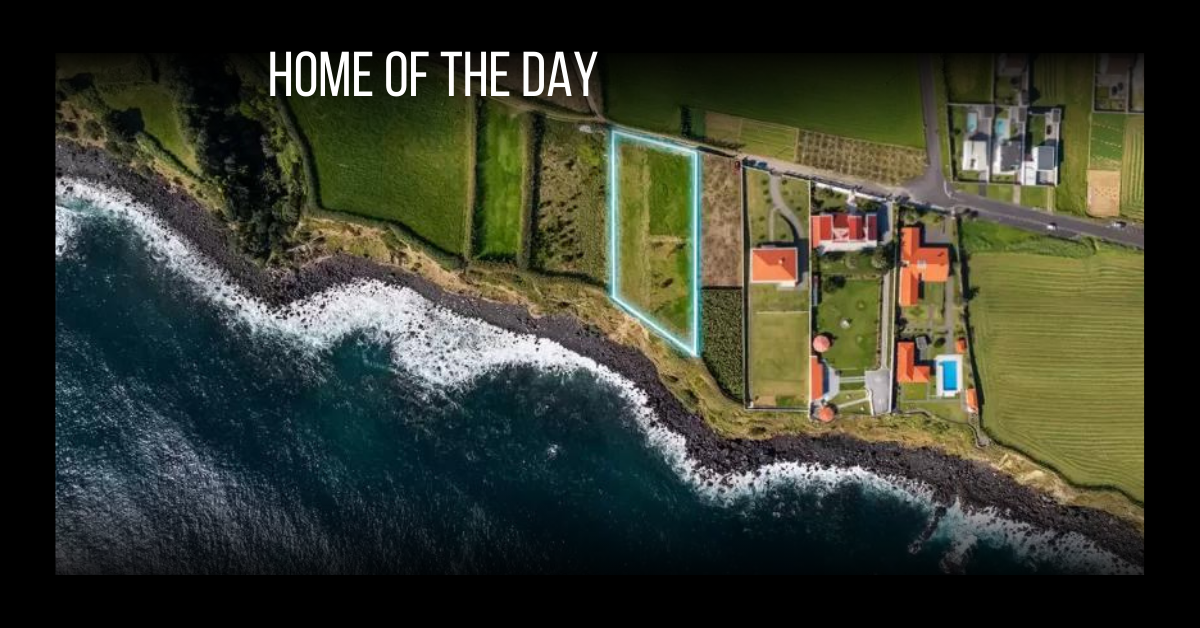

The Ultra High End’s new story: No longer is ultra high-end real estate in the U.S. just about NYC and LA.

Beverly Hills, Manhattan and Miami, along with one or two other cities, have traditionally been the locus of the most expensive and most exclusive real estate in the U.S. Now, in an increasingly diverse geographic mix from Boston to Boulder, more properties align with what the industry calls the ultra or premier market. Uber prices in these locations might not number in the hundreds of millions of dollars, but they are the highest of that market. And, no matter the ZIP code, it’s likely that properties at the very top share similar attributes.

Worldwide, the number of millionaires and billionaires continues to grow, with the U.S. still accounting for the largest share of mega wealthy. “I think the change we are seeing in the growth in the ultra high-end is directly correlated to the growth of significant wealth in the world. More people have more significant money,” says Stephanie Anton, president of Luxury Portfolio International.

“Interestingly,” she says, “it’s diversifying too. In the U.S., no longer is the story just about NYC and LA. Bottom line, the shift in location is a change that influences the high end of the housing market and the demand for significant properties in a way we have never seen before.”

Photo courtesy iStockPhoto.com / Sean Pavone

Traditionally, the very top of the market in Boston was the purview of the city’s legendary Brahmins. But the revitalization of downtown neighborhoods and growth of tech and finance, along with globally recognized educational institutions, are revamping the high end in both the city and suburbs. In 2018, there were 82-percent more luxury property sales than in 2014. Not only are more properties considered high end, but new luxury towers mix with traditional blue-chip estates.

Photo courtesy of iStockPhoto / MattGush

Jonathan Radford with Coldwell Banker Residential Brokerage in New England is representing the highest priced estate outside Central Boston. Woodland Manor is a $38 million property on more than 7 acres, five miles from the city centerline in Brookline. Photo courtesy of Boston Virtual Imaging.

The highest listing in the city is a $45 million penthouse occupying the entire 60th floor of the new Millennium Tower. Jonathan Radford with Coldwell Banker Residential Brokerage in New England is representing the highest priced estate outside Central Boston. Woodland Manor is a $38 million property on more than 7 acres, five miles from city center in Brookline. “Over the ast 5 years, we have seen consistent growth in the number of luxury property transactions outside of the city of Boston, in the range of 10 percent to 30 percent per year, with the exception of 2016, when a shortage of inventory resulted in a 2.7-percent decline in the number of luxury sales. In 2018, there were 58-percent more luxury property sales than in 2014,” explains Radford. “In the city, growth in the number of luxury transactions has exceeded 25 percent a year.”

Beverly Hills agent Joyce Rey, head of the Estates Division of Coldwell Banker Global Luxury, has brokered a number of record-setting transactions both regionally and nationally. “I never cease to be amazed at the constant ascension of real estate values. Any look in the rearview mirror at real estate values is always surprising because people realize and regret not buying more real estate. And it seems shocking today because when I founded Rodeo Realty in 1979, $1 million was a pretty major property.” The customary benchmark for luxury in many places has been $1 million. Now, in many locales, including Boulder, Colorado, the $1 million home is basically a redo. Boulder agents say luxury doesn’t begin until $2.5 million,

but even then, as Megan Bach with Colorado Landmark Realtors points out, “some homes are not necessarily luxury.” A more reliable gauge in Boulder, she says, is price per square foot, a measure often applied to premier markets in New York and California. She estimates luxury in Boulder begins at approximately $1,000 per square foot. The highest priced home currently on the market is a $9 million property on 15.42 acres outside of town with extensive views and strong indoor/outdoor connections. Having “great indoor views typically price bumps any home in any neighborhood here, as is the case in any view locale,” says Bach, emphasizing what might be a universal truth for uber luxury: No matter the location, the better the views and outdoor connections, the higher the price.

Utah ay seem an unlikely spot for the ultra high-end, but prices now approach $10 million with the highest residential listing $26 million. Photo courtesy of Summit Sotheby’s International Realty.

“Sales over $10 million are very rare, but I think they are coming,” observes Debra Johnston, with Berkshire Hathaway HomeServices Georgia Properties. Photo courtesy of Debra Johnston.

Along Florida’s west coast, values in upscale resort locales traditionally trailed Miami or Palm Beach. Now, “prices for beachfront in Naples begin at $20 million,” says Tade Bua Bell of John R. Wood Properties. The recent sale of a gulf-front property in the exclusive Port Royal for $48 million illustrates how much demand has changed. The home was eventually torn down and replaced with new construction. Another property also in Port Royal and destined for a tear down sold for $28 million. In the ultra-sphere, a $10 million or $20 million tear down is not an anomaly.

The uber market in Atlanta starts around $5 million to $7 million for new construction. “Sales over $10 million are very rare, but I think they are coming,” observes Debra Johnson, with Berkshire Hathaway HomeServices Georgia Properties. “Buckhead is running out of large land lots, which is driving up the cost to build a dream house. The time it takes to build a new luxury home in the $5 million range could take up to 2 years. Many prospective buyers are instead buying the best flat lot they can find in a resale, and renovating the house to their taste level,” observes Johnson. In Atlanta, Los Angeles and other cities, lots suitable for prestige properties are at a premium.

In New York City, ultra luxury starts at $10 million, but Martin Eiden of Compass Real Estate says if you are looking for the “Wow factor” you have to be in the $18 to $40 million range. And anyone considering a trophy — what Eiden calls “I made it big” — property, generally has to look at $60 million and up. In the ultra-sphere, trophy properties often have over-the-top list prices. Greenwich, Connecticut, is a blue-chip bastion for prestige properties. Topping price points is a mid-country European style estate offered at $29.5 million, followed by a $22.5 million property, also in a premier estate setting. Old money locales tend to be timeless. In the Washington, D.C., metropolitan area, uber prices currently do not exceed

the $20 million mark. The exception is a $62 million estate in McLean, Virginia, on 3.2 acres overlooking the Potomac and comprised of a main residence and The Marden House, which was designed and constructed by Frank Lloyd Wright in 1959. Also extraordinary is underground parking for 30 cars, bespoke interiors by Thomas Pheasant and some of the finest views of the river in the region. In the ultra realm, truly singular properties, particularly those with provenance, often merit singular list prices. Parking for dozens of cars might seem over the top, but garage space and parking are both important to high net worth buyers, according to Rey. What else is considered a must-have? Smart home tech, larger closets, a gym, kitchens and great rooms that flow, screening and media rooms. But, Rey emphasizes, “Location is still the number one consideration for buyers.”

The increasing diversity of locations in properties at the highest price points is basically a numbers game: more buyers, greater degrees of wealth, and price appreciation in the overall market. Simply, there are more people in more locations with greater net worth. Utah is an unlikely spot for the ultra high-end, but prices now approach $10 million with the highest residential listing at $26 million. The market changed in 2016, according to Kerry Oman, with Summit Sotheby’s International Realty in Park City, who brokered the sale of a $13.5 million property in Provo Canyon, the highest-priced transaction in recent years. For the ultra market, the $5 million to $7 million range is typical, and $7 million to $10 million is no longer the exception, says Oman. In spite of growing national interest in Park City, demand for uber properties is most likely to come from home-grown wealth. In the ultra-realm, U.S. buyers dominate a majority of locations today.

“A lot of money is coming out of Silicon Valley, and Seattle now. And we’re seeing a great migration of significant wealth to more resort markets like Hawaii, Florida and Texas, due to an aging affluent population and also attractive tax laws,” shares Anton. Taxes are only one driver for a new geographic mix of buyers in Florida and Georgia. Even before the tax law was passed, brokers like Bua Bell were reporting more interest from Colorado and California. Brokers in Naples and other cities are also seeing buyers from New York, New Jersey, Massachusetts and Connecticut. Johnson says there has been a big increase in out-of-state buyers in Georgia in the last year. Ultra-luxury buyers in Greenwich have broadened in terms of their use of these properties and what they are looking for, observes Robin Kencel with Compass Real Estate. Some plan to make Greenwich their fulltime residence. Others are looking for a weekend or a summer retreat. “As people discover Greenwich’s natural beauty, from having four beaches to 600-plus nature trails to a breadth of year-round activities and its sophisticated, diverse and wholesome vibe, it is becoming an attractive alternative to the Hamptons,” she says.

In the Washington D.C., metropolitan area, uber prices currently do not exceed the $20 million mark. The exception is a $62 million estate in McLean, Virginia. Photo courtesy of Gordon Beal.

Sui generis is how some characterize the ultra market, but as distant and disconnected as it may seem, the ultra sector does not exist in a separate vacuum. “Everything’s fluid in luxury real estate,” says Gary Gold with Hilton & Hyland in Beverly Hills, noting it’s not like the stock market where there is a definite price at the closing bell. “It doesn’t work that way. There are so many nuances. In general, when you have record sales, when you have record numbers of sales, when you have lots of positive activity, it has an overall significant effect on everything,” he explains.

“The rise in significant prices is a reflection of demand but also is consistent with the rise we’re seeing in luxury prices across the board,” says Anton. “According to Realtor.com, in Q4 of 2018, prices in the top 5 percent of markets in 1,000 U.S. cities closed at an increase of 4.7 percent year over year. It’s a bit of that old saying, ‘a rising tide lifts all boats.’” With pricing heading into the stratosphere, an ultra purchase might seem capricious — a product of desire rather than a well thought

out choice. Instead, no matter the price, it’s still a question of value. Every once in a while a buyer might make a crazy purchase, but agents say that’s a very rare occurrence. Even though prices might be well into the tens of millions, Gold says, “It’s not about the money. It’s about how everyone wants to make a smart purchase, and no one wants to be a chump. For the most part, when they make that purchase, people want to feel they have made a prudent, valuable purchase. People who are worth a lot of money are very used to making very very expensive acquisitions, whether it’s in business or personal.

They know how to wrap their head around these very large purchases.” “These buyers are highly sophisticated consumers and active in multiple luxury asset classes, from cars to art to jewelry. They want to know that beyond enjoying their property, they have made a sound business decision,” says Kencel. Ultra properties might be extravgent and indulgent, but the ultra buyer’s focus is still value and investment. When there are several properties on the market at the highest prices, agents often say, “When one sells, the others will to.” Surprisingly, experience does validate this claim. “If you see homes that are setting new precedent, I think it definitely is an endorsement in an area and a price range,” says Gold. Several years ago, Gold broke the $100 million price point in Los Angeles with the sale of the Playboy Mansion. “No one ever sold something well over a $100 million. Since then, we’ve seen more really big sales than ever before. It’s definitely a validation of an area, and people get more comfortable spending more money, so it’s a good sign.” And the impact trickles down. “The second I sold something for $100 million, all of a sudden the $5 million listings are now worth more.”

This editorial originally appeared in Unique Homes Ultimate ’19 Issue.

Inventories, consumer confidence, growing worldwide wealth, the stock market, tax changes and local dynamics are affecting how hot each luxury real estate market is throughout the U.S.

By Camilla McLaughlin

“Fasten your seatbelt, 2018 will be a fun and scary, but prosperous ride,” is how Brad Inman, founder of Inman News, assesses the outlook for real estate this year. On the other hand, developers and planners tapped by the Urban Land Institute (ULI) call for “a long glide path to a soft landing” for the economy and the real estate sector. They expect the current cycle to extend into 2018 and even beyond.

These comments perfectly illustrate the divergent opinions on the outlook for real estate this year, especially luxury real estate.

For real estate overall, it’s not an overstatement to say 2017 was a very good year. The National Association of Realtors (NAR) expects sales of existing homes in 2017 to tally at 5.81 million transactions, the best number since 2006, and 3.8 percent higher than 2016. Home prices grew by almost 6 percent, a pace NAR expects to be duplicated in 2018. Looking ahead, the forecast calls for an increase of 3.7 percent in the number of sales as more new construction amps up the number of homes on the market. December sales soared 5.6 percent, with most activity at the upper end of the market fueled by move-up buyers with considerable down payments, cash buyers and easing of inventory shortages.

For luxury real estate, the narrative, while positive, revolves around locations and price brackets, depicting a market beginning to settle into a sustainable pace after a protracted recovery. “Bottom line, we’re going to have a strong year,” says Philip White, president and CEO of Sotheby’s International Realty Affiliates. “The one difference this year is the up-wind market is having a better 17 versus 16. We are going to have more transactions and a higher average sales price this year than last year.”

In cities such as Seattle, San Francisco or Denver, demand for upscale properties outpaces supply. “Chicago now has 60 cranes in the air which has only happened twice in my 25 years here,” says Craig Hogan, vice president of luxury at Coldwell Banker Real Estate.

New York City is often portrayed as being in the doldrums. Although there has been a slow down in the ultra high end, other price points and neighborhoods all over the city are far from flat. Most active, according to Ellie Johnson, president at Berkshire Hathaway HomeServices New York Properties, is the $1 million to $5 million range, where multiple offers are not uncommon. From Dec. 11 through the 17, 18 properties went under contract above $4 million, which she says is a much larger number than the same period a year ago. When New Yorkers confront change, they often put buying plans on hold. Johnson says the upper price brackets are in a “strong hold pattern” right now, but she expects it to be short lived. Also, Wall Street bonuses should translate into “a very nice first quarter.”

“I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm.”

— Bob Hurwitz, founder and CEO of

The Hurwitz James Company

image courtesy istockphoto.com / Meinzahn

Traditional luxury markets in New York, California and Florida are still strong, but brokers also see big plays in smaller markets. Lesli Akers, president of Keller Williams Luxury Homes International, illustrates with a recent $22 million transaction in Austin, “the biggest sale in the history of that market.” ULI forecasts a shift in interest and investment dollars to smaller metros such as Seattle, Austin and even Salt Lake City as well as close-in suburbs of New York and Washington, D.C. In New York, Diane Ramirez, chairman and CEO of Halstead, says new buildings, both residential and rental, with views of the Hudson River, extensive amenities and a short commute to the city are generating interest from younger consumers in White Plains, New Rochelle and Tarrytown.

“Luxury is starting to move into every market. As neighborhoods change, the buyers change,” says Diane Hartley, president of the Institute for Luxury Home Marketing, noting it’s important for agents to understand this new buyer, new price points and new expectations.

For agents, “it’s no longer enough just to be a local expert, they have to have global knowledge as well. Most of the affluent are looking to see what is happening in the global market. But it’s also who agents are bringing to look at the home,” says Anne Miller, director of business alliances for RE/MAX.

At LuxuryRealEstate.com’s fall conference, comments about local markets were all positive, something Publisher John Brian Losh says usually doesn’t happen. “Prices are directly related to the economy and consumer confidence, and right now consumer confidence is high,” he says.

More than consumer confidence is bolstering luxury sales. Adding to demand are the growth of wealth in the U.S. and worldwide, a surge in the stock market, and a rise in foreign buying of U.S. properties. There are few, if any, indications this will change in the immediate future. Paul Boomsma, president of Luxury Portfolio International, explains: “Our white paper and our global survey show a lot of interest from buyers, not only for this year but over the next two years. There is more interest on the buy side than the sell side, and that is consistent among the high end, and it extends to 17 different countries. There is a lot of interest and not just in U.S. properties.”

Purchases of U.S. properties from foreign buyers surged from $102 billion to $153 billion in the year ending March 2017, accounting for 10 percent of dollar volume of sales. “Foreign buyers generally see the U.S. as a safe haven for investment,” says Bob Hurwitz, founder and CEO of The Hurwitz James Company, whose current clients include mega affluent buyers from Turkey, Singapore, China and Ukraine looking buy in price ranges of $20 million and up. “In a couple of cases this includes multiple properties, including commercial and development not exclusive to California,” he adds.

While most markets sizzle, the high end in some locations and price brackets is back to a slow simmer. “I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm,” says Hurwitz. “Prices have already adjusted, and as developers and luxury home builders start having homes sit on the market, there will be opportunities to make good buys.”

“In the ultra high end, I think prices are being adjusted to the economy,” says Losh, noting a common issue with ultra properties. Often sellers price the home at the highest price they ever imaged. After a couple of years, they get realistic. “What really determines value is what it cost to replace a property,” he says.

The ultra high end may be cooling, but, Hogan says, the luxury market is healthy. “The $1-to-3 million, $3-to-5 million and $5-to-9.9 million sectors are strong. Not in every city but as a whole, based on our year-to-date numbers. I honestly feel that we are simply normalizing.”

“We are seeing some moderating trends in the luxury space,” says Akers. Downward price adjustments and longer days on market are signs that luxury is moving toward a more balanced market. Still, she adds, “Truly unique properties still command top dollar and cash offers.”

It would seem that the performance of the stock market might discourage real estate investment. Instead, Marci Rossell, chief economist for Leading Real Estate Companies of the World, says it has an opposite effect. “For the luxury buyer, real estate is part of a larger portfolio and portfolios have swelled in terms of stock market value over the last two years. So, from the perspective of balancing a portfolio, real estate can look attractive.” The most influential trend for 2018, particularly the high end, is new consumer attitudes. “Across all price points, the word value is critical today,” says Ramirez. “Value to a $1 million buyer and a $600,000 buyer is not the same, but both want the perception of value.”

Consumers have become even more demanding. “There is a desire for perfection. They want a property or an experience to be exactly what they want it to be. There is no desire for compromise,” says Hartley.

Price matters, but it’s not the only factor in the value equation. “If it’s been on the market awhile, bringing down the price is not going to do it. You have to see what’s selling,” says Ramirez, using the example of a $7 million property in Darien that sold in a single day. It was well priced and located across from the water. Water views continue to be in highest demand.

People want new. “If it’s an older home, it must be newly renovated,” says Ramirez. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

The bottom line for sellers, according to Miller, is to listen to their agent. “We’re hoping that everybody takes a reality check on location, quality — is it unique and rare, does it have all the luxury amenities? — before they list their home.”

People want new.

“If it’s an older home, it must be newly renovated,” says Diane Ramirez, chairman and CEO of Halstead. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

Image courtesy istockphoto.com / TobiasBischof

Also, says Kevin Thompson, chief marketing officer at Sotheby’s International, “There is a search for the unique.” This new consumer isn’t interested in cookie-cutter anything. “They want something personal and outside the norm, and they are willing to pay for that.”

Looking ahead, Hogan sees new construction, contemporary/modern, a smaller footprint and full connectivity shaping future demand.

“We’re seeing more and more of what I call the ‘Tesla consumer with the Apple watch’ — a client who’s passionate about their lifestyle and their environmental foot print. They want to do what’s right for the earth, and they don’t mind people knowing it’s expensive,” shares Akers.

Recent ultra-high-end sales in Greenwich and Manhattan are evidence that buyers are out, according to appraiser Jonathan Miller, who noted in a recent blog: “Buyers remain in the market, but the price needs to reflect 2017.”

Akers says sellers should prepare to sell at fair market value. “We’re not in a ‘dip your toe in the market and test it out’ kind of market.”

The number of homes available for sale continues to be the fulcrum on which markets balance. Regarding real estate overall, Lawrence Yun, NAR’s chief economist says: “Home prices, after multiple years of fast growth, still show no signs of cooling because of the ongoing housing shortage in much of the country. The latest Case-Shiller price growth of 6.2 percent on a nationwide basis marks the strongest rise in over three years.”

High-priced markets are not immune to inventory challenges, but it’s not in every location. Instead, it is likely to be places that have had strong buying for years and strong population growth. White uses the example of San Francisco, where anything that is priced right is snapped up. Inventory constraints, according to White, are not unique to the U.S. “In Hong Kong and Japan, there are stories where people are lined up to buy high-priced units in new buildings, even to the point where they will sell their place in line.”

This year, for the first time since the downturn, inventories eased ever so slightly, and forecasts point to more new construction in the next few years. Javier Vivas, director of economic research for Realtor.com, sees 2018 as “a significant inflection point in the housing shortage, with increases in inventory felt initially in the mid- to higher-price points above $350,000.” Vivas says Boston, Detroit, Kansas City, Nashville and Philadelphia are predicted to see inventory recovery first.

As inventories grow, sellers need to understand that homes that are dated or not priced accurately will fall to the bottom of prospective buyers’ list of target properties.

At year-end, tax changes and continued political uncertainty loomed over every forecast. “For buyers worldwide, I think policy changes will matter more than economic climate. This is a year when tax policy could drive some location decisions. If you are a first-time buyer in a high-tax area and you are looking to put down roots, you will think long and hard about the tax consequences of a location. Even on the European front, we know Brexit will affect location decisions. Already we are seeing relocations out of London to Frankfurt,” shares Rossell. “The homebuying decision is part of a large mosaic, and the tax implication of that decision used to be a smaller tile, and it will become a larger tile.

Looking ahead: “The economy and housing market will grow like crazy. Job creation is at record levels; unemployment is at a 17-year low, wages are feeling upward pressure and companies are investing at a fast and furious pace,” commented Inman. “A backdrop of political uncertainty will not slow down the global economic thoroughbred that is galloping at a full run. Left in the dust will be housing affordability in many major metros.”

THIS STORY WAS FEATURED IN OUR WINTER 2018 ISSUE.

CLICK HERE FOR THE FULL DIGITAL VERSION.

By: Samantha Myers

Atelier of downtown Los Angeles

Rising 33 stories, Atelier is one of Downtown Los Angeles’ newest premium residential buildings, bringing 363 artfully appointed residences panoramic views of the swelling city skyline from the center of it all.

“Primarily, the most distinguishing feature of Atelier is location,” says Dan Garibaldi, managing partner of development and construction at Carmel Partners. “LA’s gone through a transformation in the last 15 years, which has really accelerated in the last five. When we bought the property there was not a lot of activity occurring downtown, but now there are numerous new restaurants, bars, entertainment areas and job centers moving into the area.”

Just a short distance from cultural hubs such as the Staples Center, L.A. Live and Walt Disney Concert Hall, Atelier residents can integrate a vast array of entertainment into their lives. “With Atelier, you can live near where you work and play. If you were to pick a center of Downtown LA, I believe 8th and Olive, our location, is the epicenter.”

Atelier’s design encompasses the emblematic LA lifestyle, particularly through its transitional indoor/outdoor amenity spaces. “We embrace the exterior spaces, we embrace healthy living,” says Garibaldi. Alongside a slew of resort-style amenities, Atelier boasts numerous terraces — a Yoga Terrace, Game & BBQ Terrace, Private Dining Terrace, as well as a pool deck. Yet its most impressive outdoor space is the rooftop Skyline Terrace, featuring a splash pool, cabana, fire pit, not to mention uninterrupted city views.

Atelier began pre-leasing in December 2016.

By: Camilla McLaughlin

For prime real estate markets in the U.S., 2016 was a year of change, and expectations are that 2017 might bring even more. No matter how a market changes, there is always opportunity. In honor of the year at hand, we are shining a spotlight on luxury in 17 cities.

Atlanta, Georgia — Luxury here rebounded after a slight dip at the end of the summer and the months leading up to year-end saw eight or more $2 million-plus condo sales. Outside the city, the high-end market hasn’t missed a beat and prices continue to rise. Barring any substantial shocks, one agent says, “I think we will see a very robust spring.” Lots of new construction is poised for mid-town in 2017.

Austin, Texas — Few cities can match Austin’s recent track record. It has led Urban Land Institute’s (ULI) list of “markets to watch” and even sparked a category ULI dubs “18-hour cities.” Austin has gained a reputation as a tech mecca. But taxes, cost of living and a lively arts scene also woo newcomers. Yet, the new year finds a few wondering if the fast pace can continue.

Chicago, Illinois — Inventory frames the story here. Lots of new construction on the market resulted in a slight slowing of luxury sales in city center, while suburban upscale sales were up 5 percent year over year. Still, city living continues to be a big trend, particularly for boomers who want to downsize or just have their place in the Second City. In demand: residences associated with a five-star hotel.

Delray Beach, Florida — The once sleepy Delray has taken off this year. A downtown revitalization has given this Florida secret, close to both Boca Raton and Palm Beach, a new shine without compromising laid-back ambiance. Third quarter saw a $2.98 million average luxury price, a 70-percent increase over last year. Buyers are a mix of permanent and vacation home residents. Single-family homes with water access demand a premium.

Denver, Colorado — One of the leaders in the West and nationally, Denver real estate continues on solid footing with year-to-date sales in the $1 million-plus market up 102 percent. Still, with 7.5 months of inventory, indicators are inching towards a balance — a plus for buyers. Look for slower appreciation in the year ahead.

Honolulu, Hawaii — With a 30-percent increase in sales and 17.7-percent increase in prices, Honolulu had one of the best markets nationally at year end. Christie’s International Real Estate considers it one of the 10 cities to watch globally in 2017. Hot properties include residences in new towers in Ward Village.

Jersey City, New Jersey — Luxury is beginning to find a new home here. The rush is on for upscale digs, thanks to easy access to Manhattan and bargain prices compared to the Big Apple. Neighborhoods in transition and plenty of new construction translate into opportunities for buyers.

Malibu, California — Location matters here. Flat properties set on a bluff overlooking the most desirable beaches fetch top dollar. The ultimate: Carbon Beach, nicknamed Billionaire’s Beach. The year-end median sale price hit $2.447 million, higher than nearby platinum locations, but still below 2008’s peak $3.3 million. Expect prices to rise only 0.6 percent in the next year.

Newport Beach, California — Buyers, sellers — both win here. By year end, list prices had increased by 19 percent, but the inventory of homes on the market

increased by 9 percent year over year. Look for the balance to tip toward buyers. Price increases are expected to taper down in 2017.

New York, New York — Contrary to popular perception, the bottom has not fallen out of the luxury market here. But it is a market of opportunity, particularly if an ultra-property happens to be on your horizon as the end results of a multi-year building boom come to market.

Phoenix, Arizona — Canadian buyers might be on pause, but if fall data is any indication, the high end around Phoenix is on the upswing. Closed transactions were the highest of any September since 2005, with Arcadia hitting a record. The number of homes priced above $500,000 grew by 13 percent last year, but in October the number of listings under contract was up by 12 percent. With prices holding steady, this is one market we’ll be watching this year.

Portland, Maine — Long a summer haven for the wealthy, Maine, particularly Portland, is garnering attention from out-of-staters, from retirees to young entrepreneurs and tech professionals. With a growing reputation as a foodie destination and excellent home prices, expect to see this city’s luxury star rise, particularly in New England. Recent upscale transactions range from $1 million to $4.5 million.

Salt Lake City, Utah — The fastest growing nationally, Utah is also one of five states chalking the largest year-over-year price appreciation, so it’s no surprise to find Salt Lake on many “best of” lists this year. Park City’s reputation as a luxury Mecca continues to expand, while nearby Salt Lake’s luxury cachet is just beginning. Adding to the appeal: a year-round outdoor lifestyle, urban living without mega-city hassles, diverse locations and architecture.

Seattle, Washington — Few other places occupy as many top five positions on lists of top markets. While forecasts vary depending on who you ask, one thing is certain: there is no sign of real estate in this exploding tech hub cooling any time soon. High prices in Vancouver are diverting buyers here. Interesting trend: buying sight unseen for properties priced above $750,000.

Stowe, Vermont — The grand dame of East Coast ski resorts is completing a $500 million upgrade, including a new high-speed quad, an inter-mountain gondola connecting Mt. Mansfield and Spruce Peak, a new $90 million Village Center, and amenities including a ski club. New real estate ranges from single-family homes to townhomes and a private residence club. Brisk sales and new construction set the stage for 2017.

San Diego, California — Transactions and prices still have room to expand here. It’s no surprise that projections call for a 9.9 percent price increase in 2017. Downtown luxury is in demand with new large-scale developments, including North Embarcadero Esplanade and Waterfront park injecting a new vibe into parts of the city. Artful new towers include Pacific Gate.

Lake Tahoe, California and Nevada — Here, it’s a tale of many markets depending on location and price. Lakefront, East Shore shows the average luxury sold price up 29 percent to $4.8 million. Ski properties are also up with a year-over-year increase of 175 percent in Martis Camp. Sales in Northstar also jumped with the total dollar volume increasing by 237 percent. Few other places outside the Bay Area benefit as much from San Francisco’s economy.