COURTESY RITZ-CARLTON RESIDENCES, RAS AL KHAIMAH, AL WADI DESERT

The mystique of the desert, equally reflective and immersive, inspires bold architectural statements without compromising the natural environment

In desert environments across the globe, indigenous cultures, worked hard to create nurturing living spaces in harsh desert climates, and their innovations continue to inspire architects today. Since Frank Lloyd Wright first encountered the Sonoran Desert in Arizona — the establishment of his Taliesin West studio in 1937 was driven by a fascination with the landscape — architects have viewed these rugged environments as especially inviting canvases for reflection and meditation.

“We want the architecture to be a backdrop for engaging with the experience of the landscape,” explains DUST Architects Founding Principal Cade Hayes, whose Tucson-based firm specializes in modern desert residences offering reflective, soulful qualities. Natural materials are essential to the firm’s projects, and the use of rammed earth — an ancient building material consisting of compacted soil, clay or stone whose striations result in a pleasing organic aesthetic — is a DUST signature. “We’re always conscious of how the design is shaped by the senses,” says Hayes, who focuses on olfactory influences as well as the more obvious senses of sight and touch. “We like to bring the landscape as close to the home as possible, because when breezes blow through desert flora, or when it rains, aromatic oils are released that have a calming effect.” For all its desert projects, DUST Architects provides generous terraces or patios, encouraging residents to fully engage with the environment.

COURTESY RITZ-CARLTON RESIDENCES, RAS AL KHAIMAH, AL WADI DESERT

Under the quiet shimmer of the night sky, the pool becomes a mirror of the stars, a seamless blend of design, serenity, and understated luxury.

Desert Design: A Palm Springs Specialty

Wright’s disciples, mid-century modernists like Richard Neutra and Rudolph Schindler, began designing sleek residences whose clean lines and expansive windows seem well suited for the desert landscape. Today, PalmSprings, California, is a thriving testament tothe marriage of modern residential design and the arid environment, celebrated annually with the city’s enormously popular Modernist Week. Contemporary architects are following in the mid-century masters’ footsteps, with deserts around the world attracting exceptional talent.

The Los Angeles-based architectural firm of Marmol Radziner honors Southern California’s rich mid-century modern heritage and has built an impressive desert portfolio, including the masterful restoration of the Richard Neutra- designed Kaufmann House in Palm Springs. “For us, the desert is an incredibly beautiful and powerful tapestry of color and texture, and we want to connect with that landscape while recognizing that it’s a harsh environment,” says Managing Partner Leo Marmol. He suggests a sense of human vulnerability naturally leads to meditation, and emphasizes the importance of maintaining a visual connection to the landscape in all the firm’s desert projects. “Our relationship with the world beyond us brings a sense of awe, tranquility and peace,” says Marmol.

Olson Kundig, an acclaimed Seattle firm known for introducing modern residential designs into remote natural environments, designed a home outside of Palm Springs that pays homage to the original desert settlement before the area exploded into a mecca for tourists. The firm applied natural materials to achieve a harmonious coexistence with the surrounding desert landscape and created broad overhangs to provide shade in the summer — but allow the winter sun to warm the house. A central spine topped by a clerestory enhances circulation and diffuses natural light. The spine extends from the entryway to a plaza with reflecting pool. Commenting on this juxtaposition of mass and water, Olson Kundig Principal Jim Olson notes “the movement of wind across the water brings architecture to life and reflects the changing environment.”

Arizona, Idaho, and Beyond

In Scottsdale, Arizona, where the Sonoran Desert is confronted by a metropolis of 5 million people, Marmol Radziner designed a desert home with a bold, modern theme while still respecting the fragile environment. The intent was to weave this elaborate winter retreat seamlessly into the fabric of the desert, heightening awareness of the rugged, saguaro cacti-studded landscape while integrating indoor and outdoor spaces. “We like to incorporate local building materials and techniques, which help connect the residence to nature, even in a contemporary design,” says Marmol. In the Scottsdale project, he cites surfaces inlaid with local stone — it is a recurring feature in both exterior and interior spaces — that reflect this approach.

Similarly, in the harsh high desert of Idaho, an Olson Kundig residence nicknamed “Outpost” makes a statement amid the austere landscape, yet somehow hardly interrupts the region’s endless expanse. The elevated main living level offers 360-degree views of the desert and mountains, with nary a neighbor in sight. “When you grow up in the Palouse [the high desert prairies of the Northwest], you learn quickly how insignificant your place in that larger landscape is,” muses principal Tom Kundig. Architect Daniel Joseph Chenin also designed Fort 137, a luxury residence with panoramic views of Red Rock Canyon outside of Las Vegas, with the intent to encourage an emotional connection to both the desert landscape and the rich history of Nevada. The house features a soaring 28-foot entry rotunda — a modern interpretation of an old frontier fort in the Silver State — that reflects the experiential approach of Chenin’s firm. That element serves as a transition between the external desert heat and the cooler

PHOTOS BY BILL TIMMERMAN

Above/Below: Perched on Lake Constance, this 3,700-square-foot home pivots with the landscape to frame sweeping alpine views and embrace its lakeside setting.

interior, further enhanced by soothing sounds of a stone fountain. “In researching architecture that addresses the hot, arid climate of the Southwest, it took us back to some of the settlement structures of the pioneers of the 1800s,” explains Chenin. “The idea of a stacked rock structure, similar to forts designed by the settlers of the time, really resonated.” Further embracing an indoor-outdoor desert lifestyle is a shaded courtyard set against a rugged backdrop that includes a 75-ton boulder excavated from the site.

PHOTOS BY OLSON KUNDIG

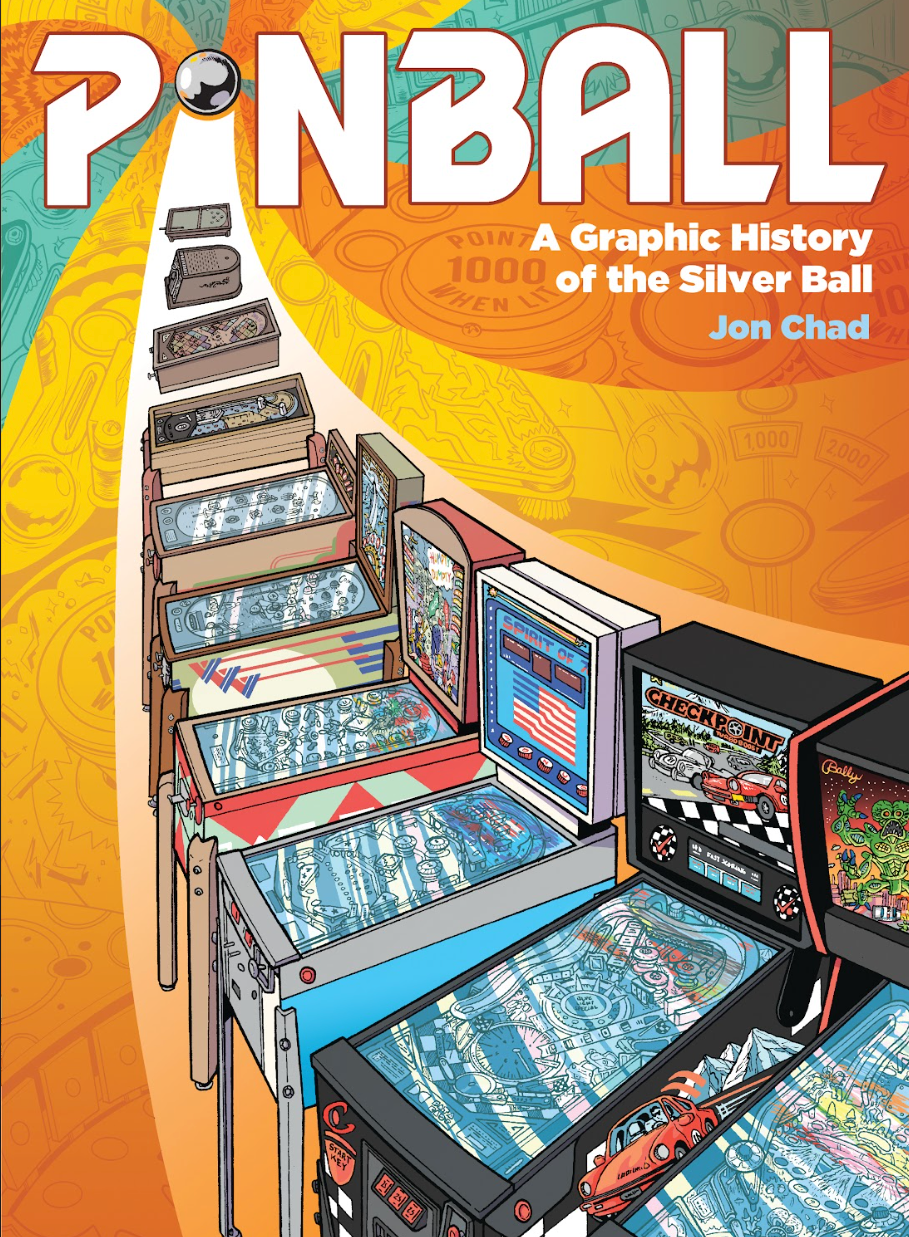

Outside of Dubai, where the Al Wadi Desert meets the Persian Gulf at Ras Al Khaimah, Ritz-Carlton Residences is developing 35 private luxury villas, applying contemporary

architectural elements to traditional Bedouin desert structures. The villas, slated for completion in early 2027, will feature clean lines and sustainable local materials while emphasizing a strong connection to the beautiful, forbidding desert environment. “With homes designed in harmony with the desert and amenities inspired by the local heritage, these Ritz-Carlton Residences are immersed in a lifestyle of quiet luxury,” says Jaidev Menezes, who oversees residential development for Marriott International in the region. With views of sweeping dunes and sunsets, these multimillion-dollar villas will ensconce residents in a desert landscape that has mesmerized explorers for millennia.