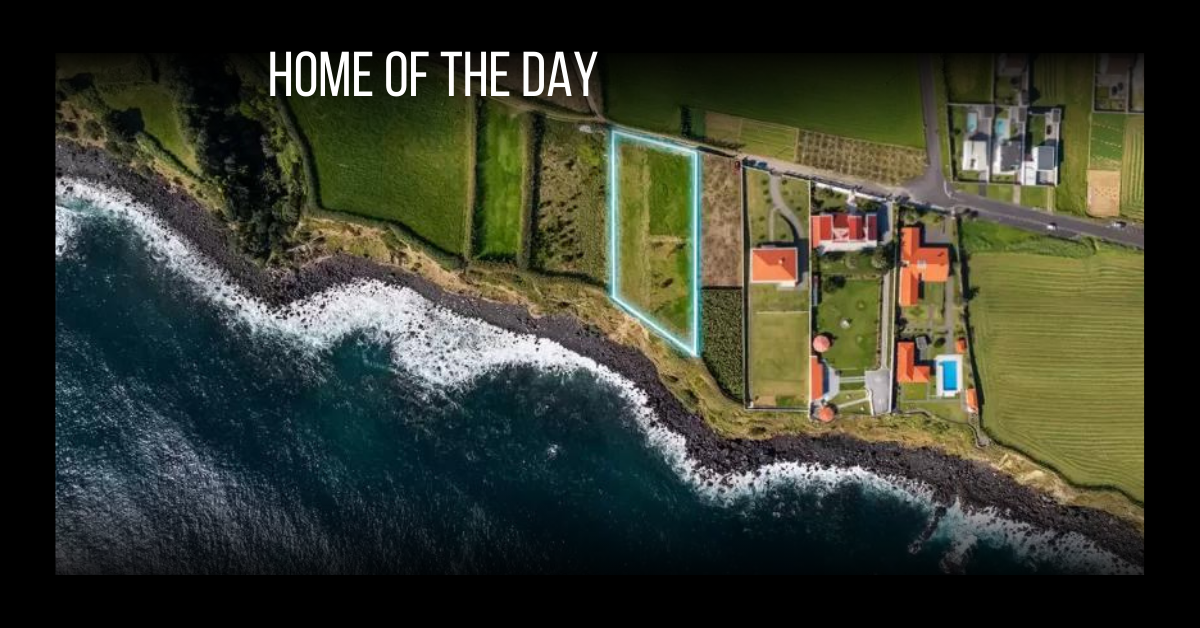

You love nothing more than uncorking an expensive bottle of wine, or enjoying a nice glass of whisky. Have you ever thought about investing in these passions?

Always popular among the luxury class, passion investments such as wine and liquor, art, watches, or coins are non-traditional ways of putting your money into physical objects that give you enjoyment. In recent years, these luxury investments have experienced significant growth, with fine wine and liquor — specifically whisky — turning out to be some of the most lucrative passion investments.

©iStockphoto.com/MinervaStudio

Wine

When it comes to wine, Andrew della Casa of The Wine Investment Fund understands the profitability of this favorite drink of many, and provides investment management of fine wines to clients through a set of established methods to ensure low-risk portfolios. “You have to look at the number of millionaires and billionaires and realize that these numbers are increasing; and they are buying these wines,” says della Casa.

“The demand is increasing because there are more people coming to buy these wines. The only thing that can move is the price, and that tends to move upwards. If you look at the gold or stock exchange, since the 1980s, gold has gone up about four times,” he says. “Wine has gone up 20 times — that puts it in perspective.”

©iStockphoto.com/PaulGrecaud

For della Casa and his team, their focus includes only investment-grade wines that can achieve and deliver absolute high returns. “The thing that attracted us to the asset class was the specific characteristics that certain wines have. It’s not just any wine or any fine wine, basically it’s a specific number of Bordeaux wines from the French region of Bordeaux,” says della Casa. “There are delicious Italian, American, African wines, and that’s fine. But that’s not what we’re about. We’re about risk analysis and risk management.”

These wines include those from the finest Bordeaux chateaux, and those that are deemed low volatility — meaning to avoid wines at the en-primeur stage, trophy wines or ones nearing the end of their optimum drinking period.

“Burgundy is the area closest to having the characteristics to Bordeaux wines, but the quantities produced are minimal,” says della Casa. “Because we’re buying and selling Bordeaux wines, the characteristics of that wine is that it’s long living so you can keep it for 20 to 30 years. Also, formula clarity, so it gets better with time.”

Della Casa asserts the importance of understanding wine investment is an alternative, rather than mainstream investment. It’s important to think about a five-year horizon at a minimum, and a limited amount of money (no more than 20 percent) from your investment portfolio should go into fine wine.

“One of the biggest risks in any investment is liquidity — to get in and out of the market whenever you want to, not when the market dictates,” says della Casa. “Wines that we look at are wines that have a strong following. There is a demand for these wines from all over the world,” he says.

The demand for these wines comes from the traditional drinker, as well as a newfound demand from Asia, which is not as long standing — they drink the wine much younger. “You can buy any wine, but it’s only when you sell it that you crystallize your gain,” he says. “You can get a 20-fold increase in value with very low risk. Look at the volatility of our portfolio and compare it to gold, or even oil; we’re very much less risky. From an investment point of view, low risk and high return. Plus, you have a physical asset.”

Whisky

Liquor offers another realm of alternative investment — and one of the most lucrative investment liquors has been and continues to be whisky. For Andy Simpson of Rare Whisky 101, who was introduced to whisky — particularly scotch — at a young age by his father, it was an accidental investment at first. “I started holding on to bottles because I had too many to drink and then realized that what I had bought for 10 to 15 pounds started to be worth 40 and 50 pounds, and I thought, could this be an investment?”

“I’ve always said, it’s an investment of passion,” says Simpson, who has been collecting for nearly 30 years and helps collectors and investors all over the world source scotch and put together world-leading collections of whisky. “People fall in love with a category, the distillery, the spirit, the legend behind it. The rules are that first you love whisky — because then it’s going to be a fun investment. Second, patience is key. While there are significant short-term gains available, it is a medium to long-term investment.”

“From an investment perspective, age matters. The older the better. But from a flavor perspective, sometimes older whisky can be worse. It can be over matured, or develop an imbalance. Yet, generally, the further back the better,” says Simpson who has personally tasted the world’s oldest — a 75-year-old whisky — and many other pre-World War II bottles.

Photo courtesy of The Macallan.

Iconic distilleries Simpson directs his clients to include Lagavulin, Talisker, Dalmore, as well as silent distilleries (those no longer producing whisky) such as Port Ellen and Brora, both soon to be reopened, and Rosebank. Commemorative limited edition bottles, distillery exclusives offered only on property, or classic ones such as the Macallan Royal Marriage bottles are always great investments. “Macallan is the Rolls Royce of collectable whiskies by a country mile,” says Simpson. The Kate and William special wedding scotch was sold for 150 pounds in 2011, and now sells for 4,000 pounds a bottle.

“The overarching principle of whisky investment is to buy the best quality liquid. Someone’s investment today is going to be someone’s favorite drink tomorrow,” says Simpson. “It if wasn’t for collectors or investors, we couldn’t be drinking, buying, opening or sharing some of the oldest bottles of whisky in the world.”

Most collectors use the two-bottle approach: buy one to keep and one to drink. Yet, sometimes this is difficult to do, as some sellers may only allow one bottle to be purchased. “We deal with people who have meaningful collections of only 50 bottles; others have 10,000 bottles, some of the biggest collections in the world,” says Simpson. “You don’t need to spend more than a couple hundred pounds for a good investment.”

©iStockphoto.com/TWSTIPP

“We split the risks into your physical storage or logistical risks, and then financial risks,” says Simpson. “The main one being the “dreaded double D: drink it or drop it.” There are of course risks from storing as well. “Since whisky has a strong percentage of alcohol (it has to be 40 percent to be legal) the strength of the alcohol will corrode through the cork stopper, and it leads to leaking and evaporation damage. Therefore, whisky should always be stored standing up at room temperature and kept out of direct sunlight. Place it in a cupboard or closet and keep it out the reach of thirsty guests,” says Simpson.

Lastly, one of the main risks plaguing the whisky market — also seen with wine as well — are fakes, with most false bottle transactions occurring across peer-to-peer auction sites, and causing a potential for significant losses. Besides these risks, Simpson asserts that the market is especially buoyant with significant price increases for certain bottles and brands, and promises to be a wonderful speculative alternative investment. “If you get a great bottle, with a great closure, you can be sure it will outlast you and I,” says Simpson.

Beer may be the everyman’s drink, but there are some ultra-premium brews priced like fine Bordeaux.

By Roger Grody

Budweiser is the “King of Beers” and rival Miller Brewing Company dubs its flagship product “High Life,” so the concept of elitism has long pervaded the mass-production market. But a new breed of brewmasters is transforming the beer drinking experience through exotic ingredients, elaborate packaging and price tags that would make a sommelier blush.

Craft brewing, a dominant trend in the industry, has fostered diversity, innovation and a focus on high quality artisanal ingredients. Also emerging are small-batch, ultra-premium beers with price points more akin to fine wines than budget-friendly, old-school labels like Pabst Blue Ribbon.

Leading beer authority Stephen Beaumont — his 13 books include The World Atlas of Beer and Premium Beer Drinker’s Guide — reports plenty of media interest in super-expensive beers but does not believe their hype represents a major shift in the industry. “It’s not so much a trend but an attention-grabber,” he says, conceding that whenever a beer sells for $800, people naturally take notice. He suggests that standing in line for the chance to buy a limited-release beer is part of an experience that transcends the palate, and points to 3 Floyds Brewing Co.’s Dark Lord Russian Imperial Stout as a prime example. On Dark Lord Day (most recently on May 19, 2018), fans make the pilgrimage to Munster, Indiana to score some of the scarce bottles.

Many high-priced beers are one-off events rather than regularly available products, and their stratospheric price tags are often attributed to extremely limited production. Sapporo, the massive Japanese brewery, introduced Space Barley in 2009, made with barley from seeds that were kept alive in the International Space Station by Japanese and Russian scientists. The grain’s exotic provenance made this one of the most unique beers ever produced — facetiously referred to as “out of this world” — and a six-pack retailed for $110.

From 2008 through 2014, Australia’s Crown Beverages produced a vintage beer called Crown Ambassador Ale, a limited-production beverage designed to cellar for a decade. The handsome 750ml wine-like bottles were originally priced at about $90 but now command in excess of $1,000 on auction sites. The brewer suggests serving it in a red wine glass and reports it pairs well with pungent cheeses, wild game and desserts.

Samuel Adams, the brand that introduced craft brewing techniques to a mass market, has offered 10 vintages of a limited-edition beer called Utopias, a blend of batches aged up to 24 years. At 28 percent alcohol by volume (ABV) — as opposed to the typical 4 to 6 percent — this beer is more akin to a Port or Cognac. Aging in a variety of wine and spirit barrels (the 2017 vintage included a stint in Scandinavian aquavit barrels) further invites such comparisons.

“My original idea for Utopias was to push the boundaries of craft beer by brewing an extreme beer that was unlike anything any brewer had conceived,” reports Samuel Adams Founder Jim Koch. “We’ve continued to stretch the boundaries in brewing with the release of our 10th vintage and I’m proud to present to drinkers this lunatic fringe of extreme beer worthy of the Utopias name,” says Koch of the 2017 vintage. Only 13,000 ceramic bottles resembling copper brewing kettles were released, with a suggested retail price of $199 per bottle. Commentators like Beaumont praise Utopias, suggesting its character and complexity warrants the high price.

BrewDog is a funky Scottish craft brewery (Beaumont calls the company, not necessarily disparagingly, “an unapologetic attention-seeker”) that produces highly rated beers with product names like Elvis Juice, Clockwork Tangerine and Tactical Nuclear Penguin. One of its most celebrated products was Sink the Bismark!, a 41 percent ABV ale that retailed at approximately $75 when released in 2011. If you can find the high-octane brew today, you’ll pay north of $200 for a 330ml bottle.

End of History is a BrewDog beer with a staggering 55 percent ABV. Only a dozen bottles were produced for its first release in 2010, so prices skyrocketed to $750 or more. The beer is now brewed at BrewDog’s Columbus, Ohio facility, legal in the Buckeye State only after a 12 percent ABV cap was lifted in 2016. Despite its American Heartland production, the beer is fermented with juniper berries and nettles from the Scottish Highlands. To raise money for the company’s American expansion, $20,000 bottles were offered to investors. And for packaging that could be viewed as either cool or creepy, each End of History bottle is inserted into a taxidermied squirrel, with the neck of the bottle extending through the mouth of the sacrificial critter.

Denmark-based Carlsberg Group is best known for its eminently affordable Carlsberg label, but offers more than 500 different brands from Uzbekistan to Laos and periodically experiments with high-end beers. Released from 2008 to 2010 is its Carlsberg Jacobsen Vintage, which was originally priced near $400. It can still be cellared until 2059 and remaining bottles are considered precious. “It’s quite a flavorful beer with lots of character and complexity,” notes Beaumont. This year, the company introduced new cask-conditioned beers in conjunction with Nordic Food Lab at the University of Copenhagen.

“The starting point was a curiosity about whether we could brew beers of sufficiently high quality to match Denmark’s elite gastronomy,” says Jacobsen Brewmaster Morten Ibsen, who notes, “We succeeded.” A limited allocation of Jacobsen’s Chanterelle Lager was provided to Michelin-starred Restaurant Tri Trin Ned in Fredericia, Denmark, where dishes on the multi-course tasting menu were carefully crafted to complement the beer’s unique character. The launch reinforces the concept of fine beer assuming the stature of wine in the highest echelons of the culinary world.

Perhaps no craft brewery in America is as dedicated to the art of “culinary brewing” as Chicago-based Moody Tongue Brewing Company, whose mission is to develop flavor profiles that pair well with fine cuisine. Founding Brewmaster Jared Rouben, a graduate of the Culinary Institute of America and an alum of Michelin three-star Per Se in New York, approaches brewing beer as he would a savory dish in the kitchen. “It’s about sourcing the best ingredients, handling them with care and knowing where, when and why to incorporate them,” he says, adding, “The finished product just hits a glass instead of a plate.”

Moody Tongue’s Shaved Black Truffle Pilsner (about $120 for a 22-ounce bottle) is a beer designed to complement rack of lamb as effectively as a Châteauneuf-du-Pape. Several acclaimed restaurants have placed it on their lists, including New York heavyweights Per Se and Blue Hill. Part of Rouben’s inspiration for founding Moody Tongue in 2014 was his frustration with seeing the beer selection relegated to the last page of restaurants’ beverage lists, with few choices that could elevate the dining experience. “My inspiration comes from the ingredients,” says the chef/brewmaster, insisting he is not motivated by price. “As soon as truffles go down in price, so will the beer,” he quips.

Shelton Brothers, Inc. is a prominent Massachusetts-based importer currently offering more than 800 labels, including those of Cantillon, a Belgian brewery whose traditionally fermented Lambic beers command high prices. Commenting on the current crop of headline-grabbing beers, Co-Founder Dan Shelton, states, “American craft brewers have figured out a lot of ways of getting people to spend more money: higher alcohol levels, novel ingredients, creating the impression of scarcity by limiting access, and using what are purported to be innovative techniques.”

“Most of this is just gimmickry,” insists Shelton, who believes the trend toward exotic food additives is cresting. Unimpressed by truffle-infused beer, he says, “I sincerely hope that what comes next is a renewed interest in what I think of as just ‘good beer’ — beer made in the traditional, painstaking way that actually tastes like beer.”

Haute Brews

BrewDog • Scotland/Ohio • www.brewdog.com

Cantillon Brewery • Belgium • www.cantillon.be

Crown Ambassador Reserve • Australia • www.crownlager.com.au

Carlsberg Group • Denmark • www.carlsberggroup.com

Moody Tongue Brewing Company • Chicago • www.moodytongue.com

Samuel Adams • Boston • www.samueladams.com

Sapporo • Japan • www.sapporobeer.com

3 Floyds Brewing Co. • Indiana • www.3floyds.com

Resources

Shelton Brothers, Inc. • www.sheltonbrothers.com

Stephen Beaumont • www.beaumontdrinks.com