HomeUnion, a leading online real estate investment and management firm, has released a list of the biggest seasonal bargains for investment housing, and found that the winter off-peak period can be the best time of the year to acquire single-family rentals (SFRs). On average, SFR investors paid 6.6 percent less per square foot for the same property during the winter of 2017/2018 as they did during the spring and summer buying season of 2017.

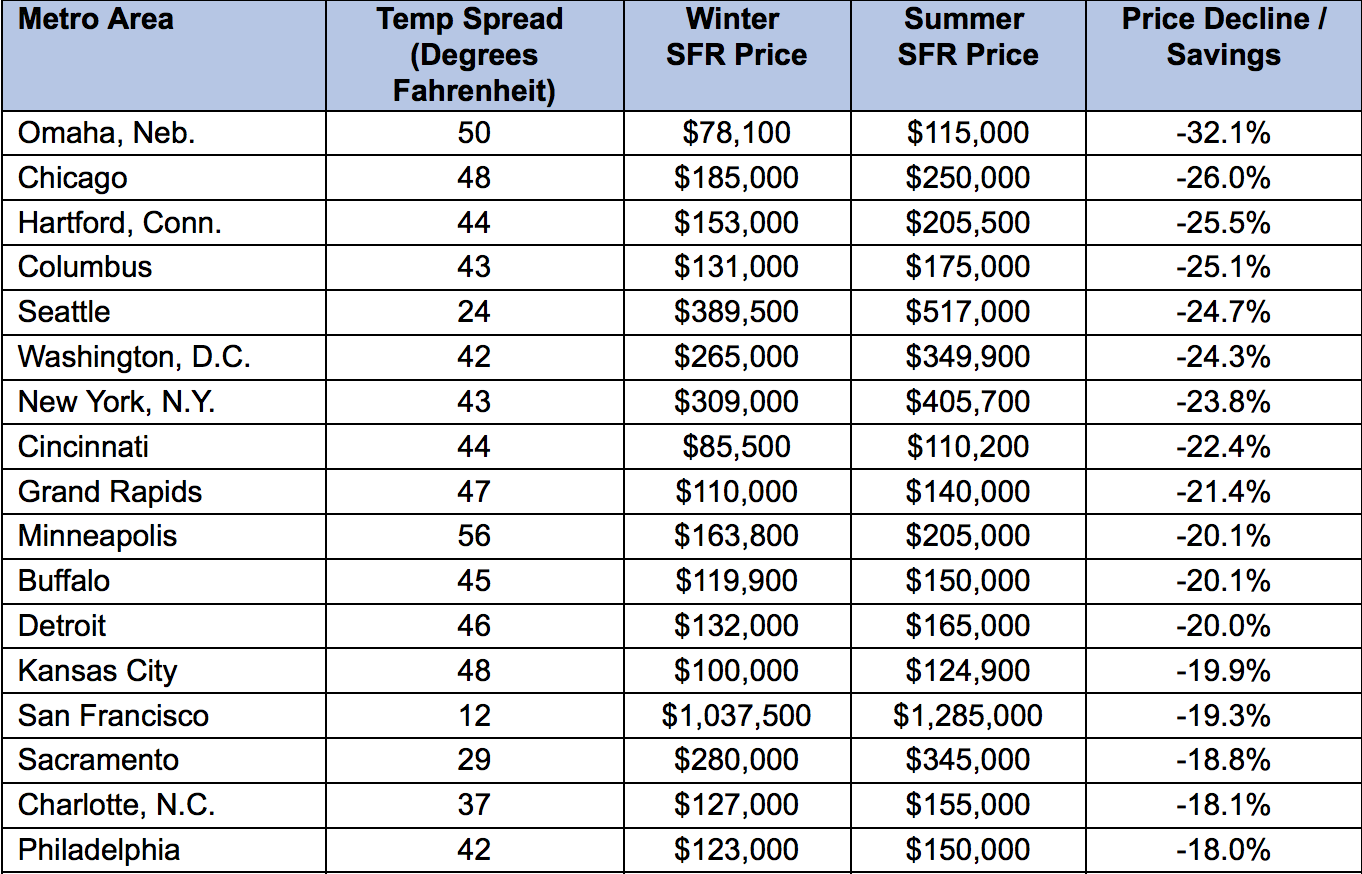

“For the second year in a row, our study found that the wintertime is the best season to acquire rental properties,” explains Steve Hovland, director of research for HomeUnion. “Median home prices drop substantially during the colder months, while rent losses remain marginal for landlords. On average, investors can acquire higher-yielding properties in cold-weather markets like Omaha, Nebraska; Chicago, and Hartford, Connecticut, as well as Charlotte and the Dallas/Fort Worth Metroplex. Rental properties in our top 10 metros are discounted between 20 percent and 32 percent in the winter months, representing a significant savings for investors.”

“Home prices are seasonal as many buyers and sellers delay an acquisition or disposition to avoid a move during a school year. As a result, smaller homes occupied by empty nesters or childless families are more likely to change hands,” adds Hovland.

Here’s a list of the best metro areas to buy rental properties in the wintertime of 2018:

Sources: HomeUnion Research Services, Maponics

To see the complete list, visit HomeUnion.com.

Leave a Reply