In the 10 years since the recession, residential real estate, especially in the realm of higher-priced properties, has morphed into a worldwide enterprise.

“There is no question; people have more of a global mindset. They are looking for real estate in places they love,” says Stephanie Anton, president, Luxury Portfolio International, which several years ago adopted the tagline, “We’re global. We’re local.” The phrase aptly characterizes the status of luxury today.

“The saying goes that all real estate is local, but that does not mean that all buyers are,” said NAR President Elizabeth Mendenhall, CEO of RE/MAX Boone Realty in Columbia, Missouri.

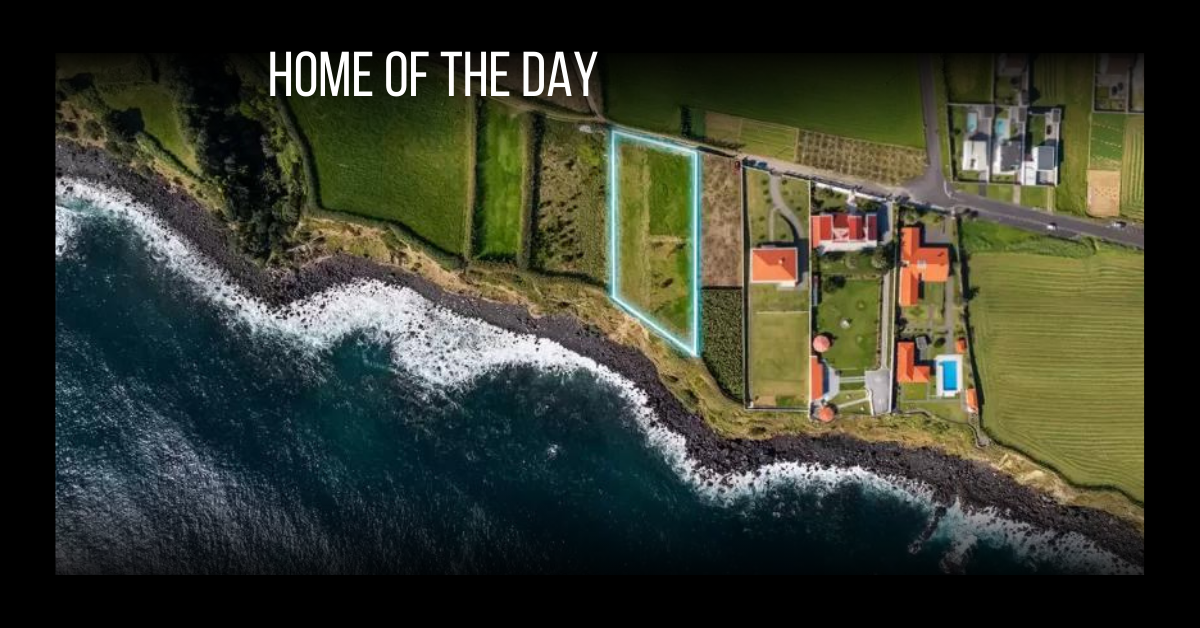

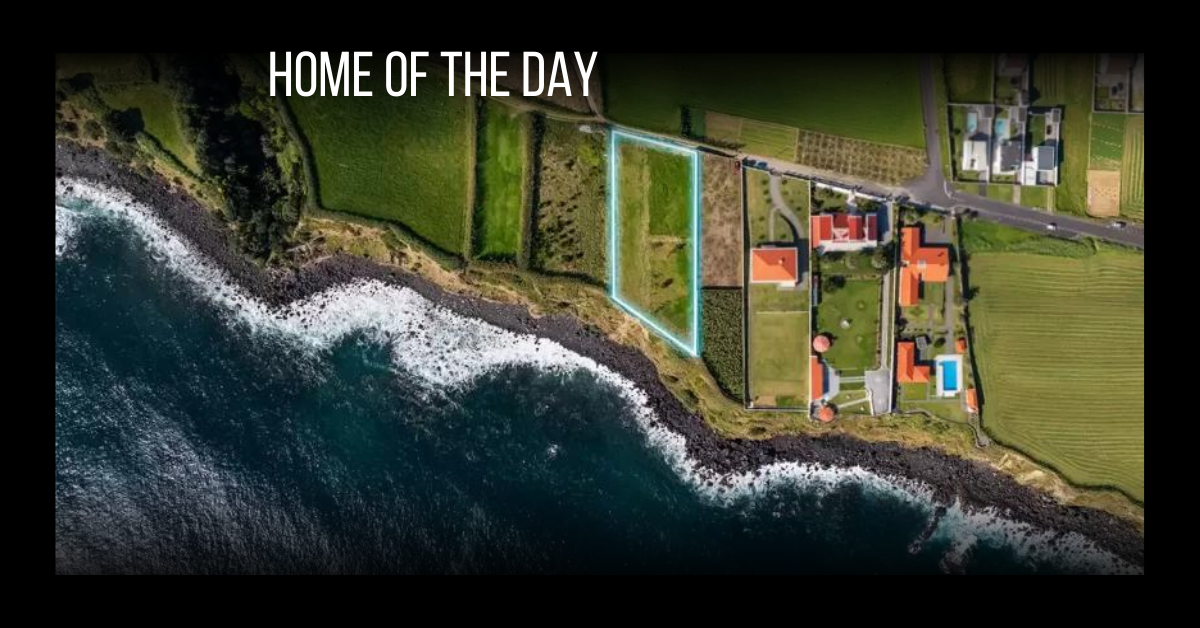

Congeliano, Italy

Photo courtesy of Atlante Properties Luxury Portfolio International®

For the industry, the ramifications of globalization extend beyond merely who buys what, where. “Historically, real estate market dynamics were considered a local phenomenon. In the luxury sector, this is no longer the case, as the value drivers for prime property in one corner of the globe increasingly originate from a completely different region of the world,” explained Christie’s International Real Estate in its 2018 report Luxury Defined, noting this trend is most evident in secondary markets — second home and resort lifestyle destinations. In 2017, sales of resort and vacation homes grew by 19 percent compared to 7 percent in 2016.

Buying property outside of one’s home country is nothing new, but, until the 1980s, sales across borders were generally limited to resort enclaves or a pied à terre in Paris, London or New York, along with the occasional trophy property.

Today, rather than a specific location, high-end buyers are likely to search for a particular property type. “Buyers these days are looking in multiple markets. They’re not as geographically contained. So, if they’re looking for a ski chalet, they could be looking at a number of different countries and throughout the Rocky Mountains in the United States,” shares Laura Brady, president and founder of Concierge Auctions, who says her company initially saw indications of this trend with ranch properties, which are very unique. “Clients don’t care specifically which market they’re in; instead, they want the right property.” Founded 10 years ago, Concierge Auctions has a team in Europe and activity in 18 countries.

Perhaps it’s geography, but Americans typically first look within their own borders. On the other hand, Bob Hurwitz, founder and CEO of the Hurwitz James Company, says, “Wealthy foreign buyers are far more likely to be open minded about locations outside their country as their first choice, in my experience. It’s not difficult to understand if you travel a great deal. In many of the countries I visit on business, you will not find many Americans, but you will meet a wide variety of citizens of other countries.”

More than property and search preferences drive the shift toward a global perspective. “There are several factors contributing to the increased globalization of luxury real estate,” shares Anthony Hitt, president and CEO, Engel & Völkers Americas, who cites the rise of digital, social and mobile technologies. “Real estate is not immune to the changing patterns of consumption enabled by technology; clients have more visibility, and therefore interest, into international homes and listings.”

Experts also point to an increasingly global economy, changing work/life balance and how commonplace travel, for both work and pleasure, has become. Craig Hogan, vice president of luxury, Coldwell Banker Real Estate, plans to exchange his primary residence in Chicago for two small condos, one on Michigan Avenue and another in Puerto Vallarta. “Fifteen years ago, my partner and I never would have considered that. Today, we are mobile. Our careers take us all over the world.”

Falmouth, Massachussetts

Photo courtesy of Robert Paul Properties/Luxury Portfolio International®

“With the world that we live in now, it’s less important that you live where your business is or where you do business. So, you’ve got a lot of people just making lifestyle choices. They’re just picking the city that they enjoy the most, and they’re moving there,” shares Mike Leipart, managing partner of The Agency Development Group in Beverly Hills.

Post-Recession Roots

The foundation for today’s international dynamic lies in the early post-recession years. In 2007 and 2008, prices on average fell by approximately 17 percent across the globe. By 2009, 73 percent of the prime property locations surveyed by Knight Frank had experienced declines, and savvy buyers scoured high-end markets worldwide for bargains. At the same time, a growing uptick in wealth and wealth creation brought more buyers to the international market.

Wealth creation continues at the post recession pace, with the number of millionaires worldwide tallying at 22.3 million, according to Wealth X. Those with a net worth between $1 million and $5 million hold 40 percent of the global millionaire wealth, while the remainder is held by the ultra wealthy, those with a net worth in excess of $30 million (Knight Frank pegs the benchmark for ultra wealth at $50 million). From 2012 to 2017, Knight Frank says the number of ultra-high-net-worth (UHNW) individuals increased by 18 percent, followed by another 10 percent gain in 2017.

Coldwell Banker Global Luxury estimates 32 million millionaires reside in the U.S. The U.S. remained the dominant nation for wealth in 2017, both among millionaires and the ultra-wealthy, according to Wealth X, although growth of this population and net worth in the U.S. was the lowest among the seven top-ranked countries. Japan was second with an 11-percent rise in the UHNW population, followed by China, Germany, the U.K. and Hong Kong.

Mexico

Photo courtesy of REMexico Real Estate/Luxury Portfolio International®

Globally, wealth in 2017 increased in all regions, with both Latin America and Europe showing a resurgence over 2016. “The confidence of foreign buyers is back,” says David Scheffler, president, Engel & Völkers France. “The Parisian luxury market has always attracted wealthy Middle Eastern buyers and continues to do so. Qatari, Kuwaiti, Saudi and Omani clients are looking for outstanding apartments and townhouses, the so called hôtel particulier. The trend to buy luxury properties in Paris is not just reserved for the ultra-wealthy, but applies instead to a wider range of affluent buyers. Some might look for a small 50- or 60-square-meter pied-à-terre, while others look for ‘representative’ apartments in the Haussmann style, up to 12 million euro.”

Over the course of the last 8 to 10 years, cross-boarder buying surged, ramped back, and picked up again. In 2016, global sales of luxury properties retrenched, partially in response to Brexit, government restrictions on wealth and the transfer of money. Markets bounced back in 2017, with sales of $1 million-plus properties up substantially.

Christie’s reports an 11-percent increase in sales, the best annual increase since 2014. Luxury properties sold in 190 days, indicating more realistic pricing in some markets and lack of inventory in others. Exceptions included New York and Miami, which saw an influx of new inventory and a shift in buyer interest. In Toronto and Vancouver, newly introduced cooling measures from the government slowed sales.

“I don’t think there is any indication that they [international buyers] are NOT looking in Manhattan. The indication is that they are either interested in the properties at lower numbers or they prefer to wait the market out and hope to buy when things are at a bottom (I have seen this many times before. It never works!). Nobody is moving to Detroit because they can’t find what they want in New York City,” shares Frederick Warburg Peters, CEO of Warburg Realty. “Russians and Europeans are far scarcer than they were in 2010 or 2011.”

Still, both for high-net-worth and ultra-high-net-worth individuals, New York follows Hong Kong as the best city for prime properties.

Nassau, Bahamas

Photo courtesy of Bahamas Realty/Luxury Portfolio International®

Toronto, Canada

Photo courtesy of Harvey Kalles/Luxury Portfolio International®

Following the recession, a growing body of research focused on wealth and global cities publish multiple rankings. A city’s position may shift slightly, depending on the research, but all reports include the same top locations for luxury properties. Hong Kong places ahead of New York in Christie’s 2017 index, with New York moving up to second, followed by London, Singapore, San Francisco, Los Angeles, Sydney, Paris, Toronto and Vancouver.

Lower prices pushed Miami just out of the top 10, but the city remains a good example of the change international activity can spark. “The international market has arguably impacted Miami as much or more than any other U.S. market. The influx of capital from Europe, South America, Russia, China and Asia has permanently changed our community. The easiest example is by simply looking at our booming skyline,” says Irving Padron, president and managing broker, Engel & Völkers, Miami.

The highest-priced sale globally was $360 million in Hong Kong, and despite government efforts to curb rising prices, there are no indications of slowing demand for luxury residences here. Also, adding to this market, according to Anton, is continued interest from mainland Chinese buyers.

Numbers Tell the Story

Rather than sales and prices, the best indication of just how global real estate has become can be seen in the expansion of major brands, affiliate groups, and even boutique firms worldwide. “All brands are connected globally,” Hogan observes, adding that even independents need some kind of a global connection. “It’s part of the dynamic,” he says.

Coldwell Banker is in 49 countries. Sotheby’s International Realty network has offices in 72 countries and territories. Luxury Portfolio International and Leading Real Estate Companies of the World lists properties in over 70 countries. Who’s Who in Luxury Real Estate’s network includes 130,000 professionals in over 70 countries. Berkshire Hathaway HomeServices recently opened franchises in Germany and in London. Bob Hurwitz had already positioned his boutique firm as an international player before the recession. Today, he has offices in Los Angeles, San Francisco, New York, London, Shanghai and Singapore.

A global orientation can also be seen in members of the Institute for Luxury Home Marketing. There is “an increased focus and intentional approach as they target international buyers through affiliations with brands, networks and associations,” says general manager Diane Hartley. “In fact,” she says, “we have members in many countries outside of North America who are building relationships and sharing business with our members in the U.S. and Canada.”

Whistler, Canada

Photo courtesy of The Whistler Real Estate Co./Luxury Portfolio International

Firms based in Europe also continue to increase their footprint. Founded as a boutique firm in Hamburg, Germany, Engel & Völkers is now in 800 locations in Europe, Asia and the Americas, establishing its first offices in the U.S. in 2007. “We have experienced firsthand the globalization of luxury real estate,” says Hitt.

“For luxury and coastal markets, real estate has absolutely become more global,” shares Leipart. Like a growing number of independent firms, The Agency partners with an international real estate advisory company, Savills, which allows them to sell through 700 offices around the world. Still, he adds, “we are focused on international, kind of connecting the dots around the world as opposed to other cities in the U.S.”

In the luxury world, L.A.’s star continues to rise, and the city in recent years has figured into lists for top global markets. According to the National Association of Realtors, Florida, California and Texas remain the top three destinations for purchases from foreign buyers, followed by Arizona and New York. Still, just under half of all residential transactions for foreign buyers took place in other states. Among buyers, China, Canada, India, Mexico and the United Kingdom account for the most purchases.

Also, Hogan points out, international buyers in the U.S. aren’t always in luxury markets. For example, Asians love to buy real estate close to a university. Another group looks for locations with smaller downtowns. Still others want a large home with a big yard near a lake or river, something hard to find in their home country.

As Much As Things Change

Even though foreign buying in the U.S. slowed in 2017 compared to prior years and to overall activity worldwide, international buyers still have their sights on the U.S. “It’s all about consumer confidence. As long as people feel that the U.S. economy is in good shape and it’s going in the right direction, they’ll buy real estate,” says Brian Losh, chairman of Who’s Who in Luxury Real Estate.

Connections to local markets remain essential. “I will say a lot of it still happens in a very traditional way. People are either coming to L.A. a lot, either they have a child in school here, or they love the area and they decide to buy a home, and they do that through a local Realtor, regardless of where they come from,” observes Leipart.

Appearing in UH Summer 2018, “Ten Years Later: Our year-long look at what’s changed in U.S. luxury real estate since the 2008 recession.”

Consumer sentiments toward owning and buying real estate continue to evolve, along with the definition of luxury.

By Camilla McLaughlin

Ten years ago, there were few signposts for the journey out of the recession. Real estate’s perfect storm got a lot worse in the summer and fall of 2008 as a combination of job losses, high energy costs, an ongoing tide of foreclosures, a pending presidential election and the near collapse of the credit markets rocked the economy. Many, but not all, upscale consumers put real estate plans on hold and shifted into a watch-and-wait mode. “Consumers’ confidence gets shaken, and the rich are not immune,” observes John Brian Losh, publisher of Luxuryrealestate.com and owner of Seattle brokerage Ewing & Clark.

Following that low point, luxury real estate embarked on a remarkable journey of recovery with luxury properties selling and prices escalating in many locations, boosted in part by the exponential growth of wealth worldwide. Just in the last year, the combined net worth of the world’s billionaires increased by 18 percent. Residential real estate remains a favored investment with prime property sales worldwide up by 11 percent in 2017.

Attitudes toward buying, selling and luxury overall have followed an equally transformative path. “The lesson from the recession is to buy smart. Impulse buying, overextending to get the home of your dreams, and buying without doing your homework have all gone the way of the fax machine,” says Jason Haber, a broker at Warburg Realty in Manhattan.

Value is most important. Greenwich saw two record sales in 2017, but only after list prices were reduced. In their luxury white paper, Christie’s International Real Estate reported strong sales “where buyers and sellers showed a willingness to adjust pricing expectation to new market realities.”

“Price was the name of the game,” said Michael Saunders of Michael Saunders & Company, noting that luxury homes in Sarasota sold in record numbers after homeowners adjusted prices.

Affluent individuals also have a new perspective on the investment potential of properties, locations for both primary and second homes, expectations regarding the agent’s role in the transaction and what constitutes luxury.

What Is Luxury?

Few other terms have been hyped more than the word “luxury” in recent years. Most industry experts would agree with Mike Leipart, managing partner of The Agency Development Group in Beverly Hills, who says, “It’s used so often that it’s become virtually meaningless.”

Even wealthy consumers struggle to find a suitable alternative phrase, yet they have a clear understanding of what luxury means today. “I think people can’t describe it, but when you walk into it, when you are standing in it, you respond to it,” says Craig Hogan, vice president of luxury, Coldwell Banker Real Estate. “People can tell quality; they can tell beautiful design. Service is critical.”

“Ten years ago, the luxury industry was able to dictate to consumers what luxury was and almost define it for them. We are not able to do that today,” explains Kevin Thompson, CMO of Sotheby’s International Realty Affiliates LLC. “Luxury is being viewed from an experiential perspective. People are choosing to live different ways and somehow have what they value. It is a very individual approach.”

“The meaning of luxury has changed a lot. I think luxury has become personal. It’s become a feeling. It’s become an emotional part of a real estate experience,” says Christina Huffstickler, owner of Engel & Völkers in Atlanta.

“You can’t pin it to price level or finish levels. It’s very complex. It’s very much what people are willing to pay extra for,” says Leipart using the example of how a desirable view — prized by today’s buyers — amps up a per square foot price. “I think the basic thing of luxury is that it is everything that has not been commodity priced,” he explains.

Value & Inventories

“By and large, people value home ownership,” shares Hogan. “I just keep watching this trend toward smaller and more wonderful. Just beautiful in every way. Great finishes, smart home technology, all the things you’d expect except beyond those expectations.”

“I think that people, wealthy people, have always found real estate to be an attractive investment. It’s an asset that usually appreciates that they can enjoy,” says Losh.

Coming out of recession, the Bay Area led the recovery, and the region continues to rack up amazing stats with May’s median sold price exceeding $3 million in both San Francisco and Silicon Valley, according to The Institute for Luxury Home Marketing. Inventories remain barebones with homes selling in weeks. In fact, the median time it takes for both attached and single-family homes to sell in Silicon Valley is about nine days. Here, as in many other upscale locations, the biggest issue is too few listings to satisfy demand.

“Even with interest rates rising because of the moves the Feds have been making the last 18 months, there is no slowdown in the appetite for wealthy consumers purchasing homes,” says Jim Walberg with Pacific Union, noting, he has never seen more all cash purchases in 35 years. “Buyers and sellers still view Bay Area real estate as a great place to put their resources. And, remember, these are wealthy people, so it’s not as if they are not diversified in many other investment categories.“ Many of these purchasers are looking at long-term ownership. The homes have a dual purpose: a fun community and place to raise their kids, and a home they plan to live in after their children are grown.

“The primary residence purchase remains largely emotionally driven based on finding the right property to suit the purchaser’s desire for location, space, finishes, et cetera,” rather than a cold calculation of investment dollars,” says Leslie Hirsch, an advisor with Engel & Völkers in New York City.

Second Homes & Investments

Second homes and resort properties are in demand. More than half of the world’s high- and ultra-high-net-worth individuals own two or more residences, and many sought out at least one luxury property acquisition in 2017 and 2018, say experts at Christie’s International Real Estate in their annual industry report.

Among the U.S. population with a net worth of $500 million and up, 2,700 own on average 10 or more homes each, shares Hogan.

“An interesting trend we have noticed is that more wealthy clientele are electing to purchase properties as investment pieces instead of purchasing a third or fourth home to use as a personal residence. Or in some cases they are using a single property as both a vacation home and income property,” shares Anthony Hitt, CEO of Engel & Völkers Americas.

“Second, third and fourth homes are now being scrutinized more carefully to make sure there is an upside in the investment should the purchase decide to sell in the future,” says Hirsch. Investors are diversifying portfolios, she says, “choosing to buy property in several countries as a hedge against a drastic change in one country’s economy.”

Affluent consumers continue to be bullish on real estate, an attitude enhanced by recent volatility in equity markets. Losh believes security and safety are more important to consumers. “People are also looking for a safe harbor. They want to feel safe, and they want their investment to be secure,” he says.

What Buyers Want

Ten years ago, the luxury echeleon was defined as homes priced in the top 10 percent of any market, and that benchmark still stands. But for consumers, dollar signs do not necessarily determine luxury. “Money sometimes doesn’t even become part of the search parameters. They just want to find the right property,” and these buyers today are willing to take their time, says Katie Hauser, a broker associate with Baird & Warner in Winnetka, Illinois.

Like many agents today, Hauser sees several different buyer profiles in the market. Some, particularly empty nesters, “want to ditch their suburban house for something unique. They want value, but they want to find the right place,” she says.

“There is a search for the unique. The emerging luxury consumer isn’t interested in cookie-cutter anything. They want personal and outside the norm and are willing to pay more for that,” adds Thompson.

On the other hand, other upscale buyers want a platinum location and are extremely discerning regarding every facet of the property.

“Luxury buyers in Omaha want what they want, and if they cannot find it they build,” says Judy Smith with RE/MAX Real Estate Group in Omaha. High on wish lists are rooms large enough for grand pianos, buffets and sideboards. “They still love walk-out basements for entertaining and as a separate living area for family members extended visits. The view from the deck is always important.”

Millennials

Millennials are beginning to make their play in real estate. Because they delayed buying a home, many of their first purchases fall into the luxury niche, giving new meaning to “starter home.”

According to research from Luxury Portfolio International, most buyers seeking $1 million-plus homes are 25 to 49 years old and have inherited or plan to inherit significant wealth. This consumer has begun powering the $1 million-plus real estate market, more so than their older counterparts.

Millennials overall, says Lindsay Bacigalupo, an Engel & Völkers licensed partner in Minneapolis, “waited to buy and are now in their late 20s and early 30s. They are buying starter homes that are $400,000 to $1 million.

Millennials expected to be as transformative for real estate as the baby boomer cohort was. “Millennials are the next generation who are redefining luxury. Their attitudes toward homes are shaping what is publically seen as ‘good real estate,’ influencing what others look for in a home,” says John Dean, license partner with Engel & Völkers Vancouver. “Millennials are rejigging real estate wish lists, which differ from past generations. They place a big focus on the shared economies. They prioritize modern design. They see real estate differently than predecessors as big traditional homes are too expensive for them to afford, at least right now.”

“Bigger is a little yesterday,” says Hogan, who characterizes current preferences among all consumers as “smaller and finer.”

The drive for a safe harbor along with quality of life, changing demographics, government tax policies and technology are all reshaping the geography of luxury. Denver, Nashville and Atlanta are new luxury players. Victoria, British Columbia topped Christie’s annual report as the primary luxury market. Santa Fe was the hottest second home market; Sun Valley and the Bahamas were in the top five.

More consumers are also opting to make places such as Charleston, South Carolina; Austin or Orlando home. A number are also trading their primary home for a resort home in locations such as Jackson Hole or Bluffton, South Carolina, and many are doing so with kids in tow.

“The definition of luxury means something different to millennials than previous generations. As we know, they value the experience of material wealth. They may choose to settle in traditionally second-home markets to be close to the beach or mountains. They are not as tied to a specific geographic area as many have the option to work remotely,” explains Hitt.

Technology & the Agent’s Role

Probably nothing has changed more, as well as stayed the same, as the way homes are sold and how real estate agents work with buyers and sellers. “Technology has played a huge role in changing everything we do now as agents,” says Dean.

Buyers are more knowledgable; the mechanics of the transaction are more streamlined. Artificial intelligence and virtual reality are starting to kick off the next tech evolution.

The agent’s role continues to shift from provider of information to trusted advisor. “Today’s buyer comes armed with data, comps, neighborhood analysis, and newspaper articles. In some cases they know more about pricing than the listing agent,” says Haber.

What agents need to understand, Leipart says, is, “you don’t sell anything” to the wealthy. “If your approach is to get them to buy, you are going to strike out every time. The best you can hope for is to be a trusted advisor, and you can’t have that role if you are trying to sell.”