Peter Barkin & Mark Gilman

Compass, Barkin-Gilman Group

1200 E. Las Olas Blvd Suite 103, Fort Lauderdale, FL 33301

Peter: (954) 675-6656 | Mark: (954) 557-8777 | www.barkingilman.com

Peter Barkin and Mark Gilman have been successfully supporting the real estate dreams of buyers and sellers in South Florida for more than 20 years. In 2002, Peter and Mark teamed together to create the Barkin-Gilman Group, a highly respected and successful brand within the South Florida real estate community.

Listing by Peter Barkin & Mark Gilman

Fort Lauderdale, Florida

AQUABLU

There are 2-bedroom and 3-bedrooms available at the beautiful development, as well as dockage.

Starting at $1,395,000.

Peter Barkin & Mark Gilman originally appeared as Elite Agents in the Unique Homes Spring ’19: Elite edition. See their page here.

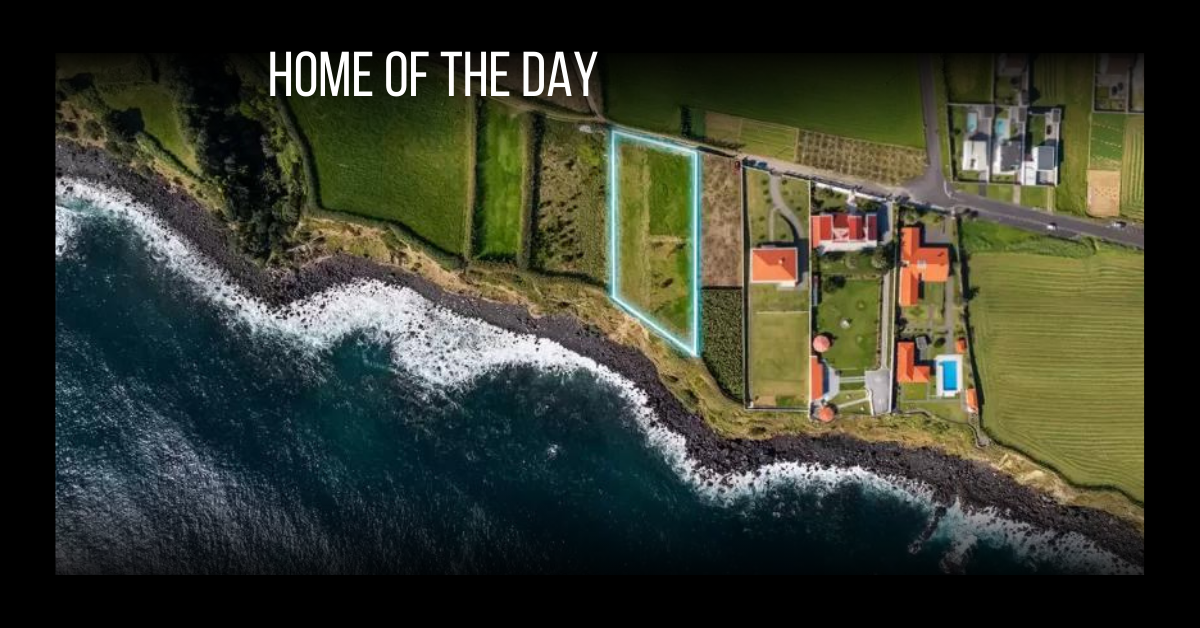

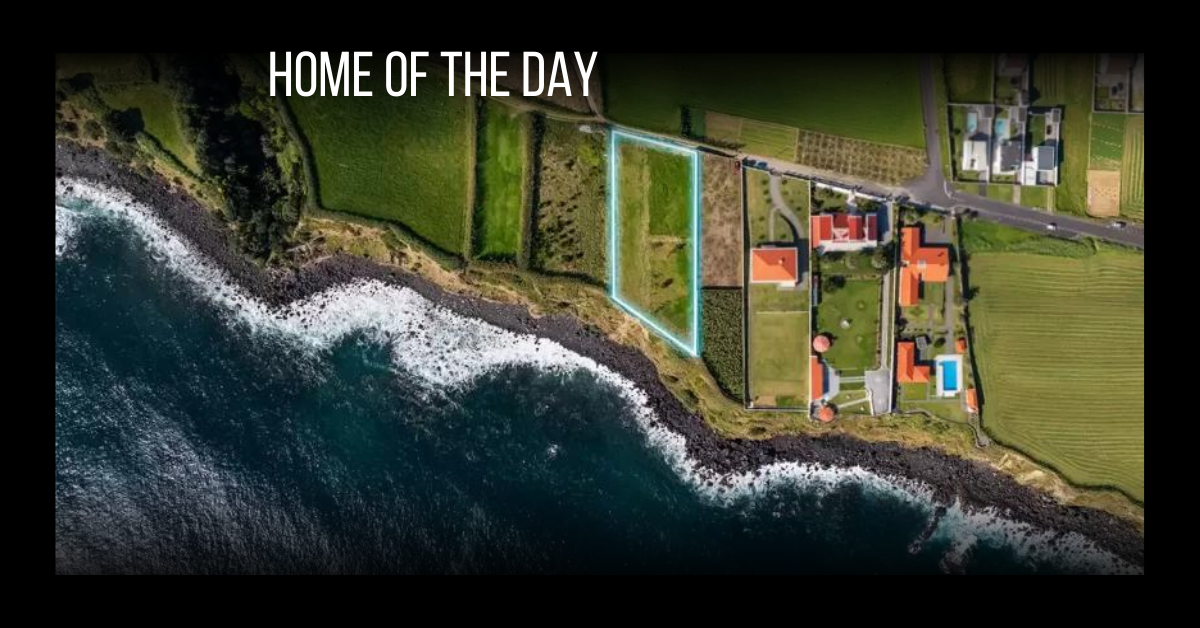

With panoramic Pacific Ocean views, this exclusive and private compound is nestled in the Hermosa Hillsides in Northwest Pacific Costa Rica. The property spans two lots, each with over one-plus acres. It includes a main villa plus two guesthouses.

“Villa Vista Azul offers privacy, ocean views and flexibility as a family compound or executive or yoga retreat with rental income benefits,” says Linda Ann Gray of Coldwell Banker Coast to Coast Properties, who is listing the property for $1.675 million.

The compound is just 30 minutes to the International Airport in Liberia and a short drive to the full-service beach community of Playas Del Coco.

For more information, visit www.coldwellbankercr.com

This property originally appeared in Homes & Estates Summer Supplement.

Engel & Völkers | Mallorca West

Archiduque Luis Salvador, 1, E-07179 Deià, Mallorca, Balearic Islands, Spain

+34.971.636.363 | deia@engelvoelkers.com | www.engelvoelkers.com/mallorca-westcoast

On Mallorca, the West Coast where the Sierra de Tramuntana is located has recently declared a World Heritage Site by UNESCO, remains one of the most authentic and sought after areas of the island. The Engel & Völkers real estate team will be pleased to present you with the best properties in this region, both those seeking a second home for the summer and those who have decided to reside here permanently.

Listings by Engel & Völkers | Mallorca West

A GEM ON THE WEST COAST OF THE TRAMUNTANA

IThe origins of this extraordinary estate date back to the 13th century. In 1983, the former winery was awakened from its slumber. The impressive entrance hall leads into the living room with its imposing archways — a spacious, luminous room was created. There is an open-plan studio area with a dining and a conference table, a gallery and a library. On the ground floor, there is also the Majorcan-style, fully fitted kitchen and on the same level as a charming covered terrace. On this floor, there is also a cozy guest wing with a private terrace with sea views. The entire 1st floor accommodates 5 bedrooms with private baths. There is so much to say about this extraordinary property — only a personal impression will convey the true atmosphere. This is a unique, premium home in the Sierra de Tramuntana, which must be viewed.

E&V ID W-02BEEL. €16,500,000.

Engel & Völkers | Mallorca West originally appeared as an Elite company in the Unique Homes Spring ’19: Elite edition. See their page here.

Miramar is luxurious mansion in St. Croix, U.S. Virgin Islands, in a private estate located in the most extraordinary seafront setting perched on a bluff overlooking the Caribbean Sea.

The estate is custom designed to integrate comfort and elegance, with coral columns and marble flooring throughout. The impressive great room features a lavish living room, gourmet kitchen, formal bar and dining areas.

The property, listed for $8.9 million by Amy Land-de Wilde of Coldwell Banker St. Croix Realty, also includes a studio apartment, 1-car garage and a 2-car garage. A luxurious seaside mansion.

Combining island chic and luxury beachfront living in San Salvador, Bahamas, this ultra-private, 35,000-square-foot property boasts 400 feet of private white-sand beach.

“This home, feels like a private get away,” says listing agent Margaret Glynatsis of Coldwell Banker Lightbourn Realty.

“From the keyless entree pads, remote-controlled air conditioner and lighting system and the positioning of the home — with slight elevations allowing for most rooms to look out into the horizon — no thought or detailed was overlooked.”

With 3,200 square feet of living space, this home features an open-concept floor plan with 12-foot ceilings, floor-to-ceiling windows, two beds, two baths and a master bedroom with a floating bathtub, shower, double vanity, walk-in closet, office space and balcony looking out into the turquoise ocean.

“My favorite room of the home is the master bedroom as it includes 1,500 square feet dedicated to pure luxury and comfort,” says Glynatsis. “The really unique and stunning feature here is the stand alone tub in the center of the room with views of the never-ending ocean.” The home, listed for $1.499 million, is complete with a wrap around deck just steps away from the beach. “This beachfront oasis is perfect for someone looking to live off the grid, but still have access to every day modern amenities,” says Glynatsis. “San Salvador itself is a hidden gem that most people have yet to discover — the land is full of undulating hills, beautiful beaches, numerous salt water lakes, and amazing reefs that surround the greater part of the island.”

With 54 feet of beachfront, this lakefront home in Vernon, British Columbia is ideal for entertaining — it features a dock, boat lift, outdoor living spaces and two full kitchens.

Inside, details include open-concept living, vaulted ceilings, granite countertops hardwood floors and a covered deck with outdoor gas fireplace and views of Okanagan Lake. The lower floor includes waterfront living at its best with in-floor heating, a wine cellar, summer kitchen, outside shower and large walk-out patio with outdoor gas fireplace and built in barbecue.

“Guests are always welcome, as the house has a self-contained 3-bedroom casita above the garage with lake views and a private deck,” says listing agent Norm Brenner of Coldwell Banker Four Seasons Real Estate, who is listing the home for $2.95 million. “It is ideal for those that want to entertain or anyone that has extended family.”

ACTRESS, AUTHOR AND ENTREPRENEUR SUZANNE SOMERS AND HER HUSBAND ALAN HAMEL HAVE LISTED THEIR ONE-OF-A-KIND, 72-ACRE HILLSIDE RETREAT IN PALM SPRINGS, CALIFORNIA.

The couple, who have owned this expansive mountainside compound since the late 1970s, are listing it at $9.5 million and have selected Ron Parks of Pacific Sotheby’s International Realty and Scott Lyle of Douglas Elliman Real Estate to co-list the one-of-a-kind property.

“Alan and I have finally decided to let go of our compound,” says Somers. “It’s been our private paradise; our L.A. getaway for so many years; our kids grew up here. We love entertaining on the grounds; our friends fly in from all over for a surprising south of France experience in Palm Springs. We’re changing things up a bit now and have purchased a Steve Chase-designed mid-century modern home on the other side of town. We don’t need 70-plus acres anymore; time for a new journey.”

Scattered across the main courtyard area are five buildings with 7,200 square feet of private living space, including five fully appointed bedroom suites (one of which is The Rock House by iconic architect Albert Frey), a pool house, a two-bedroom caretaker quarters, and an outdoor amphitheater carved into the mountain that seats 50 and has a dance floor that doubles as a yoga and meditation area, and offers a pool, spa, hiking trails and natural waterfall that spills down the hillside.

The compound is reachable by a private funicular, on foot or by golf cart via a private road. In the late ’70s, Somers and Hamel moved to the property as a weekend retreat; it was a safe haven, very private and an escape from their public life in L.A. Eventually, it became their permanent residence.

There have only been three owners in 100 years including the Hamels. “That says it all about this unique mountainside compound,” adds Somers.

Photos courtesy of Pacific Sotheby’s International Realty.

This fantastic Mediterranean villa showcases stunning views of the Catalan coastal sea in exclusive of Punta Brava, in Sant Feliu de Guixols, Spain in one of the most beautiful places of the Costa Brava. The property offers total privacy and a very impressive panoramic views of the coast.

Enter the home by the garage, which has an elevator to the solarium terrace with a bar and spectacular views. Going down, the third floor features a suite, a suite with a dressing room plus distributor room, a master suite with office, full bathroom and large dressing room with access to the garden. All suites showcase terrace and sea views.

Descending to the second floor, there are two suites, one with access to garden, living room with fireplace, and kitchen — all with access to the outside and spectacular views. Traveling to the first floor, it includes a cellar, electrical equipment room, gym, sauna, Turkish bath, and a cinema room with access to the private pool with a wooden platform. Additionally, there is an apartment for service with kitchen, living room, one double bedroom and one bathroom with shower. The garage can hold up to four cars.

The house, listed for 7.5 million euros by Coldwell Banker Prestige Begur, was built in 2012 with a modern design and high quality materials. It has a constructed area of 1,110 square meters on a 1,933-square-meter plot.

Usually, it’s possible to sum up the outlook with a pithy phrase, but this year the luxury landscape is nuanced. Some markets sizzle; others simmer. Dynamic outside forces are at play and will potentially exert even more influence in 2019. In the background, the words recession and bubble are whispered, but most experts don’t see either in the cards, particularly for residential real estate in 2019.

“In most markets, I think it’s a case of ‘from great to good,’” says Stephanie Anton, president of Luxury Portfolio International.

“We’ve left a crazy market, and we’re moving into a more normal market,” shares John Brian Losh, chairman of Who’s Who in Luxury Real Estate. “We are beginning to see a more normalized market where supply is more equal to demand. Even in the luxury market, there are fewer bidding situations.”

According to Redfin, the number of competitive offers fell from 45 percent to 32 percent in 2018. Still, some ZIP codes in busy markets such as Boston, Washington, D.C., and the Bay Area remain hotbeds of competition, with the number of multi-bid scenarios increasing in the third quarter.

© istockphoto.com/JZHUK

Concerns about potential bubbles continue to percolate, but economists and other experts caution that fundamentals are strong and for real estate the next downturn will be different. “The recent tax reform and increased government spending have been a shot in the arm of the U.S. economy,” Tim Wang, head of investment research at Clarion Partners, explained to journalists at the Urban Land Institute’s fall conference. Wang and other experts expect the current expansion of the economy to continue through 2019, tapering to 2.5 percent next year.

“The housing market is following the trend in the overall economy, which needs to be noted because housing led the last downturn,” comments Marci Rossell, chief economist for Leading Real Estate Companies of the World, citing politics and global uncertainty as factors affecting real estate. This time, she says, “the casualties will be a little bit different, and because of that I don’t anticipate a meltdown.”

A cooling period is how Craig Hogan, vice president of luxury at Coldwell Banker Real Estate, characterizes the luxury climate, particularly in the second half of 2018. It’s a change Coldwell Banker has anticipated. “For any of us to think it was always going to be incredible is a little naive. The market is always going to fluctuate.” Hogan says it’s important not to interpret cooling as a market decline. “Cooling is a normal fluctuation, while a decline happens when the value of homes begins dipping.”

“There hasn’t been any great price suppression. Houses are staying on the market a little longer, but demand is still healthy,” says Losh.

“I think we’re still going to have a very strong year overall. I do believe we’re seeing price adjustments, and that’s okay. I think the key is watching how long properties are staying on the market and watching the size of the price adjustments,” observes Lesli Akers, president of Keller Williams Luxury International.

The average sales price for Sotheby’s transactions is up year over year. “From a luxury point of view, many of our companies are having a record year,” says Philip White, president and CEO of Sotheby’s International Realty. “Revenues are up, and in some cases pretty significantly,” he shares, noting that this number also reflects significant recruiting and/or acquisitions by some companies.

Recent stats show prices for upscale properties still increasing, but at a slower pace than past years. The number of sales in many places has dipped, but that differs by location, and in more than a few instances sales still exceed 2017.

Data from the Institute for Luxury Home Marketing (ILHM) shows median prices for single family luxury homes climbing 8.5 percent in November over October, while the number of sales fell 11.7 percent. For attached luxury properties, sales rose 2.6 percent with a 2.3 percent hike in prices.

Putting the current market for real estate overall into perspective, Lawrence Yun, chief economist for the National Association of Realtors, said, “2017 was the best year for home sales in 10 years, and 2018 is only down 1.5 percent year to date. Statistically, it is a mild twinge in the data and a very mild adjustment compared to the long-term growth we’ve been experiencing over the past few years.” Yun and other housing economists are quick to point out that new construction still hasn’t caught up with demand and foreclosure levels are at historic lows, factors which make the current climate different than the run up to the recession. NAR’s forecast calls for an overall price increase of about 3 percent in 2019 while the number of sales flattens or edges up very slightly.

Tale of Two Markets

Luxury’s story is a little different. “This year the luxury market has been a tale of two markets, for sure. Some areas are struggling, but most have been stronger than many realize, particularly in the first half of the year. As median prices have been slowing (and getting lots of media attention), the top 5 percent of many major metro markets nationally have been growing, with sales over $1 million up over 5 percent year over year and prices breaking records, in some cases by double digits. In the majority of markets, inventory has been selling faster. This is happening simply because of the health of the affluent,” observes Anton.

What sets this year’s outlook apart is that some places are having a strong, dynamic market, while others are seeing a softening, often only in specific price brackets. “The slowdown that started on the East Coast is having some effect on the West Coast. But it’s not a typical slowdown,” says Mike Leipart, managing partner of new development at The Agency. “Good product that has relative value is continuing to transact.”

The top three sales nationally in the third quarter, each over $30 million, occurred in Laguna, and seven out of the top 10 were in Southern California.

Rather than a general market malaise, Leipart characterizes the slowdown as more of a spec home problem. “It’s just too much has been built too fast, and not all of it is very good. The people who thought they could build a house for $15 million and sell it for $30 million are struggling.”

The higher price points in L.A. may see an even stronger downturn in the near future, suggests Bob Hurtwitz, owner of Hurwitz James Company, who typically works in the very high end. “There is a lot of inventory on the higher end, and luxury home buyers are usually in a position to wait and see. The drops in price are a lot more dramatic on property at $15 million and above, and buyers are aware of the benefit in waiting to see how it plays out. At the ultra-high end of $100 million or more, you are going to see and already are seeing huge reductions in price.” What’s hot in L.A.? Luxury penthouses in full 24-hour security buildings in prime areas, according to Hurwitz. “High-end penthouses will continue to be in-demand from foreign buyers purchasing as a part time home or for housing for their children.” Other price brackets, notably the $1.5-million to $3.5-million range, are busy, and, Hurwitz says, his agents are doing a lot of deals.

Perceptions of prices in Manhattan can be skewed, since recent closings are often for new construction for which contracts (and prices) were written a couple of years prior. Even though stats show sales decreasing, Ellie Johnson, president of Berkshire Hathaway HomeServices New York Properties, says, “There is still a healthy but steady group of buyers that are still out there in the high-end luxury landscape.” Additionally, New York is particularly keyed to Wall Street, and volatility in the stock market often means more money gets transferred into brick and mortar. “We’ve seen an uptick that we didn’t have at the beginning of the fall season,” Johnson observes. Despite a less than stellar real estate market at year end, New York remains a global gateway and the top city for global wealth.

Manhattan

© istockphoto.com/CreativeImages1900

Los Angeles

© istockphoto.com/SeanPavonePhoto

St. Petersburg

© istockphoto.com/SeanPavonePhoto

In other locations, particularly those with lower prices for upscale properties compared to California, Florida or New York, reports show strong interest and price growth. An acre in one of Atlanta’s prime addresses in Buckhead can demand as much as $1 million. It’s just one indication that luxury here continues to reach new price levels with considerable demand coming from outside the region, including buyers from California and Florida. Some relocate simply because they want a home in the city; others follow corporate moves. The city has also become a favorite for the film industry, which has become a $4 million industry. “It’s changing everything about this city,” says Debra Johnston with Berkshire Hathaway HomeServices Georgia Properties. Luxury really doesn’t begin until the $5 million threshold, says Johnston, but prices compared to Florida and California are reasonable.

At one time, it was thought it might take more than 20 years for Florida real estate to recoup from the recession. In October, the state tracked 82 consecutive months of price hikes for both single-family and condo-townhouse properties, with many cities showing double-digit increases in the number of sales. “The overall market in Florida, particularly higher-end areas such as Sarasota, Naples and Palm Beach, is definitely strong and stable. Maybe not as robust as say 2013 and 2014, but we haven’t had any major slide — except the economists talking about the market slowing down,” says Pam Charron with Berkshire Hathaway HomeServices Florida Realty in Sarasota.

“The St. Petersburg market seems to be performing differently than other Florida markets and other national trends,” observes Tami Simms with Coastal Properties Group, noting November sales skyrocketed over the prior year. “We have developed into a year-round market with luxury downtown condominiums in high steady demand.” Another sign of consumer confidence is lack of defaults on pre-construction sales. “When we experienced the crash, those buildings that had been sold out prior to completion experienced a significant number of defaults. We see none of that in this instance.”

Florida is one of several states including Texas and Nevada benefiting from changes in tax law. Tax changes not only force some to reevaluate where they live, but they also impact the margins of price brackets. “While it doesn’t mean people wholesale leave New York or San Francisco, marginal changes tickle up and trickle down to the next closest price level,” and it will take several years for that to be felt, says Rossell.

The New Market

“So many trends have taken place they are no longer trends, they are the new market,” observes Hogan, using new construction as one example. “It doesn’t matter where you go or who you talk to, new construction is part of the conversation.”

Global demographics will have a long-term impact. “What luxury is adjusting to is a different demographic worldwide. Those aging baby boomers are kind of done with big homes and the following demographic is 50-percent smaller,” Rossell says.

Changing demographics affect location and property type. “I think we’ll see increased demand for primary residences in traditional second home and resort markets. We are seeing this trend in select markets, as individuals who have the freedom to work remotely are opting to live in places where they feel their quality of life will be the best,” observes Anthony Hitt, president and CEO, Engel & Völkers Americas.

Summer 2019 will mark the most prolonged economic recovery since World War II, but wild cards including interest rates, a trade war and further instability could easily derail this expectation. However, there is a silver lining to the current market. Increasing inventories will bring some buyers back to the market and create more demand. “I think it’s going to a be a great opportunity. People will buy things that they haven’t considered, and they’re going to buy more of them. I think that’s been a big challenge. We’ve not had the inventory, and a lot of buyers kind of just fell out of the market because they didn’t feel like there really was one,” explains Akers.

ILHM President Diane Hartley believes 2019 will be a year of opportunity for both buyers and sellers provided they remain agile, innovative and adaptable to their local market influence.

This story originally appeared in the Winter 2019 edition of Unique Homes Magazine.

Improving on excellence is not easy, but Overlook in Camden, Maine (featured on our cover) elevates already significant architecture along with 21 stunning acres perched above a desirable stretch of Maine coastline to an even higher strata.

By Camilla McLaughlin

Inspired by the iconic Gamble House in Pasadena, California, this home is a prime example of the Arts & Crafts style but interpreted for the 21st century.

As with many contemporary designs, the open concept entry showcases the views of Penobscot Bay and the islands beyond from the moment you step inside. But then the finely-crafted details in the millwork and joinery, and the world-class stained glass are all reminiscent of the more traditional designs of another era, a hallmark of Arts & Crafts design.

There’s a sense of peace here that exudes from the many ponds and waterfalls, and more than 5,000 specimen trees and plants set against the forest and mountainside. Inside and out, you are surrounded by the colors of nature. “The feeling of the house is one of extreme warmth and comfort. There is a purity of design with great value placed on organic materials and artisan-crafted workmanship that melds beauty with utility. There is a wonderful intimacy in the house and the property. This is a place you never want to leave,” says listing agent Scott Horty, with Camden Real Estate Company.

With a full complement of amenities (a large theater/cinema, a game room, a gym, sauna, and an equally wondrous guesthouse) along with the extensive infrastructure (geothermal heating and cooling, whole house generator and solar array hidden among the trees) you may never have to leave!

Beauty, peace of mind and connection to nature are all priceless. But the price of Overlook is $7.9 million…