Whether you’re hosting a clambake on Nantucket, enjoying a procession of edible jewels at a Tokyo sushi bar or simply shopping for a suburban supper, the days of consuming seafood with careless abandon are gone. The oceans are desperately overfished, and seafood lovers must be conscious of their own personal impact on the aquatic environment.

The best known resource for both suppliers and consumers is Seafood Watch, a program created by the Monterey Bay Aquarium in Northern California 20 years ago. Its regional consumer guides, identifying the most sustainable and most threatened species, are valued by consumers, chefs and eco-conscious corporations. “We use a rigorous, scientifically-based standard to come up with recommendations, result-ing in the most up-to-date, credible information,” states Maddie Southard, content manager for Seafood Watch.

So influential are these guides—60 million have been distributed to date—that when a particular item moves from the red (“Avoid”) category to yellow (“Good Alternatives”) or green (“Best Choices”), millions of dollars can change hands. Reflecting the thoroughness of Seafood Watch’s recommendations, flounder appears four times as a “Best Choice,” 14 times as a “Good Alternative” and 18 times in the “Avoid” column depending on the exact species, geographic origin and methods of fishing or farming employed.

©Monteray Bay Aquarium, Photo by Tyson V. Rininger.

“Consumers help drive change, and when businesses recognize what’s import-ant to consumers they respond,” reports Southard of Seafood Watch’s ability to engage corporations like Whole Foods and Blue Apron. The program’s restaurant partners transcend economic strata, from trendy Farallon in San Francisco to family-friendly Red Lobster restaurants across the country.

In its early days, businesses viewed Seafood Watch as a fringe movement but today participation is embraced and display of the organization’s yellowfin tuna logo can be a marketing asset. A Blue Ribbon Task Force, comprised of honored culinary authorities, enhances Seafood Watch’s relevance with diners. “The public admires chefs and culinarians, and we realized the impact they have on consumers,” offers Southard, who adds, “Chefs were some of the earliest supporters of the movement so this was a natural partnership.”

“Whenever I’m making decisions about what to put on a menu, I always ask myself, ‘What would Sheila do,’” says Los Angeles chef Michael Cimarusti, referring to Seafood Watch’s Sheila Bowman, who oversees outreach to chefs. Cimarusti, who has earned two Michelin stars at his flag-ship restaurant Providence, became conscious of sustainable sourcing issues as a young chef in L.A. 20 years ago, when a Gourmet magazine review admonished him for serving bluefin tuna.

“As I learned more about issues relating to sustainability, I became really passion-ate about it and wanted to become more active in the movement,” explains Cimarusti. “I was honored to be asked to sit on the Task Force and have learned a tremendous amount from Seafood Watch,” says the chef, who shares all of the program’s recommendation alerts with his staff.

Éric Ripert, chef/partner of New York’s Le Bernardin, takes sustainability as seriously as Cimarusti. “I spend my days with many varieties of fish, considering which are best for the restaurant, he says. Ripert explains, “This means more than just judging by flavor and composition, but includes the ethics and politics surrounding how they’ve been made available to us.” The Michelin three-star chef cautions, “If we don’t support the artisanal way of catching fish, it’s going to disappear.”

Michael Cimarusti. ©Jennkl Photography.

Courtesy of Whole Foods Market.

Hugh Acheson, author and James Beard Award-winning chef with a family of Georgia restaurants, also sits on Seafood Watch’s advisory board and is a strong advocate for local, sustainable ingredients. He recalls that in the 1990s chefs addressed a severe threat to swordfish through a voluntary ban and use of more sustainable alternatives, allowing stocks to replenish. “It made me realize how much clout we have, as chefs, to mandate change when we act as a plurality,” states Acheson.

“I think Seafood Watch has succeeded in being a valuable resource for consumers, chefs, wholesalers, and grocery stores,” says the Canadian-born chef who has helped reimagine Southern cuisine. Acheson, who notes that swordfish continues to face challenges, suggests Seafood Watch would have been an invaluable resource decades ago, when many chefs were oblivious to sustainability issues.

An affinity for bluefin tuna (maguro) and eel (unagi), both largely on Seafood Watch’s “Avoid” list, and adherence to centuries-old traditions makes sushi chefs among the most reluctant to adopt sustainable practices. One sushi chef committed to sustainability is Bun Lai, chef/owner of Miya’s Sushi in New Haven, Connecticut and another member of Seafood Watch’s Blue Ribbon Task Force. Some odd ingredients—every-thing from insects and invasive species to edible weeds—populate his voluminous menu, and the James Beard Award nominee relies on guidance from Seafood Watch.

Éric Rippert. ©Daniel Kreiger Photography.

Hugh Acheson. Photo by Emily B. Hall.

“Miya’s started working on sustainable seafood very gradually in the early 2000s,” reports Lai, explaining that unreliable data made conscientious sourcing challenging. “Monterey Bay Aquarium’s Seafood Watch changed all of that by creating a tool that helped people choose sustainable seafood in a market awash with imported seafood of mostly dubious origin and quality,” says Lai. “When I first discovered Seafood Watch, it was as if a light beamed into the darkness I was surrounded by,” he says.

Bun Lai. ©Alan S. Orling.

“I admire my heritage, but we must question our traditions, too,” states Lai, acknowledging sushi’s popularity contributes to overfishing around the globe. He cites Jiro Ono, the revered sushi master featured in the documentary film Jiro Dreams of Sushi, who lamented the demise of the majestic bluefin while continuing to serve it to customers.

“There are, however, sushi chefs filled with a passion for sustainable seafood like those café owners who pioneered fair trade coffee decades ago,” says Lai with optimism. With Seafood Watch’s guides and app available to chefs and consumers alike, good choices can be made on both sides of the bar.

Sustainable Sources

Hugh Acheson

www.hughacheson.com

Le Bernardin

www.le-bernardin.com

Miya’s Sushi

www.miyassushi.com

Providence

www.providencela.com

Seafood Watch

www.seafoodwatch.org

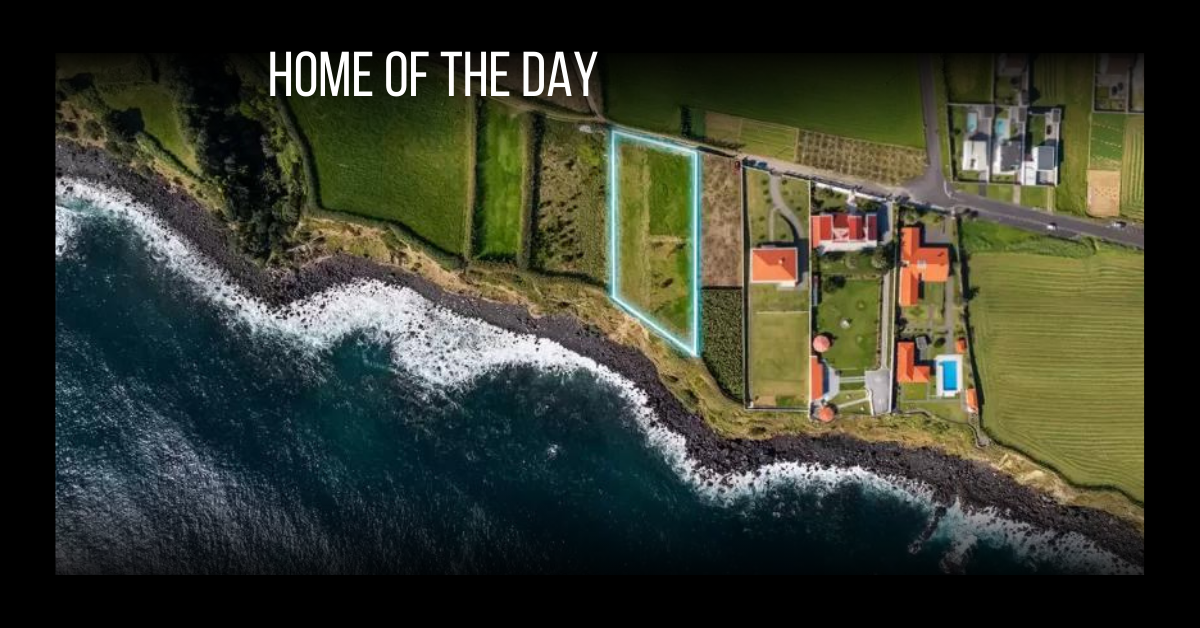

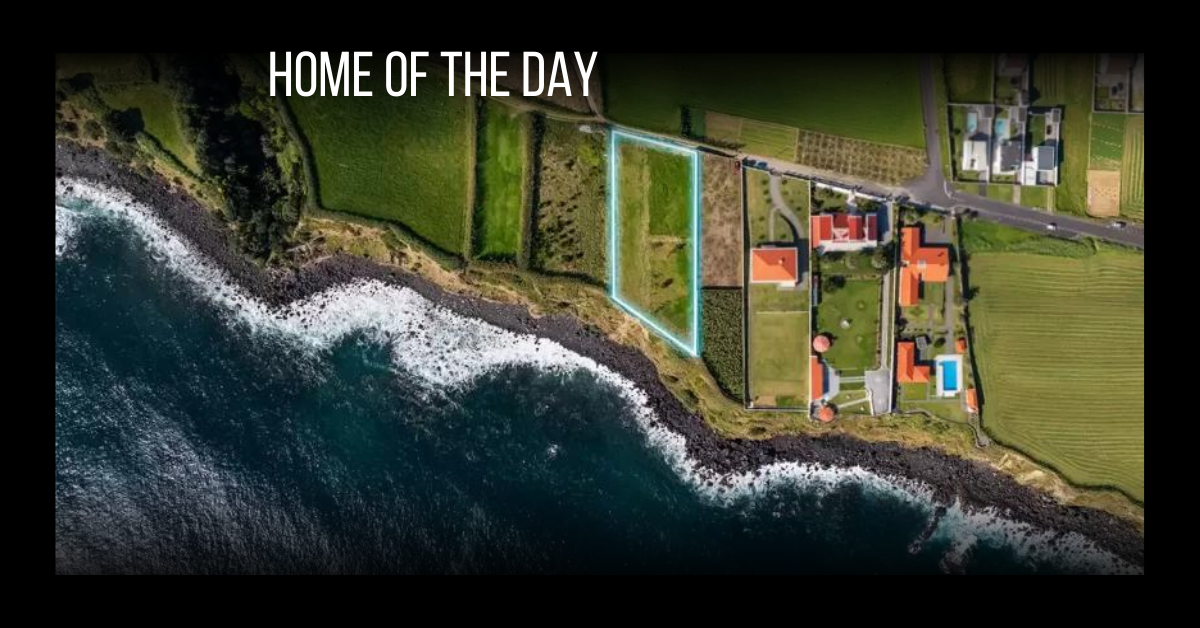

Inventories, consumer confidence, growing worldwide wealth, the stock market, tax changes and local dynamics are affecting how hot each luxury real estate market is throughout the U.S.

By Camilla McLaughlin

“Fasten your seatbelt, 2018 will be a fun and scary, but prosperous ride,” is how Brad Inman, founder of Inman News, assesses the outlook for real estate this year. On the other hand, developers and planners tapped by the Urban Land Institute (ULI) call for “a long glide path to a soft landing” for the economy and the real estate sector. They expect the current cycle to extend into 2018 and even beyond.

These comments perfectly illustrate the divergent opinions on the outlook for real estate this year, especially luxury real estate.

For real estate overall, it’s not an overstatement to say 2017 was a very good year. The National Association of Realtors (NAR) expects sales of existing homes in 2017 to tally at 5.81 million transactions, the best number since 2006, and 3.8 percent higher than 2016. Home prices grew by almost 6 percent, a pace NAR expects to be duplicated in 2018. Looking ahead, the forecast calls for an increase of 3.7 percent in the number of sales as more new construction amps up the number of homes on the market. December sales soared 5.6 percent, with most activity at the upper end of the market fueled by move-up buyers with considerable down payments, cash buyers and easing of inventory shortages.

For luxury real estate, the narrative, while positive, revolves around locations and price brackets, depicting a market beginning to settle into a sustainable pace after a protracted recovery. “Bottom line, we’re going to have a strong year,” says Philip White, president and CEO of Sotheby’s International Realty Affiliates. “The one difference this year is the up-wind market is having a better 17 versus 16. We are going to have more transactions and a higher average sales price this year than last year.”

In cities such as Seattle, San Francisco or Denver, demand for upscale properties outpaces supply. “Chicago now has 60 cranes in the air which has only happened twice in my 25 years here,” says Craig Hogan, vice president of luxury at Coldwell Banker Real Estate.

New York City is often portrayed as being in the doldrums. Although there has been a slow down in the ultra high end, other price points and neighborhoods all over the city are far from flat. Most active, according to Ellie Johnson, president at Berkshire Hathaway HomeServices New York Properties, is the $1 million to $5 million range, where multiple offers are not uncommon. From Dec. 11 through the 17, 18 properties went under contract above $4 million, which she says is a much larger number than the same period a year ago. When New Yorkers confront change, they often put buying plans on hold. Johnson says the upper price brackets are in a “strong hold pattern” right now, but she expects it to be short lived. Also, Wall Street bonuses should translate into “a very nice first quarter.”

“I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm.”

— Bob Hurwitz, founder and CEO of

The Hurwitz James Company

image courtesy istockphoto.com / Meinzahn

Traditional luxury markets in New York, California and Florida are still strong, but brokers also see big plays in smaller markets. Lesli Akers, president of Keller Williams Luxury Homes International, illustrates with a recent $22 million transaction in Austin, “the biggest sale in the history of that market.” ULI forecasts a shift in interest and investment dollars to smaller metros such as Seattle, Austin and even Salt Lake City as well as close-in suburbs of New York and Washington, D.C. In New York, Diane Ramirez, chairman and CEO of Halstead, says new buildings, both residential and rental, with views of the Hudson River, extensive amenities and a short commute to the city are generating interest from younger consumers in White Plains, New Rochelle and Tarrytown.

“Luxury is starting to move into every market. As neighborhoods change, the buyers change,” says Diane Hartley, president of the Institute for Luxury Home Marketing, noting it’s important for agents to understand this new buyer, new price points and new expectations.

For agents, “it’s no longer enough just to be a local expert, they have to have global knowledge as well. Most of the affluent are looking to see what is happening in the global market. But it’s also who agents are bringing to look at the home,” says Anne Miller, director of business alliances for RE/MAX.

At LuxuryRealEstate.com’s fall conference, comments about local markets were all positive, something Publisher John Brian Losh says usually doesn’t happen. “Prices are directly related to the economy and consumer confidence, and right now consumer confidence is high,” he says.

More than consumer confidence is bolstering luxury sales. Adding to demand are the growth of wealth in the U.S. and worldwide, a surge in the stock market, and a rise in foreign buying of U.S. properties. There are few, if any, indications this will change in the immediate future. Paul Boomsma, president of Luxury Portfolio International, explains: “Our white paper and our global survey show a lot of interest from buyers, not only for this year but over the next two years. There is more interest on the buy side than the sell side, and that is consistent among the high end, and it extends to 17 different countries. There is a lot of interest and not just in U.S. properties.”

Purchases of U.S. properties from foreign buyers surged from $102 billion to $153 billion in the year ending March 2017, accounting for 10 percent of dollar volume of sales. “Foreign buyers generally see the U.S. as a safe haven for investment,” says Bob Hurwitz, founder and CEO of The Hurwitz James Company, whose current clients include mega affluent buyers from Turkey, Singapore, China and Ukraine looking buy in price ranges of $20 million and up. “In a couple of cases this includes multiple properties, including commercial and development not exclusive to California,” he adds.

While most markets sizzle, the high end in some locations and price brackets is back to a slow simmer. “I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm,” says Hurwitz. “Prices have already adjusted, and as developers and luxury home builders start having homes sit on the market, there will be opportunities to make good buys.”

“In the ultra high end, I think prices are being adjusted to the economy,” says Losh, noting a common issue with ultra properties. Often sellers price the home at the highest price they ever imaged. After a couple of years, they get realistic. “What really determines value is what it cost to replace a property,” he says.

The ultra high end may be cooling, but, Hogan says, the luxury market is healthy. “The $1-to-3 million, $3-to-5 million and $5-to-9.9 million sectors are strong. Not in every city but as a whole, based on our year-to-date numbers. I honestly feel that we are simply normalizing.”

“We are seeing some moderating trends in the luxury space,” says Akers. Downward price adjustments and longer days on market are signs that luxury is moving toward a more balanced market. Still, she adds, “Truly unique properties still command top dollar and cash offers.”

It would seem that the performance of the stock market might discourage real estate investment. Instead, Marci Rossell, chief economist for Leading Real Estate Companies of the World, says it has an opposite effect. “For the luxury buyer, real estate is part of a larger portfolio and portfolios have swelled in terms of stock market value over the last two years. So, from the perspective of balancing a portfolio, real estate can look attractive.” The most influential trend for 2018, particularly the high end, is new consumer attitudes. “Across all price points, the word value is critical today,” says Ramirez. “Value to a $1 million buyer and a $600,000 buyer is not the same, but both want the perception of value.”

Consumers have become even more demanding. “There is a desire for perfection. They want a property or an experience to be exactly what they want it to be. There is no desire for compromise,” says Hartley.

Price matters, but it’s not the only factor in the value equation. “If it’s been on the market awhile, bringing down the price is not going to do it. You have to see what’s selling,” says Ramirez, using the example of a $7 million property in Darien that sold in a single day. It was well priced and located across from the water. Water views continue to be in highest demand.

People want new. “If it’s an older home, it must be newly renovated,” says Ramirez. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

The bottom line for sellers, according to Miller, is to listen to their agent. “We’re hoping that everybody takes a reality check on location, quality — is it unique and rare, does it have all the luxury amenities? — before they list their home.”

People want new.

“If it’s an older home, it must be newly renovated,” says Diane Ramirez, chairman and CEO of Halstead. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

Image courtesy istockphoto.com / TobiasBischof

Also, says Kevin Thompson, chief marketing officer at Sotheby’s International, “There is a search for the unique.” This new consumer isn’t interested in cookie-cutter anything. “They want something personal and outside the norm, and they are willing to pay for that.”

Looking ahead, Hogan sees new construction, contemporary/modern, a smaller footprint and full connectivity shaping future demand.

“We’re seeing more and more of what I call the ‘Tesla consumer with the Apple watch’ — a client who’s passionate about their lifestyle and their environmental foot print. They want to do what’s right for the earth, and they don’t mind people knowing it’s expensive,” shares Akers.

Recent ultra-high-end sales in Greenwich and Manhattan are evidence that buyers are out, according to appraiser Jonathan Miller, who noted in a recent blog: “Buyers remain in the market, but the price needs to reflect 2017.”

Akers says sellers should prepare to sell at fair market value. “We’re not in a ‘dip your toe in the market and test it out’ kind of market.”

The number of homes available for sale continues to be the fulcrum on which markets balance. Regarding real estate overall, Lawrence Yun, NAR’s chief economist says: “Home prices, after multiple years of fast growth, still show no signs of cooling because of the ongoing housing shortage in much of the country. The latest Case-Shiller price growth of 6.2 percent on a nationwide basis marks the strongest rise in over three years.”

High-priced markets are not immune to inventory challenges, but it’s not in every location. Instead, it is likely to be places that have had strong buying for years and strong population growth. White uses the example of San Francisco, where anything that is priced right is snapped up. Inventory constraints, according to White, are not unique to the U.S. “In Hong Kong and Japan, there are stories where people are lined up to buy high-priced units in new buildings, even to the point where they will sell their place in line.”

This year, for the first time since the downturn, inventories eased ever so slightly, and forecasts point to more new construction in the next few years. Javier Vivas, director of economic research for Realtor.com, sees 2018 as “a significant inflection point in the housing shortage, with increases in inventory felt initially in the mid- to higher-price points above $350,000.” Vivas says Boston, Detroit, Kansas City, Nashville and Philadelphia are predicted to see inventory recovery first.

As inventories grow, sellers need to understand that homes that are dated or not priced accurately will fall to the bottom of prospective buyers’ list of target properties.

At year-end, tax changes and continued political uncertainty loomed over every forecast. “For buyers worldwide, I think policy changes will matter more than economic climate. This is a year when tax policy could drive some location decisions. If you are a first-time buyer in a high-tax area and you are looking to put down roots, you will think long and hard about the tax consequences of a location. Even on the European front, we know Brexit will affect location decisions. Already we are seeing relocations out of London to Frankfurt,” shares Rossell. “The homebuying decision is part of a large mosaic, and the tax implication of that decision used to be a smaller tile, and it will become a larger tile.

Looking ahead: “The economy and housing market will grow like crazy. Job creation is at record levels; unemployment is at a 17-year low, wages are feeling upward pressure and companies are investing at a fast and furious pace,” commented Inman. “A backdrop of political uncertainty will not slow down the global economic thoroughbred that is galloping at a full run. Left in the dust will be housing affordability in many major metros.”