FOR YEARS, NEW TECH COMPANIES HAVE BEEN THOUGHT OF AS THE ‘DISRUPTERS’ IN THE REAL ESTATE INDUSTRY. BUT SAVVY REALTORS ARE POSITIONING THEMSELVES AS THE AGENTS OF CHANGE.

The current market shift from buyers to sellers generates the most attention, but the number of sales and pace of price appreciation are only one swell in the wave of transformation rolling through the real estate industry. Technology is typically hailed as the disrupter, but changing demographics, new lifestyle aspirations and evolving buyer preferences are all at play in today’s real estate landscape.

“If you ask anyone that has been in the business more than 10 years, they say ‘here we go again.’ More paperwork, more platforms, more new companies, more new agents. Yet, ultimately real estate is the same. Our clients require handholding, advice, and moral support, deals get negotiated, and transactions finalize or fall apart. Yes, there are slight shifts in the marketplace, but generally, it still functions the same,” shares Lucio Bernal, a broker associate with Coldwell Banker Residential Brokerage in Palm Springs, who is also an expert trainer with the Institute for Luxury Home Marketing.

What is changing is almost every other aspect of real estate from tools to facilitate broker client relationships to virtual reality apps enabling buyers to envision making a prospective property their own. Increasingly agents are looking to their brokerages to keep pace with technology. “They are leaning on their brokerages, more than ever, to help arm them with tools, from digital marketing to smart, proactive customer relationship management systems (CRMs) that will keep them cutting edge, as well as those they can’t afford to leverage on their own,” says Stephanie Anton, president of Luxury Portfolio International. Additionally, affiliate groups like Luxury Portfolio and major brands have amped up marketing capabilities so agents can easily create a cohesive campaign.

There might be a technology revolution taking place in real estate, but market shifts are reinforcing the importance of the agent. “Technology has always been the present. It’s how you use it that benefits you the most,” shares Bernal. “The perfect example is: If you are dealing with a consumer, they are more likely to use you based on reputation and recognition than whether you know a certain app or technology platform. Technology should be used as a resource and compliment your ability to get face-to-face and maintain contact with a consumer.”

At this time last year, blockchain and the impact of virtual reality and artificial intelligence on real estate were being debated. Today, the chatter is about portals morphing from search engines to places to buy and sell homes, a new classification the industry characterizes as iBuyers. Opendoor, founded in 2013, started the trend, followed by others including Offerpad and Knock. Zillow and Redfin have also introduced iBuying in some markets. iBuyers purchase consumer’s homes outright using analytics that enable them to come up with a price based on the home’s perceived value, usually within days. Unlike homes sought by flippers, these are not troubled properties and offers reportedly are close to the value estimation. Other portals are beefing up offerings for consumers, adding mortgage and title services. Startups such as Purple Bricks offer a new twist on the flat-fee concept.

Investor dollars from venture capital and hedge funds are flowing into real estate, fueling many new ventures, which is another change potentially revamping the industry. “Everyone is investing in technology to disrupt or change real estate,” says Mark Choey, co-founder of Climb Real Estate, a San Francisco brokerage, which was acquired by Realogy’s subsidiary NRT in 2016. The real estate industry is rapidly shifting, and innovation is not just welcome, it’s desperately needed,” said founder Chris Lim, whose background is in marketing. Choey hails from the tech sector. Climb was the first brokerage to work with Matterport and continues to incubate emerging apps and work with new vendors.

ENABLING THE AGENT

Among traditional brokers, Keller Williams and RE/MAX are often noted for new tech initiatives, but almost every brand and national affiliate group is boosting technology offerings and platforms, often through relationships with providers and new tech venders including virtual staging, enhanced CRM and 3D tours and imaging. Technology ultimately benefits consumers, but traditional brands and affiliates say their focus is enabling their agents to do a better job.

“Everything has shifted in many different areas from the brokerage level, the buyer level, who the buyers are, what they are looking for,” says Sally Forster Jones, executive director, Luxury Estates, Compass. “I think there is a shift in the way that brokers are functioning. They are more innovative with more technology and more marketing as opposed to the older traditional real estate firms.

“Consumers care about responsiveness. They care about the fact that if they reach out to an agent, whether it be on their website or mobile app the agents gets back to them instantly, and technology can help with that,” says Marilyn Wilson, founding partner of real estate consultants WAV Group and also a founder of RETechnology.com.

“Technology has always been the present. It’s how you use it that benefits you the most. The perfect example is: If you are dealing with a consumer, they are more likely to use you based on reputation and recognition than whether you know a certain app or technology platform. Technology should be used as a resource and compliment your ability to get face-to-face and maintain contact with a consumer.”

Tapped by Google to create a virtual staging app using augmented reality, Sotheby’s added Curate to agent toolboxes last year. Not only can a homeowner visualize a home before buying, but a partnership with a home furnishings company allows potential buyers to virtually furnish the home as well.

“A depth of understanding of what a property has is really important to consumers. The other thing that consumers are responding to online are floorplans,” says Wilson.

GETTING REAL WITH VIRTUAL

In the last year, GeoVC, a tech start-up offering 3D immersive tours and floorplans that can be created using next generation smartphones, integrated virtual staging, exterior 3D scans, and aerial 360-degree panoramas captured with a drone with interior 3D tours. “Outdoor imagery is captured using a regular drone, automatically processed into a 3D model, and integrated together with interior virtual tour. Such an exclusive experience will differentiate luxury properties with beautiful facades and roofs, and spacious lots,” shares Anton Yakubenko, co-founder and CEO of GeoCV.

“Luxury has really turned into personalization now,” comments Thompson. Tools like Curate, RoOomy and virtual staging apps enhance opportunities for personalization. Thompson explains: “Someone can walk into a home and say, ‘not my style,’ but it doesn’t matter because I have the tools that allow me to make it feel like what I want it to be.”

Even Compass, which touts itself as “The first modern real estate platform, paring the

industry’s top talent with technology,” says technology is there to benefit the agent. “Compass is building for the agent. Every program, tool, and service is (created) with the agent in mind. Many of the other real estate technology companies out there are working to improve the consumer experience and not focusing on the agent. We believe that by empowering the agent, consumer experience will be improved,” says Sarah Vallarino, head of West Region Communications at Compass.

“Talking to agents, the message we consistently heard was ‘give us technology,’” says Thompson. “They didn’t necessarily know what that technology was just that they needed it. They understood that the industry was changing, and consumer behavior was changing. They know because they’re the boots on the ground and so they can feel the shift in consumer behavior.”

As markets shift, agents are retooling, once again looking at how they do business and what skills and knowledge will be required. “It’s always either somewhat of a buyer’s market. It’s somewhat of a seller’s market. You just have to have your tools in your tool shed and the mindset to be nimble enough to adjust as you read the tealeaves, ” is Wilson’s suggestion.

“Luxury has really turned into personalization now,” comments Thompson. Tools like Curate, Ro0my and virtual staging apps enhance opportunities for personalization. Thompson explains: “Someone can walk into a home and say ‘not my style,’ but it doesn’t matter to me because I have the tools that allow me to make it feel like what I want it to be.”

AGENT PIVOTS

“Many long-time successful agents are being the clever, resourceful entrepreneurs that they are and changing with the market as the market shifts,” says Anton. “Agents today talk about how much of their time and value derives from being an educator for their clients. They partner with their clients to keep them armed with as much information, insights and insider activity as they can, so when it comes time, for example, for an agent to recommend a price reduction, the client is completely aware of the statistics, days on market, what is moving and what isn’t. Nobody wants to have an overpriced home that is sitting and not selling even in a hot market.”

“Today, clients will attempt to collect their information on their own, perhaps from incorrect sources, so agents report pivoting, now more than ever, to spend a lot of their time educating their clients,” she says.

Regarding slowing sales or price appreciation, Anton says: “I highly recommend agents tell the truth, focus on educating their following/clients, and in the process, let their own voice be heard and be themselves. If the market is cooling, share the stats and manage expectations. It’s not the time to be overly positive and cheery as you will come off inauthentic and salesy. Focus on the facts, insights and provide professional guidance.”

“Agents have to stay on top of what is available to them and the consumer. It is imperative to be able to explain the data, to have polished negotiation skills, and to know when to assist the consumer in processing that information,” says Bernal.

“Agents should take full advantage of all the resources that the brands they work with provide. The majority of agents won’t, and that has never changed. Those that want an edge in the industry recognize that there is value in resources and take advantage of some of them. For most agents, resources are overwhelming, and therefore don’t take the time to learn and use them,” says Bernal.

Thompson recalls, “We had to dig in and find out what exactly is it that they (agents) need that will make a difference for them in their day-to-day because they think, you know, there are lots of real estate brands that tout themselves as technology companies, but they really don’t have anything really different.”

“Everything has shifted in many different areas from the brokerage level, the buyer level, who the buyers are, what they are looking for. I think there is a shift in the way that brokers are functioning. They are more innovative with more technology and more marketing as opposed to the older traditional real estate firms.”

EYE ON THE FUTURE

Mark Choey from Climb says, “I think you’re going to see a lot of change in the next year or two,” most likely from many directions. Choey is head of Climb’s Innovation Lab. Having an innovation lab, particularly for a small company, is in itself an innovation. “You’re going to have some business models that are going to evolve, like Opendoor and Knock, that are really going to change the way people buy and sell homes, but it’s not gonna change everything, right. You’re going to have Redfin, Zillow and others come out with tools and things that are going to attempt to either reduce the commission or to simplify to transaction. On the other hand,” he says, “you’re going to see traditional real estate firms arming themselves with technology.”

And while some tout themselves as technology companies, Thompson doesn’t see traditional and technology as being mutually exclusive terms. “You don’t have to be one or the other. People think of Sotheby’s as a heritage brand because we’re been around for close to 300 years now. But a heritage brand can also be tech savvy. It doesn’t have to be one or the other.”

Looking ahead, Bernal says, “The real estate industry has to take both a broad look and a hyper-local look at where the marketplace is based on data and individual perspectives. We say that real estate is local, yet there are many determining factors that create a web of interconnected behaviors throughout the world of real estate.”

Consider Los Angeles, Manhattan and Miami, where the impact of fewer international buyers extends beyond sales and prices. Post-recession, international buyers became a market force determining what was being developed, locations and price points. On the West Coast, view properties and contemporary architecture were particularly favored by Asian buyers, and new builds were often geared to these buyers. Now many L.A. buyers, particularly in higher price points, are local or hail from the U.S. and have different expectations of luxury with walkable locations and neighborhoods taking precedence over views. “That’s a shift and it will continue to be a shift because we have a lot of properties coming on the market geared toward that international buyer,” says Jones.

The desire for the ability to walk to shops and restaurants is happening across all price points, according to Jones, and these new preferences are not limited to L.A. Walkability has been associated with urban settings, but increasingly this characteristic is being applied to suburbs, towns and master-planned communities.

Traffic and gridlock also add to new preferences for locations. In the not too distant future, traffic itself may be seen as even more of a disruptor than it is now, changing where people live and property types.

Photo of Lucio Bernal by Cherie Johnson for Moncherie Fotography. Photo of Sally Forster Jones by Lauren Hurt. Photo of Kevin Thompson courtesy of Sotheby’s International Realty.

The latest market reports from Lucas Fox International Properties portray a positive outlook for the luxury Spanish property residential market during 2017 and beyond, identifying three new trends.

The three main trends were discovered from the company’s 2016 data and are as follows: foreign buyers are continuing to drive sales; new home transactions are significantly up on 2015 but a lack of stock is pushing up prices and the Brexit vote and the election of Donald Trump are starting to affect British and American buying habits.

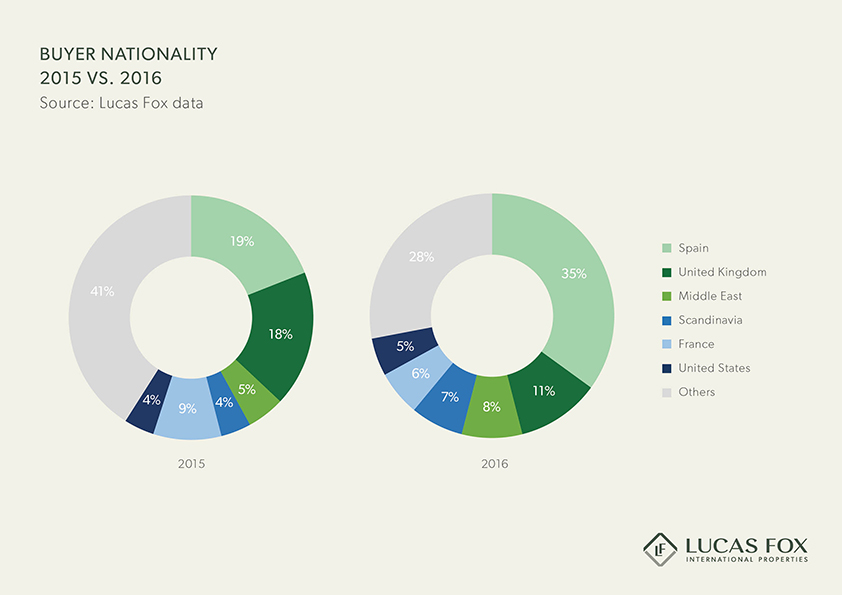

Property sales up

Lucas Fox registered a 31% rise in the number of property sales transactions in 2016 compared to 2015, the biggest increase since the company was founded in 2005. Sales transactions in Barcelona increased by 69%, driven in part by an increasingly diversified global market – foreign investors represented 65% of all Lucas Fox sales. Despite the Brexit vote, the British continue to made up the biggest proportion of foreign buyers (11% but down from last year’s 18%), followed by buyers from the Middle East (8% compared to 5% in 2015), Scandinavia (7% compared to 4% in 2015), France (6% compared to 9% in 2015) and the US (5% compared to 4.5% in 2015). Asian and South American buyers are also on the increase.

“We’re seeing growing national and international demand for homes in leading cities and desirable second-home destinations showing that Spain’s economic recovery is on course despite last year’s political paralysis” explains Lucas Fox co-founder Alexander Vaughan. In total, 35% of Lucas Fox sales in 2016 were to national buyers up from 19% in 2015.

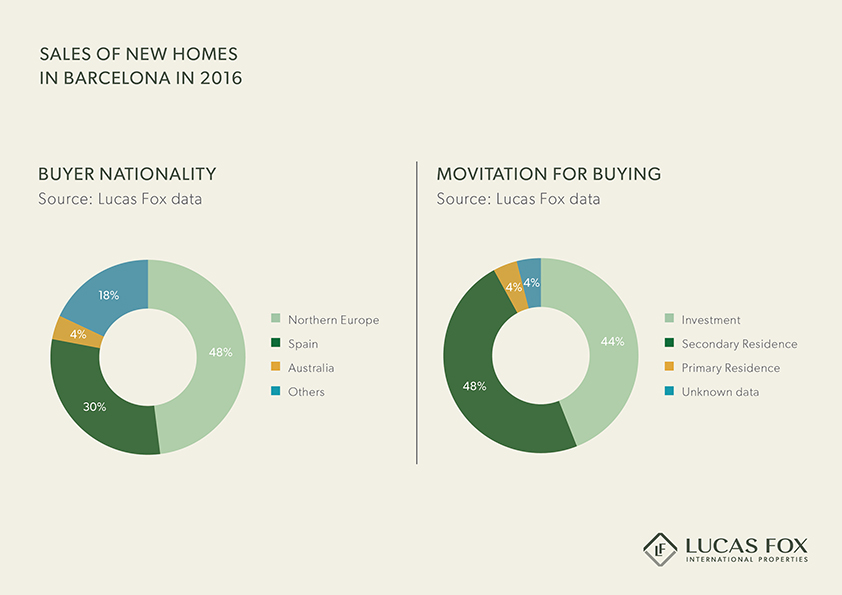

New homes top the list for foreign buyers

New and newly renovated homes accounted for over 100 million euros of Lucas Fox sales in 2016 and just under half of all Lucas Fox Barcelona sales. Three-quarters of these turnkey properties were bought by foreigners, 46% of whom were buying for investment reasons. Lucas Fox data shows that the average selling price of a new home in Barcelona during 2016 was 6,200€/m2 (€720,000), significantly above the Barcelona average.

“New homes are in high demand particularly in prime districts of Barcelona and Madrid but a lack of stock is currently pushing prices up in these areas” explains Lucas Fox Head of New Developments Joanna Papis. “The outlook for 2017 looks promising. Our current portfolio consists of more than 350 homes with a value of approximately 250 million euros and we are expecting to take on a further 1000 new homes with an approximate value of 550 million euros in the next 12 months.”

Brexit and the ‘Trump effect’

Both the UK’s Brexit vote and the election of Donald Trump have begun to shape both American and British buying habits. Lucas Fox data shows that both the number of visits to the Lucas Fox website and the number of enquiries from Americans during 2016 have increased compared to 2015. Almost 70,000 visitors to the Lucas Fox websites (8% of the total interest) came from the US during 2016, up from 5% in 2015, with the most sought-after locations being Madrid and Barcelona.

Meanwhile the reverse is true of the British (10% of website visitors in 2016 down from 12% in 2015). Enquiries from the UK for homes in all desirable second-home destinations have decreased following the Brexit vote, most notably on the Costa del Sol, traditionally popular among British buyers. Lucas Fox data shows that Barcelona and Ibiza were the most searched for destinations among UK buyers during 2016.

“Since the referendum, UK buyers have dropped off due to the weakening of the Pound,” explains Lucas Fox Marbella Partner Stephen Lahiri. “There is still movement at the lower end of the market and towards the latter half of the year there has been an increase in the numbers of sellers of re-sale properties discounting prices, particularly British sellers who can now afford to reduce the price without affecting what they will make in Sterling.”

Latest sales figures for last year from the National Institute of Statistics (INE) show the Spanish property market expanded 14% in 2016, the biggest increase since the run up to the last boom. Sales were particularly strong in Barcelona (24%) and the Balearics (31%) but rose just 5% in Malaga, most likely due to the Brexit vote. Another notable trend during 2016 was that investors who have traditionally bought in key property investment hotspots such as London or New York are now looking at Spanish cities as a viable option.

“We’re optimistic that the Spanish Property market will continue to improve through 2017 and for the coming years,” concludes Mr Vaughan.