The latest market reports from Lucas Fox International Properties portray a positive outlook for the luxury Spanish property residential market during 2017 and beyond, identifying three new trends.

The three main trends were discovered from the company’s 2016 data and are as follows: foreign buyers are continuing to drive sales; new home transactions are significantly up on 2015 but a lack of stock is pushing up prices and the Brexit vote and the election of Donald Trump are starting to affect British and American buying habits.

Property sales up

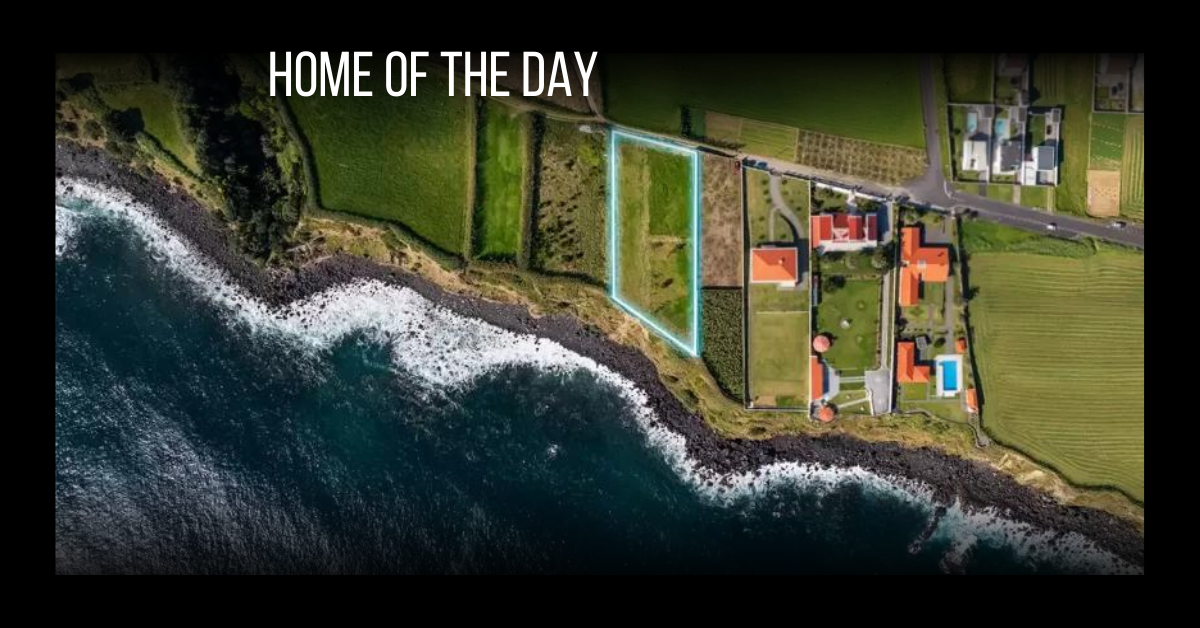

Lucas Fox registered a 31% rise in the number of property sales transactions in 2016 compared to 2015, the biggest increase since the company was founded in 2005. Sales transactions in Barcelona increased by 69%, driven in part by an increasingly diversified global market – foreign investors represented 65% of all Lucas Fox sales. Despite the Brexit vote, the British continue to made up the biggest proportion of foreign buyers (11% but down from last year’s 18%), followed by buyers from the Middle East (8% compared to 5% in 2015), Scandinavia (7% compared to 4% in 2015), France (6% compared to 9% in 2015) and the US (5% compared to 4.5% in 2015). Asian and South American buyers are also on the increase.

“We’re seeing growing national and international demand for homes in leading cities and desirable second-home destinations showing that Spain’s economic recovery is on course despite last year’s political paralysis” explains Lucas Fox co-founder Alexander Vaughan. In total, 35% of Lucas Fox sales in 2016 were to national buyers up from 19% in 2015.

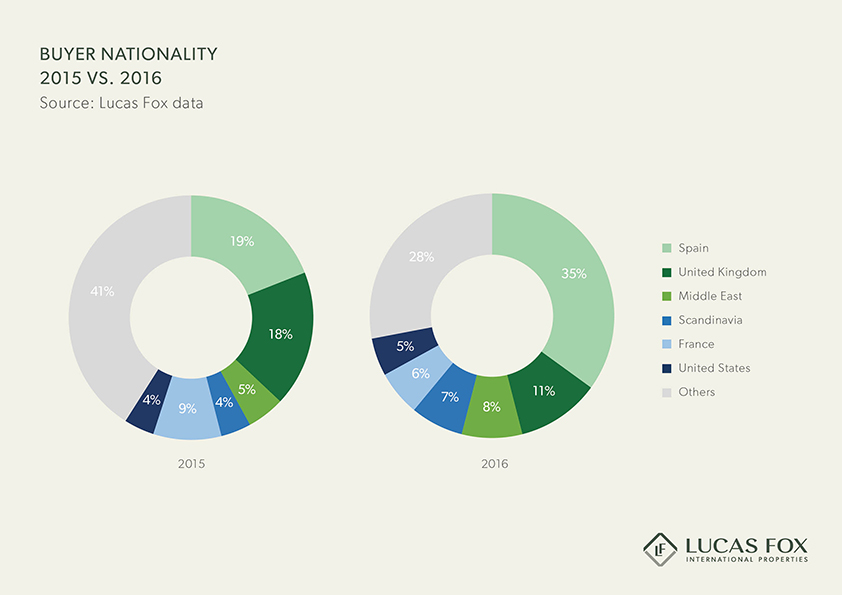

New homes top the list for foreign buyers

New and newly renovated homes accounted for over 100 million euros of Lucas Fox sales in 2016 and just under half of all Lucas Fox Barcelona sales. Three-quarters of these turnkey properties were bought by foreigners, 46% of whom were buying for investment reasons. Lucas Fox data shows that the average selling price of a new home in Barcelona during 2016 was 6,200€/m2 (€720,000), significantly above the Barcelona average.

“New homes are in high demand particularly in prime districts of Barcelona and Madrid but a lack of stock is currently pushing prices up in these areas” explains Lucas Fox Head of New Developments Joanna Papis. “The outlook for 2017 looks promising. Our current portfolio consists of more than 350 homes with a value of approximately 250 million euros and we are expecting to take on a further 1000 new homes with an approximate value of 550 million euros in the next 12 months.”

Brexit and the ‘Trump effect’

Both the UK’s Brexit vote and the election of Donald Trump have begun to shape both American and British buying habits. Lucas Fox data shows that both the number of visits to the Lucas Fox website and the number of enquiries from Americans during 2016 have increased compared to 2015. Almost 70,000 visitors to the Lucas Fox websites (8% of the total interest) came from the US during 2016, up from 5% in 2015, with the most sought-after locations being Madrid and Barcelona.

Meanwhile the reverse is true of the British (10% of website visitors in 2016 down from 12% in 2015). Enquiries from the UK for homes in all desirable second-home destinations have decreased following the Brexit vote, most notably on the Costa del Sol, traditionally popular among British buyers. Lucas Fox data shows that Barcelona and Ibiza were the most searched for destinations among UK buyers during 2016.

“Since the referendum, UK buyers have dropped off due to the weakening of the Pound,” explains Lucas Fox Marbella Partner Stephen Lahiri. “There is still movement at the lower end of the market and towards the latter half of the year there has been an increase in the numbers of sellers of re-sale properties discounting prices, particularly British sellers who can now afford to reduce the price without affecting what they will make in Sterling.”

Latest sales figures for last year from the National Institute of Statistics (INE) show the Spanish property market expanded 14% in 2016, the biggest increase since the run up to the last boom. Sales were particularly strong in Barcelona (24%) and the Balearics (31%) but rose just 5% in Malaga, most likely due to the Brexit vote. Another notable trend during 2016 was that investors who have traditionally bought in key property investment hotspots such as London or New York are now looking at Spanish cities as a viable option.

“We’re optimistic that the Spanish Property market will continue to improve through 2017 and for the coming years,” concludes Mr Vaughan.

By: Camilla McLaughlin

For prime real estate markets in the U.S., 2016 was a year of change, and expectations are that 2017 might bring even more. No matter how a market changes, there is always opportunity. In honor of the year at hand, we are shining a spotlight on luxury in 17 cities.

Atlanta, Georgia — Luxury here rebounded after a slight dip at the end of the summer and the months leading up to year-end saw eight or more $2 million-plus condo sales. Outside the city, the high-end market hasn’t missed a beat and prices continue to rise. Barring any substantial shocks, one agent says, “I think we will see a very robust spring.” Lots of new construction is poised for mid-town in 2017.

Austin, Texas — Few cities can match Austin’s recent track record. It has led Urban Land Institute’s (ULI) list of “markets to watch” and even sparked a category ULI dubs “18-hour cities.” Austin has gained a reputation as a tech mecca. But taxes, cost of living and a lively arts scene also woo newcomers. Yet, the new year finds a few wondering if the fast pace can continue.

Chicago, Illinois — Inventory frames the story here. Lots of new construction on the market resulted in a slight slowing of luxury sales in city center, while suburban upscale sales were up 5 percent year over year. Still, city living continues to be a big trend, particularly for boomers who want to downsize or just have their place in the Second City. In demand: residences associated with a five-star hotel.

Delray Beach, Florida — The once sleepy Delray has taken off this year. A downtown revitalization has given this Florida secret, close to both Boca Raton and Palm Beach, a new shine without compromising laid-back ambiance. Third quarter saw a $2.98 million average luxury price, a 70-percent increase over last year. Buyers are a mix of permanent and vacation home residents. Single-family homes with water access demand a premium.

Denver, Colorado — One of the leaders in the West and nationally, Denver real estate continues on solid footing with year-to-date sales in the $1 million-plus market up 102 percent. Still, with 7.5 months of inventory, indicators are inching towards a balance — a plus for buyers. Look for slower appreciation in the year ahead.

Honolulu, Hawaii — With a 30-percent increase in sales and 17.7-percent increase in prices, Honolulu had one of the best markets nationally at year end. Christie’s International Real Estate considers it one of the 10 cities to watch globally in 2017. Hot properties include residences in new towers in Ward Village.

Jersey City, New Jersey — Luxury is beginning to find a new home here. The rush is on for upscale digs, thanks to easy access to Manhattan and bargain prices compared to the Big Apple. Neighborhoods in transition and plenty of new construction translate into opportunities for buyers.

Malibu, California — Location matters here. Flat properties set on a bluff overlooking the most desirable beaches fetch top dollar. The ultimate: Carbon Beach, nicknamed Billionaire’s Beach. The year-end median sale price hit $2.447 million, higher than nearby platinum locations, but still below 2008’s peak $3.3 million. Expect prices to rise only 0.6 percent in the next year.

Newport Beach, California — Buyers, sellers — both win here. By year end, list prices had increased by 19 percent, but the inventory of homes on the market

increased by 9 percent year over year. Look for the balance to tip toward buyers. Price increases are expected to taper down in 2017.

New York, New York — Contrary to popular perception, the bottom has not fallen out of the luxury market here. But it is a market of opportunity, particularly if an ultra-property happens to be on your horizon as the end results of a multi-year building boom come to market.

Phoenix, Arizona — Canadian buyers might be on pause, but if fall data is any indication, the high end around Phoenix is on the upswing. Closed transactions were the highest of any September since 2005, with Arcadia hitting a record. The number of homes priced above $500,000 grew by 13 percent last year, but in October the number of listings under contract was up by 12 percent. With prices holding steady, this is one market we’ll be watching this year.

Portland, Maine — Long a summer haven for the wealthy, Maine, particularly Portland, is garnering attention from out-of-staters, from retirees to young entrepreneurs and tech professionals. With a growing reputation as a foodie destination and excellent home prices, expect to see this city’s luxury star rise, particularly in New England. Recent upscale transactions range from $1 million to $4.5 million.

Salt Lake City, Utah — The fastest growing nationally, Utah is also one of five states chalking the largest year-over-year price appreciation, so it’s no surprise to find Salt Lake on many “best of” lists this year. Park City’s reputation as a luxury Mecca continues to expand, while nearby Salt Lake’s luxury cachet is just beginning. Adding to the appeal: a year-round outdoor lifestyle, urban living without mega-city hassles, diverse locations and architecture.

Seattle, Washington — Few other places occupy as many top five positions on lists of top markets. While forecasts vary depending on who you ask, one thing is certain: there is no sign of real estate in this exploding tech hub cooling any time soon. High prices in Vancouver are diverting buyers here. Interesting trend: buying sight unseen for properties priced above $750,000.

Stowe, Vermont — The grand dame of East Coast ski resorts is completing a $500 million upgrade, including a new high-speed quad, an inter-mountain gondola connecting Mt. Mansfield and Spruce Peak, a new $90 million Village Center, and amenities including a ski club. New real estate ranges from single-family homes to townhomes and a private residence club. Brisk sales and new construction set the stage for 2017.

San Diego, California — Transactions and prices still have room to expand here. It’s no surprise that projections call for a 9.9 percent price increase in 2017. Downtown luxury is in demand with new large-scale developments, including North Embarcadero Esplanade and Waterfront park injecting a new vibe into parts of the city. Artful new towers include Pacific Gate.

Lake Tahoe, California and Nevada — Here, it’s a tale of many markets depending on location and price. Lakefront, East Shore shows the average luxury sold price up 29 percent to $4.8 million. Ski properties are also up with a year-over-year increase of 175 percent in Martis Camp. Sales in Northstar also jumped with the total dollar volume increasing by 237 percent. Few other places outside the Bay Area benefit as much from San Francisco’s economy.