Cover photo ©istockphoto.com / Evgeny Zhigalov

Of all the changes brought on by the pandemic, what is here to stay?

From a drone’s eye perspective of 50 years, real estate might resemble a Mobius strip, a never-ending roller coaster of ups and downs with each boom-and-bust cycle sparking small changes and adaptations. But none have had an impact comparable to the pandemic, which ushered in an avalanche of innovation, new ways of doing business and a profound shift in consumer values. Some effects are a temporary response, while many reflect a significant transformation.

“The way that real estate as an industry operates has changed, and I believe it is a microcosm that can be applied to 90 percent of the economy out there. No one is going back, and that means the way we live, work and play changes forever,” observes Marci Rossell, former CNBC chief economist and chief economist for Leading RE. “COVID drop-kicked us into 2030.”

Ask agents if any prior cycle compares to the experience of the last year and a half, and they will tell you the pandemic boom is unparalleled. “I don’t think any Realtor in the country has had the experience we’ve had this last year! Yes, there have been good upticks in certain years in certain places, but never anything like this!” shares Trinkie Watson with Chase International in Lake Tahoe.

“We’ve certainly seen periods where you had to pivot skill sets and be really aware of the market and things that would impact clients, but we’ve never seen anything like the last year and a half, (and) that’s been compounded by a lack of availability,” shares Tami Simms, with Coastal Properties Group in St. Petersburg, Florida, who is also trainer for the Institute for Luxury Home Marketing.

“I think that last year was the most significant year of change from a tech perspective,” says David Marine, chief marketing officer at Coldwell Banker Real Estate. The pandemic market accomplished what major brands had been working on for years. “In 90 days,” he says, “every single real estate agent figured out a way to move the transition online. Now it’s commonplace. It’s no longer an issue.”

“Agents basically skyrocketed 10 years into the future, and they did it in a two-month period,” says Rossell. Rather than an abrupt switch, industry experts see real estate’s seemingly overnight embrace of new technology as acceptance of tools already available. Think of it as “escalating trends that were already underway that would have happened, but they are going to happen almost a decade faster than anyone expected,” explains Rossell.

Will it be a virtual world?

Prior to what Simms dubs “the Zoom age,” she says, there wasn’t a widespread understanding or trust or proficiency with virtual apps. “Now,” she says, “we know how to use it. We’re reasonably proficient at it, and there’s a level of trust. So, we’re able to embrace this technology. You know I don’t ever want to go back to having to communicate with out-of-state buyers purely by telephone.”

Virtual Sales are touted as the main advancement sparked by the pandemic, but an even greater benefit has been an industry-wide recognition and adaptation of virtual apps to enhance and expedite the process from initial views of a property to consumer education. “FaceTime is an effective tool, but really more to give a prospect a better idea of the home, not to induce an offer … though it could,” says Watson.

Looking ahead, agents don’t expect virtual sales to disappear, but they will continue to be a rarity. “I don’t think we’ll see many escrows where the buyer hasn’t physically seen the property. Yes, Zoom and similar will continue to be a part of our lives. Also, more defined photography for our listings … the importance of a comprehensive ‘walk through’ so prospects can get a good feeling for how the house flows,” says Watson.

Detailed virtual walk-throughs became more important than ever, with platforms such as Matterport leading the way.

©istockphoto.com / fizkes

“In-person viewings have been very limited. No one wants to go to open houses. No one is walking about a house just for fun. People are looking online. They are viewing the pictures of a listing maybe 10 times before they see a house. So, a showing is more like a fourth showing, and agents need in-depth knowledge of a property,” says Joanne Nemerovski, with Compass in Chicago.

©istockphoto.com / joakimbkk

Dreaming of Home

The ability to work remotely is often cited as the main driver for the surge in sales, but even more fundamental are new consumer values regarding home and lifestyle. Citing millennials, who now comprise a substantial portion of buyers, Nemerovski says many were starting careers and literally were never home, so home basically was a shoebox they visited. “I think that sentiment has changed. Home is where the heart is. It has become the center of people’s lives. People are also more respectful of their homes.”

Everybody wants their dream home,” says Frank Aazami with Russ Lyon Sotheby’s International Realty in Scottsdale, Arizona, “because they just cashed out of another home that maybe they inherited or maybe were there for 20, 30 or 40 years.”

Buyers’ expectations of quality are high and will continue to be so. “People understand the level of finishes better than ever before. We’ve gotten so much better with respecting architects, good architects’ work, good designers’ work,” he says.

“All of a sudden, consumers are finding that now it’s not all about a commute. It’s about ‘does the place that I live offer me the things that I want to do when I have a little extra time, both inside and outside.’ Outside spaces have always been a luxury item, but more so now than ever,” says Simms. Topping wish lists are beautiful recreational facilities, inside and out. Also becoming more desirable is access to nearby outdoor venues such as parks and trails. Before COVID-19, outdoor living was a growing trend; now a connection with nature has become almost an essential for homes, particularly new construction.

Skills Put to the Test

With properties selling days or hours after going on the market and multiple platforms broadcasting new listings, it would seem agents’ skills are not essential. However, the pandemic market has proved the opposite. “It’s been a really intense time for real estate professionals in terms of making sure that their communication skills are absolutely the most important thing that they have, setting expectations, both on the seller side and the buyer side,” says Simms.

“There’s more attention to vetting prospective buyers, making sure they are qualified to buy before showing them property,” adds Watson.

Price is only part of an offer’s appeal to sellers, and crafting a winning offer has been an important skill for agents and buyers in the current market. Even when multiple offers become less of the norm, this aspect of buying will continue to be important.

An intense market tempts buyers to forgo contingencies. “It has been definitely challenging to counsel people on strategies to be successful in acquiring properties, but also in making sure that they truly understand the ramifications of releasing contingencies and know the risks they are taking on,” shares Simms.

“A downside of the intensity has been buyer’s remorse, cancellations before closing, some attempted lawsuits … a result of no inspections, jumping too fast without thorough exploration, et cetera. This would be a small percentage of the purchasers, but certainly a reflection of ‘herd mentality’ going the wrong way!” says Watson, referring to the pressure buyers felt to make a decision.

Cooldown Ahead

With days on market hovering just over 14 in July, prices rising in 99 percent of all metro areas, and double-digit price increases in 94 percent of metros (according to NAR), the current pace might seem no less fevered. Still, indications of a transition are beginning to filter out from a number of locations. Days on market are increasing ever so slightly, and overblown prices are being reduced. Or, as Katie Treem at Keller Williams Realty in Portland, Maine, explains, it might be that a property receives 20 offers instead of 40. “We’re still seeing people moving from New York, Boston, Connecticut and D.C.,” she says.

Also, agents like Treem are just beginning to see a few who bought in 2020 reselling. Sometimes they improved the property, but in others, decided the lifestyle was not what they desire or the commute, even for occasional days in the office, was too difficult.

In Tahoe, Watson says, “I believe the intensity has certainly calmed down, and I suspect very few listing agents will accept an offer from a buyer who hasn’t physically viewed the property. That goes for waived inspections … I’d be surprised if many are doing that any longer.”

No Bubbles Here

Bubble talk has become almost a perennial for real estate, but experts such as Rossell do not subscribe to this characterization of the market. Rossell says, “It’s not a bubble. It’s simply real demand bumping up against severe supply constraints. But this doesn’t mean house prices continue to go up. But what it does mean is you’re very unlikely to see the bottom fall out of the market, the way that you did in 2007, 2008.

“September 11 forever changed the way that we thought about terrorism. And I think in the same way, the first round of COVID in March of 2020 forever changed the way that we thought about public health, and pandemics. I think we’re all going to be living with the reality that at any given time something like this could happen, just like terrorism.”

Days on market are increasing, and overblown prices are being reduced. It might be a property receives 20 offers instead of 40, says Katie Treem at Keller Williams Realty in Portland, Maine.

©istockphoto.com / sara_winter

This story originally appeared in Unique Homes Fall ’21. Click here to see the digital version.

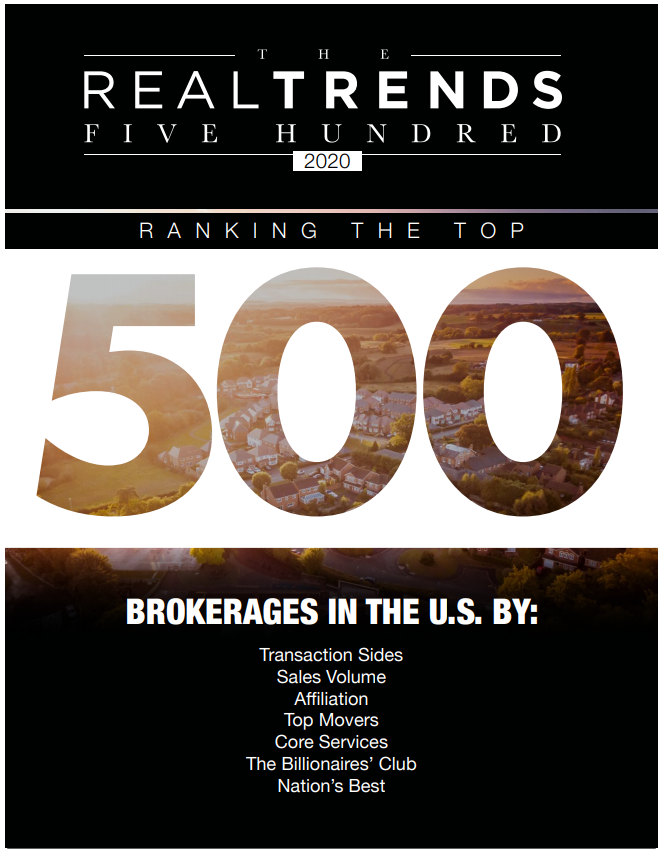

Who’s Who in Luxury Real Estate Members Recognized More Than 150 Times in REAL Trends 500

REAL Trends recently published their 33rd Annual REAL Trends 500, a leading report ranking the performance of the top residential real estate firms in the United States.

The list ranks the Top 500 firms ranked by both closed transactions sides as well as closed sales volume throughout 2019. Additionally, they acknowledged firms that closed at least one billion dollars’ worth of residential real estate in the surveyed year.

This year, Who’s Who in Luxury Real Estate members were recognized more than 150 times in the REAL Trends 500. Many members were included more than once and ranked among the top ten in their respective categories!

Congratulations to all Who’s Who in Luxury Real Estate members who made this prestigious list!

Residential real estate leaders have been looking to REAL Trends for more than 30 years for timely and trusted information and analysis through their monthly newsletter, conferences and publications. They provide vital data and insight into market trends that are imperative to the luxury real estate community, and inclusion in the REAL Trends 500 is a high honor.

Please visit REAL Trends 500 to view the entire report; keep an eye out for our latest LRE® promotion on page 3.

Photo at left provided by Who’s Who in Luxury Real Estate.

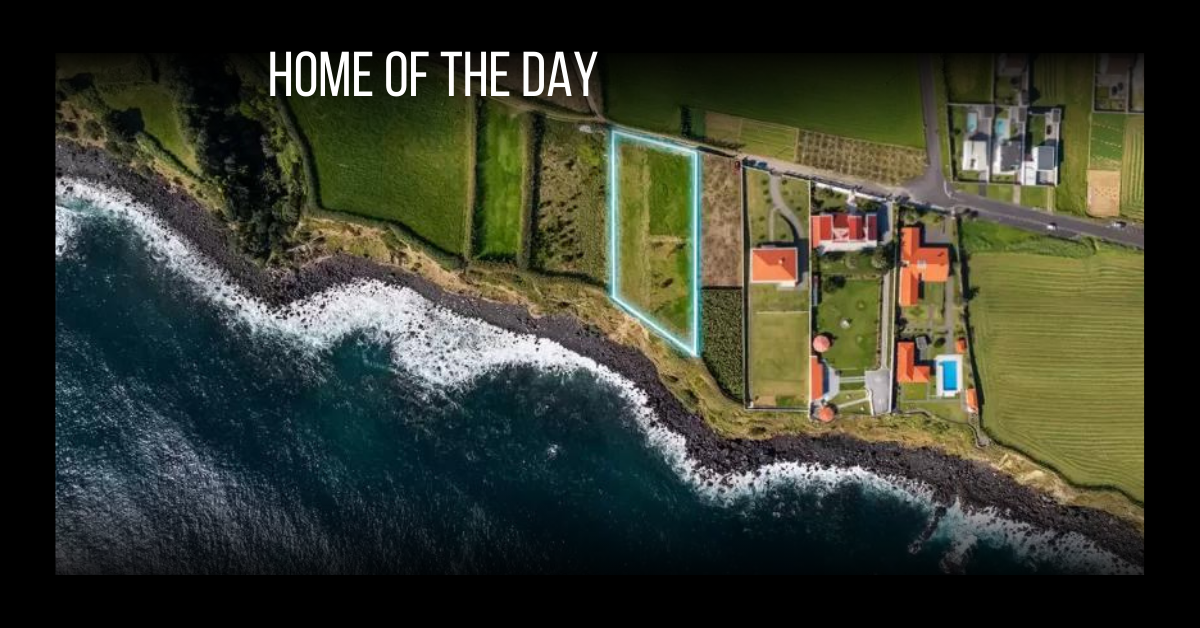

Featured photo by Luan Oosthuizen.

Investment is a great way to grow wealth over time and can be a game-changer for most people. It can help you generate cash, providing you an additional source of income and even have you covered with regard to retirement. Either way, if done right, investment builds wealth. Naturally, investing your hard-earned money can be an overwhelming challenge since there are a wide range of investment options to choose from. At this point, assessing your personal risk tolerance and time horizon helps you to decide where and how to allocate your investments.

Condominiums

As with any investment, there are several variables that can influence the outcome of your investments. Condos are in high demand among millennials, and so, investing in them can be a great move if you make smart decisions and purchases. Unlike most housing options, the management of the condominium tends to its maintenance and upkeep, meaning you save time, energy and money. Condos typically come with premium amenities such as swimming pools and gym, yet the purchase price is generally cheaper than single-family homes. When it comes to investing to provide future income, investing condominiums tend to be a safe bet. Head on over to get a listing in this location.

Photo courtesy of Unsplash

Dividend Stocks

If you’re open to taking on a little more risk, dividend stocks may be an option for you. Including both common and preferred stocks, the equity market can provide great possibilities for future income. Invest in companies that have safe dividend payout ratios and, in return, the portion of profit for shareholders is distributed among the shareholders. Generate income on the basis of the number of shares you own.

For those who love consistently warm weather throughout the year, Florida is known for its tropical, relaxed atmosphere. The palm trees and sunny days transport you to the Caribbean — especially in a residential amenity like Laguna Solé.

Laguna Solé is a massive 7-acre, man-made swimming lagoon large enough to fit 21 Olympic-sized swimming pools. The crystal clear water imitates the Caribbean while its ultrasonic filtration system uses 100 times fewer chemicals than a regular pool.

The lagoon is located in the heart of Solé Mia, known for being the “city within a city” that’s being built by two of the most powerful real estate dynasties in America, the LeFraks and Soffers. The LeFraks developed LeFrak City in New York and Newport, New Jersey, while the Soffers are known for developing much of what Miami is today.

The lagoon is accessible by residents and guests of the Shoreline, Solé Mia’s newest two residential towers located right next to the lagoon.

The $4 billion city of Solé Mia is known for its residential amenities that are elevating the standard of residential living — and Laguna Solé is the most recent and extravagant example.

Photos courtesy of Solé Mia.

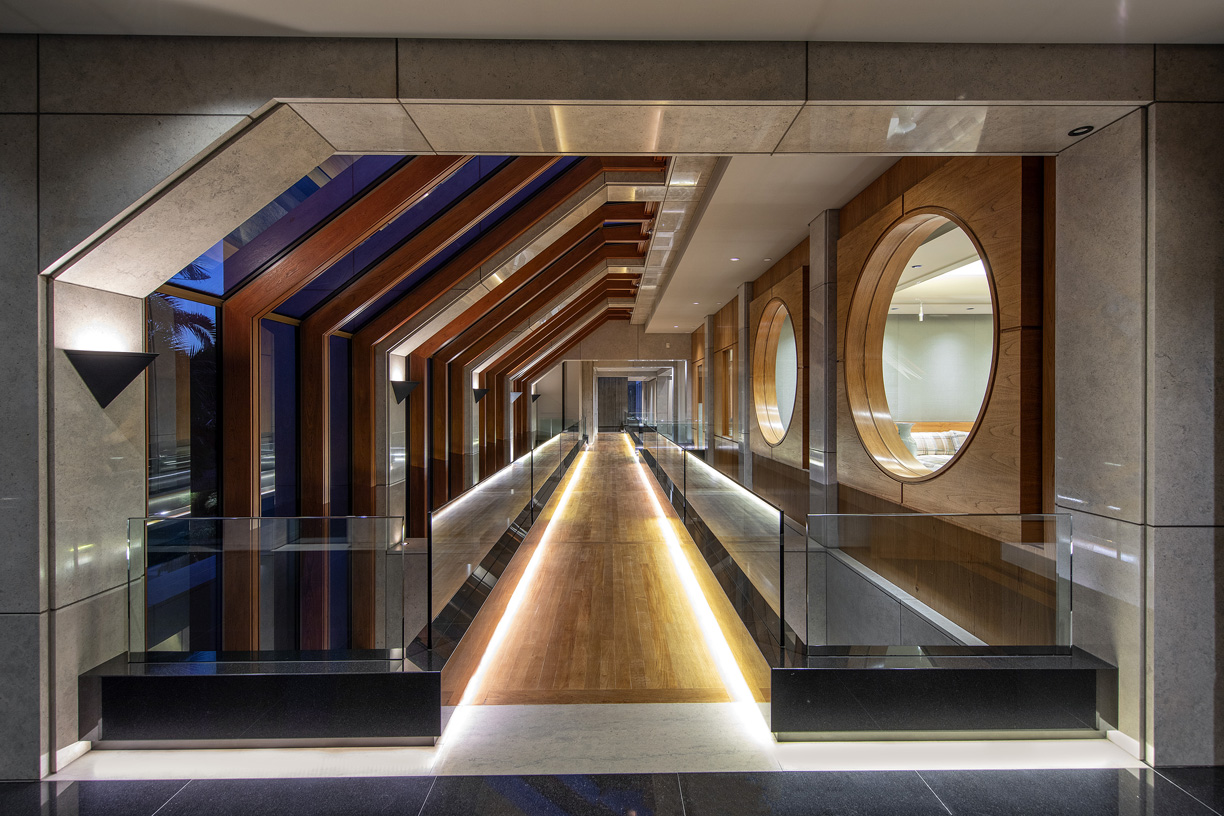

Jeff Hyland and Drew Fenton are thrilled to present The Glazer Estate, located in Beverly Hills, California. Totaling approximately 27,500 square feet, the massive concrete home with a modern museum-style aesthetic was completed in 1995, and has since replaced the longtime home Dean Martin originally purchased in the 1950s. The property was most recently owned by late real estate developer Guilford Glazer and his wife, Diane Glazer.

“Offering an exclusive Beverly Hills lifestyle, this rare gem is the ultimate in refinement and architectural prowess,” Hyland says.

Beautifully situated on 1.6+ acres in the most prime neighborhood of Beverly Hills real estate, Mountain Drive is arguably the best street in the city, making The Glazer Estate a world-class home in a world-class location.

Guests are instantly greeted by a long, private driveway surrounded by park-like grounds. With no expense spared, The Glazer Estate makes entertaining on a grand-scale seamless, with the ability to host over 1,000 guests.

From large teak doors to a two-story atrium and theatrical water elements, only the highest level of quality is showcased throughout the residence. The open floor plan allows guests to flow between the grand formal dining room to the glass-enclosed junior dining room, formal living room, and an exceptional water lounge surrounded by ponds on all sides.

The lavish master retreat is a world unto itself, with dual baths and closets. Other standout amenities include indoor and outdoor pools as well as a ballroom.

Photos courtesy of Jim Bartsch

Miramar is luxurious mansion in St. Croix, U.S. Virgin Islands, in a private estate located in the most extraordinary seafront setting perched on a bluff overlooking the Caribbean Sea.

The estate is custom designed to integrate comfort and elegance, with coral columns and marble flooring throughout. The impressive great room features a lavish living room, gourmet kitchen, formal bar and dining areas.

The property, listed for $8.9 million by Amy Land-de Wilde of Coldwell Banker St. Croix Realty, also includes a studio apartment, 1-car garage and a 2-car garage. A luxurious seaside mansion.

Combining island chic and luxury beachfront living in San Salvador, Bahamas, this ultra-private, 35,000-square-foot property boasts 400 feet of private white-sand beach.

“This home, feels like a private get away,” says listing agent Margaret Glynatsis of Coldwell Banker Lightbourn Realty.

“From the keyless entree pads, remote-controlled air conditioner and lighting system and the positioning of the home — with slight elevations allowing for most rooms to look out into the horizon — no thought or detailed was overlooked.”

With 3,200 square feet of living space, this home features an open-concept floor plan with 12-foot ceilings, floor-to-ceiling windows, two beds, two baths and a master bedroom with a floating bathtub, shower, double vanity, walk-in closet, office space and balcony looking out into the turquoise ocean.

“My favorite room of the home is the master bedroom as it includes 1,500 square feet dedicated to pure luxury and comfort,” says Glynatsis. “The really unique and stunning feature here is the stand alone tub in the center of the room with views of the never-ending ocean.” The home, listed for $1.499 million, is complete with a wrap around deck just steps away from the beach. “This beachfront oasis is perfect for someone looking to live off the grid, but still have access to every day modern amenities,” says Glynatsis. “San Salvador itself is a hidden gem that most people have yet to discover — the land is full of undulating hills, beautiful beaches, numerous salt water lakes, and amazing reefs that surround the greater part of the island.”

With 54 feet of beachfront, this lakefront home in Vernon, British Columbia is ideal for entertaining — it features a dock, boat lift, outdoor living spaces and two full kitchens.

Inside, details include open-concept living, vaulted ceilings, granite countertops hardwood floors and a covered deck with outdoor gas fireplace and views of Okanagan Lake. The lower floor includes waterfront living at its best with in-floor heating, a wine cellar, summer kitchen, outside shower and large walk-out patio with outdoor gas fireplace and built in barbecue.

“Guests are always welcome, as the house has a self-contained 3-bedroom casita above the garage with lake views and a private deck,” says listing agent Norm Brenner of Coldwell Banker Four Seasons Real Estate, who is listing the home for $2.95 million. “It is ideal for those that want to entertain or anyone that has extended family.”

“Cap Blanc Ibiza” is in one of Spain’s most desired locations on the island — Cap Martinet, Talamanca.

The exclusive private residence of nine luxury villas was designed so each home ensures the privacy and seclusion of its owners.

“It is just a short drive to the world’s best nightlife, and some of the most spectacular white-sand beaches you can imagine,” says Richard Lacey of Coldwell Banker Global Luxury Blue Moon who is representing the property. “Ibiza is one of the most beautiful islands in the world.”

The home showcases stunning architecture inspired by contemporary, Brazilian design — a work of a team of leading Dutch and Spanish architects that create these properties where outdoors and indoors merge and flow.

Notable features include floor-to-ceiling windows and large doors that provide unobstructed views of the sea and the island of Formentera. “The lounge for me is the best spot, high ceilings with lots of light, ideal for entertaining,” says Lacey.

Listed for 3.75 million euros, the home also features 600 square meters of living space over three floors, five en-suite bedrooms, open-space fully equipped kitchen, incredible sea views, private garden with spacious swimming pool, private garage, state-of-the-art security, additional service kitchen, fitness room and sauna, and a wine cellar. There is also an optional private movie theater and separate accommodation for staff. The nine residences that make up Cap Blanc Ibiza offer unparalleled amenities and facilities for those seeking a place to relax in comfortable luxury.

Restored and refurbished, this immaculate residence in Dublin, Ireland spans over 492 square meters.

“The attention to detail is phenomenal,” says listing agent Karen Mulvaney of Coldwell Banker Ireland. “There are pictured buttons on the light panels that represent scenes and moods. The current owners have thought of everything.”

Features of the home include a cinema, wine room, bar, gym, playroom, office and formal drawing room. “The drawing room is magnificent and made for a family Christmas,” says Mulvaney. “And, the large open plan kitchen/dining/living room is truly the heart of this home.”

The home, listed for 3.25 million euros, also offers a master suite with walk-in wardrobes and an en suite bath, and a garden that is landscaped to allow sunlight into different areas throughout the day.

“This is the perfect period home, without the maintenance, as it’s been future-proofed with technology, even though it was built sometime after 1780,” says Mulvaney.