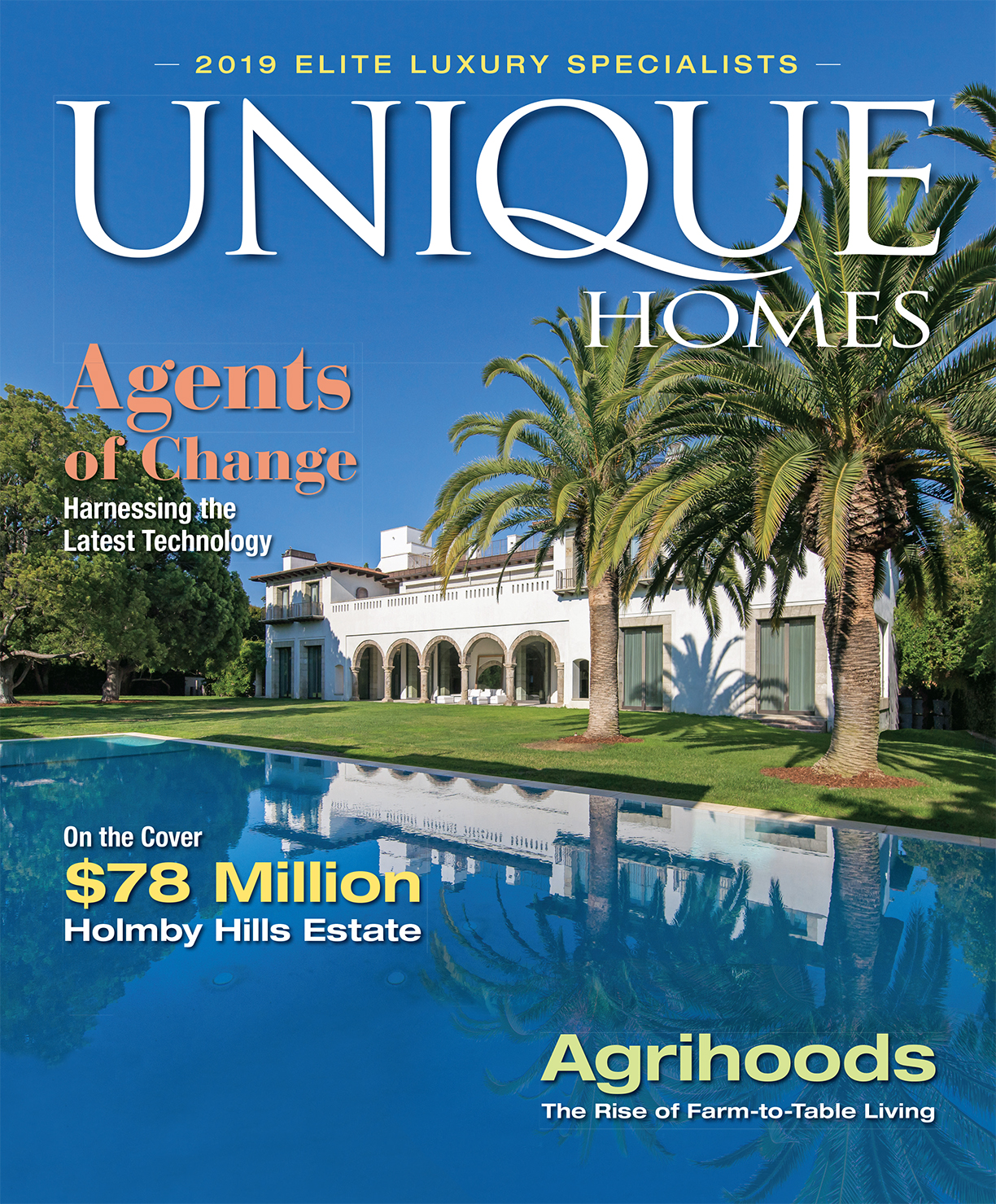

OUR EXCLUSIVE GUIDE TO THE MOST EXPENSIVE HOMES FOR SALE IN AMERICA

This is the 15th year the editors of Unique Homes have published Ultimate Homes. Our comprehensive list of every property for sale in the U.S. for at least $25 million starts on page 52 of our recent Ultimate edition, and remains the only of its kind. Below, you will find a list of the top 10 most expensive properties featured on this year’s list — starting with a $500 million estate in Bel Air, California and ending with a $135 million property in Manalapan, Florida.

$500 million

The One

Bel Air, California

$250 million

Mesa Vista Ranch

Pampa, Texas

$245 million

Chartwell

Bel Air, California

$180 million

908 Bel Air Road

Bel Air, California

$165 million

Villa Firenze

Beverly Hills, California

$150 million

Billionaire

Bel Air, California

$150 million

Meadow Lane Oceanfront

Southampton,

New York

$145 million

90 Jule Pond Drive

Southampton,

New York

$137.5 million

Gemini

Manalapan, Florida

$135 million

Wallingsford Estate

Beverly Hills, California

$135 million

The Beverly House

Beverly Hills, California

$135 million

La Follia

Palm Beach, Florida

Featured photo courtesy of Tyler Hogan

The Ultra High End’s new story: No longer is ultra high-end real estate in the U.S. just about NYC and LA.

Beverly Hills, Manhattan and Miami, along with one or two other cities, have traditionally been the locus of the most expensive and most exclusive real estate in the U.S. Now, in an increasingly diverse geographic mix from Boston to Boulder, more properties align with what the industry calls the ultra or premier market. Uber prices in these locations might not number in the hundreds of millions of dollars, but they are the highest of that market. And, no matter the ZIP code, it’s likely that properties at the very top share similar attributes.

Worldwide, the number of millionaires and billionaires continues to grow, with the U.S. still accounting for the largest share of mega wealthy. “I think the change we are seeing in the growth in the ultra high-end is directly correlated to the growth of significant wealth in the world. More people have more significant money,” says Stephanie Anton, president of Luxury Portfolio International.

“Interestingly,” she says, “it’s diversifying too. In the U.S., no longer is the story just about NYC and LA. Bottom line, the shift in location is a change that influences the high end of the housing market and the demand for significant properties in a way we have never seen before.”

Photo courtesy iStockPhoto.com / Sean Pavone

Traditionally, the very top of the market in Boston was the purview of the city’s legendary Brahmins. But the revitalization of downtown neighborhoods and growth of tech and finance, along with globally recognized educational institutions, are revamping the high end in both the city and suburbs. In 2018, there were 82-percent more luxury property sales than in 2014. Not only are more properties considered high end, but new luxury towers mix with traditional blue-chip estates.

Photo courtesy of iStockPhoto / MattGush

Jonathan Radford with Coldwell Banker Residential Brokerage in New England is representing the highest priced estate outside Central Boston. Woodland Manor is a $38 million property on more than 7 acres, five miles from the city centerline in Brookline. Photo courtesy of Boston Virtual Imaging.

The highest listing in the city is a $45 million penthouse occupying the entire 60th floor of the new Millennium Tower. Jonathan Radford with Coldwell Banker Residential Brokerage in New England is representing the highest priced estate outside Central Boston. Woodland Manor is a $38 million property on more than 7 acres, five miles from city center in Brookline. “Over the ast 5 years, we have seen consistent growth in the number of luxury property transactions outside of the city of Boston, in the range of 10 percent to 30 percent per year, with the exception of 2016, when a shortage of inventory resulted in a 2.7-percent decline in the number of luxury sales. In 2018, there were 58-percent more luxury property sales than in 2014,” explains Radford. “In the city, growth in the number of luxury transactions has exceeded 25 percent a year.”

Beverly Hills agent Joyce Rey, head of the Estates Division of Coldwell Banker Global Luxury, has brokered a number of record-setting transactions both regionally and nationally. “I never cease to be amazed at the constant ascension of real estate values. Any look in the rearview mirror at real estate values is always surprising because people realize and regret not buying more real estate. And it seems shocking today because when I founded Rodeo Realty in 1979, $1 million was a pretty major property.” The customary benchmark for luxury in many places has been $1 million. Now, in many locales, including Boulder, Colorado, the $1 million home is basically a redo. Boulder agents say luxury doesn’t begin until $2.5 million,

but even then, as Megan Bach with Colorado Landmark Realtors points out, “some homes are not necessarily luxury.” A more reliable gauge in Boulder, she says, is price per square foot, a measure often applied to premier markets in New York and California. She estimates luxury in Boulder begins at approximately $1,000 per square foot. The highest priced home currently on the market is a $9 million property on 15.42 acres outside of town with extensive views and strong indoor/outdoor connections. Having “great indoor views typically price bumps any home in any neighborhood here, as is the case in any view locale,” says Bach, emphasizing what might be a universal truth for uber luxury: No matter the location, the better the views and outdoor connections, the higher the price.

Utah ay seem an unlikely spot for the ultra high-end, but prices now approach $10 million with the highest residential listing $26 million. Photo courtesy of Summit Sotheby’s International Realty.

“Sales over $10 million are very rare, but I think they are coming,” observes Debra Johnston, with Berkshire Hathaway HomeServices Georgia Properties. Photo courtesy of Debra Johnston.

Along Florida’s west coast, values in upscale resort locales traditionally trailed Miami or Palm Beach. Now, “prices for beachfront in Naples begin at $20 million,” says Tade Bua Bell of John R. Wood Properties. The recent sale of a gulf-front property in the exclusive Port Royal for $48 million illustrates how much demand has changed. The home was eventually torn down and replaced with new construction. Another property also in Port Royal and destined for a tear down sold for $28 million. In the ultra-sphere, a $10 million or $20 million tear down is not an anomaly.

The uber market in Atlanta starts around $5 million to $7 million for new construction. “Sales over $10 million are very rare, but I think they are coming,” observes Debra Johnson, with Berkshire Hathaway HomeServices Georgia Properties. “Buckhead is running out of large land lots, which is driving up the cost to build a dream house. The time it takes to build a new luxury home in the $5 million range could take up to 2 years. Many prospective buyers are instead buying the best flat lot they can find in a resale, and renovating the house to their taste level,” observes Johnson. In Atlanta, Los Angeles and other cities, lots suitable for prestige properties are at a premium.

In New York City, ultra luxury starts at $10 million, but Martin Eiden of Compass Real Estate says if you are looking for the “Wow factor” you have to be in the $18 to $40 million range. And anyone considering a trophy — what Eiden calls “I made it big” — property, generally has to look at $60 million and up. In the ultra-sphere, trophy properties often have over-the-top list prices. Greenwich, Connecticut, is a blue-chip bastion for prestige properties. Topping price points is a mid-country European style estate offered at $29.5 million, followed by a $22.5 million property, also in a premier estate setting. Old money locales tend to be timeless. In the Washington, D.C., metropolitan area, uber prices currently do not exceed

the $20 million mark. The exception is a $62 million estate in McLean, Virginia, on 3.2 acres overlooking the Potomac and comprised of a main residence and The Marden House, which was designed and constructed by Frank Lloyd Wright in 1959. Also extraordinary is underground parking for 30 cars, bespoke interiors by Thomas Pheasant and some of the finest views of the river in the region. In the ultra realm, truly singular properties, particularly those with provenance, often merit singular list prices. Parking for dozens of cars might seem over the top, but garage space and parking are both important to high net worth buyers, according to Rey. What else is considered a must-have? Smart home tech, larger closets, a gym, kitchens and great rooms that flow, screening and media rooms. But, Rey emphasizes, “Location is still the number one consideration for buyers.”

The increasing diversity of locations in properties at the highest price points is basically a numbers game: more buyers, greater degrees of wealth, and price appreciation in the overall market. Simply, there are more people in more locations with greater net worth. Utah is an unlikely spot for the ultra high-end, but prices now approach $10 million with the highest residential listing at $26 million. The market changed in 2016, according to Kerry Oman, with Summit Sotheby’s International Realty in Park City, who brokered the sale of a $13.5 million property in Provo Canyon, the highest-priced transaction in recent years. For the ultra market, the $5 million to $7 million range is typical, and $7 million to $10 million is no longer the exception, says Oman. In spite of growing national interest in Park City, demand for uber properties is most likely to come from home-grown wealth. In the ultra-realm, U.S. buyers dominate a majority of locations today.

“A lot of money is coming out of Silicon Valley, and Seattle now. And we’re seeing a great migration of significant wealth to more resort markets like Hawaii, Florida and Texas, due to an aging affluent population and also attractive tax laws,” shares Anton. Taxes are only one driver for a new geographic mix of buyers in Florida and Georgia. Even before the tax law was passed, brokers like Bua Bell were reporting more interest from Colorado and California. Brokers in Naples and other cities are also seeing buyers from New York, New Jersey, Massachusetts and Connecticut. Johnson says there has been a big increase in out-of-state buyers in Georgia in the last year. Ultra-luxury buyers in Greenwich have broadened in terms of their use of these properties and what they are looking for, observes Robin Kencel with Compass Real Estate. Some plan to make Greenwich their fulltime residence. Others are looking for a weekend or a summer retreat. “As people discover Greenwich’s natural beauty, from having four beaches to 600-plus nature trails to a breadth of year-round activities and its sophisticated, diverse and wholesome vibe, it is becoming an attractive alternative to the Hamptons,” she says.

In the Washington D.C., metropolitan area, uber prices currently do not exceed the $20 million mark. The exception is a $62 million estate in McLean, Virginia. Photo courtesy of Gordon Beal.

Sui generis is how some characterize the ultra market, but as distant and disconnected as it may seem, the ultra sector does not exist in a separate vacuum. “Everything’s fluid in luxury real estate,” says Gary Gold with Hilton & Hyland in Beverly Hills, noting it’s not like the stock market where there is a definite price at the closing bell. “It doesn’t work that way. There are so many nuances. In general, when you have record sales, when you have record numbers of sales, when you have lots of positive activity, it has an overall significant effect on everything,” he explains.

“The rise in significant prices is a reflection of demand but also is consistent with the rise we’re seeing in luxury prices across the board,” says Anton. “According to Realtor.com, in Q4 of 2018, prices in the top 5 percent of markets in 1,000 U.S. cities closed at an increase of 4.7 percent year over year. It’s a bit of that old saying, ‘a rising tide lifts all boats.’” With pricing heading into the stratosphere, an ultra purchase might seem capricious — a product of desire rather than a well thought

out choice. Instead, no matter the price, it’s still a question of value. Every once in a while a buyer might make a crazy purchase, but agents say that’s a very rare occurrence. Even though prices might be well into the tens of millions, Gold says, “It’s not about the money. It’s about how everyone wants to make a smart purchase, and no one wants to be a chump. For the most part, when they make that purchase, people want to feel they have made a prudent, valuable purchase. People who are worth a lot of money are very used to making very very expensive acquisitions, whether it’s in business or personal.

They know how to wrap their head around these very large purchases.” “These buyers are highly sophisticated consumers and active in multiple luxury asset classes, from cars to art to jewelry. They want to know that beyond enjoying their property, they have made a sound business decision,” says Kencel. Ultra properties might be extravgent and indulgent, but the ultra buyer’s focus is still value and investment. When there are several properties on the market at the highest prices, agents often say, “When one sells, the others will to.” Surprisingly, experience does validate this claim. “If you see homes that are setting new precedent, I think it definitely is an endorsement in an area and a price range,” says Gold. Several years ago, Gold broke the $100 million price point in Los Angeles with the sale of the Playboy Mansion. “No one ever sold something well over a $100 million. Since then, we’ve seen more really big sales than ever before. It’s definitely a validation of an area, and people get more comfortable spending more money, so it’s a good sign.” And the impact trickles down. “The second I sold something for $100 million, all of a sudden the $5 million listings are now worth more.”

This editorial originally appeared in Unique Homes Ultimate ’19 Issue.

Luxury real estate company, Engel & Völkers Snell Real Estate, recently announced its newest partnership with Lifestyle Asset Group, an exclusive vacation home company. The new collaboration creates a strategic bridge between the two companies, offering a select number of shares from Engel & Völkers Snell Real Estate’s choice portfolio. With the alliance, Engel & Völkers Snell Real Estate continues to “solidify its dominant position in the Los Cabos market,” according to a recent press release.

“By aligning our services with Lifestyle Asset Group we are ensuring that the marketplace’s luxury homeowners have a dynamic sales solution at hand. We can now provide the most sophisticated and effective collective ownership services for families to affordably own vacation homes,” says Vanessa Fukunaga, President and CEO of Engel & Völkers Snell Real Estate.

Photo courtesy of Engel & Völkers Snell Real Estate

The partnership will ensure a smart solution for buyers and sellers in the Los Cabos’ luxury second home market. The buyers have the ability to make a logical investment with a clear exit in place so they know when their capital will return after eight years of time in their beach getaway. Sellers will have the advantage of selling their property at or above its market value with no additional cost.

Over $50 million worth of luxury real estate is being offered on the peninsula. Both Engel & Völkers Snell Real Estate and Lifestyle Asset Group are looking forward to a successful vacation home partnership.

No other property would be better suited for an issue devoted to prestige properties than the palatial waterfront mansion in Coral Gables, Florida, featured on our cover. It’s not often family, Miami and a palatial residence are mentioned in this same sentence, but that’s what makes this property is so spectacular.

The gated community of Gables Estates offers the ultimate in security, including patrols on the water. It’s not unusual to see children out on bikes and neighbors walking dogs here. Nearby are some of the best schools in the Miami. That’s one of many reasons why those who know the area see Gables Estates as one of the best neighborhoods, explains Sandra Fiorenza with ONE Sotheby’s International Realty, who is representing the property.

The 14,443 square foot residence itself offers a huge measure of security with concrete construction and windows that exceed hurricane standards. The exterior is clad with marble, and the same stone — all from a single source — is used on covered balconies and lanais that overlook an infi nity pool and the blue of the wide lagoon. Inside, light dances throughout the home. A neutral palate becomes an ideal backdrop to showcase exquisite details such as Venetian plaster and carved plaster moldings, marble columns and stone carvings. The overall effect is elegant and restrained.

An extensive master suite with his and her bathrooms occupies one wing of the second floor with an additional four en-suite bedrooms in an opposite wing. The home also has two offices, private staff quarters and a wine cellar. The site on the largest lagoon in Gables Estates also offers access to deep water and the ocean. With a new seawall and 140-foot dock, this could be the ultimate Miami home, as well as a perfect family compound. It’s easy to see why those who know the area see Gables Estates as one of the best places to call home. This Ultimate compound is priced at $25.9 million.

This editorial appeared in the Unique Homes Ultimate ’19 Issue.

This home in Bellevue, Washington, is redefining what it means to live in luxury. This stunning new construction is the perfect modern home for an individual or family.

Walk into through the solid mahogany doors to the foyer and see the unique and custom-made staircase to your right. The 5-bed, 6-bath home has the master suite on the main level and four en suite bedrooms on the upper level as well.

On the main level is also a home office, patio with a built-in barbecue and heaters a chef’s kitchen and so much more. Meanwhile, the upper level features an entertainment room with all the bells and whistles, convenient laundry room and cozy reading nook.

The chef’s kitchen with quartz countertops & backsplash, 14-foot island, a Wolf stove and Miele appliances.

This home has been thoughtfully designed with luxury and efficiency in mind, and is the ultimate form of luxury for its owner.

Luxury Portfolio International® (LPI), the luxury marketing division of Leading Real Estate Companies of the World®, has released a new, global report: The Allure of the Second Home: Why Affluent Buyers are Displaying Confidence in Resort Markets.

This detailed research focuses on affluent consumers (the top 10 percent and above income earners in 26 countries) who are in the market to buy or sell a second or vacation home in the next three years.

The Allure of the Second Home reveals that the potential for luxury property has never been bigger. Just in the last four years, personal wealth globally has grown by 15 percent and the number of high-net-worth-individuals has increased by 25 percent. For those at the highest end of the wealth spectrum (over $10 million in assets), this represents a unique opportunity. While the mainstream market has concern and is showing caution, this consumer, and particularly those in the market to buy a second home, is becoming more aggressive and feeling a high degree of confidence in the market.

Photo by Jessica Bryant.

“Today’s affluent second home buyers have more assets than in the past, they are younger, with nearly half under 40 years, and they are experienced with home ownership,” said Stephanie Anton, president of Luxury Portfolio International®. “This group is looking for additional residences for their portfolio that cater to their discerning lifestyles, where amenities and wellness are priorities.”

Photo by Expect Best.

Beyond physical and emotional wellness, which most affluent consumers focus on, luxury second home buyers are especially keen to improve their intellectual, social and even spiritual wellness, with 96 percent taking at least one aspect of wellness seriously. Learn more about how luxury developers are keeping this in mind to differentiate themselves in the full report.

Key Takeaways

-

The high-end second home market is a net growing market

-

Younger buyers make up half of the luxury second home market right now

-

Ultra-high-net-worth individuals are investing more aggressively

-

Buyers are ultimately seeking a life well-lived

Download the complete report at luxuryportfolio.com/whitepaper

Chris Loffreno

Loffreno Real Estate, Inc

2100 Estero Boulevard, Fort Myers Beach, Florida 33931

239.463.2999 | 800.741.2986 | chris@loffreno.com | FortMyersBeachRealEstate.com | Loffreno.com

Fort Myers Beach is a laid back casual beach town on Estero Island, off the Southwest Florida coast. A long, sandy beach faces the Gulf of Mexico, and offers the bay on the other side of the Island featuring fresh seafood off the docks. Boating and fishing are boundless from the island or its offshore Gulf waters. A short drive brings you to neighboring communities of Naples, Sanibel and Captiva. There are numerous stores and shopping centers, waterfront dining and an array of water sports and activities. There is always something to do in this active beach town!

Listings by Chris Loffreno

Classic Florida Beachfront Enclave

Your island estate located in a secluded and private setting just off road. An extended driveway greets you to this outstanding gulf-front property of two attached homes. Upper $2 million.

Chris Loffreno originally appeared as an Elite agent in the Unique Homes Spring ’19: Elite edition.

Investment is a great way to grow wealth over time and can be a game-changer for most people. It can help you generate cash, providing you an additional source of income and even have you covered with regard to retirement. Either way, if done right, investment builds wealth. Naturally, investing your hard-earned money can be an overwhelming challenge since there are a wide range of investment options to choose from. At this point, assessing your personal risk tolerance and time horizon helps you to decide where and how to allocate your investments.

Condominiums

As with any investment, there are several variables that can influence the outcome of your investments. Condos are in high demand among millennials, and so, investing in them can be a great move if you make smart decisions and purchases. Unlike most housing options, the management of the condominium tends to its maintenance and upkeep, meaning you save time, energy and money. Condos typically come with premium amenities such as swimming pools and gym, yet the purchase price is generally cheaper than single-family homes. When it comes to investing to provide future income, investing condominiums tend to be a safe bet. Head on over to get a listing in this location.

Photo courtesy of Unsplash

Dividend Stocks

If you’re open to taking on a little more risk, dividend stocks may be an option for you. Including both common and preferred stocks, the equity market can provide great possibilities for future income. Invest in companies that have safe dividend payout ratios and, in return, the portion of profit for shareholders is distributed among the shareholders. Generate income on the basis of the number of shares you own.

John Fairbanks & Marion Fairbanks

Coldwell Banker Residential Brokerage, The Fairbanks Group

333 Village Main Street, Suite 670, Ponte Vedra Beach, FL 32082

626.398.9000 | 626.390.1000 | Est8homes@aol.com | www.TheFairbanksGroup.com | CalBRE #00972895 | CalBRE #01009669

With combined Real Estate experience of more than 60 years, The Fairbanks Group share a passion for their profession. John Fairbanks and Marion Fairbanks continue to bring international recognition for their people-centered, results driven professionalism. Having earned membership in the Society of Excellence and the International President’s Elite, they represent the top 1% of the company’s sales force, both domestic and international. Much of their business is repeat and referral from satisfied individuals. Always able to provide exceptional service, John and Marion are available to exceed your needs with their aggressive marketing and astute negotiating skills, coupled with a personal interest in their clients’ real estate concerns, mean results for their clients. These strengths continue to maintain John and Marion as top performing agents in the San Gabriel Valley for Coldwell Banker Residential Brokerage for more than 30 years.

Listings by John Fairbanks & Marion Fairbanks

1955 Brigden Road, Pasadena, ca

A mountain backdrop, exquisite facade with brick accent, stately front porch and elegant curb appeal is only the beginning of this newly redesigned and renovated residence located in Pasadena’s prestigious Brigden Ranch! Offering more than 3,000 square feet of living space including 4 bedrooms (2 master suites), 4 baths, a formal living room with fireplace, a family room with Napoleon fireplace, an office, breakfast area and a chef’s delight of a kitchen. The backyard is an entertainer’s dream with an outdoor barbecue!

Offered at $1,750,000

John Fairbanks & Marion Fairbanks originally appeared as Elite agents in the Unique Homes Spring ’19: Elite edition.

See their page and additional listings here!

In Sarasota, Florida, this home is elevating the standard of luxury, waterfront living.

1309 Vista Drive in Sarasota, Florida, is a gated French Country private estate located right on the bay. It was built in 2015 on the 1.5-acre-plus property.

Located in one of Sarasota’s most coveted neighborhoods, Harbor Acres, the property is just as close to the bay as it is to the bustling downtown district filled with restaurants and retail stores. The perfect blend of old-world charm and modern Florida luxury.

The interior of the home includes a La Cornue gourmet kitchen, imported French stone floors and cabinetry. But the quality doesn’t end inside — with over 244 feet of direct bayfront on the property, you can enjoy the water every day of the year.

1309 Vista Drive in Harbor Acres, being a perfect blend of French charm and modern style, is the quintessential home of the neighborhood and surrounding area.

Photos courtesy of 1309 Vista Drive.