Kim Martin-Fisher

& Jennifer Martin Faulkner

Coldwell Banker Vanguard Realty

2240 Ponte Vedra Park Drive, Suite 201, Ponte Vedra Beach, FL 32082

K: 904.699.9993 | J: 904.524.6000 | KMFandJMF.com

Listings by Kim & Jennifer

725 Ponte Vedra Boulevard

Ponte Vedra Beach, FL

5BR | 3BA | 2,404 sq. ft. 725PonteVedraBoulevard.com

Contact Kim & Jennifer for a private showing.

Kim Martin-Fisher & Jennifer Martin Faulkner originally appeared as Elite agents in the Unique Homes Spring ’19: Elite edition. See their page here.

Debra Duvall

Water Pointe Realty Group

3727 S. East Ocean Blvd. Suite 100 Stuart, FL 34996

772.283.3330 | Deb@WaterPointe.com | www.DebraDuvall.com

Debra Duvall, a resident of Florida’s Treasure Coast since 1965, is a leader in the marketing and sales of luxury and waterfront residential properties. Entering the real estate field in 1981, Debra combines her hands-on, historical knowledge of the region with a determination to offer unparalleled sales, marketing, and relocation/absentee services. As a partner of Water Pointe Realty Group, an independent, locally-owned real estate firm, which is a member of numerous national and international networks, specializing in residential, investment, development, luxury and waterfront properties, she ensures that all of her clients are properly represented. Debra’s personal and professional success is built on a firm foundation of experience, education, integrity, and dedication to service.

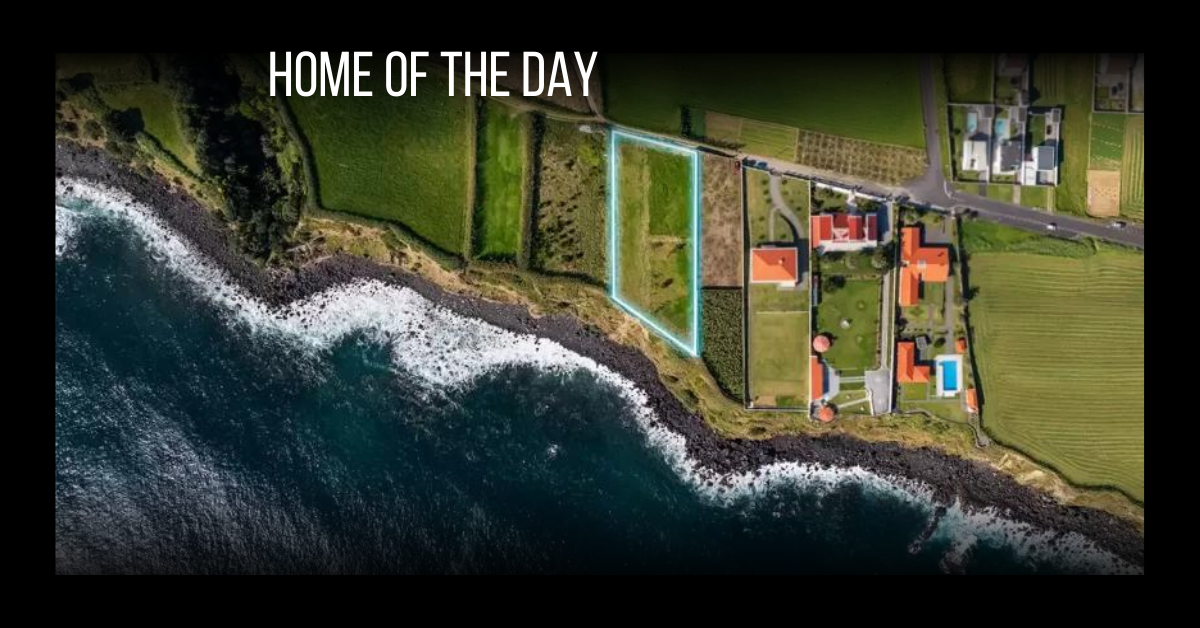

Listing by Debra Duvall

Florida

Private Island Lifestyle

From the moment you arrive, you’ll instantly forget that life exists beyond this tropical oasis! A casual style main house and guest cottage sit on 3.4-plus acres with 2,700 feet of shoreline, white sandy beaches, and just minutes to the ocean! Close to downtown dining, shopping, a private executive airport and only 45 minutes to an international airport.

www.DebraDuvall.com

$3,995,000.

Debra Duvall originally appeared as an Elite Agent in the Unique Homes Spring ’19: Elite edition. See her page here.

Peter Barkin & Mark Gilman

Compass, Barkin-Gilman Group

1200 E. Las Olas Blvd Suite 103, Fort Lauderdale, FL 33301

Peter: (954) 675-6656 | Mark: (954) 557-8777 | www.barkingilman.com

Peter Barkin and Mark Gilman have been successfully supporting the real estate dreams of buyers and sellers in South Florida for more than 20 years. In 2002, Peter and Mark teamed together to create the Barkin-Gilman Group, a highly respected and successful brand within the South Florida real estate community.

Listing by Peter Barkin & Mark Gilman

Fort Lauderdale, Florida

AQUABLU

There are 2-bedroom and 3-bedrooms available at the beautiful development, as well as dockage.

Starting at $1,395,000.

Peter Barkin & Mark Gilman originally appeared as Elite Agents in the Unique Homes Spring ’19: Elite edition. See their page here.

No other property would be better suited for an issue devoted to prestige properties than the palatial waterfront mansion in Coral Gables, Florida, featured on our cover. It’s not often family, Miami and a palatial residence are mentioned in this same sentence, but that’s what makes this property is so spectacular.

The gated community of Gables Estates offers the ultimate in security, including patrols on the water. It’s not unusual to see children out on bikes and neighbors walking dogs here. Nearby are some of the best schools in the Miami. That’s one of many reasons why those who know the area see Gables Estates as one of the best neighborhoods, explains Sandra Fiorenza with ONE Sotheby’s International Realty, who is representing the property.

The 14,443 square foot residence itself offers a huge measure of security with concrete construction and windows that exceed hurricane standards. The exterior is clad with marble, and the same stone — all from a single source — is used on covered balconies and lanais that overlook an infi nity pool and the blue of the wide lagoon. Inside, light dances throughout the home. A neutral palate becomes an ideal backdrop to showcase exquisite details such as Venetian plaster and carved plaster moldings, marble columns and stone carvings. The overall effect is elegant and restrained.

An extensive master suite with his and her bathrooms occupies one wing of the second floor with an additional four en-suite bedrooms in an opposite wing. The home also has two offices, private staff quarters and a wine cellar. The site on the largest lagoon in Gables Estates also offers access to deep water and the ocean. With a new seawall and 140-foot dock, this could be the ultimate Miami home, as well as a perfect family compound. It’s easy to see why those who know the area see Gables Estates as one of the best places to call home. This Ultimate compound is priced at $25.9 million.

This editorial appeared in the Unique Homes Ultimate ’19 Issue.

In Sarasota, Florida, this home is elevating the standard of luxury, waterfront living.

1309 Vista Drive in Sarasota, Florida, is a gated French Country private estate located right on the bay. It was built in 2015 on the 1.5-acre-plus property.

Located in one of Sarasota’s most coveted neighborhoods, Harbor Acres, the property is just as close to the bay as it is to the bustling downtown district filled with restaurants and retail stores. The perfect blend of old-world charm and modern Florida luxury.

The interior of the home includes a La Cornue gourmet kitchen, imported French stone floors and cabinetry. But the quality doesn’t end inside — with over 244 feet of direct bayfront on the property, you can enjoy the water every day of the year.

1309 Vista Drive in Harbor Acres, being a perfect blend of French charm and modern style, is the quintessential home of the neighborhood and surrounding area.

Photos courtesy of 1309 Vista Drive.

For those who love consistently warm weather throughout the year, Florida is known for its tropical, relaxed atmosphere. The palm trees and sunny days transport you to the Caribbean — especially in a residential amenity like Laguna Solé.

Laguna Solé is a massive 7-acre, man-made swimming lagoon large enough to fit 21 Olympic-sized swimming pools. The crystal clear water imitates the Caribbean while its ultrasonic filtration system uses 100 times fewer chemicals than a regular pool.

The lagoon is located in the heart of Solé Mia, known for being the “city within a city” that’s being built by two of the most powerful real estate dynasties in America, the LeFraks and Soffers. The LeFraks developed LeFrak City in New York and Newport, New Jersey, while the Soffers are known for developing much of what Miami is today.

The lagoon is accessible by residents and guests of the Shoreline, Solé Mia’s newest two residential towers located right next to the lagoon.

The $4 billion city of Solé Mia is known for its residential amenities that are elevating the standard of residential living — and Laguna Solé is the most recent and extravagant example.

Photos courtesy of Solé Mia.

Partnering with sonnen, a worldwide leader in smart solar technology, residential development firm Pearl Homes announced its plans for a zero-energy community in the small fishing village of Cortez, Florida.

Hunters Point Pearl Homes & Marina will include 86 performance homes, 62 lodges, and 47 boat slips. Comprised of a network of solar-powered smart homes, each smart home in the innovative community will share excess renewable energy with its neighbors and to a larger grid, which creates a virtual power plant that produces clean electricity.

Construction on the fully furnished green homes will begin in late 2019. Hunters Point is the first residential community established to help decarbonize southwest Florida, and also makes history as the first time an energy storage system will use Google Home to intelligently maximize renewable energy in each household.

“We have an opportunity and responsibility to improve our impact on the environment, and this is our chance. Hunters Point is about luxury living and sustainability, but also about the larger picture — creating a world that is better for our kids and grandchildren,” said Marshall Gobuty, president and founder of Pearl Homes.

In addition to a 600 square foot open-air entertainment space, 600 square feet of interior living space, and a 1,200-square-foot garage that doubles as a basement, each home uses sonnen’s energy management technology to control rooftop solar panels, a smart Nest thermostat, and an electric vehicle charger, ensuring that the home is powered by the cleanest possible energy source.

Photos courtesy of Hunters Point Pearl Homes & Marina.

This story previously appeared in the Winter 2019 edition of Unique Homes Magazine.

Propelled by natural beauty, cultural diversity and imagination, Florida has built an entire industry dedicated to luxury living.

The Seagate Hotel & Spa

© Scott Wiseman

Florida is more than a single place or prevailing attitude. While its history is multicultural, this vestige of the Deep South has attracted enough newcomers to swell into the nation’s third-most populous state and an economic powerhouse. Snowbirds from up north arrived, so did Cuban and Haitian refugees looking to rebuild their lives. Ultimately, people from around the world joined native Floridians in contributing a unique energy that makes the Sunshine State a world-class destination.

Checking In

The combination of sunshine and sandy beaches is irresistible to the hospitality industry, so it is hardly surprising that luxury brands like Ritz-Carlton and Four Seasons maintain a heavy presence in Florida. “Four Seasons has a history of entering into markets and setting the standard for luxury lifestyle experiences,” says J. Allen Smith, President & CEO of Four Seasons Hotels & Resorts. To date, his company has invested in Miami, Surfside, Orlando, Palm Beach, and Fort Lauderdale, while Ritz-Carlton has more than a dozen properties in the state.

When it opened in 1954 — long before nearby South Beach became trendy — the Fontainebleau was Miami Beach’s premier hotel. Reimagined for a new generation, it now features restaurants from celebrity chefs and a vibe reminiscent of Las Vegas. Equally iconic but more buttoned-down is The Breakers, a stately oceanfront property in Palm Beach where high society has convened for a century.

The Seagate Hotel & Spa presents a stylish package of amenities in Delray Beach, including a contemporary tropical aesthetic that incorporates five eye-popping custom aquariums. “Affluent, in-the-know travelers looking for an intimate, personal setting are increasingly venturing beyond the Greater Miami area,” explains William J. Sander, III, executive vice president, director of operations and general manager of the Seagate.

On the Gulf Coast, an Edition Hotel (a modern luxury brand from Marriott International in collaboration with Ian Schrager) is being integrated into Water Street Tampa, a $3 billion, 50-acre mega-project. On the top 15 floors of the 26-story tower will be 46 Edition-branded residences, among the most luxurious of the 3,500 housing units planned for Water Street.

Orlando has shaken its reputation as a company town, but two of its best hospitality properties are at Walt Disney World. The Victorian-themed Grand Floridian Resort & Spa is luxuriously nostalgic, while the Mediterranean-esque Four Seasons Resort Orlando offers a sense of privacy, championship golf and a chic rooftop steakhouse.

The Seagate Hotel & Spa

© DominicMiguel Photo

Real Estate Snapshot: Tampa Bay Area

Trend: The market is no longer so reserved, but still a bargain by Miami standards.

Clientele: Real estate developers, old money Floridians, newcomers looking for an alternative to South Florida.

Signature Property: Offered at $15.9 million is a historic oceanfront estate in Clearwater, with 23,900 extravagantly appointed square feet.

Settling Down

In addition to luxurious overnight accommodations, Florida leads the nation in branded residences with all the amenities of a five-star hotel. Now that Fort Lauderdale, once the capital of spring break, has grown up, the 22-story Four Seasons Hotel & Private Residences is rising over the oceanfront. More than $100 million in sales have already occurred for residences scheduled for completion in 2020. A four-bedroom, 4,200-square-foot unit is currently priced at $7.7 million.

Fortune International Group, whose development projects include the glitzy Jade Signature in Sunny Isles Beach and Auberge Beach Residences & Spa in Fort Lauderdale, responds to worldwide demand for the South Florida luxury lifestyle. President & CEO Edgardo Defortuna reports, “Developers look to differentiate themselves by bringing in international architects to create unique amenities and products.” He believes the scarcity of sites in Greater Miami and the extension of the Brightline high-speed rail project will encourage investment in other regions of Florida.

Even for a weekend, luxury is taken seriously at Aqualina Resort & Spa in Sunny Isles Beach, but there is also an opportunity to move permanently into the Mansions at Aqualina or forthcoming Estates at Aqualina. Almost ready for occupancy is the Mansions’ $38 million Palazzo del Cielo (“Palace in the Sky”) penthouse that includes complimentary use of a Rolls-Royce or Lamborghini.

Fortune International Group’s Defortuna reports that branding of residential towers, pioneered by hospitality companies, is now attracting other iconic names — Porsche and Aston Martin from the automotive industry, Armani and Fendi from the fashion world — to convey exclusivity.

Real Estate Snapshot: Greater Miami

Signature: Jaw-dropping oceanfront estates; penthouses in towers designed by “starchitects.”

Clientele: Hedge fund managers, pro athletes, international entrepreneurs.

Highest-Priced Property: 14,000 square feet of Neo-Classical opulence on 2.38 lushly landscaped acres in Coral Gables, offered at $55 million.

Jade Signature in Sunny Isles Beach

Photo by DBOX

Retail Therapy

With annual events like Miami Fashion Week and Miami Swim Week, designers and fashionistas are focusing their attention on Florida, where Latin influences are fused with European themes to arrive at cutting-edge fashion design. Local boutiques, from Key West to Pensacola, reflect that creative energy.

Alexis Barbara Isaias, who co-founded the trendy Alexis fashion label with mother Ana Barbara in Miami, reports the city’s fashion cred has evolved. “Miami was stereotyped as a sexy beachwear city, not a place to debut a fall collection,” says Barbara Isaias, but insists the Miami Design District, Art Basel and new fashion education programs are changing perceptions. “There’s a lot to inspire designers” says the young entrepreneur of her hometown, citing the climate, bold colors and vibrant cultures, and believes the industry will eventually spread throughout Florida.

There are luxury shopping destinations scattered throughout Greater Miami, including Aventura Mall and Bal Harbour Shops. Art, fashion and interior design intersect at the Miami Design District, where iconic labels Bulgari, Givenchy and Tom Ford compete for attention with art galleries and high-end home furnishing showrooms.

Worth Avenue in Palm Beach has been called the “Rodeo Drive of the East,” sharing many exclusive designer boutiques with Beverly Hills’ famous shopping street. Escada, Chanel, Jimmy Choo, and Louis Vuitton are just a handful of the rarified fashion labels found on this lovely sun-drenched lane.

Despite the emergence of smartwatches, demand for ultra-luxury handcrafted timepieces is sizzling. With prices rivaling Italian sports cars, no brand is hotter than celebrity-favored Richard Mille, famous for its avant-garde aesthetics. A Richard Mille boutique is found at Miami’s Brickell City Centre, which also hosts a branch of Westime, a Beverly Hills retailer whose 50-plus brands of Swiss watches include Audemars Piguet, Greubel Forsey and Hublot. Company President Greg Simonian, who clearly appreciates the sophistication of his new clientele, states, “I’m continually reminded of how many clients we already know in South Florida because they travel the world and have shopped at Westime in California.”

A watch is not the only thing you can wear on your wrist that is worth more than a typical Florida condo. Creating extravagant bracelets is Lugano Diamonds, which arrived on Worth Avenue last year, breaking into the Palm Beach market after establishing boutiques in Newport Beach and Aspen. In Naples, Gucci, Louis Vuitton and De Beers occupy storefronts at Waterside Shops.

Tiffany & Co., Burberry and Hugo Boss are among the 200 stores at Tampa’s International Plaza & Bay Street, anchored by Neiman Marcus. And in Orlando, names like Prada, Versace and Ferragamo elevate the suburban shopping experience at The Mall at Millenia.

Miami’s Brickell City Centre

Real Estate Snapshot: Naples

Trend: Increasingly opulent oceanfront homes competing with more prestigious Atlantic Coast markets.

Clientele: Retired entrepreneurs and Fortune 500 execs, Miami expats.

Highest-Priced Property: 16,000 square feet of European-style elegance with beachfront exposure, offered at $49.5 million.

For the Sport of It

Florida is home to numerous major league teams, high-profile PGA events and some of the nation’s top collegiate programs, but spectators are not the only ones having fun. None of Florida’s 21 million residents live more than 90 minutes from the ocean — not to mention the state’s 30,000 lakes and network of waterways — so watersports are a part of everyone’s life.

Sailing in Florida can take many forms, from sport fishing off the coast of Destin or Panama City to boarding opulent yachts whose amenities rival luxury hotels. For those dreaming of jetting across Biscayne Bay like Sonny Crockett, Florida is the best place to acquire a high-performance speedboat.

South Florida is one of the centers of the yachting world, offering a short voyage to hundreds of Caribbean islands ripe for exploration. Brokers are currently experiencing an explosion of demand for larger, faster and more flamboyant vessels with prices equivalent to oceanfront estates. For those interested in a short-term relationship, a glamorous 230-foot Benetti superyacht — complete with eight staterooms, gym, Jacuzzi, and crew of 27 to pamper the guests — can be chartered for about $500,000 per week.

With more courses and more touring PGA professionals residing there than any other state, golf is practically a religion in Florida. “Florida remains a world-class destination for golfers, thanks to the year-round sunshine and mild weather, as well as the variety of golf courses offered throughout the state,” says Jeremy Wiernasz, general manager and director of golf operations at the multi-course PGA Golf Club in Port St. Lucie.

Offering 160-plus golf courses, Palm Beach County proclaims itself “Florida’s Golf Capital,” undeterred by Naples’ bold assertion that it is the “Golf Capital of the World.” Nobody disputes the game is an economic force statewide, generating about $9 billion annually to Florida’s economy, even more than theme parks. Florida Gulf Coast University Professor of Economics Christopher Westley reports, “The development of a corporate culture — with capital and labor moving here from higher tax and regulation states — has resulted in greater demand for golf.”

Further reflecting the synergy between golf and real estate in Florida, several homes lining the fairways at the Nicklaus-designed Bear’s Club in Jupiter are on the market for nearly $10 million. Identified as among the most exclusive courses in the world by Forbes is Key Largo’s Ocean Reef Club, where members enjoy a private airstrip, 175-slip marina and two impeccably manicured championship-caliber courses. Adjoining homes can command in excess of $15 million.

The Ritz-Carlton Golf Resort, Naples

Photo courtesy of Ritz Carlton Naples

Frequently ranked by golf journalists as the best course in the state, Juno Beach’s Seminole Golf Club is so elite it reportedly turned down golf legend Jack Nicklaus for membership. Sandwiched between Ocean Drive and the Atlantic surf, the estates surrounding the course are predictably palatial.

For equestrian sports, Florida is unrivaled. There are thoroughbred racing venues in the Tampa Bay Area and Greater Miami (some with casinos). Many of America’s most legendary horses, including Triple Crown winners Affirmed and American Pharoah, have connections to Ocala, a northern Florida city nicknamed “Horse Capital of the World.” Its hunter/jumper events draw competitors from around the globe, and multimillion-dollar ranches reflect the economic clout of the community’s biggest industry.

The Village of Wellington, outside Palm Beach, hosts the Winter Equestrian Festival, where 8,000 horses compete for more than $9 million in prize money. As one of America’s premier equestrian communities, Wellington home prices regularly gallop past $12 million in price while some ranches command $30 million.

The “Sport of Kings” also has a presence in Wellington, where the 250-acre International Polo Club Palm Beach hosts the prestigious U.S. Open Polo Championship. The accompanying social scene involves the consumption of Champagne and caviar at fêtes that sometimes make the matches feel like an afterthought.

Real Estate Snapshot: Palm Beach

Signature: Gated Mediterranean-inspired estates with ocean frontage.

Clientele: Old money, both native Floridians and New York elites settling in for the winter.

Highest-Priced Property: Over 28,000 square feet of classical elegance on the ocean, priced at a staggering $109.5 million.

Cultivated Communities

Once dismissed as a sleepy state reserved for leisurely rounds of golf or perpetual sunbathing, Florida has assembled a world-class portfolio of cultural institutions. Sarasota is known for sugar-white beaches, but The Ringling, an art museum and Venetian-style palazzo built by one of the founders of Ringling Brothers Circus, puts the city on the arts trail. St. Petersburg, long burdened with the reputation as an overgrown retirement community, has developed a robust cultural scene headlined by the Salvador Dalí Museum.

The largest performing arts venue in Florida is the Straz Center in Tampa, but Miami’s Adrienne Arsht Center hosts the New World Symphony, Florida Grand Opera and touring musicals. In 2002, Swiss-based Art Basel added Miami Beach to its exclusive calendar of events and the trendsetting festival has helped the city burnish its status on the world’s art stage.

Other cultural attractions in the state’s largest city include the Pérez Art Museum Miami and the spectacular Vizcaya Museum & Gardens on Biscayne Bay. Executive Director/CEO Joel Hoffman maintains his institution inspires people to embrace the natural beauty and cultural vitality of its host city. “Today, Miami represents a global perspective with limitless creative and artistic viewpoints and experiences,” he says.

The Miami skyline, with buildings from celebrity architects Norman Foster, Frank Gehry, Herzog & de Meuron, and Zaha Hadid, reflects the city’s dominance in the visual/interactive art of architecture. It is also a testament to a competitive luxury real estate market in which high-rise developers showcase world-class design to sell condos at a premium.

Miami is not the only Florida city where architecture contributes to the local heritage. Sarasota, nationally recognized for its Mid-Century Modern design, is the equivalent of a drive-thru museum, while both the natural environment and ethnic diversity foster a culture of creativity in Jacksonville. St. Augustine, the oldest city in the nation, showcases Spanish, French and English architecture.

Art collectors appreciate the Sunshine State’s generous clusters of galleries, such as Duval Street in Key West, Las Olas Boulevard in Fort Lauderdale, downtown Jacksonville, and Gallery Row in Naples. Tallahassee’s Railroad Square is home to more than 50 studios and galleries, while resident artists in St. Augustine are inspired by the city’s 450-year history.

For equestrian sports, Florida is unrivaled.

Real Estate Snapshot: St. Augustine

Signature: Traditional villas that complement the city’s unique heritage.

Clientele: Affluent history buffs with little interest in showing off; old-time Augustinians.

Highest-Priced Property: Offered at $6.5 million is a nearly 8,000-square-foot villa on the Matanzas River.

Flavors of Florida

“Another day, another country,” was how the late Anthony Bourdain described Miami on CNN’s Parts Unknown. “You can eat your way across the Caribbean and through all of Latin America, and then over to Africa if you’d like. It’s all there,” he said. Contemporary Floridian cuisine, in which classic technique is applied to eclectic ingredients, takes full advantage of that diversity while showcasing resources nurtured by the state’s farmers, ranchers and fishermen. And while you can score a satisfying Cuban sandwich for a few bucks, there are some bona fide luxury experiences awaiting diners in the Sunshine State.

At Victoria & Albert’s, the restaurant at Disney World’s Grand Floridian that put the Magic Kingdom on the culinary map, a tasting menu at the exclusive kitchen-adjacent chef’s table begins at $250 per person. Celebrity chef José Andrés brought molecular gastronomy and some wildly creative mashups (e.g. jamón ibérico and caviar “tacos”) to The Bazaar in South Beach, but his latest Miami restaurant, Bazaar Mar, offers a $225 tasting menu called “A Study of the Sea.”

Many award-winning wine lists do not offer a single bottle of revered Château Pétrus, widely considered the best of Bordeaux. But the extraordinary list at Tampa’s Bern’s Steak House — thick as a telephone book and backed-up by a cellar overflowing with a half-million bottles — offers more than a dozen vintages of Pétrus, several exceeding $5,000 per bottle.

The steaks at Bern’s are justifiably renowned, but for beef with a more exotic pedigree consider Prime 112 in Miami Beach, where an eight-ounce Japanese A5 Kobe filet is priced at $280. With just eight seats, Miami’s Naoe presents an exclusive, highly personalized sushi experience, but before even ordering a glass of sake, the meter starts running at $220 per person.

Real Estate Snapshot: Orlando

Signature: Sprawling Mediterranean-style homes, often lakeside, that are long on amenities, short on pretenses.

Clientele: Corporate execs and entrepreneurs, plus some Mouseketeers at heart.

Hot Property: Under construction in Four Seasons Private Residences at Disney World is an 8,500-square-foot Mid-Century Modern-inspired home, priced at $7.945 million.

This story originally appeared in the Winter 2019 edition of Unique Homes Magazine.

Usually, it’s possible to sum up the outlook with a pithy phrase, but this year the luxury landscape is nuanced. Some markets sizzle; others simmer. Dynamic outside forces are at play and will potentially exert even more influence in 2019. In the background, the words recession and bubble are whispered, but most experts don’t see either in the cards, particularly for residential real estate in 2019.

“In most markets, I think it’s a case of ‘from great to good,’” says Stephanie Anton, president of Luxury Portfolio International.

“We’ve left a crazy market, and we’re moving into a more normal market,” shares John Brian Losh, chairman of Who’s Who in Luxury Real Estate. “We are beginning to see a more normalized market where supply is more equal to demand. Even in the luxury market, there are fewer bidding situations.”

According to Redfin, the number of competitive offers fell from 45 percent to 32 percent in 2018. Still, some ZIP codes in busy markets such as Boston, Washington, D.C., and the Bay Area remain hotbeds of competition, with the number of multi-bid scenarios increasing in the third quarter.

© istockphoto.com/JZHUK

Concerns about potential bubbles continue to percolate, but economists and other experts caution that fundamentals are strong and for real estate the next downturn will be different. “The recent tax reform and increased government spending have been a shot in the arm of the U.S. economy,” Tim Wang, head of investment research at Clarion Partners, explained to journalists at the Urban Land Institute’s fall conference. Wang and other experts expect the current expansion of the economy to continue through 2019, tapering to 2.5 percent next year.

“The housing market is following the trend in the overall economy, which needs to be noted because housing led the last downturn,” comments Marci Rossell, chief economist for Leading Real Estate Companies of the World, citing politics and global uncertainty as factors affecting real estate. This time, she says, “the casualties will be a little bit different, and because of that I don’t anticipate a meltdown.”

A cooling period is how Craig Hogan, vice president of luxury at Coldwell Banker Real Estate, characterizes the luxury climate, particularly in the second half of 2018. It’s a change Coldwell Banker has anticipated. “For any of us to think it was always going to be incredible is a little naive. The market is always going to fluctuate.” Hogan says it’s important not to interpret cooling as a market decline. “Cooling is a normal fluctuation, while a decline happens when the value of homes begins dipping.”

“There hasn’t been any great price suppression. Houses are staying on the market a little longer, but demand is still healthy,” says Losh.

“I think we’re still going to have a very strong year overall. I do believe we’re seeing price adjustments, and that’s okay. I think the key is watching how long properties are staying on the market and watching the size of the price adjustments,” observes Lesli Akers, president of Keller Williams Luxury International.

The average sales price for Sotheby’s transactions is up year over year. “From a luxury point of view, many of our companies are having a record year,” says Philip White, president and CEO of Sotheby’s International Realty. “Revenues are up, and in some cases pretty significantly,” he shares, noting that this number also reflects significant recruiting and/or acquisitions by some companies.

Recent stats show prices for upscale properties still increasing, but at a slower pace than past years. The number of sales in many places has dipped, but that differs by location, and in more than a few instances sales still exceed 2017.

Data from the Institute for Luxury Home Marketing (ILHM) shows median prices for single family luxury homes climbing 8.5 percent in November over October, while the number of sales fell 11.7 percent. For attached luxury properties, sales rose 2.6 percent with a 2.3 percent hike in prices.

Putting the current market for real estate overall into perspective, Lawrence Yun, chief economist for the National Association of Realtors, said, “2017 was the best year for home sales in 10 years, and 2018 is only down 1.5 percent year to date. Statistically, it is a mild twinge in the data and a very mild adjustment compared to the long-term growth we’ve been experiencing over the past few years.” Yun and other housing economists are quick to point out that new construction still hasn’t caught up with demand and foreclosure levels are at historic lows, factors which make the current climate different than the run up to the recession. NAR’s forecast calls for an overall price increase of about 3 percent in 2019 while the number of sales flattens or edges up very slightly.

Tale of Two Markets

Luxury’s story is a little different. “This year the luxury market has been a tale of two markets, for sure. Some areas are struggling, but most have been stronger than many realize, particularly in the first half of the year. As median prices have been slowing (and getting lots of media attention), the top 5 percent of many major metro markets nationally have been growing, with sales over $1 million up over 5 percent year over year and prices breaking records, in some cases by double digits. In the majority of markets, inventory has been selling faster. This is happening simply because of the health of the affluent,” observes Anton.

What sets this year’s outlook apart is that some places are having a strong, dynamic market, while others are seeing a softening, often only in specific price brackets. “The slowdown that started on the East Coast is having some effect on the West Coast. But it’s not a typical slowdown,” says Mike Leipart, managing partner of new development at The Agency. “Good product that has relative value is continuing to transact.”

The top three sales nationally in the third quarter, each over $30 million, occurred in Laguna, and seven out of the top 10 were in Southern California.

Rather than a general market malaise, Leipart characterizes the slowdown as more of a spec home problem. “It’s just too much has been built too fast, and not all of it is very good. The people who thought they could build a house for $15 million and sell it for $30 million are struggling.”

The higher price points in L.A. may see an even stronger downturn in the near future, suggests Bob Hurtwitz, owner of Hurwitz James Company, who typically works in the very high end. “There is a lot of inventory on the higher end, and luxury home buyers are usually in a position to wait and see. The drops in price are a lot more dramatic on property at $15 million and above, and buyers are aware of the benefit in waiting to see how it plays out. At the ultra-high end of $100 million or more, you are going to see and already are seeing huge reductions in price.” What’s hot in L.A.? Luxury penthouses in full 24-hour security buildings in prime areas, according to Hurwitz. “High-end penthouses will continue to be in-demand from foreign buyers purchasing as a part time home or for housing for their children.” Other price brackets, notably the $1.5-million to $3.5-million range, are busy, and, Hurwitz says, his agents are doing a lot of deals.

Perceptions of prices in Manhattan can be skewed, since recent closings are often for new construction for which contracts (and prices) were written a couple of years prior. Even though stats show sales decreasing, Ellie Johnson, president of Berkshire Hathaway HomeServices New York Properties, says, “There is still a healthy but steady group of buyers that are still out there in the high-end luxury landscape.” Additionally, New York is particularly keyed to Wall Street, and volatility in the stock market often means more money gets transferred into brick and mortar. “We’ve seen an uptick that we didn’t have at the beginning of the fall season,” Johnson observes. Despite a less than stellar real estate market at year end, New York remains a global gateway and the top city for global wealth.

Manhattan

© istockphoto.com/CreativeImages1900

Los Angeles

© istockphoto.com/SeanPavonePhoto

St. Petersburg

© istockphoto.com/SeanPavonePhoto

In other locations, particularly those with lower prices for upscale properties compared to California, Florida or New York, reports show strong interest and price growth. An acre in one of Atlanta’s prime addresses in Buckhead can demand as much as $1 million. It’s just one indication that luxury here continues to reach new price levels with considerable demand coming from outside the region, including buyers from California and Florida. Some relocate simply because they want a home in the city; others follow corporate moves. The city has also become a favorite for the film industry, which has become a $4 million industry. “It’s changing everything about this city,” says Debra Johnston with Berkshire Hathaway HomeServices Georgia Properties. Luxury really doesn’t begin until the $5 million threshold, says Johnston, but prices compared to Florida and California are reasonable.

At one time, it was thought it might take more than 20 years for Florida real estate to recoup from the recession. In October, the state tracked 82 consecutive months of price hikes for both single-family and condo-townhouse properties, with many cities showing double-digit increases in the number of sales. “The overall market in Florida, particularly higher-end areas such as Sarasota, Naples and Palm Beach, is definitely strong and stable. Maybe not as robust as say 2013 and 2014, but we haven’t had any major slide — except the economists talking about the market slowing down,” says Pam Charron with Berkshire Hathaway HomeServices Florida Realty in Sarasota.

“The St. Petersburg market seems to be performing differently than other Florida markets and other national trends,” observes Tami Simms with Coastal Properties Group, noting November sales skyrocketed over the prior year. “We have developed into a year-round market with luxury downtown condominiums in high steady demand.” Another sign of consumer confidence is lack of defaults on pre-construction sales. “When we experienced the crash, those buildings that had been sold out prior to completion experienced a significant number of defaults. We see none of that in this instance.”

Florida is one of several states including Texas and Nevada benefiting from changes in tax law. Tax changes not only force some to reevaluate where they live, but they also impact the margins of price brackets. “While it doesn’t mean people wholesale leave New York or San Francisco, marginal changes tickle up and trickle down to the next closest price level,” and it will take several years for that to be felt, says Rossell.

The New Market

“So many trends have taken place they are no longer trends, they are the new market,” observes Hogan, using new construction as one example. “It doesn’t matter where you go or who you talk to, new construction is part of the conversation.”

Global demographics will have a long-term impact. “What luxury is adjusting to is a different demographic worldwide. Those aging baby boomers are kind of done with big homes and the following demographic is 50-percent smaller,” Rossell says.

Changing demographics affect location and property type. “I think we’ll see increased demand for primary residences in traditional second home and resort markets. We are seeing this trend in select markets, as individuals who have the freedom to work remotely are opting to live in places where they feel their quality of life will be the best,” observes Anthony Hitt, president and CEO, Engel & Völkers Americas.

Summer 2019 will mark the most prolonged economic recovery since World War II, but wild cards including interest rates, a trade war and further instability could easily derail this expectation. However, there is a silver lining to the current market. Increasing inventories will bring some buyers back to the market and create more demand. “I think it’s going to a be a great opportunity. People will buy things that they haven’t considered, and they’re going to buy more of them. I think that’s been a big challenge. We’ve not had the inventory, and a lot of buyers kind of just fell out of the market because they didn’t feel like there really was one,” explains Akers.

ILHM President Diane Hartley believes 2019 will be a year of opportunity for both buyers and sellers provided they remain agile, innovative and adaptable to their local market influence.

This story originally appeared in the Winter 2019 edition of Unique Homes Magazine.

Every year we select locations to highlight as Markets to Watch. This year change is underway and we take a look at some top performers, others that are beginning to transition, and a handful of under-the-radar locations that are emerging.

Austin, Texas

On track for another record with sales up more than 3 percent, Austin’s luxury patina shines ever brighter. In October, the medium home value in Barton Creek increased to $1.02 million, making it the city’s first million-dollar neighborhood. Austin’s charms include no income tax to win over newcomers, but music and tech might be tops.

Bozeman, Montana

Bozeman might seem like a sleeper on this list, but with ranches, the Yellowstone Club and Big Sky country it’s an under-the-radar hangout for demi-billionaires and billionaires.

Brooklyn, New York

No longer second best! Buyers are making Brooklyn a first choice. Median prices in the most expensive neighborhoods hit the $1 million mark. Israelis, Chinese and Western Europeans also gravitate here. It’s no surprise this New York City borough is No. 2 on Urban Land Institute’s Markets to Watch.

©istockphoto.com/Auseklis

Chicago, Illinois

By August, the Chicago area recorded as many luxury sales as in all of 2016 or 2017. Sales of $1 million-and-up properties set a record in the third quarter with a 19-percent increase over 2017. According to RE/MAX, luxury is booming in the west loop area. Upscale suburbs trail the city. Lots of new condos and stunning new buildings open doors to more urban opportunities in a market that hangs in the balance.

Dallas, Texas

Few cities have charted a post-recession course as strong as Dallas and the city remains Urban Land Institute’s No. 1 location for overall real estate prospects in 2019. But the dramatic post-recession price increases are over, say economists. Moderating prices and adjusting inventories are positive indicators that that a move back to a normal market is underway.

© istockphoto.com/Kanonsky

Denver, Colorado

Real estate’s Rocky Mountain high isn’t over yet. Denver continues to rank in the top group on many lists. In the upscale bracket, a shift toward balance is underway with the inventory of $1 million-plus homes at about seven months. Year-over-year prices are up on average 9.29 percent. Boulder remains a sweet spot for luxury, ranking 10th among cities and towns with at least 10 neighborhoods considered million-dollar.

Las Vegas, Nevada

Projections call for appreciation as high as 10 percent this year. Nevada was the fastest growing state, with new platinum communities; forward-looking, innovative architecture; and spectacular views capturing the attention of buyers looking for lifestyle and tax relief.

Hilton Head, South Carolina

Coastal South Carolina and Georgia are ground zero for demographic shifts and the growing ability among the affluent to live wherever they want — a trend just taking off. New developments including Palmetto Bluff add to demand for the Hilton Head region.

Minneapolis, Minnesota

Moving toward balance. A long-awaited uptick in homes on the market is one of several hints of a market shift. Median prices reached a record high this fall, and homes still sell quickly. Still the inventory of homes for sale is one of the lowest in the country. Upper tier and move-up brackets are less competitive.

Northern Virginia

D.C. continues to be in the top group on watch lists but Amazon’s recent announcement makes real estate in Northern Virginia much more interesting. What the prospect portends for current homeowners is uncertain, but sure to make this a market to watch in 2019.

Park City, Utah

No longer just a ski hangout, this Salt Lake neighbor is luxury’s newest player. The most desirable neighborhoods see a shortfall of inventory. Land prices increased by 25 percent with the highest number of sales occurring at Promontory. Opportunities abound: new projects at The Canyons, a large expansion of Deer Valley, a $4 billion renovation of the Salt Lake airport and a bid for the 2030 Olympics.

Wikimedia Commons / Don Lavange

Portland, Maine

Beaches and skiing, does it get any better than that? Hipsters meet old money here. Ranked among the top 20 for entrepreneurs, the city has a growing tech industry and one of the best foodie scenes in the Northeast. Look for more new construction. Prices will continue to ease upward as more people discover this hidden gem.

© istockphoto.com/DougLemke

Santa Barbara, California

Opportunities for buyers in many California locales continue to increase as markets shift. Median prices in Santa Barbara in November were down more than 25 percent, which is good news for buyers. The area remains a prized luxury refuge and lower prices open the door for newcomers to enjoy one of the most unique locations in the U.S.

Sarasota, Florida

The city’s iconic waterfront is being reimagined with a vision to increase cultural programming and urban amenities. Median prices have been increasing steadily, up 25 percent since 2014. New construction means more inventory with more on the horizon. Agents report steady and growing interest in individuals from high tax states.

© istockphoto.com/KarolinaBorowski

Seattle, Washington

Happier times are ahead for buyers in Seattle with active listings up by 41 percent. Even though inventories are still slim, it’s a good indication the frenzy is over. Closed sales in November were down 28 percent. Homes continue to appreciate but the increase has slowed to 5 percent. For buyers and sellers this is definitely a market to watch. The city still is in top groups in many rankings, but the frenzy is over.

Wikimedia Commons / Jeff Gunn

Toronto, Canada

Canadian Baby Boomers and Millennials came together and turned up the heat on the luxury condos in 2018; single-family home sales decreased by as much as 44 percent. While the foreign buyers tax has reduced sales to overseas buyers, it’s also opening new opportunities for locals. Local buyers will continue to drive demand for condos here.

Resort Markets

Luxury’s top performers in 2018. Not only are residences in demand, but new resorts are raising the bar for luxury and reinvigorating current markets. New developments in Turks and Caicos, including the ultra-indulgent Gansevoort Villas, turn up the heat on interest in the Caribbean. Easy reach from the U.S. and private enclaves generate new interest in the Bahamas. Cabo San Lucas, Mexico is seeing new resorts and other regions along the Sea of Cortez are seeing new development. Mandarina in Nyarit is the site of One & Only’s first collection of private homes. Owning a private island continues to be an ultimate purchase and the Bahamas is ground zero.

Thanks to:

Austin Board of Realtors

Michael Saunders, Founder and CEO Michael Saunders & Company

Anthony Hitt, President and CEO, Engel & Völkers Americas

Aleksandra Scepanovic, Co-Founder and Managing Director of Ideal Properties Group

National Association of Realtors

Northwest Multiple Listing Service, Kirkland, Washington

RE/MAX Canada

Trulia

Zillow

This story originally appeared in the Winter 2019 issue of Unique Homes Magazine.