Every year we select locations to highlight as Markets to Watch. This year change is underway and we take a look at some top performers, others that are beginning to transition, and a handful of under-the-radar locations that are emerging.

Austin, Texas

On track for another record with sales up more than 3 percent, Austin’s luxury patina shines ever brighter. In October, the medium home value in Barton Creek increased to $1.02 million, making it the city’s first million-dollar neighborhood. Austin’s charms include no income tax to win over newcomers, but music and tech might be tops.

Bozeman, Montana

Bozeman might seem like a sleeper on this list, but with ranches, the Yellowstone Club and Big Sky country it’s an under-the-radar hangout for demi-billionaires and billionaires.

Brooklyn, New York

No longer second best! Buyers are making Brooklyn a first choice. Median prices in the most expensive neighborhoods hit the $1 million mark. Israelis, Chinese and Western Europeans also gravitate here. It’s no surprise this New York City borough is No. 2 on Urban Land Institute’s Markets to Watch.

©istockphoto.com/Auseklis

Chicago, Illinois

By August, the Chicago area recorded as many luxury sales as in all of 2016 or 2017. Sales of $1 million-and-up properties set a record in the third quarter with a 19-percent increase over 2017. According to RE/MAX, luxury is booming in the west loop area. Upscale suburbs trail the city. Lots of new condos and stunning new buildings open doors to more urban opportunities in a market that hangs in the balance.

Dallas, Texas

Few cities have charted a post-recession course as strong as Dallas and the city remains Urban Land Institute’s No. 1 location for overall real estate prospects in 2019. But the dramatic post-recession price increases are over, say economists. Moderating prices and adjusting inventories are positive indicators that that a move back to a normal market is underway.

© istockphoto.com/Kanonsky

Denver, Colorado

Real estate’s Rocky Mountain high isn’t over yet. Denver continues to rank in the top group on many lists. In the upscale bracket, a shift toward balance is underway with the inventory of $1 million-plus homes at about seven months. Year-over-year prices are up on average 9.29 percent. Boulder remains a sweet spot for luxury, ranking 10th among cities and towns with at least 10 neighborhoods considered million-dollar.

Las Vegas, Nevada

Projections call for appreciation as high as 10 percent this year. Nevada was the fastest growing state, with new platinum communities; forward-looking, innovative architecture; and spectacular views capturing the attention of buyers looking for lifestyle and tax relief.

Hilton Head, South Carolina

Coastal South Carolina and Georgia are ground zero for demographic shifts and the growing ability among the affluent to live wherever they want — a trend just taking off. New developments including Palmetto Bluff add to demand for the Hilton Head region.

Minneapolis, Minnesota

Moving toward balance. A long-awaited uptick in homes on the market is one of several hints of a market shift. Median prices reached a record high this fall, and homes still sell quickly. Still the inventory of homes for sale is one of the lowest in the country. Upper tier and move-up brackets are less competitive.

Northern Virginia

D.C. continues to be in the top group on watch lists but Amazon’s recent announcement makes real estate in Northern Virginia much more interesting. What the prospect portends for current homeowners is uncertain, but sure to make this a market to watch in 2019.

Park City, Utah

No longer just a ski hangout, this Salt Lake neighbor is luxury’s newest player. The most desirable neighborhoods see a shortfall of inventory. Land prices increased by 25 percent with the highest number of sales occurring at Promontory. Opportunities abound: new projects at The Canyons, a large expansion of Deer Valley, a $4 billion renovation of the Salt Lake airport and a bid for the 2030 Olympics.

Wikimedia Commons / Don Lavange

Portland, Maine

Beaches and skiing, does it get any better than that? Hipsters meet old money here. Ranked among the top 20 for entrepreneurs, the city has a growing tech industry and one of the best foodie scenes in the Northeast. Look for more new construction. Prices will continue to ease upward as more people discover this hidden gem.

© istockphoto.com/DougLemke

Santa Barbara, California

Opportunities for buyers in many California locales continue to increase as markets shift. Median prices in Santa Barbara in November were down more than 25 percent, which is good news for buyers. The area remains a prized luxury refuge and lower prices open the door for newcomers to enjoy one of the most unique locations in the U.S.

Sarasota, Florida

The city’s iconic waterfront is being reimagined with a vision to increase cultural programming and urban amenities. Median prices have been increasing steadily, up 25 percent since 2014. New construction means more inventory with more on the horizon. Agents report steady and growing interest in individuals from high tax states.

© istockphoto.com/KarolinaBorowski

Seattle, Washington

Happier times are ahead for buyers in Seattle with active listings up by 41 percent. Even though inventories are still slim, it’s a good indication the frenzy is over. Closed sales in November were down 28 percent. Homes continue to appreciate but the increase has slowed to 5 percent. For buyers and sellers this is definitely a market to watch. The city still is in top groups in many rankings, but the frenzy is over.

Wikimedia Commons / Jeff Gunn

Toronto, Canada

Canadian Baby Boomers and Millennials came together and turned up the heat on the luxury condos in 2018; single-family home sales decreased by as much as 44 percent. While the foreign buyers tax has reduced sales to overseas buyers, it’s also opening new opportunities for locals. Local buyers will continue to drive demand for condos here.

Resort Markets

Luxury’s top performers in 2018. Not only are residences in demand, but new resorts are raising the bar for luxury and reinvigorating current markets. New developments in Turks and Caicos, including the ultra-indulgent Gansevoort Villas, turn up the heat on interest in the Caribbean. Easy reach from the U.S. and private enclaves generate new interest in the Bahamas. Cabo San Lucas, Mexico is seeing new resorts and other regions along the Sea of Cortez are seeing new development. Mandarina in Nyarit is the site of One & Only’s first collection of private homes. Owning a private island continues to be an ultimate purchase and the Bahamas is ground zero.

Thanks to:

Austin Board of Realtors

Michael Saunders, Founder and CEO Michael Saunders & Company

Anthony Hitt, President and CEO, Engel & Völkers Americas

Aleksandra Scepanovic, Co-Founder and Managing Director of Ideal Properties Group

National Association of Realtors

Northwest Multiple Listing Service, Kirkland, Washington

RE/MAX Canada

Trulia

Zillow

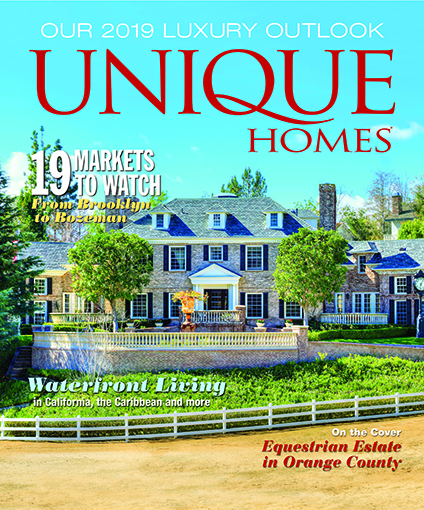

This story originally appeared in the Winter 2019 issue of Unique Homes Magazine.

Leave a Reply