Khaliah O. Guillory, Owner of Nap Bar

A new set of businesses aims to help a sleep-deprived society relax and rejuvenate.

Nap bars. Upon hearing about this concept, various images come to mind, from a series of bedrooms with designated time slots for napping, to a pillowy oasis set in the clouds. While some ideas are more fantastical than others, the meaning behind many nap bar businesses and their missions is far more down to earth.

Whether naps are offered as a complimentary service or finely curated in a luxury setting, the importance of sleep has been reinvigorated by companies like these who know that the benefits of napping are nothing to sneeze (or snore) at in today’s world.

In recent years, with the rise of globalization and businesses running 24/7, productivity can and has for some time become a priority. Maria Jose Hernandez of recharj, a meditation studio headquartered in Washington, D.C., says the needs of the human body should take precedence, however.

An avid lover of naps since childhood, Guillory developed her company as a way to keep herself from “taking naps in [her] car.”

Photos courtesy Nap Bar.

“Science has proven that sleep is how you are able to learn, retain memory — all these functions that we need to be productive.”

Many nap bars and sleep-oriented businesses have been developed by busy business professionals and entrepreneurs who found themselves suffering from sleep deprivation or sleep-related issues. For example, Khaliah O. Guillory was working at a Fortune 500 company and struggled with getting restful sleep when she was inspired to open Nap Bar in Houston. An avid lover of naps since childhood, she developed her company as a way to keep herself from “taking naps in [her] car,” and engage other young professionals to rest, relax and feel rejuvenated through a curated, white-glove napping experience.

Top: Zen – Bar à Sieste Weightless Chair and VR.

Photos courtesy Zen – Bar à Sieste

Christophe Chanhsavang and his wife, Virginie, have had similar trials and tribulations. From Virginie’s corporate work hours to Christophe’s long hours of study, he realized from his experience working in the UK, China and Greece how much the concept of wellness was nonexistent in the French society. To avoid taking more naps in the office bathroom, Chanhsavang says they founded Zen – Bar à Sieste in 2011 in Paris and have since approached wellness from a holistic perspective by promoting sleep, nutrition, physical activity and mental health.

Professionals in the wellness industry have noted and continue to highlight the importance of sleep, which in turn has led to research and results into the benefits of napping. Guillory offers facts that have helped fuel the educational aspect of Nap Bar, including a NASA statistic that suggests shorter nap durations are better for reducing the impact of sleep inertia, a physiological state of impairment that affects cognitive and sensory-motor performance.*

Mauricio Villamizar, CEO of Pop & Rest in London, takes these findings a step further, noting how a lack of sleep can ultimately lead to disruptions in workflow. “Sleep deprivation is linked to lower productivity at work and it’s one of the main drivers of absenteeism … in the workplace. If we translate this into working days, we are looking at around 200,000 working days being lost each year in the UK only. In terms of economic consequences, it’s around £40 billion, almost 2 percent of the UK’s GDP,” Villamizar says.

Wellness overall has seen a resurgence in strength from businesses like these, as health has come to be the utmost priority of nations around the world. And just like there are many types of methods of getting and staying well, there are a variety of ways to nap.

Pop & Rest is a London-based wellness startup that connects locals and travelers with sleep and meditation pods, offering clients safe and secure spaces to unwind, rest, and work peacefully. According to Villamizar, customers can visit one of the company’s various locations throughout London and become immersed in a calm environment where the pods are situated.

“Once you are inside, your pod will be like a box that features a single bed, small table, along with accessories to change lights, music and the aroma,” he says, noting that everything is built to ensure the best relaxation experience. The pods are movable and soundproofed, and only require a power supply and WiFi connection to function, an enticing offer for companies looking to purchase these pods for their own offices.

The aforementioned Nap Bar curates a luxury napping experience for customers, which Guillory says is ensured by engaging all five senses. For sight, all of the custom suites are outfitted with mood lighting that is adjustable; for taste, a duo of raw juice shots are offered with rich nutrients and ingredients that aid in relaxing the body pre-nap, and waking it up post-nap; for hearing, exclusive brain waves are curated for each client and played inside suites that increases the release of melatonin in the body by 97 percent; and for smell, an aromatherapy pillow mist infused with lavender is available.

recharj – D.C. meditation room and class.

Photos courtesy recharj

Pop & Rest sleep pod for napping.

Photo courtesy Pop & Rest.

The final sense, of touch, goes a step further, as all suites include an organic, locally sourced mattress, linens and sheets, and each room is painted with toxin-free paint. All of these inclusions are accompanied by a full-service concierge who will guide customers through the experience and help them on their wellness journey

According to Chanhsavang of Zen – Bar à Sieste, wellness is the future of humanity, a future he aims to advance with the Siesta Bar, which combines technological and traditional means of treatment for sleep deprivation. For nap services, customers can choose from a luxurious memory foam retreat, a zero-gravity massage chair or a Shiatsu bed; for aiding in relaxation and overall wellness, complimentary services include massages, virtual-reality meditation and even a fish spa.

As a meditation studio, recharj has been offering premier restorative practices to help clients, which includes the use of power naps. According to Hernandez, during open hours these power nap sessions are curated to be 25 minutes long and offered in large Yogibo chairs, a favorite for many. “A client once described them to me as if you’re laying down in a cloud,” Hernandez says, which only adds to the whole-body experience.

Binaural beats are also incorporated into the nap session, a type of music melody that registers at different frequencies that are meant to relax your body and get it ready for sleep. Overall, the studio aims to bring a sense of relaxation as well as mindfulness through meditation to its clients. “We offer workshops about mindful leadership, mindful communication and mindfulness in general,” Hernandez says, which in turn helps clients learn ways to de-stress and regain focus on whatever tasks lay ahead.

Unlike the typical fad that comes and goes, wellness is rooted in a deep need for comfort and stability. As we write this, we’re in the midst of a public health crisis, and brick and mortar locations may not be open. But there are ways to implement the wisdom of these businesses from your own home. Studios like recharj continue to offer online meditation classes, in an effort to keep a consistent schedule that is based solely on keeping well. And though the future is uncertain, businesses like Pop & Rest, Nap Bar and Zen – Bar à Sieste continue to work and create solutions for customers, from promoting online educational sessions and tips to developing applications, products and services for when businesses are fully up and running.

“Wellness is not just a fashion, but a fundamental trend in our societies,” Chanhsavang asserts. “Hopefully the nap services and related businesses will become a game-changer in the hospitality industry.”

*Source: NASA conducted a study on sleepy military pilots and astronauts and found a 26-minute nap increased productivity by 34 percent and alertness by 54 percent.

Every year we select locations to highlight as Markets to Watch. This year change is underway and we take a look at some top performers, others that are beginning to transition, and a handful of under-the-radar locations that are emerging.

Austin, Texas

On track for another record with sales up more than 3 percent, Austin’s luxury patina shines ever brighter. In October, the medium home value in Barton Creek increased to $1.02 million, making it the city’s first million-dollar neighborhood. Austin’s charms include no income tax to win over newcomers, but music and tech might be tops.

Bozeman, Montana

Bozeman might seem like a sleeper on this list, but with ranches, the Yellowstone Club and Big Sky country it’s an under-the-radar hangout for demi-billionaires and billionaires.

Brooklyn, New York

No longer second best! Buyers are making Brooklyn a first choice. Median prices in the most expensive neighborhoods hit the $1 million mark. Israelis, Chinese and Western Europeans also gravitate here. It’s no surprise this New York City borough is No. 2 on Urban Land Institute’s Markets to Watch.

©istockphoto.com/Auseklis

Chicago, Illinois

By August, the Chicago area recorded as many luxury sales as in all of 2016 or 2017. Sales of $1 million-and-up properties set a record in the third quarter with a 19-percent increase over 2017. According to RE/MAX, luxury is booming in the west loop area. Upscale suburbs trail the city. Lots of new condos and stunning new buildings open doors to more urban opportunities in a market that hangs in the balance.

Dallas, Texas

Few cities have charted a post-recession course as strong as Dallas and the city remains Urban Land Institute’s No. 1 location for overall real estate prospects in 2019. But the dramatic post-recession price increases are over, say economists. Moderating prices and adjusting inventories are positive indicators that that a move back to a normal market is underway.

© istockphoto.com/Kanonsky

Denver, Colorado

Real estate’s Rocky Mountain high isn’t over yet. Denver continues to rank in the top group on many lists. In the upscale bracket, a shift toward balance is underway with the inventory of $1 million-plus homes at about seven months. Year-over-year prices are up on average 9.29 percent. Boulder remains a sweet spot for luxury, ranking 10th among cities and towns with at least 10 neighborhoods considered million-dollar.

Las Vegas, Nevada

Projections call for appreciation as high as 10 percent this year. Nevada was the fastest growing state, with new platinum communities; forward-looking, innovative architecture; and spectacular views capturing the attention of buyers looking for lifestyle and tax relief.

Hilton Head, South Carolina

Coastal South Carolina and Georgia are ground zero for demographic shifts and the growing ability among the affluent to live wherever they want — a trend just taking off. New developments including Palmetto Bluff add to demand for the Hilton Head region.

Minneapolis, Minnesota

Moving toward balance. A long-awaited uptick in homes on the market is one of several hints of a market shift. Median prices reached a record high this fall, and homes still sell quickly. Still the inventory of homes for sale is one of the lowest in the country. Upper tier and move-up brackets are less competitive.

Northern Virginia

D.C. continues to be in the top group on watch lists but Amazon’s recent announcement makes real estate in Northern Virginia much more interesting. What the prospect portends for current homeowners is uncertain, but sure to make this a market to watch in 2019.

Park City, Utah

No longer just a ski hangout, this Salt Lake neighbor is luxury’s newest player. The most desirable neighborhoods see a shortfall of inventory. Land prices increased by 25 percent with the highest number of sales occurring at Promontory. Opportunities abound: new projects at The Canyons, a large expansion of Deer Valley, a $4 billion renovation of the Salt Lake airport and a bid for the 2030 Olympics.

Wikimedia Commons / Don Lavange

Portland, Maine

Beaches and skiing, does it get any better than that? Hipsters meet old money here. Ranked among the top 20 for entrepreneurs, the city has a growing tech industry and one of the best foodie scenes in the Northeast. Look for more new construction. Prices will continue to ease upward as more people discover this hidden gem.

© istockphoto.com/DougLemke

Santa Barbara, California

Opportunities for buyers in many California locales continue to increase as markets shift. Median prices in Santa Barbara in November were down more than 25 percent, which is good news for buyers. The area remains a prized luxury refuge and lower prices open the door for newcomers to enjoy one of the most unique locations in the U.S.

Sarasota, Florida

The city’s iconic waterfront is being reimagined with a vision to increase cultural programming and urban amenities. Median prices have been increasing steadily, up 25 percent since 2014. New construction means more inventory with more on the horizon. Agents report steady and growing interest in individuals from high tax states.

© istockphoto.com/KarolinaBorowski

Seattle, Washington

Happier times are ahead for buyers in Seattle with active listings up by 41 percent. Even though inventories are still slim, it’s a good indication the frenzy is over. Closed sales in November were down 28 percent. Homes continue to appreciate but the increase has slowed to 5 percent. For buyers and sellers this is definitely a market to watch. The city still is in top groups in many rankings, but the frenzy is over.

Wikimedia Commons / Jeff Gunn

Toronto, Canada

Canadian Baby Boomers and Millennials came together and turned up the heat on the luxury condos in 2018; single-family home sales decreased by as much as 44 percent. While the foreign buyers tax has reduced sales to overseas buyers, it’s also opening new opportunities for locals. Local buyers will continue to drive demand for condos here.

Resort Markets

Luxury’s top performers in 2018. Not only are residences in demand, but new resorts are raising the bar for luxury and reinvigorating current markets. New developments in Turks and Caicos, including the ultra-indulgent Gansevoort Villas, turn up the heat on interest in the Caribbean. Easy reach from the U.S. and private enclaves generate new interest in the Bahamas. Cabo San Lucas, Mexico is seeing new resorts and other regions along the Sea of Cortez are seeing new development. Mandarina in Nyarit is the site of One & Only’s first collection of private homes. Owning a private island continues to be an ultimate purchase and the Bahamas is ground zero.

Thanks to:

Austin Board of Realtors

Michael Saunders, Founder and CEO Michael Saunders & Company

Anthony Hitt, President and CEO, Engel & Völkers Americas

Aleksandra Scepanovic, Co-Founder and Managing Director of Ideal Properties Group

National Association of Realtors

Northwest Multiple Listing Service, Kirkland, Washington

RE/MAX Canada

Trulia

Zillow

This story originally appeared in the Winter 2019 issue of Unique Homes Magazine.

Chris Karsteter

Coldwell Banker Bain

1661 East Olive Way Seattle, WA 98102

T. 206.794.1465 ~ karsteter@coldwellbanker.com ~ Coldwell Banker Bain

Chris’ goal is to provide exceptional personalized service throughout the real estate experience. He relies on 30 years of customer service expertise to help ensure professional, pleasant and “painless” real estate transactions for his customers and clients.

Featured Listing by Chris Karsteter

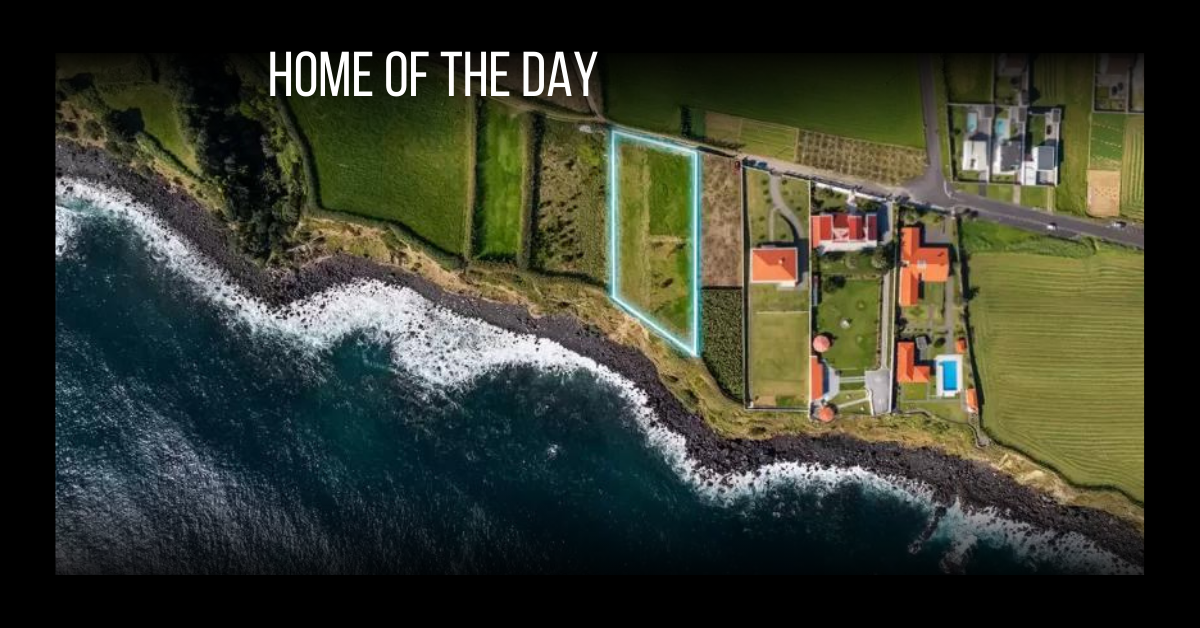

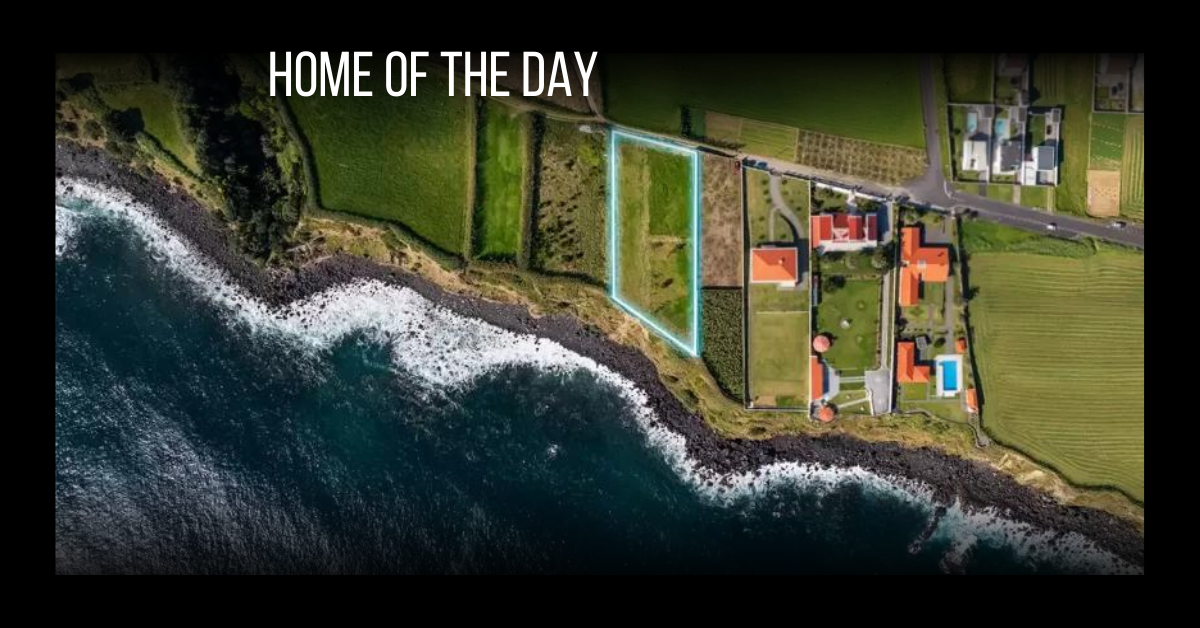

San Juan Islands, Washington

A rare opportunity. Situated within the breathtaking San Juan Islands archipelago, just north of Seattle, this extraordinary 29-acre gated estate offers supreme privacy and is a sophisticated retreat on the wooded shores of Puget Sound. 4,421 feet of front footage and sheltered boathouses. Although the property feels like a private island, it is connected to Blakely Island proper, its marina and airport. $4,500,000 price reduction… seller wants to sell.

www.BlakelyEstate.com

$13,995,000

Chris Karsteter originally appeared as an Elite agent in the Unique Homes Spring ’18: Elite edition. See his page here.

Hedy Joyce

Keri Lynn

Allyson Lin

Coldwell Banker Bain Global Luxury

H: 206.406.7275 | K: 425.395.6780 | A: 425.305.8028

hedyjoyce@cbbain.com | kerilin@cbbain.com | allysonlin@cbbain.com

Featured Listing by Hedy Joyce, Keri Lin and Allyson Lin

BELLEVUE, WASHINGTON

10415 NE 15th Street

Stunning luxury residence — nothing compromised — offers the finest craftsman wood and detailing with nuances of transitional/contemporary features; a superb blend of aesthetics for a particular buyer looking for quality construction. The home features excellent flow pattern throughout the main floor, a large office, guest en suite with a separate butler/formal sitting and dining room, and kitchen with nook and family room. Garden kitchen and sink with fire pits. Luxurious master suite/spa bath plus 4 bedrooms en suite; media and bonus. MLS#12402

$3,898,000

Hedy Joyce, Keri Lin and Allyson Lin originally appeared as Elite agents in the Unique Homes Spring ’18: Elite edition. See their page here.

State capitals are oftentimes thriving cities with a lot of economic and cultural value. In fact, they can be some of the best places to live in America. But not all state capitals are created equal. WalletHub has put together a list of 2018’s Best State Capitals to live in. And though 17 of them are the largest cities in their states, the biggest population doesn’t always represent the best quality of life.

In order to determine which state capitals make the best homes, WalletHub compared all 50 across 51 key indicators of affordability, economic strength, quality of education and health, and overall living standards. Our data set ranges from cost of living to K–12 school-system quality to number of attractions.

Best State Capitals to Live In

- Austin, TX

- Madison, WI

- Boise, ID

- Lincoln, NE

- Bismarck, ND

- Raleigh, NC

- Denver, CO

- Salt Lake City, UT

- Juneau, AK

- Concord, NH

- Columbus, OH

- Helena, MT

- Olympia, WA

- Oklahoma City, OK

- St. Paul, MN

- Cheyenne, WY

- Montpelier, VT

- Pierre, SD

- Des Moines, IA

- Phoenix, AZ

Pictured above: Columbus, OH waterfront; Oklahoma City, OK

Out of these places:

- Juneau, Alaska, has the highest median household income (adjusted for cost of living), $67,310, which is 2.6 times higher than in Hartford, Connecticut, the city with the lowest at $26,264.

- Bismarck, North Dakota, has the lowest unemployment rate, 1.7 percent, which is 4.6 times lower than in Hartford, Connecticut, the city with the highest at 7.8 percent.

- Providence, Rhode Island, has the lowest share of state-, local- and federal-government employees, 8.4 percent, which is 4.6 times lower than in Juneau, Alaska, the city with the highest at 38.4 percent.

- Madison, Wisconsin has the highest share of adults 25 years and older with at least a bachelor’s degree, 56.3 percent, which is 4.7 times higher than in Trenton, New Jersey, the city with the lowest at 11.9 percent.

For the full story, and the entire list of best small cities, visit WalletHub.com.

Phoneix, AZ

Denver, CO

Photo courtesy Maxwell Mackenzie.

In 2017, Unique Homes is traveling the U.S. to find the dominant stories in each region of the country — This issue covers the Northeast and Mid-Atlantic.

By Camilla McLaughlin

To say 2017 is a year of change is an understatement, and real estate is no exception. Prices are up … and down. Condition matters, and design and architecture have almost become a national obsession. In our yearlong series, we are taking a look at all the regions of the country in an attempt to answer the question of the year,

WHAT NOW?

For real estate in major East Coast cities, 2017 culminates a decade of change. In many locations, it is a turning point of sorts with new value equations being forged and entirely new standards for luxury properties emerging. Lifestyle matters more than ever. Whether it’s a desire for arts and culture or an escape from ever-increasing gridlock, a penchant for urban living has become a prime driver for real estate in many markets. What changes also stays the same, as neighborhoods that were hot hundreds of years ago are back in vogue.

Photo courtesy ©getty images.

New York

“We used to say cash is king. I think right now value is king. Everyone from luxury down to the $1 million range wants to feel some value,” says Diane Ramirez, chairman and CEO of Halstead Property, about real estate in the Big Apple.

Few real estate markets received as much scrutiny in 2016 as New York. Reports from the first quarter of 2017 point toward a revival, with prices and transactions for resale apartments increasing by 5 percent year-over-year. Closing prices for new development averaged $4.3 million, 15-percent higher than the first quarter 2016. “Post election, we’re seeing a great deal of interest. In Manhattan, the luxury market is bubbling, very interesting and active. We’re seeing activity, but the higher you go up the more challenging it is. Yet, we recently closed on a $41-million-plus sale,” says Ramirez.

Years of white-hot demand tempered in 2016, and sellers have had to fine tune expectations and adjust to the new market reality. Ramirez explains: “Buyers, whether it’s $30 million or $16 million or $1.5 million, want to see or feel they got some value.” It doesn’t necessarily have to be price. It could be some type of a concession or initiative.

What’s hot here continues to be new. “People love new construction. They just love the newness. It’s no longer just about space,” Ramirez says, listing the benefits new construction delivers — views even from the kitchen, open plans with excellent flow, collaborative spaces and technology. And big windows that make these urban dwellings almost seem like a suburban home.

Fewer permit applications suggest development is slowing. New buildings currently in the pipeline are not on ultra prime streets. While still very upscale, they will come to market at lower price points. “I am happy to see some of the newest development coming in prices that are still in the $6 million range or higher but not starting at $8 million,” says Ramirez.

Highest-priced listing: $110 million penthouse in the Woolworth Tower Residences

Boston

“Boston is becoming a little shinier. The public gardens and esplanade, all the things we love about it, are still here, but you can definitely see change,” says Paul Grover, a partner at Robert Paul Properties. More than the skyline is being altered as recent construction, such as the 60-story Millennium Towers, introduces a new paradigm for premium properties. Unlike the townhouses prized by Boston’s legendary Brahmin, the lifestyle is ultra luxurious with services, architecture and amenities comparable to prime buildings in New York and San Francisco. For example, the Millennium has a private restaurant and bar, under the helm of Michael Mina, solely for residents.

Change is not new to Boston. For almost two decades, the city has been in a constant state of flux as one neighborhood after another is rediscovered. Some of the most compelling real estate stories today are coming out of old towns that ring city center. Newton, Brookline, Chestnut Hill and Weston remain luxury stalwarts, but close-in communities like Watertown, Chelsea and Everett are seeing record prices. Cambridge is white hot. In Somerville, once a haven for first-time buyers, million-dollar prices are not uncommon.

Right now, Boston has one of the hottest real estate markets in the country with the number of single-family homes for sale down 35.2 percent year-over-year in February; condos were down 27.6 percent. Statewide, February marked the 60th time in the last 61 months with a year-over-year inventory decrease.

What’s hot: Close-in locations with access to transportation.

Highest-priced listing: Woodland Manor, a $90 million estate on 14 acres, less than 6 miles from the center of the city in Chestnut Hill.

Top: ©getty images; Bottom: 2 Avery Street, courtesy Robert Paul Properties.

Photo courtesy ©getty images.

Washington, D.C.

“The thing with D.C., it’s always been a solid market with so many people moving in and out,” says Katherine Herndon Martin with McEnearney Associates. Long before the recession, Washington’s real estate star was on the rise, and in recent years it has charted among top markets nationally. In March, homes were selling within two weeks, with the number of units sold up 15 percent vs. a year ago.

The recent focus on ultra properties on Kalorama Road has pushed upscale Washington into the limelight. Until recently, prices above $12 million were rare, but billionaire interest, beginning with Jeff Bezos’ purchase of a $23 million property on S Street, puts new upscale dynamics in play. Similar to Beverly Hills, new estates, rather than new towers, create rising benchmarks for luxury here.

The most expensive property on the market in the District of Columbia is a $22 million estate on Chain Bridge Road on the second-highest point in the

city. (The National Cathedral is the highest.) At first glance, the regency-styled home seems to be one of the city’s historic estates, but it is newly built and constructed with a level of materials and attention to detail comparable to that found in the most expensive areas of the country.

The other facet of the D.C. real estate story is continued redevelopment and gentrification of neighborhoods and parts of the city, a process that began decades ago. Some of the newest hot areas include Brookland near Catholic University as well as neighborhoods around Logan Circle. In many of the suburbs, bigger continues to have great appeal with buyers often adding on to what is already substantial square footage in properties in Potomac, Maryland and McLean, Virginia.

Highest Price in the Region: $24 million for new construction in McLean, Virginia.

Highest Price in the District: $22 million for a newly constructed estate in the Foxhall Neighborhood.

Philadelphia

Eds and meds is how Mark Wade with Berkshire Hathaway HomeServices Fox and Roach Realtors sums up part of the draw to Center City Philadelphia. But, based on the large number of downsizers exchanging suburb for city, arts and culture are easily in the mix. The big news here is new super premium buildings that fetch unheard of prices, especially for condominium residences. “Basically, what we have is that Philadelphia is a town of Toyotas and Mercedes. That’s our high-rise market. What’s coming down the pike are Bentleys. There is a huge disparity between the two. The gap is unbelievable,” Wade says referring to the recent sale of an 8,900-square-foot, two-story penthouse at 500 Walnut for $17.85 million, a record in a city where the previous high priced sale was a $12.5 million penthouse, set in 2010.

Newcomers, particularly those drawn by the universities and medical systems, also opt for a home in the city. “Twenty-five years ago, the trend was the exact opposite. Somebody would move here, say from Atlanta, and they would bypass the city and magically end up in the suburbs. Today, when we get a transferee like that, it’s the exact opposite,” observes Wade. Additionally, the city attracts a large contingent of commuters to Manhattan, who happily trade an hour in the car for a productive hour on the train.

Highest-priced listing: $16.795 million for a

Society Hill condo.

On the radar: New ultra-luxury buildings, such as the Residences at the Ritz Carlton, are setting records over $10 million.

Market Insight: “When our market rises, it does so at a sustainable pace,” says Wade. “When our market falls, it does so gradually — we don’t have the crazy ups and downs of say a Miami, or New York, or D.C. We seem to chug along either up or down. Nothing wrong with that!”

Photo courtesy ©Mefmanoo/Wikimedia Commons.

The Residences at The Ritz-Carlton, Philadelphia. Photo courtesy Ritz-Carlton.

Baltimore

Photo courtesy ©getty images.

Charm City is more than just a catchy moniker. “Baltimore is a hotbed,” and when you are here you discover that it literally is Charm City, observes Charlie Hatter, owner of Prime Building Advantage and Monument Sotheby’s International Realty in Baltimore. “Luxury real estate is doing very, very well,” he says, citing a recent $6 million sale. “Anything above $2 million is considered ultra luxury for this market.” High-end suburbs including Roland Park and Towson and properties in the horse country see strong demand.

The ambiance of the city and prices bring a number of new residents who have children in New York or Washington, D.C., which are both an easy train ride away. Revitalized areas in the city and inner harbor area are in demand. Like many places, sales were slow or even stagnant in summer and fall. On the other hand, Charlie Hatter describes the spring market as “huge” with lots of activity around the inner harbor, as well as areas that have been revitalized. “People love the charm and the uniqueness of the older properties,” he says.

Highest-priced listing: $12.5 million for a Four Seasons penthouse with skyline and water views.

This story originally appeared in Unique Homes Ultimate ’17. Click here to see the digital version.