Hedy Joyce

Keri Lynn

Allyson Lin

Coldwell Banker Bain Global Luxury

H: 206.406.7275 | K: 425.395.6780 | A: 425.305.8028

hedyjoyce@cbbain.com | kerilin@cbbain.com | allysonlin@cbbain.com

Featured Listing by Hedy Joyce, Keri Lin and Allyson Lin

BELLEVUE, WASHINGTON

10415 NE 15th Street

Stunning luxury residence — nothing compromised — offers the finest craftsman wood and detailing with nuances of transitional/contemporary features; a superb blend of aesthetics for a particular buyer looking for quality construction. The home features excellent flow pattern throughout the main floor, a large office, guest en suite with a separate butler/formal sitting and dining room, and kitchen with nook and family room. Garden kitchen and sink with fire pits. Luxurious master suite/spa bath plus 4 bedrooms en suite; media and bonus. MLS#12402

$3,898,000

Hedy Joyce, Keri Lin and Allyson Lin originally appeared as Elite agents in the Unique Homes Spring ’18: Elite edition. See their page here.

MaunaKeaLiving.com and Hapuna Realty announce new oceanfront condominiums on the Big Island.

By Brielle Bryan

Set within the iconic Mauna Kea Resort on the lush western coast of Hawaii — the legendary destination where modern island luxury was born — a new collection of exceptional residences is reinventing the beloved resort for the next generation. Just mere steps from two of Hawaii’s most celebrated beaches, with sweeping views from the snow-capped Mauna Kea volcano all the way to Maui, the Hapuna Beach Residences present a rare and limited opportunity to own one of the last and most coveted beachfront properties in all of Hawaii.

The Residences promise an exhilarating beachfront lifestyle that embraces the warm and welcoming spirit of aloha. Limited to just 62 owners in total, the spacious and sophisticated residences offer unobstructed views from each of the four distinctive floor plans, ranging from one to four bedrooms and up to 3,400 square feet. The initial release offers 17 of the most exceptional properties in the collection along with exclusive benefits for debut release buyers.

“Early buyers are afforded the benefit of locking in one of the most favored properties at the debut rate, as well as the added luxury of customizing select finishes, and first choice selection of an original work from Hawaiian painter Jaline Pol, our artist in residence,” said Tomo Matsumoto, owner of Hapuna Realty, the dedicated brokerage exclusively representing the property.

Guided by two of Hawaii’s most respected firms — de Reus Architects and Philpotts Interiors — the Residences reinterpret island luxury for the modern age. Elegantly understated interiors and open living areas with floor-to-ceiling windows flow into well-appointed chef’s kitchens with Sub-Zero and Wolf appliances — all connected by expansive oceanfront glass terraces that maximize the indoor and outdoor lifestyle of living just steps from the beach. The contemporary décor is strong and subtle, with warm wood accents and a neutral color palette that allow the serene lushness of the land to shine.

“Hapuna Beach Residences promise to be an incomparable living environment — private, quietly exclusive and in all ways visually and spiritually invigorating.” Matsumoto said. “It’s the perfect setting for entertaining or spending time with family against the backdrop of a magnificent Hawaiian sunset.”

The Residences are the latest offering to come to market from MaunaKeaLiving.com’s collection of new contemporary living options within the resort, and have a starting price of $1,500,000. Along with the one-of-a-kind Hapuna Beach Villa — a spectacular four bedroom, 10,600 square foot private oceanfront estate — and Hapuna Estates homesites, the Residences are part of a multi-million-dollar transformation bringing fresh excitement to the Mauna Kea. At the centerpiece of the expansive refresh is the new Westin Hapuna Beach Resort; a dramatic $46 million renovation which debuted in March, with transformed common spaces, refreshed dining experiences, beautifully re-imagined guest rooms and an invigorating new wellness and workout center. Owners can easily access the hotel’s amenities, as well as those at the neighboring Mauna Kea Beach Hotel.

Owners have the opportunity to join The Club at Mauna Kea, considered the most active and vibrant club on the island. Members enjoy preferred tee times at two world-class courses, and there is a lively social scene at the Seaside Tennis Club, named one of the world’s top five tennis experiences. Three fitness centers, inspiring dining options and a revitalizing spa rejuvenate and refuel the mind, body and soul. Owners also have exclusive access to the new Amaui Club at Mauna Kea Resort, with fitness activities, massages, men’s and women’s locker rooms with steam showers, a pool, water slide and barbecue area.

Photos courtesy of Hapuna Beach Residences

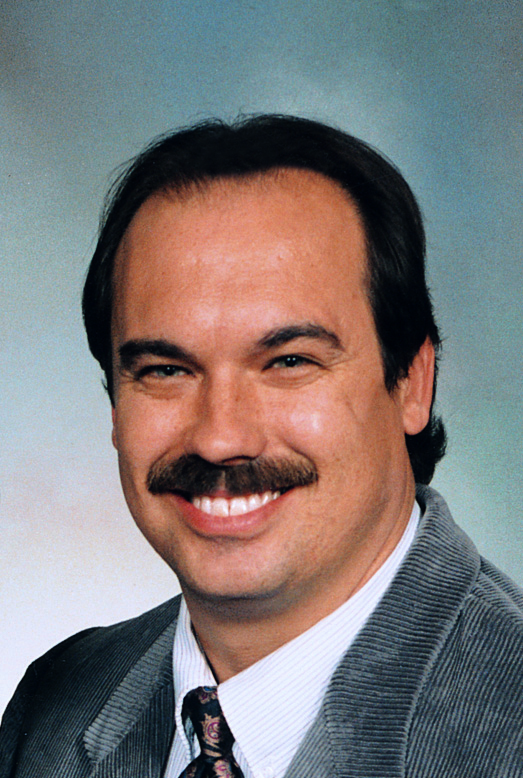

Terry Potts

Country Club Properties

183 West Main Street | Highlands, NC 28741

828.526.2520 | Fax: 828.526.2470 | ccp4terry@gmail.com | www.ccphighlandsnc.com

Country Club Properties is a fully independent real estate brokerage firm serving the country club market in the Highlands-Cashiers area. Completely independent from any developers, speculators or sales programs, Country Club Properties offers an untethered relationship. Area country clubs include Highlands, Wildcat Cliffs, Old Edwards Club, Mountaintop Club, Trillium Links Club, Cullasaja Club and Highlands Falls. Whether your interest is buying or selling real estate in the Highlands area, give Country Club Properties a call!

Featured Listing by Terry Potts

HIGHLANDS, NORTH CAROLINA

The best long-range view in Highlands

Overlooking parts of NC, SC and GA, this property has views and so much more. Winding along a private road, you will be surrounded by nearly a mile of native forests before reaching the entrance drive of this estate of over 6 acres. MLS #86778

$2,900,000

Terry Potts originally appeared as an Elite agent in the Unique Homes Spring ’18: Elite edition. See his page here.

Eugenia Foxworth

Foxworth Realty

15424 Amsterdam Ave., Suite #2, New York, NY 10031

212.368.4902 | eugenia@foxworthrealtyonline.com | www.foxworthrealtyonline.com

Eugenia Foxworth is a unique real estate Broker “without borders” specializing in exceptional Properties in New York City, Riverdale, NY and Internationally. She has acquired a reputation with both buyers and sellers as someone who can make a deal happen through her tenacity, knowledge of the market, professionalism and personality. She has established a reputation for “being out of the box” while getting the job done, therefore this economy does not phase her. Ms. Foxworth is the President/Owner of Foxworth Realty. She is a New York State licensed Broker, CIPS (Certified International Property Specialist), a member of REBNY (Real Estate Board of New York), NYRS (New York Residential Specialist), NAR (National Association of Realtors), MANAR (Manhattan Association of Realtors), NYSAR (NY State Association of Realtors), MWBE (Minority & Women-Owned Business Enterprise) and is on the Executive Board of Directors for FIABCI-USA (the International Federation of Real Estate) that is an NGO (non-governmental organization) with the United Nations and is in 65 countries.

Featured Listing by Eugenia Foxworth

RIVERDALE, NEW YORK

The Whitehall

The Whitehall has long been recognized by real estate influencers as the premier residence in Riverdale. The latest addition to this unique property is this 30,000-square-foot green roof. The largest development of its kind that boasts walking paths, picnic areas, tree-shaded and open-sun seating areas, a hot pit, children’s playground and the finest glass-domed indoor pool in the area. Designed by Genie Masucci, principal of G. Masucci Architects in consultation with Site Works, one of the landscape consultants to Manhattan’s renowned High Line.

Price upon request.

Eugenia Foxworth originally appeared as an Elite agent in the Unique Homes Spring ’18: Elite edition. See her page here.

Inventories, consumer confidence, growing worldwide wealth, the stock market, tax changes and local dynamics are affecting how hot each luxury real estate market is throughout the U.S.

By Camilla McLaughlin

“Fasten your seatbelt, 2018 will be a fun and scary, but prosperous ride,” is how Brad Inman, founder of Inman News, assesses the outlook for real estate this year. On the other hand, developers and planners tapped by the Urban Land Institute (ULI) call for “a long glide path to a soft landing” for the economy and the real estate sector. They expect the current cycle to extend into 2018 and even beyond.

These comments perfectly illustrate the divergent opinions on the outlook for real estate this year, especially luxury real estate.

For real estate overall, it’s not an overstatement to say 2017 was a very good year. The National Association of Realtors (NAR) expects sales of existing homes in 2017 to tally at 5.81 million transactions, the best number since 2006, and 3.8 percent higher than 2016. Home prices grew by almost 6 percent, a pace NAR expects to be duplicated in 2018. Looking ahead, the forecast calls for an increase of 3.7 percent in the number of sales as more new construction amps up the number of homes on the market. December sales soared 5.6 percent, with most activity at the upper end of the market fueled by move-up buyers with considerable down payments, cash buyers and easing of inventory shortages.

For luxury real estate, the narrative, while positive, revolves around locations and price brackets, depicting a market beginning to settle into a sustainable pace after a protracted recovery. “Bottom line, we’re going to have a strong year,” says Philip White, president and CEO of Sotheby’s International Realty Affiliates. “The one difference this year is the up-wind market is having a better 17 versus 16. We are going to have more transactions and a higher average sales price this year than last year.”

In cities such as Seattle, San Francisco or Denver, demand for upscale properties outpaces supply. “Chicago now has 60 cranes in the air which has only happened twice in my 25 years here,” says Craig Hogan, vice president of luxury at Coldwell Banker Real Estate.

New York City is often portrayed as being in the doldrums. Although there has been a slow down in the ultra high end, other price points and neighborhoods all over the city are far from flat. Most active, according to Ellie Johnson, president at Berkshire Hathaway HomeServices New York Properties, is the $1 million to $5 million range, where multiple offers are not uncommon. From Dec. 11 through the 17, 18 properties went under contract above $4 million, which she says is a much larger number than the same period a year ago. When New Yorkers confront change, they often put buying plans on hold. Johnson says the upper price brackets are in a “strong hold pattern” right now, but she expects it to be short lived. Also, Wall Street bonuses should translate into “a very nice first quarter.”

“I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm.”

— Bob Hurwitz, founder and CEO of

The Hurwitz James Company

image courtesy istockphoto.com / Meinzahn

Traditional luxury markets in New York, California and Florida are still strong, but brokers also see big plays in smaller markets. Lesli Akers, president of Keller Williams Luxury Homes International, illustrates with a recent $22 million transaction in Austin, “the biggest sale in the history of that market.” ULI forecasts a shift in interest and investment dollars to smaller metros such as Seattle, Austin and even Salt Lake City as well as close-in suburbs of New York and Washington, D.C. In New York, Diane Ramirez, chairman and CEO of Halstead, says new buildings, both residential and rental, with views of the Hudson River, extensive amenities and a short commute to the city are generating interest from younger consumers in White Plains, New Rochelle and Tarrytown.

“Luxury is starting to move into every market. As neighborhoods change, the buyers change,” says Diane Hartley, president of the Institute for Luxury Home Marketing, noting it’s important for agents to understand this new buyer, new price points and new expectations.

For agents, “it’s no longer enough just to be a local expert, they have to have global knowledge as well. Most of the affluent are looking to see what is happening in the global market. But it’s also who agents are bringing to look at the home,” says Anne Miller, director of business alliances for RE/MAX.

At LuxuryRealEstate.com’s fall conference, comments about local markets were all positive, something Publisher John Brian Losh says usually doesn’t happen. “Prices are directly related to the economy and consumer confidence, and right now consumer confidence is high,” he says.

More than consumer confidence is bolstering luxury sales. Adding to demand are the growth of wealth in the U.S. and worldwide, a surge in the stock market, and a rise in foreign buying of U.S. properties. There are few, if any, indications this will change in the immediate future. Paul Boomsma, president of Luxury Portfolio International, explains: “Our white paper and our global survey show a lot of interest from buyers, not only for this year but over the next two years. There is more interest on the buy side than the sell side, and that is consistent among the high end, and it extends to 17 different countries. There is a lot of interest and not just in U.S. properties.”

Purchases of U.S. properties from foreign buyers surged from $102 billion to $153 billion in the year ending March 2017, accounting for 10 percent of dollar volume of sales. “Foreign buyers generally see the U.S. as a safe haven for investment,” says Bob Hurwitz, founder and CEO of The Hurwitz James Company, whose current clients include mega affluent buyers from Turkey, Singapore, China and Ukraine looking buy in price ranges of $20 million and up. “In a couple of cases this includes multiple properties, including commercial and development not exclusive to California,” he adds.

While most markets sizzle, the high end in some locations and price brackets is back to a slow simmer. “I already see a softening in the luxury home market with a growing inventory and properties on the very high end sitting on the market. An excess of new construction, with major homes that have been enthusiastically designed and under construction when the market was hotter, are now coming on to the scene in a different paradigm,” says Hurwitz. “Prices have already adjusted, and as developers and luxury home builders start having homes sit on the market, there will be opportunities to make good buys.”

“In the ultra high end, I think prices are being adjusted to the economy,” says Losh, noting a common issue with ultra properties. Often sellers price the home at the highest price they ever imaged. After a couple of years, they get realistic. “What really determines value is what it cost to replace a property,” he says.

The ultra high end may be cooling, but, Hogan says, the luxury market is healthy. “The $1-to-3 million, $3-to-5 million and $5-to-9.9 million sectors are strong. Not in every city but as a whole, based on our year-to-date numbers. I honestly feel that we are simply normalizing.”

“We are seeing some moderating trends in the luxury space,” says Akers. Downward price adjustments and longer days on market are signs that luxury is moving toward a more balanced market. Still, she adds, “Truly unique properties still command top dollar and cash offers.”

It would seem that the performance of the stock market might discourage real estate investment. Instead, Marci Rossell, chief economist for Leading Real Estate Companies of the World, says it has an opposite effect. “For the luxury buyer, real estate is part of a larger portfolio and portfolios have swelled in terms of stock market value over the last two years. So, from the perspective of balancing a portfolio, real estate can look attractive.” The most influential trend for 2018, particularly the high end, is new consumer attitudes. “Across all price points, the word value is critical today,” says Ramirez. “Value to a $1 million buyer and a $600,000 buyer is not the same, but both want the perception of value.”

Consumers have become even more demanding. “There is a desire for perfection. They want a property or an experience to be exactly what they want it to be. There is no desire for compromise,” says Hartley.

Price matters, but it’s not the only factor in the value equation. “If it’s been on the market awhile, bringing down the price is not going to do it. You have to see what’s selling,” says Ramirez, using the example of a $7 million property in Darien that sold in a single day. It was well priced and located across from the water. Water views continue to be in highest demand.

People want new. “If it’s an older home, it must be newly renovated,” says Ramirez. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

The bottom line for sellers, according to Miller, is to listen to their agent. “We’re hoping that everybody takes a reality check on location, quality — is it unique and rare, does it have all the luxury amenities? — before they list their home.”

People want new.

“If it’s an older home, it must be newly renovated,” says Diane Ramirez, chairman and CEO of Halstead. “People feel they don’t have the time for a renovation and they are unsure of the cost.”

Image courtesy istockphoto.com / TobiasBischof

Also, says Kevin Thompson, chief marketing officer at Sotheby’s International, “There is a search for the unique.” This new consumer isn’t interested in cookie-cutter anything. “They want something personal and outside the norm, and they are willing to pay for that.”

Looking ahead, Hogan sees new construction, contemporary/modern, a smaller footprint and full connectivity shaping future demand.

“We’re seeing more and more of what I call the ‘Tesla consumer with the Apple watch’ — a client who’s passionate about their lifestyle and their environmental foot print. They want to do what’s right for the earth, and they don’t mind people knowing it’s expensive,” shares Akers.

Recent ultra-high-end sales in Greenwich and Manhattan are evidence that buyers are out, according to appraiser Jonathan Miller, who noted in a recent blog: “Buyers remain in the market, but the price needs to reflect 2017.”

Akers says sellers should prepare to sell at fair market value. “We’re not in a ‘dip your toe in the market and test it out’ kind of market.”

The number of homes available for sale continues to be the fulcrum on which markets balance. Regarding real estate overall, Lawrence Yun, NAR’s chief economist says: “Home prices, after multiple years of fast growth, still show no signs of cooling because of the ongoing housing shortage in much of the country. The latest Case-Shiller price growth of 6.2 percent on a nationwide basis marks the strongest rise in over three years.”

High-priced markets are not immune to inventory challenges, but it’s not in every location. Instead, it is likely to be places that have had strong buying for years and strong population growth. White uses the example of San Francisco, where anything that is priced right is snapped up. Inventory constraints, according to White, are not unique to the U.S. “In Hong Kong and Japan, there are stories where people are lined up to buy high-priced units in new buildings, even to the point where they will sell their place in line.”

This year, for the first time since the downturn, inventories eased ever so slightly, and forecasts point to more new construction in the next few years. Javier Vivas, director of economic research for Realtor.com, sees 2018 as “a significant inflection point in the housing shortage, with increases in inventory felt initially in the mid- to higher-price points above $350,000.” Vivas says Boston, Detroit, Kansas City, Nashville and Philadelphia are predicted to see inventory recovery first.

As inventories grow, sellers need to understand that homes that are dated or not priced accurately will fall to the bottom of prospective buyers’ list of target properties.

At year-end, tax changes and continued political uncertainty loomed over every forecast. “For buyers worldwide, I think policy changes will matter more than economic climate. This is a year when tax policy could drive some location decisions. If you are a first-time buyer in a high-tax area and you are looking to put down roots, you will think long and hard about the tax consequences of a location. Even on the European front, we know Brexit will affect location decisions. Already we are seeing relocations out of London to Frankfurt,” shares Rossell. “The homebuying decision is part of a large mosaic, and the tax implication of that decision used to be a smaller tile, and it will become a larger tile.

Looking ahead: “The economy and housing market will grow like crazy. Job creation is at record levels; unemployment is at a 17-year low, wages are feeling upward pressure and companies are investing at a fast and furious pace,” commented Inman. “A backdrop of political uncertainty will not slow down the global economic thoroughbred that is galloping at a full run. Left in the dust will be housing affordability in many major metros.”

THIS STORY WAS FEATURED IN OUR WINTER 2018 ISSUE.

CLICK HERE FOR THE FULL DIGITAL VERSION.

Just 10 minutes from the main island of Bora Bora, the private island of Motu Tane encompasses approximately 10 acres of sandy beach, tropical foliage and coconut groves all set against a mountainous backdrop.

Owned by cosmetics mogul François Nars, Motu Tane consists of traditional thatched-roof Polynesian huts or “fares”, with 22 separate structures, including 2 luxurious suites comprised of 2,500 square feet, each with a sunken lava bathtub, shower and dressing area, as well as panoramic views onto the garden, the beach and the main island.

The island features nine beach bungalows and two suites to accommodate up to 20 guests, a library with museum-quality Polynesian art and artifacts, a photography studio, a chef’s dream kitchen with commercial-quality stainless steel equipment, and two staff quarters. The great room, encompassing about 2,500 square feet, is perfect for casual gatherings or formal entertaining with an adjacent dining area offering a hidden wet bar and two extra large custom-made tables for up to 36 people, all surrounded by the garden.

Designed by Christian Liaigre, the rooms feature custom-crafted furniture made from rare tropical wood and natural fabrics, and most bungalows have motorized screens which can bring the outside in and can offer shelter in case of excessive winds or tropical rains. The island is dotted with 1,500 coconut palms and other native flora, creating a garden-like retreat.

Motu Tane is offered at $42,000,000 by Bob Hurwitz of The Hurwitz James Company.