says usually doesn’t happen. “Prices are directly related to the economy and consumer confidence, and right now consumer confidence is high,” he says.

More than consumer confidence is bolstering luxury sales. Adding to demand are the growth of wealth in the U.S. and worldwide, a surge in the stock market, and a rise in foreign buying of U.S. properties. There are few, if any, indications this will change in the immediate future. Paul Boomsma, president of Luxury Portfolio International, explains: “Our white paper and our global survey show a lot of interest from buyers, not only for this year but over the next two years. There is more interest on the buy side than the sell side, and that is consistent among the high end, and it extends to 17 different countries. There is a lot of interest and not just in U.S. properties.”

Purchases of U.S. properties from foreign buyers surged from $102 billion to $153 billion in the year ending March 2017, accounting for 10 percent of dollar volume of sales. “Foreign buyers generally see the U.S. as a safe haven for investment,” says Bob Hurwitz, founder and CEO of The Hurwitz James Company, whose current clients include mega affluent buyers from Turkey, Singapore, China and Ukraine looking buy in price ranges of $20 million and up. “In a couple of cases this includes multiple properties, including commercial and development not exclusive to California,” he adds.

While most markets sizzle, the high end in some locations and price brackets is back to a slow simmer. “I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm,” says Hurwitz. “Prices have already adjusted, and as developers and luxury home builders start having homes sit on the market, there will be opportunities to make good buys.”

“In the ultra high end, I think prices are being adjusted to the economy,” says Losh, noting a common issue with ultra properties. Often sellers price the home at the highest price they ever imaged. After a couple of years, they get realistic. “What really determines value is what it cost to replace a property,” he says.

The ultra high end may be cooling, but, Hogan says, the luxury market is healthy. “The $1-to-3 million, $3-to-5 million and $5-to-9.9 million sectors are strong. Not in every city but as a whole, based on our year-to-date numbers. I honestly feel that we are simply normalizing.”

“We are seeing some moderating trends in the luxury space,” says Akers. Downward price adjustments and longer days on market are signs that luxury is moving toward a more balanced market. Still, she adds, “Truly unique properties still command top dollar and cash offers.”

It would seem that the performance of the stock market might discourage real estate investment. Instead, Marci Rossell, chief economist for Leading Real Estate Companies of the World, says it has an opposite effect. “For the luxury buyer, real estate is part of a larger portfolio and portfolios have swelled in terms of stock market value over the last two years. So, from the perspective of balancing a portfolio, real estate can look attractive.” The most influential trend for 2018, particularly the high end, is new consumer attitudes. “Across all price points, the word value is critical today,” says Ramirez. “Value to a $1 million buyer and a $600,000 buyer is not the same, but both want the perception of value.”

Consumers have become even more demanding. “There is a desire for perfection. They want a property or an experience to be exactly what they want it to be. There is no desire for compromise,” says Hartley.

Price matters, but it’s not the only factor in the value equation. “If it’s been on the market awhile, bringing down the price is not going to do it. You have to see what’s selling,” says Ramirez, using the example of a $7 million property in Darien that sold in a single day. It was well priced and located across from the water. Water views continue to be in highest demand.

People want new. “If it’s an older home, it must be newly renovated,” says Ramirez. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

The bottom line for sellers, according to Miller, is to listen to their agent. “We’re hoping that everybody takes a reality check on location, quality — is it unique and rare, does it have all the luxury amenities? — before they list their home.”

People want new.

“If it’s an older home, it must be newly renovated,” says Diane Ramirez, chairman and CEO of Halstead. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

Image courtesy istockphoto.com / TobiasBischof

Also, says Kevin Thompson, chief marketing officer at Sotheby’s International, “There is a search for the unique.” This new consumer isn’t interested in cookie-cutter anything. “They want something personal and outside the norm, and they are willing to pay for that.”

Looking ahead, Hogan sees new construction, contemporary/modern, a smaller footprint and full connectivity shaping future demand.

“We’re seeing more and more of what I call the ‘Tesla consumer with the Apple watch’ — a client who’s passionate about their lifestyle and their environmental foot print. They want to do what’s right for the earth, and they don’t mind people knowing it’s expensive,” shares Akers.

Recent ultra-high-end sales in Greenwich and Manhattan are evidence that buyers are out, according to appraiser Jonathan Miller, who noted in a recent blog: “Buyers remain in the market, but the price needs to reflect 2017.”

Akers says sellers should prepare to sell at fair market value. “We’re not in a ‘dip your toe in the market and test it out’ kind of market.”

The number of homes available for sale continues to be the fulcrum on which markets balance. Regarding real estate overall, Lawrence Yun, NAR’s chief economist says: “Home prices, after multiple years of fast growth, still show no signs of cooling because of the ongoing housing shortage in much of the country. The latest Case-Shiller price growth of 6.2 percent on a nationwide basis marks the strongest rise in over three years.”

High-priced markets are not immune to inventory challenges, but it’s not in every location. Instead, it is likely to be places that have had strong buying for years and strong population growth. White uses the example of San Francisco, where anything that is priced right is snapped up. Inventory constraints, according to White, are not unique to the U.S. “In Hong Kong and Japan, there are stories where people are lined up to buy high-priced units in new buildings, even to the point where they will sell their place in line.”

This year, for the first time since the downturn, inventories eased ever so slightly, and forecasts point to more new construction in the next few years. Javier Vivas, director of economic research for Realtor.com, sees 2018 as “a significant inflection point in the housing shortage, with increases in inventory felt initially in the mid- to higher-price points above $350,000.” Vivas says Boston, Detroit, Kansas City, Nashville and Philadelphia are predicted to see inventory recovery first.

As inventories grow, sellers need to understand that homes that are dated or not priced accurately will fall to the bottom of prospective buyers’ list of target properties.

At year-end, tax changes and continued political uncertainty loomed over every forecast. “For buyers worldwide, I think policy changes will matter more than economic climate. This is a year when tax policy could drive some location decisions. If you are a first-time buyer in a high-tax area and you are looking to put down roots, you will think long and hard about the tax consequences of a location. Even on the European front, we know Brexit will affect location decisions. Already we are seeing relocations out of London to Frankfurt,” shares Rossell. “The homebuying decision is part of a large mosaic, and the tax implication of that decision used to be a smaller tile, and it will become a larger tile.

Looking ahead: “The economy and housing market will grow like crazy. Job creation is at record levels; unemployment is at a 17-year low, wages are feeling upward pressure and companies are investing at a fast and furious pace,” commented Inman. “A backdrop of political uncertainty will not slow down the global economic thoroughbred that is galloping at a full run. Left in the dust will be housing affordability in many major metros.”

THIS STORY WAS FEATURED IN OUR WINTER 2018 ISSUE.

CLICK HERE FOR THE FULL DIGITAL VERSION.

In 2017, Unique Homes is traveling the U.S. to find the dominant stories in each region of the country — this issue covers international buyers.

By Camilla McLaughlin

Photo courtesy istockphoto.com/ALotOfPeople

“International buyers are spreading their wings. It’s not just about New York, Miami and L.A. anymore,” observes Stephanie Pfeffer Anton, executive vice president of Luxury Portfolio International.

When buyers from outside the country came to the U.S., they used to gravitate to a handful of cities. Today, they are apt to look for homes and condos almost anywhere in the country. Even though five states capture the most international attention, 46 percent of sales to foreign buyers are scattered across the country in states ranging from Kentucky to Massachusetts to Illinois. Buyers from China, Canada, the United Kingdom, Mexico and India account for just over half of the transactions, but 48 percent, almost half of all foreign buyers, hail from other countries.

“Quite simply, as the world continues to get smaller, the number of people with the interest and means to purchase outside their own country increases. Buyers are spreading their wings. It’s not just about New York, Miami and L.A. anymore. Global buyers continue to be a small percentage of buyers in most

markets, but even our members in smaller markets like Wilmington, North Carolina or Boulder, Colorado, are reporting demand from non-U.S. buyers,” says Stephanie Pfeffer Anton, executive vice president of Luxury Portfolio International.

The much publicized pull back of luxury buyers and substantial inventory of upscale properties in Manhattan and Miami might create the impression that demand from foreign buyers is in the doldrums; in reality, sales of residential property to foreign buyers hit a new high in the 12 months ending March 2017. Total dollar volume jumped 49 percent (from $102 billion to $153 billion), and the number of sales increased 32 percent, according to the National Association of Realtors (NAR). “The political and economic uncertainty both here and abroad did not deter foreigners from exponentially ramping up their purchases of U.S. property over the past year,” observed Lawrence Yun, NAR chief economist. “While the strengthening of the U.S. dollar in relation to other currencies and steadfast home-price growth made buying a home more expensive in many areas, foreigners increasingly acted on their beliefs that the U.S. is a safe and secure place to live, work and invest.”

Even with a strong dollar, tight inventories and recent appreciation, prices for U.S. residences are still lower than many other countries, and the search for value is bringing new groups of buyers to new places. As an example, Anne Miller, director, business alliances at RE/MAX, says more Canadians from British Columbia are looking in areas surrounding Portland, Oregon, and Seattle for a good investment that will hold its value. Also prompting purchases, according to Yun, is the possibility that other currencies could further weaken against the dollar, making U.S. properties more expensive in the future.

Once again, buyers from China accounted for the most transactions, spending $31.7 billion, up from 2015’s record $28.6 billion. However, NAR’s data was compiled before many of the new restrictions imposed by the Chinese government regarding the transfer of money outside mainland China were fully in force, and sales to Chinese nationals this year have been softer in some places. Still, brokers who work in the international arena, such as Joyce Rey, executive director, Coldwell Banker Global Luxury, say most very wealthy Chinese already have their money outside the country.

“We have seen a slowdown in the Chinese buyer, but they have by no means disappeared,” says Anton. “The slowdown is felt most directly in U.S. cities that saw a dramatic rise — places like Seattle and San Francisco.” Anton also points to other diverse factors fueling international demand, including changes in direct flights and education. “Boston is another example where we still see a lot of international buyers due in large part to the significant concentration of colleges and universities,” she says. Buying for a student, present or future, is important for a percentage of Chinese buyers.

Boston also has new ultra-luxury buildings offering a high level of security and an international design aesthetic that appeals to foreign buyers and Chinese buyers in particular. Boston, along with San Jose, San Francisco, Seattle, Los Angeles and San Diego were the U.S. markets most popular with Chinese shoppers. As a group, these buyers also typically target higher price points than domestic buyers.

For high-end properties, Bob Hurwitz, founder and CEO of the Hurwitz James Company in Beverly Hills, says Chinese buyers are shifting their focus toward lower prices. “The tightening of restrictions on capital leaving mainland China and buyers wishing to avoid scrutiny caused a pullback in purchases of high-profile property,” he says, noting that he is getting more requests for the $1.5 million to $4 million range.

Canadians as Catalysts

This year, Canadians were the wild card in the international mix. After dipping in the 2016 survey to $8.9 billion, transactions by Canadians hit a new high — $19 billion. The Canadian influence extends as far as Hawaii, but Florida is the epicenter. Twenty-two percent of all purchases by foreign buyers occurred in the Sunshine State, with the highest number to Canadians. South Florida ranks with Los Angeles as the U.S. markets eliciting the most international interest with inquiries on Realtor.com coming from Brazil, Columbia, Germany and the U.K., in addition to Canada.

Although geopolitical factors have slowed demand from some South American countries, Miami’s cachet as a global luxury hub is not tarnished. Value-conscious buyers, particularly Canadians, also look to Fort Lauderdale, according to Zach Joslin of the Brissi Group of EWM Realty International.

Park Shore Beach, Naples Florida

Photo courtesy The Bua Bell Group

Venezuelan buyers are drawn to nearby Weston. Indian buyers are newcomers in both Broward and Miami-Dade counties. An ongoing expansion of the Fort Lauderdale airport is expected to enhance international connections.

Nationally, those from outside the U.S. spend more on real estate than domestic buyers, and in Miami, they spend more on average than in anywhere else in Florida or nationally. About 70 percent of Miami Realtors work with international buyers, more than double NAR’s national figure.

Palm Beach continues to be recognized globally for luxury, and the area appeals to a diverse group hailing from countries including Germany, Argentina, Ireland and Russia, but agents say Canadians and buyers from the U.K. still comprise the largest contingent. Also casting a wide net globally is the equestrian season in nearby Wellington.

Orlando is the second location preferred by Florida’s international home buyers with 12 percent opting for the region, up from 8 percent in 2015. Like foreign buyers nationally, they tend to spend more on a purchase, usually with cash. Top countries of origin: Brazil, U.K. and Canada. Argentines and Venezuelans tend to buy rental properties with the intent of cashing in on the region’s steady stream of tourists. A recent market shift has 40 percent of purchases happening in central Orlando.

Perhaps the best testimony to changes in locations preferred by foreign buyers is Naples, Florida, where one is likely to encounter multiple languages on a stroll through downtown. “We’ve always had buyers from Canada, Germany and the U.K. But we are now seeing the Asian market consumers,” says Tade Bua Bell with John R. Wood Properties. Other newcomers are from Spain, France, Russia and Sweden. Top preference: turnkey residences near the beach and ocean. An exchange program between a local private school and a school in China also elicits international interest.

Casa Rancho Mirage, Palm Springs Valley California

Photo courtesy Hurwitz James Company

California Dreaming

California and Texas vie for second place in the race for international buyers with each accounting for 12 percent. Los Angeles, both the city and prime Westside enclaves such as Beverly Hills, continue to be a magnet for foreign buyers. In the ultra high end, Rey says, foreign buyers “typically dominate from 20 to 35 percent of the market, a number that varies from year to year.”

“They place great emphasis on views, and these types of properties are escalating in value as a result of the influence of foreign buyers,” she says. Middle Eastern buyers tend to go to Bel Air because of the views; Europeans look to Sunset Strip and Bel Air locations, also for views.

Traditionally, Asian buyers gravitated to the Pasadena/Arcadia area, and now Rey says she is seeing more coming to her market. Other hot locations for Chinese buyers include Bradbury and Irvine. Hurwitz says Russians and Ukrainians are diverse in what they look for, but tend to own in the same area they bought previously, whether that be Beverly Hills, Bel Air, Cheviot Hills or wherever.

Along with prices, foreign buyers also influence design and architecture, here and in a number of other locations. “Developers definitely build for an international taste level,” says Rey.

In Texas, international sales surged from April 2016 to May 2017, with the number of dollars doubling. In Dallas and Houston, both centers of international businesses including finance and energy, purchases from buyers out of the country are often related to work. One in 10 Indian buyers and 43 percent of Mexican buyers purchase in Texas. Also, 11 percent of Chinese buyers purchased in the Lone Star State. Brokers in a number of other states and locations including New Jersey and Connecticut are seeing a similar trend, particularly with buyers from India. Greenwich and Darien, Connecticut are also seeing more foreign buyers, many of whom might move from other U.S. locations.

What those buyers want is quite different than someone looking for a place to spend a few weeks a year, explains Diane Ramirez, chairman and CEO of Halstead Real Estate. Space for extended family or multiple generations or even really good staff quarters might be important to these buyers.

It is important to note, NAR’s data includes recent immigrants as well as non-resident buyers and it covers all price brackets.

Ramirez also points out that although influential, foreign buyers still comprise a small percentage of overall sales. “We always have interest from foreign buyers, but it is never the percentage most people think it is,” she explains.

After a sharp decline in 2015, the ranks of the ultra-wealthy globally grew by 3.5 percent in 2016, with North America and Asia registering the greatest increase. New York City, home to the largest concentration of ultra-wealthy, continues to vie with London for the top position in rankings such as the Alpha Cities Index, compliled by Wealth-X, Warburb Realty and Barnes International Realty, which ranks 50 of the world’s top cities based on their potential for a purchase and interest to ultra-wealthy individuals. A number of U.S. cities ranked among the top 20, with Chicago, San Francisco and Washington, D.C., in the top 10, along with New York. Los Angeles, Boston, Miami, Houston and Dallas rounding out the list. While San Francisco is a top market for foreign buyers, Chicago, Dallas and a few other cities have a larger ultra-high-net worth population.

Cedric Choi, Choi International, Honolulu

Craig Denton, Managing Broker and Director of Business Development, Berkshire Hathaway HomeServices Colorado Properties, Vail, Colorado

John Engle, Halstead Property, New Canaan, Connecticut

Karen Rodriguez, Group Kora and Berkshire Hathaway HomeServices Georgia Properties

Aleksandra Scepanovic, Managing Director, Ideal Properties Group