Investment is a great way to grow wealth over time and can be a game-changer for most people. It can help you generate cash, providing you an additional source of income and even have you covered with regard to retirement. Either way, if done right, investment builds wealth. Naturally, investing your hard-earned money can be an overwhelming challenge since there are a wide range of investment options to choose from. At this point, assessing your personal risk tolerance and time horizon helps you to decide where and how to allocate your investments.

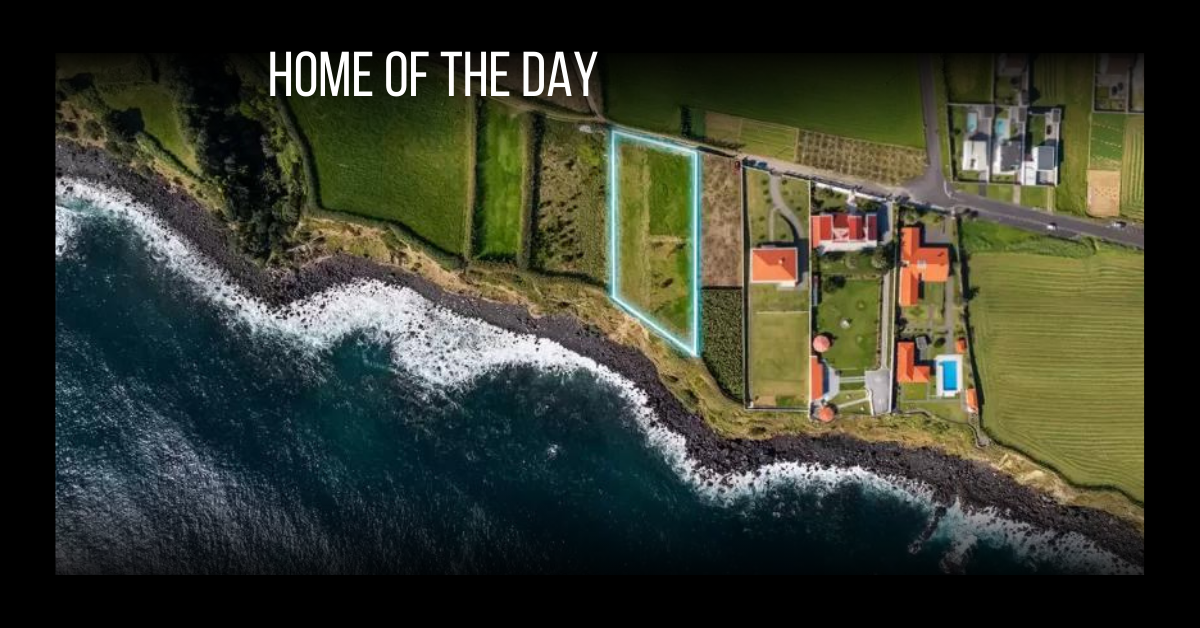

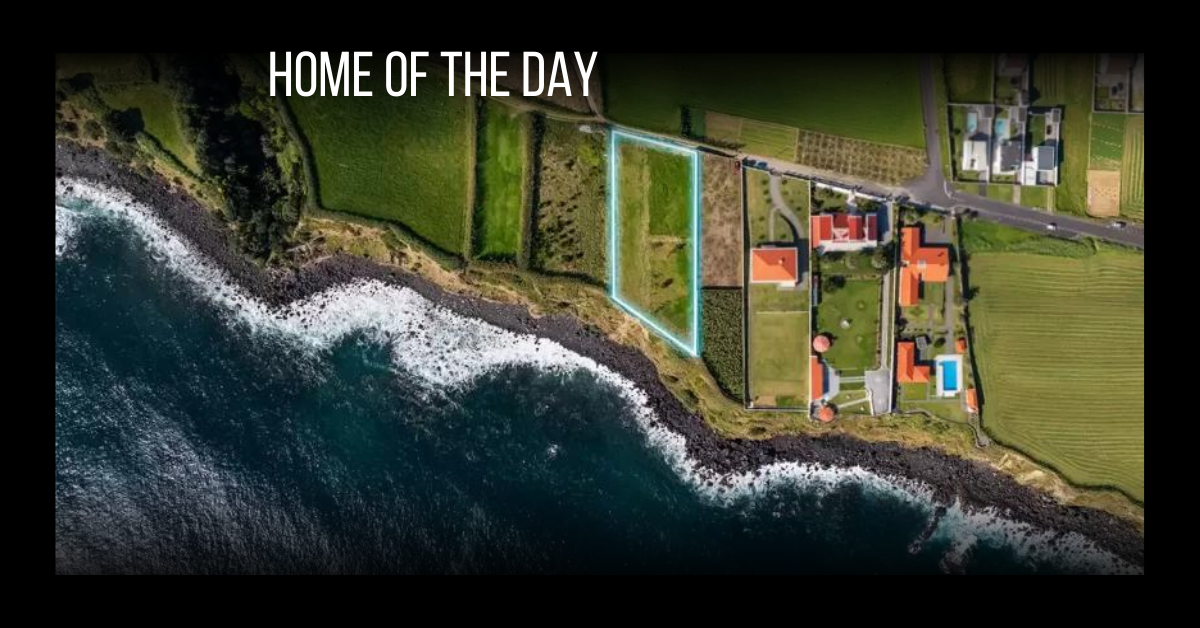

Condominiums

As with any investment, there are several variables that can influence the outcome of your investments. Condos are in high demand among millennials, and so, investing in them can be a great move if you make smart decisions and purchases. Unlike most housing options, the management of the condominium tends to its maintenance and upkeep, meaning you save time, energy and money. Condos typically come with premium amenities such as swimming pools and gym, yet the purchase price is generally cheaper than single-family homes. When it comes to investing to provide future income, investing condominiums tend to be a safe bet. Head on over to get a listing in this location.

Photo courtesy of Unsplash

Dividend Stocks

If you’re open to taking on a little more risk, dividend stocks may be an option for you. Including both common and preferred stocks, the equity market can provide great possibilities for future income. Invest in companies that have safe dividend payout ratios and, in return, the portion of profit for shareholders is distributed among the shareholders. Generate income on the basis of the number of shares you own.

You love nothing more than uncorking an expensive bottle of wine, or enjoying a nice glass of whisky. Have you ever thought about investing in these passions?

Always popular among the luxury class, passion investments such as wine and liquor, art, watches, or coins are non-traditional ways of putting your money into physical objects that give you enjoyment. In recent years, these luxury investments have experienced significant growth, with fine wine and liquor — specifically whisky — turning out to be some of the most lucrative passion investments.

©iStockphoto.com/MinervaStudio

Wine

When it comes to wine, Andrew della Casa of The Wine Investment Fund understands the profitability of this favorite drink of many, and provides investment management of fine wines to clients through a set of established methods to ensure low-risk portfolios. “You have to look at the number of millionaires and billionaires and realize that these numbers are increasing; and they are buying these wines,” says della Casa.

“The demand is increasing because there are more people coming to buy these wines. The only thing that can move is the price, and that tends to move upwards. If you look at the gold or stock exchange, since the 1980s, gold has gone up about four times,” he says. “Wine has gone up 20 times — that puts it in perspective.”

©iStockphoto.com/PaulGrecaud

For della Casa and his team, their focus includes only investment-grade wines that can achieve and deliver absolute high returns. “The thing that attracted us to the asset class was the specific characteristics that certain wines have. It’s not just any wine or any fine wine, basically it’s a specific number of Bordeaux wines from the French region of Bordeaux,” says della Casa. “There are delicious Italian, American, African wines, and that’s fine. But that’s not what we’re about. We’re about risk analysis and risk management.”

These wines include those from the finest Bordeaux chateaux, and those that are deemed low volatility — meaning to avoid wines at the en-primeur stage, trophy wines or ones nearing the end of their optimum drinking period.

“Burgundy is the area closest to having the characteristics to Bordeaux wines, but the quantities produced are minimal,” says della Casa. “Because we’re buying and selling Bordeaux wines, the characteristics of that wine is that it’s long living so you can keep it for 20 to 30 years. Also, formula clarity, so it gets better with time.”

Della Casa asserts the importance of understanding wine investment is an alternative, rather than mainstream investment. It’s important to think about a five-year horizon at a minimum, and a limited amount of money (no more than 20 percent) from your investment portfolio should go into fine wine.

“One of the biggest risks in any investment is liquidity — to get in and out of the market whenever you want to, not when the market dictates,” says della Casa. “Wines that we look at are wines that have a strong following. There is a demand for these wines from all over the world,” he says.

The demand for these wines comes from the traditional drinker, as well as a newfound demand from Asia, which is not as long standing — they drink the wine much younger. “You can buy any wine, but it’s only when you sell it that you crystallize your gain,” he says. “You can get a 20-fold increase in value with very low risk. Look at the volatility of our portfolio and compare it to gold, or even oil; we’re very much less risky. From an investment point of view, low risk and high return. Plus, you have a physical asset.”

Whisky

Liquor offers another realm of alternative investment — and one of the most lucrative investment liquors has been and continues to be whisky. For Andy Simpson of Rare Whisky 101, who was introduced to whisky — particularly scotch — at a young age by his father, it was an accidental investment at first. “I started holding on to bottles because I had too many to drink and then realized that what I had bought for 10 to 15 pounds started to be worth 40 and 50 pounds, and I thought, could this be an investment?”

“I’ve always said, it’s an investment of passion,” says Simpson, who has been collecting for nearly 30 years and helps collectors and investors all over the world source scotch and put together world-leading collections of whisky. “People fall in love with a category, the distillery, the spirit, the legend behind it. The rules are that first you love whisky — because then it’s going to be a fun investment. Second, patience is key. While there are significant short-term gains available, it is a medium to long-term investment.”

“From an investment perspective, age matters. The older the better. But from a flavor perspective, sometimes older whisky can be worse. It can be over matured, or develop an imbalance. Yet, generally, the further back the better,” says Simpson who has personally tasted the world’s oldest — a 75-year-old whisky — and many other pre-World War II bottles.

Photo courtesy of The Macallan.

Iconic distilleries Simpson directs his clients to include Lagavulin, Talisker, Dalmore, as well as silent distilleries (those no longer producing whisky) such as Port Ellen and Brora, both soon to be reopened, and Rosebank. Commemorative limited edition bottles, distillery exclusives offered only on property, or classic ones such as the Macallan Royal Marriage bottles are always great investments. “Macallan is the Rolls Royce of collectable whiskies by a country mile,” says Simpson. The Kate and William special wedding scotch was sold for 150 pounds in 2011, and now sells for 4,000 pounds a bottle.

“The overarching principle of whisky investment is to buy the best quality liquid. Someone’s investment today is going to be someone’s favorite drink tomorrow,” says Simpson. “It if wasn’t for collectors or investors, we couldn’t be drinking, buying, opening or sharing some of the oldest bottles of whisky in the world.”

Most collectors use the two-bottle approach: buy one to keep and one to drink. Yet, sometimes this is difficult to do, as some sellers may only allow one bottle to be purchased. “We deal with people who have meaningful collections of only 50 bottles; others have 10,000 bottles, some of the biggest collections in the world,” says Simpson. “You don’t need to spend more than a couple hundred pounds for a good investment.”

©iStockphoto.com/TWSTIPP

“We split the risks into your physical storage or logistical risks, and then financial risks,” says Simpson. “The main one being the “dreaded double D: drink it or drop it.” There are of course risks from storing as well. “Since whisky has a strong percentage of alcohol (it has to be 40 percent to be legal) the strength of the alcohol will corrode through the cork stopper, and it leads to leaking and evaporation damage. Therefore, whisky should always be stored standing up at room temperature and kept out of direct sunlight. Place it in a cupboard or closet and keep it out the reach of thirsty guests,” says Simpson.

Lastly, one of the main risks plaguing the whisky market — also seen with wine as well — are fakes, with most false bottle transactions occurring across peer-to-peer auction sites, and causing a potential for significant losses. Besides these risks, Simpson asserts that the market is especially buoyant with significant price increases for certain bottles and brands, and promises to be a wonderful speculative alternative investment. “If you get a great bottle, with a great closure, you can be sure it will outlast you and I,” says Simpson.

Appearing in UH Summer 2018, “Ten Years Later: Our year-long look at what’s changed in U.S. luxury real estate since the 2008 recession.”

Consumer sentiments toward owning and buying real estate continue to evolve, along with the definition of luxury.

By Camilla McLaughlin

Ten years ago, there were few signposts for the journey out of the recession. Real estate’s perfect storm got a lot worse in the summer and fall of 2008 as a combination of job losses, high energy costs, an ongoing tide of foreclosures, a pending presidential election and the near collapse of the credit markets rocked the economy. Many, but not all, upscale consumers put real estate plans on hold and shifted into a watch-and-wait mode. “Consumers’ confidence gets shaken, and the rich are not immune,” observes John Brian Losh, publisher of Luxuryrealestate.com and owner of Seattle brokerage Ewing & Clark.

Following that low point, luxury real estate embarked on a remarkable journey of recovery with luxury properties selling and prices escalating in many locations, boosted in part by the exponential growth of wealth worldwide. Just in the last year, the combined net worth of the world’s billionaires increased by 18 percent. Residential real estate remains a favored investment with prime property sales worldwide up by 11 percent in 2017.

Attitudes toward buying, selling and luxury overall have followed an equally transformative path. “The lesson from the recession is to buy smart. Impulse buying, overextending to get the home of your dreams, and buying without doing your homework have all gone the way of the fax machine,” says Jason Haber, a broker at Warburg Realty in Manhattan.

Value is most important. Greenwich saw two record sales in 2017, but only after list prices were reduced. In their luxury white paper, Christie’s International Real Estate reported strong sales “where buyers and sellers showed a willingness to adjust pricing expectation to new market realities.”

“Price was the name of the game,” said Michael Saunders of Michael Saunders & Company, noting that luxury homes in Sarasota sold in record numbers after homeowners adjusted prices.

Affluent individuals also have a new perspective on the investment potential of properties, locations for both primary and second homes, expectations regarding the agent’s role in the transaction and what constitutes luxury.

What Is Luxury?

Few other terms have been hyped more than the word “luxury” in recent years. Most industry experts would agree with Mike Leipart, managing partner of The Agency Development Group in Beverly Hills, who says, “It’s used so often that it’s become virtually meaningless.”

Even wealthy consumers struggle to find a suitable alternative phrase, yet they have a clear understanding of what luxury means today. “I think people can’t describe it, but when you walk into it, when you are standing in it, you respond to it,” says Craig Hogan, vice president of luxury, Coldwell Banker Real Estate. “People can tell quality; they can tell beautiful design. Service is critical.”

“Ten years ago, the luxury industry was able to dictate to consumers what luxury was and almost define it for them. We are not able to do that today,” explains Kevin Thompson, CMO of Sotheby’s International Realty Affiliates LLC. “Luxury is being viewed from an experiential perspective. People are choosing to live different ways and somehow have what they value. It is a very individual approach.”

“The meaning of luxury has changed a lot. I think luxury has become personal. It’s become a feeling. It’s become an emotional part of a real estate experience,” says Christina Huffstickler, owner of Engel & Völkers in Atlanta.

“You can’t pin it to price level or finish levels. It’s very complex. It’s very much what people are willing to pay extra for,” says Leipart using the example of how a desirable view — prized by today’s buyers — amps up a per square foot price. “I think the basic thing of luxury is that it is everything that has not been commodity priced,” he explains.

Value & Inventories

“By and large, people value home ownership,” shares Hogan. “I just keep watching this trend toward smaller and more wonderful. Just beautiful in every way. Great finishes, smart home technology, all the things you’d expect except beyond those expectations.”

“I think that people, wealthy people, have always found real estate to be an attractive investment. It’s an asset that usually appreciates that they can enjoy,” says Losh.

Coming out of recession, the Bay Area led the recovery, and the region continues to rack up amazing stats with May’s median sold price exceeding $3 million in both San Francisco and Silicon Valley, according to The Institute for Luxury Home Marketing. Inventories remain barebones with homes selling in weeks. In fact, the median time it takes for both attached and single-family homes to sell in Silicon Valley is about nine days. Here, as in many other upscale locations, the biggest issue is too few listings to satisfy demand.

“Even with interest rates rising because of the moves the Feds have been making the last 18 months, there is no slowdown in the appetite for wealthy consumers purchasing homes,” says Jim Walberg with Pacific Union, noting, he has never seen more all cash purchases in 35 years. “Buyers and sellers still view Bay Area real estate as a great place to put their resources. And, remember, these are wealthy people, so it’s not as if they are not diversified in many other investment categories.“ Many of these purchasers are looking at long-term ownership. The homes have a dual purpose: a fun community and place to raise their kids, and a home they plan to live in after their children are grown.

“The primary residence purchase remains largely emotionally driven based on finding the right property to suit the purchaser’s desire for location, space, finishes, et cetera,” rather than a cold calculation of investment dollars,” says Leslie Hirsch, an advisor with Engel & Völkers in New York City.

Second Homes & Investments

Second homes and resort properties are in demand. More than half of the world’s high- and ultra-high-net-worth individuals own two or more residences, and many sought out at least one luxury property acquisition in 2017 and 2018, say experts at Christie’s International Real Estate in their annual industry report.

Among the U.S. population with a net worth of $500 million and up, 2,700 own on average 10 or more homes each, shares Hogan.

“An interesting trend we have noticed is that more wealthy clientele are electing to purchase properties as investment pieces instead of purchasing a third or fourth home to use as a personal residence. Or in some cases they are using a single property as both a vacation home and income property,” shares Anthony Hitt, CEO of Engel & Völkers Americas.

“Second, third and fourth homes are now being scrutinized more carefully to make sure there is an upside in the investment should the purchase decide to sell in the future,” says Hirsch. Investors are diversifying portfolios, she says, “choosing to buy property in several countries as a hedge against a drastic change in one country’s economy.”

Affluent consumers continue to be bullish on real estate, an attitude enhanced by recent volatility in equity markets. Losh believes security and safety are more important to consumers. “People are also looking for a safe harbor. They want to feel safe, and they want their investment to be secure,” he says.

What Buyers Want

Ten years ago, the luxury echeleon was defined as homes priced in the top 10 percent of any market, and that benchmark still stands. But for consumers, dollar signs do not necessarily determine luxury. “Money sometimes doesn’t even become part of the search parameters. They just want to find the right property,” and these buyers today are willing to take their time, says Katie Hauser, a broker associate with Baird & Warner in Winnetka, Illinois.

Like many agents today, Hauser sees several different buyer profiles in the market. Some, particularly empty nesters, “want to ditch their suburban house for something unique. They want value, but they want to find the right place,” she says.

“There is a search for the unique. The emerging luxury consumer isn’t interested in cookie-cutter anything. They want personal and outside the norm and are willing to pay more for that,” adds Thompson.

On the other hand, other upscale buyers want a platinum location and are extremely discerning regarding every facet of the property.

“Luxury buyers in Omaha want what they want, and if they cannot find it they build,” says Judy Smith with RE/MAX Real Estate Group in Omaha. High on wish lists are rooms large enough for grand pianos, buffets and sideboards. “They still love walk-out basements for entertaining and as a separate living area for family members extended visits. The view from the deck is always important.”

Millennials

Millennials are beginning to make their play in real estate. Because they delayed buying a home, many of their first purchases fall into the luxury niche, giving new meaning to “starter home.”

According to research from Luxury Portfolio International, most buyers seeking $1 million-plus homes are 25 to 49 years old and have inherited or plan to inherit significant wealth. This consumer has begun powering the $1 million-plus real estate market, more so than their older counterparts.

Millennials overall, says Lindsay Bacigalupo, an Engel & Völkers licensed partner in Minneapolis, “waited to buy and are now in their late 20s and early 30s. They are buying starter homes that are $400,000 to $1 million.

Millennials expected to be as transformative for real estate as the baby boomer cohort was. “Millennials are the next generation who are redefining luxury. Their attitudes toward homes are shaping what is publically seen as ‘good real estate,’ influencing what others look for in a home,” says John Dean, license partner with Engel & Völkers Vancouver. “Millennials are rejigging real estate wish lists, which differ from past generations. They place a big focus on the shared economies. They prioritize modern design. They see real estate differently than predecessors as big traditional homes are too expensive for them to afford, at least right now.”

“Bigger is a little yesterday,” says Hogan, who characterizes current preferences among all consumers as “smaller and finer.”

The drive for a safe harbor along with quality of life, changing demographics, government tax policies and technology are all reshaping the geography of luxury. Denver, Nashville and Atlanta are new luxury players. Victoria, British Columbia topped Christie’s annual report as the primary luxury market. Santa Fe was the hottest second home market; Sun Valley and the Bahamas were in the top five.

More consumers are also opting to make places such as Charleston, South Carolina; Austin or Orlando home. A number are also trading their primary home for a resort home in locations such as Jackson Hole or Bluffton, South Carolina, and many are doing so with kids in tow.

“The definition of luxury means something different to millennials than previous generations. As we know, they value the experience of material wealth. They may choose to settle in traditionally second-home markets to be close to the beach or mountains. They are not as tied to a specific geographic area as many have the option to work remotely,” explains Hitt.

Technology & the Agent’s Role

Probably nothing has changed more, as well as stayed the same, as the way homes are sold and how real estate agents work with buyers and sellers. “Technology has played a huge role in changing everything we do now as agents,” says Dean.

Buyers are more knowledgable; the mechanics of the transaction are more streamlined. Artificial intelligence and virtual reality are starting to kick off the next tech evolution.

The agent’s role continues to shift from provider of information to trusted advisor. “Today’s buyer comes armed with data, comps, neighborhood analysis, and newspaper articles. In some cases they know more about pricing than the listing agent,” says Haber.

What agents need to understand, Leipart says, is, “you don’t sell anything” to the wealthy. “If your approach is to get them to buy, you are going to strike out every time. The best you can hope for is to be a trusted advisor, and you can’t have that role if you are trying to sell.”

The Corcoran Group is selling the 75-acre French compound, Le Domaine des Oliviers de l’Esterel, which sits on a hilltop overlooking the Bay of Cannes and consists of three independent villas.

By Brielle Bryan

Located in the heart of the French Riviera, this rare estate, Le Domaine des Oliviers de l’Esterel, is seated within 75 acres of landscaped gardens and offers a contemporary perspective of the art of Provence in its most prestigious form. This estate offers a panorama of exceptional beauty with its endless meadows, olive trees, lavender fields and breathtaking views of the Bay of Cannes.

The Corcoran Group and the Paris agency, Vingt Paris, have listed the estate for $65 million, or €53 million. Tom Di Domenico, founder and president of The Domenico Team at The Corcoran Group, as well as the listing agent for Le Domaine des Oliviers de l’Esterel, described the estate to be nestled in an “amazing, private, tranquil environment.”

“The property was restored back to its original local flavor, and all of the furnishings and details in terms of the finishes are from local artisans that were brought in to make it indigenous to the area,” Domenico said.

Consisting of three independent villas — Le Manoir, La Sandrilene and La Ferme — this estate offers more than 21,000 square feet of living space, including 17 suites, three swimming pools, spa and fitness facilities, a tennis court, three miles of fitness trail, a helipad, garages, independent quarters for staff and a caretaker’s residence.

“This is an investment property or can be used as a private compound for a family that would want to use one home for theirselves or rent out to others,” Domenico said.

“This is an investment property or can be used as a private compound for a family that would want to use one home for theirselves or rent out to others,” Domenico said.

The price covers the real estate assets and includes the French operating structure, which manages the day-to-day running of the complex, as well as the rental component and exclusive bookings for on-site events. There is also a maintenance personnel living all year round in a separate house at the entrance of the compound, as well as a house manager on site every day located in an independent office.

As the largest of the three villas, Le Manoir offers approximately 11,000 square feet of living space, showcasing picturesque views of the French countryside and Bay of Cannes. Upon entering this home, one is immediately greeted by a grand entrance hall and central living room, separating the two wings of the property. The expansive living room is flooded with light and opens onto the summer terrace, overlooking the infinity pool.

The east wing includes a gracious dining room and has a fully equipped commercial-grade kitchen with a butler’s pantry, cellar and sideboard for direct or independent access. There is a sizable office which is complete with traditional beamed ceilings, intricate millwork and a wood-burning fireplace with a custom stone mantle. Additional rooms in the east wing include a laundry room and an archive room.

The west wing of Le Manoir contains private living quarters, including the master suite which has its own lobby, a lounge with a wood-burning fireplace and a glass-enclosed terrace. Down the hall from the master suite are four guest bedrooms, each having their own en suite bath with double sinks, T.V.s, dressing rooms and terrace access.

Inhabitants of this villa can also enjoy the fineries of the home cinema, as well as the separate entertainment room which includes a billiards table, wet bar and access to outdoor dining areas. This villa has a lower garden level relaxation area with an on-site spa, comprised of a fitness room, sauna, large jacuzzi and shower.

This villa is comprised of approximately 4,600 square feet. Through its gracious entrance hall is a bright and airy living room, which has a wood-burning fireplace and custom detail throughout.

This villa is comprised of approximately 4,600 square feet. Through its gracious entrance hall is a bright and airy living room, which has a wood-burning fireplace and custom detail throughout.

Just off the main entertaining space is the sleek chef’s kitchen, with tailored wood cabinetry and stainless-steel appliances. Next to the kitchen is the dining room which opens onto the large covered terrace. The outdoor space encompasses a complete summer kitchen and gracious living and dining area that overlook the infinity pool and provide tranquil views of the Esterél Hills.

The sleeping accommodations are generous in size, offering two bedroom suites in addition to the luxurious master bedroom that comes with a dressing room, en suite bath and balcony. The covered terrace leads to an independent guest house, which has its own kitchen, dining and living room and two bedroom suites. The villa also contains a large office as well as fitness area and relaxation facilities with a sauna and hammam.

This particular villa includes more than 5,300 square feet and affords sprawling indoor and outdoor living, as well as a windowed chef’s kitchen complete with top-of-the-line stainless steel appliances, marble countertops and direct access to the covered terrace.

This particular villa includes more than 5,300 square feet and affords sprawling indoor and outdoor living, as well as a windowed chef’s kitchen complete with top-of-the-line stainless steel appliances, marble countertops and direct access to the covered terrace.

The separate lounge is the perfect place to relax as it showcases a custom stone fireplace. The elegant dining room is highlighted by high wood-beamed ceilings and glass French doors that open onto the summer terrace for seamless flow to the outdoor kitchen facilities and barbecue.

The private quarters of this home are the epitome of luxury, with the impressive South facing master bedroom suite that extends into a spacious office and dressing room. Four additional en suite bedrooms can be found throughout the premises.

Centrally located, this villa’s beautiful custom pool house, La Bergerie, ideally blends the main residence with the outdoor entertaining component. Le Bergerie offers 1,600 plus square feet of independent amenities for guests, including a fully-equipped kitchen, dining and living room and two en suite bedrooms with dressing quarters.

Photo courtesy of The Corcoran Group

Los Angeles is the best city in the world to invest in real estate, according to an article published on Forbes.com.

The top 10 cities as ranked in the Schroders Global Cities 30 Index.

The City of Angels beat out London as the new hot spot for global real estate investors in the third annual Schroders Global Cities 30 Index, released on June 26.

For a city known more as a one-trick pony producing movie magic, Los Angeles is home to the well-respected colleges UCLA, USC and Pepperdine and start up tech companies are claiming their spot on the A-list. Snapchat, Pandora, eHarmony, Dollar Shave Club and Boingo Wireless are just some of the big names in tech that call LA their home. This means there is more to LA than acting and writing screenplays. LA is not only attracting some refugees from costly Marin County up in northern California, but it is also attracting Chinese capital. China is building real estate and moving in to LA at a faster pace than they are in Miami and New York.

“The scale and economic depth of LA makes it a compelling location to work and live. One of its key economic strengths is that it doesn’t have to rely on only one industry,” says Tom Walker, co-head of global real estate at Schroders. “The technology sector, in particular, has grown substantially over the past few years, and this has not only boosted demand for office space but also for residential property, much of it due to the increased hiring of Millennials.”

American cities are dominating the index, taking 18 of the top 30 places and four of the top five places. Read the complete story at Forbes.com.