In the 10 years since the recession, residential real estate, especially in the realm of higher-priced properties, has morphed into a worldwide enterprise.

“There is no question; people have more of a global mindset. They are looking for real estate in places they love,” says Stephanie Anton, president, Luxury Portfolio International, which several years ago adopted the tagline, “We’re global. We’re local.” The phrase aptly characterizes the status of luxury today.

“The saying goes that all real estate is local, but that does not mean that all buyers are,” said NAR President Elizabeth Mendenhall, CEO of RE/MAX Boone Realty in Columbia, Missouri.

Congeliano, Italy

Photo courtesy of Atlante Properties Luxury Portfolio International®

For the industry, the ramifications of globalization extend beyond merely who buys what, where. “Historically, real estate market dynamics were considered a local phenomenon. In the luxury sector, this is no longer the case, as the value drivers for prime property in one corner of the globe increasingly originate from a completely different region of the world,” explained Christie’s International Real Estate in its 2018 report Luxury Defined, noting this trend is most evident in secondary markets — second home and resort lifestyle destinations. In 2017, sales of resort and vacation homes grew by 19 percent compared to 7 percent in 2016.

Buying property outside of one’s home country is nothing new, but, until the 1980s, sales across borders were generally limited to resort enclaves or a pied à terre in Paris, London or New York, along with the occasional trophy property.

Today, rather than a specific location, high-end buyers are likely to search for a particular property type. “Buyers these days are looking in multiple markets. They’re not as geographically contained. So, if they’re looking for a ski chalet, they could be looking at a number of different countries and throughout the Rocky Mountains in the United States,” shares Laura Brady, president and founder of Concierge Auctions, who says her company initially saw indications of this trend with ranch properties, which are very unique. “Clients don’t care specifically which market they’re in; instead, they want the right property.” Founded 10 years ago, Concierge Auctions has a team in Europe and activity in 18 countries.

Perhaps it’s geography, but Americans typically first look within their own borders. On the other hand, Bob Hurwitz, founder and CEO of the Hurwitz James Company, says, “Wealthy foreign buyers are far more likely to be open minded about locations outside their country as their first choice, in my experience. It’s not difficult to understand if you travel a great deal. In many of the countries I visit on business, you will not find many Americans, but you will meet a wide variety of citizens of other countries.”

More than property and search preferences drive the shift toward a global perspective. “There are several factors contributing to the increased globalization of luxury real estate,” shares Anthony Hitt, president and CEO, Engel & Völkers Americas, who cites the rise of digital, social and mobile technologies. “Real estate is not immune to the changing patterns of consumption enabled by technology; clients have more visibility, and therefore interest, into international homes and listings.”

Experts also point to an increasingly global economy, changing work/life balance and how commonplace travel, for both work and pleasure, has become. Craig Hogan, vice president of luxury, Coldwell Banker Real Estate, plans to exchange his primary residence in Chicago for two small condos, one on Michigan Avenue and another in Puerto Vallarta. “Fifteen years ago, my partner and I never would have considered that. Today, we are mobile. Our careers take us all over the world.”

Falmouth, Massachussetts

Photo courtesy of Robert Paul Properties/Luxury Portfolio International®

“With the world that we live in now, it’s less important that you live where your business is or where you do business. So, you’ve got a lot of people just making lifestyle choices. They’re just picking the city that they enjoy the most, and they’re moving there,” shares Mike Leipart, managing partner of The Agency Development Group in Beverly Hills.

Post-Recession Roots

The foundation for today’s international dynamic lies in the early post-recession years. In 2007 and 2008, prices on average fell by approximately 17 percent across the globe. By 2009, 73 percent of the prime property locations surveyed by Knight Frank had experienced declines, and savvy buyers scoured high-end markets worldwide for bargains. At the same time, a growing uptick in wealth and wealth creation brought more buyers to the international market.

Wealth creation continues at the post recession pace, with the number of millionaires worldwide tallying at 22.3 million, according to Wealth X. Those with a net worth between $1 million and $5 million hold 40 percent of the global millionaire wealth, while the remainder is held by the ultra wealthy, those with a net worth in excess of $30 million (Knight Frank pegs the benchmark for ultra wealth at $50 million). From 2012 to 2017, Knight Frank says the number of ultra-high-net-worth (UHNW) individuals increased by 18 percent, followed by another 10 percent gain in 2017.

Coldwell Banker Global Luxury estimates 32 million millionaires reside in the U.S. The U.S. remained the dominant nation for wealth in 2017, both among millionaires and the ultra-wealthy, according to Wealth X, although growth of this population and net worth in the U.S. was the lowest among the seven top-ranked countries. Japan was second with an 11-percent rise in the UHNW population, followed by China, Germany, the U.K. and Hong Kong.

Mexico

Photo courtesy of REMexico Real Estate/Luxury Portfolio International®

Globally, wealth in 2017 increased in all regions, with both Latin America and Europe showing a resurgence over 2016. “The confidence of foreign buyers is back,” says David Scheffler, president, Engel & Völkers France. “The Parisian luxury market has always attracted wealthy Middle Eastern buyers and continues to do so. Qatari, Kuwaiti, Saudi and Omani clients are looking for outstanding apartments and townhouses, the so called hôtel particulier. The trend to buy luxury properties in Paris is not just reserved for the ultra-wealthy, but applies instead to a wider range of affluent buyers. Some might look for a small 50- or 60-square-meter pied-à-terre, while others look for ‘representative’ apartments in the Haussmann style, up to 12 million euro.”

Over the course of the last 8 to 10 years, cross-boarder buying surged, ramped back, and picked up again. In 2016, global sales of luxury properties retrenched, partially in response to Brexit, government restrictions on wealth and the transfer of money. Markets bounced back in 2017, with sales of $1 million-plus properties up substantially.

Christie’s reports an 11-percent increase in sales, the best annual increase since 2014. Luxury properties sold in 190 days, indicating more realistic pricing in some markets and lack of inventory in others. Exceptions included New York and Miami, which saw an influx of new inventory and a shift in buyer interest. In Toronto and Vancouver, newly introduced cooling measures from the government slowed sales.

“I don’t think there is any indication that they [international buyers] are NOT looking in Manhattan. The indication is that they are either interested in the properties at lower numbers or they prefer to wait the market out and hope to buy when things are at a bottom (I have seen this many times before. It never works!). Nobody is moving to Detroit because they can’t find what they want in New York City,” shares Frederick Warburg Peters, CEO of Warburg Realty. “Russians and Europeans are far scarcer than they were in 2010 or 2011.”

Still, both for high-net-worth and ultra-high-net-worth individuals, New York follows Hong Kong as the best city for prime properties.

Nassau, Bahamas

Photo courtesy of Bahamas Realty/Luxury Portfolio International®

Toronto, Canada

Photo courtesy of Harvey Kalles/Luxury Portfolio International®

Following the recession, a growing body of research focused on wealth and global cities publish multiple rankings. A city’s position may shift slightly, depending on the research, but all reports include the same top locations for luxury properties. Hong Kong places ahead of New York in Christie’s 2017 index, with New York moving up to second, followed by London, Singapore, San Francisco, Los Angeles, Sydney, Paris, Toronto and Vancouver.

Lower prices pushed Miami just out of the top 10, but the city remains a good example of the change international activity can spark. “The international market has arguably impacted Miami as much or more than any other U.S. market. The influx of capital from Europe, South America, Russia, China and Asia has permanently changed our community. The easiest example is by simply looking at our booming skyline,” says Irving Padron, president and managing broker, Engel & Völkers, Miami.

The highest-priced sale globally was $360 million in Hong Kong, and despite government efforts to curb rising prices, there are no indications of slowing demand for luxury residences here. Also, adding to this market, according to Anton, is continued interest from mainland Chinese buyers.

Numbers Tell the Story

Rather than sales and prices, the best indication of just how global real estate has become can be seen in the expansion of major brands, affiliate groups, and even boutique firms worldwide. “All brands are connected globally,” Hogan observes, adding that even independents need some kind of a global connection. “It’s part of the dynamic,” he says.

Coldwell Banker is in 49 countries. Sotheby’s International Realty network has offices in 72 countries and territories. Luxury Portfolio International and Leading Real Estate Companies of the World lists properties in over 70 countries. Who’s Who in Luxury Real Estate’s network includes 130,000 professionals in over 70 countries. Berkshire Hathaway HomeServices recently opened franchises in Germany and in London. Bob Hurwitz had already positioned his boutique firm as an international player before the recession. Today, he has offices in Los Angeles, San Francisco, New York, London, Shanghai and Singapore.

A global orientation can also be seen in members of the Institute for Luxury Home Marketing. There is “an increased focus and intentional approach as they target international buyers through affiliations with brands, networks and associations,” says general manager Diane Hartley. “In fact,” she says, “we have members in many countries outside of North America who are building relationships and sharing business with our members in the U.S. and Canada.”

Whistler, Canada

Photo courtesy of The Whistler Real Estate Co./Luxury Portfolio International

Firms based in Europe also continue to increase their footprint. Founded as a boutique firm in Hamburg, Germany, Engel & Völkers is now in 800 locations in Europe, Asia and the Americas, establishing its first offices in the U.S. in 2007. “We have experienced firsthand the globalization of luxury real estate,” says Hitt.

“For luxury and coastal markets, real estate has absolutely become more global,” shares Leipart. Like a growing number of independent firms, The Agency partners with an international real estate advisory company, Savills, which allows them to sell through 700 offices around the world. Still, he adds, “we are focused on international, kind of connecting the dots around the world as opposed to other cities in the U.S.”

In the luxury world, L.A.’s star continues to rise, and the city in recent years has figured into lists for top global markets. According to the National Association of Realtors, Florida, California and Texas remain the top three destinations for purchases from foreign buyers, followed by Arizona and New York. Still, just under half of all residential transactions for foreign buyers took place in other states. Among buyers, China, Canada, India, Mexico and the United Kingdom account for the most purchases.

Also, Hogan points out, international buyers in the U.S. aren’t always in luxury markets. For example, Asians love to buy real estate close to a university. Another group looks for locations with smaller downtowns. Still others want a large home with a big yard near a lake or river, something hard to find in their home country.

As Much As Things Change

Even though foreign buying in the U.S. slowed in 2017 compared to prior years and to overall activity worldwide, international buyers still have their sights on the U.S. “It’s all about consumer confidence. As long as people feel that the U.S. economy is in good shape and it’s going in the right direction, they’ll buy real estate,” says Brian Losh, chairman of Who’s Who in Luxury Real Estate.

Connections to local markets remain essential. “I will say a lot of it still happens in a very traditional way. People are either coming to L.A. a lot, either they have a child in school here, or they love the area and they decide to buy a home, and they do that through a local Realtor, regardless of where they come from,” observes Leipart.

The tallest residential structure in Queens, Skyline Tower, is set to launch sales of its luxury condominiums later this spring.

The tower’s robust amenity package and proximity to transit for a quick commute to Manhattan are helping to draw newcomers to the prosperous neighborhood. Skyline Tower is located in the Court Square area of Queens, which is known for its abundance of outdoor parks, restaurants and bars and artistic and entertainment venues.

Skyline Tower is the tallest residential building outside Manhattan, making it a game changer for real estate in the Queens borough and setting the stage for the future of luxury residential living in Long Island City.

Designed by Hill West Architects + White Hall Interiors, the 67-story building will offer residents striking 360-degree panoramic views of LIC, Greenpoint, Downtown Brooklyn, Midtown and Lower Manhattan. The designers anticipate that young professionals and families alike will be attracted to the tower’s unparalleled views and plethora of amenities.

Skyline Tower features a 75-foot, temperature-controlled swimming pool, a whimsical, hot air balloon-themed children’s playroom and an extensive spa package with a cedar-lined sauna, a steam room and a massage/treatment room. LIC-based brokerage firm Modern Spaces is selling studio to four-bedroom residences from $500K to $4 million.

Photos courtesy of Binyan Studios.

A selection of gorgeous penthouse units on the market allow for home seekers to find a sky-high residence all their own. From the Italian countryside to the sandy beaches of Hawaii, here are a variety of penthouses across the globe, all with elevated aesthetic sensibilities and access to world-class amenities.

Castello di Casole, Bargagli Penthouse

Tuscany, Italy

Overlooking the hilltop town of Casole d’Elsa, the 3,350 square foot residence is perfectly situated within Castello di Casole, a historic castle in Tuscany, Italy that dates back to the 10th century. It is the ultimate in estate living encompassing three bedrooms, spacious private terrace, full kitchen and fireplace. Owners can enjoy a dedicated concierge, governate and private chefs as well as ensuite dining and spa services.

Photo courtesy of Casali di Casole.

Photo courtesy of Ascent South Lake Union.

Ascent South Lake Union, Penthouse C08

Seattle, Washington

Developed by Greystar, this nautical-inspired two-bedroom, two-bathroom penthouse stands high within Ascent South Lake Union, a 25-story luxury apartment tower newly opened in Seattle’s up-and-coming neighborhood. Ascent South Lake Union offers penthouse residents prime access to the adjacent Amazon headquarters across the street, unparalleled views of the Downtown skyline, Lake Union and the Space Needle, and a host of smart home technology. Penthouse residents have access to The Observatory, a rooftop lounge and open-air deck, as well as an organic green roof, a rooftop spa, indoor entertainment kitchen, a pet spa, life-size Scrabble board and state-of-the-art fitness center. View the floor plan here.

Timbers Kauai, The Kaiholo Penthouse 3202

Kauai, Hawaii

As the pinnacle of luxury at the newest resort and on the lush island of Kauai, the three-bedroom and three-and-a-half bathroom Kaiholo penthouse offers spacious living with cliffside views of the 18-hole Ocean Course at Hokuala, Hau’pu Mountain Range and Nawiliwili Bay. As the largest residence at Timbers Kauai, the penthouse spans 5,239 square feet with a 1,795 square foot private lanai and features include Sapele hardwood floors, natural stone vanities and custom cabinetry, and beautifully appointed kitchens with Thermador Masterpiece appliances and an integrated wine cooler.

Photo courtesy of Timbers Kauai.

On nearly 700 acres of coastal Vietnam, Laguna Lang Cô — one of the most luxurious resorts in Asia — is slated to add the palatial Banyan Tree Residences over the next few years to the ambitious resort. Incorporated seamlessly into the oceanfront jungle, each of the 40 new mountainside residences will include its own outdoor infinity pool.

Located on the northern end of the sprawling property, the luxury villas will vary in size from 1,636 square feet for a one-bedroom layout to 2,799 square feet for a three-bedroom. The residences also boast breathtaking views of Laguna’s nearly two-mile stretch of private beach property.

“These residences really showcase everything that is special about this property — its combination of mountains, forest and ocean,” said Gavin Herholdt, Laguna Lang Cô’s managing director. “Not only will owners get to savor the nature and the amenities here, they will also enjoy attractive arrangements at properties around the globe.”

The design of the new residences is inspired by the architecture of Hue, Vietnam’s former imperial capital city, and is complemented by contemporary accents, including specially chosen artwork. Owners of these world-class villas also gain access to amenities including exclusive access to spas, golf courses, excursions, and watersports.

Photos courtesy of Laguna Lang Co.

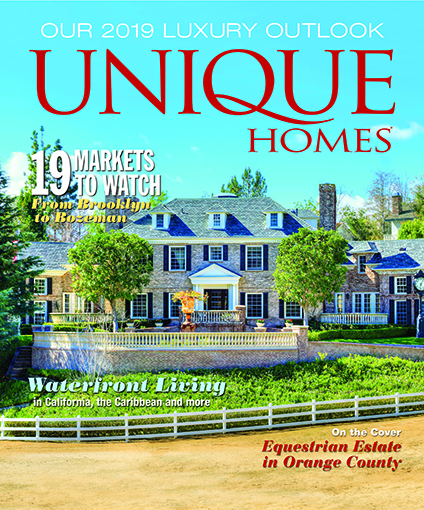

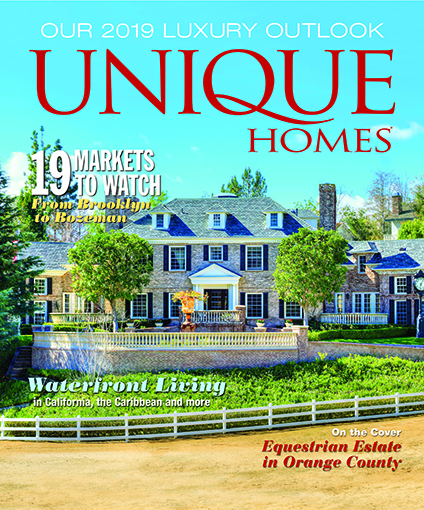

This story previously appeared in the Winter 2019 edition of Unique Homes Magazine.

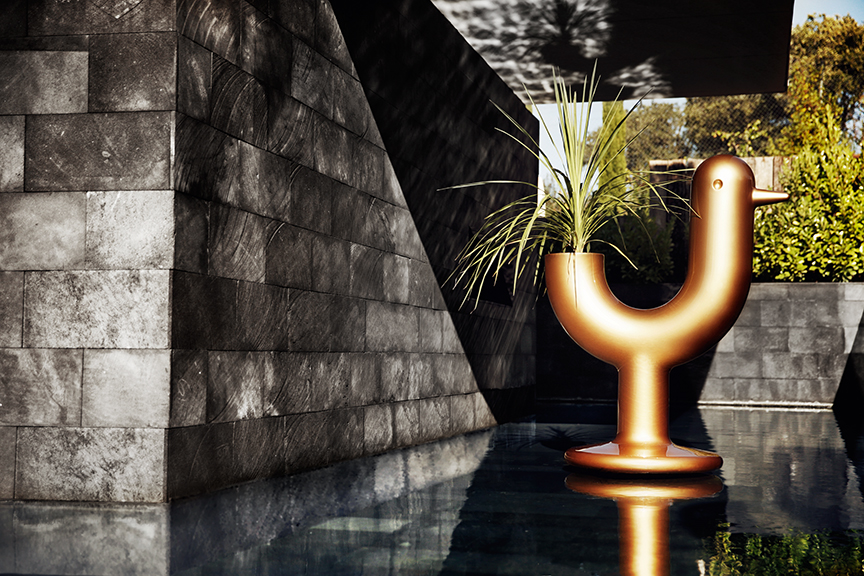

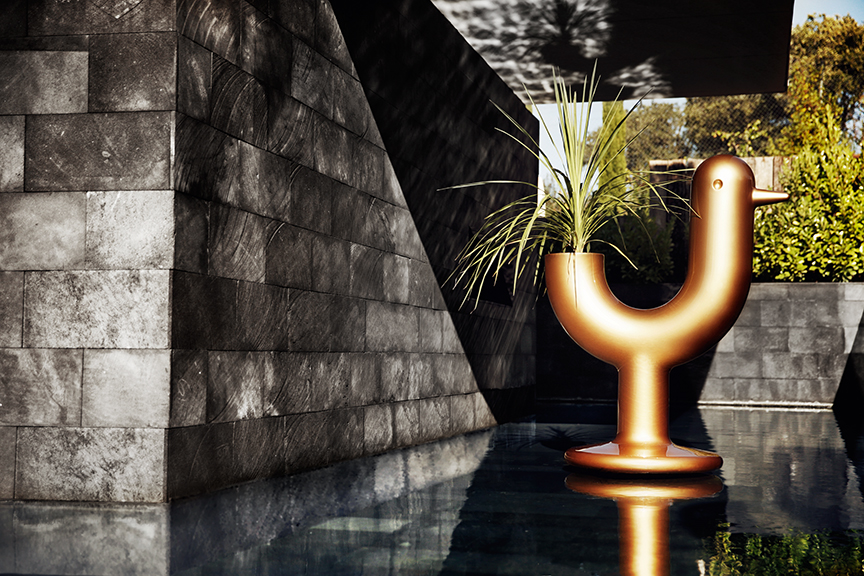

Bring fun and function to your outdoor space this spring with three collections from Vondom, by Eero Aarnio. Modern shapes and unique fun concepts are combined to make up the Roulette, Rosinante, and Peacock collections.

Eero Aarnio, the mastermind behind these designs is described as a “plastic pioneer master and a living legend of modern design,” according to the Vondom website. Aarino has been a freelance designer since 1962, and his iconic designs continue to inspire today.

Rosinante Collection

The Rosinante collection was inspired by the fascinating world of carousels and Ferris wheels. The whimsical nature of the rocking horses makes them perfect for families. With sleek lines and modern colors, the designs are equally as fun as they are sophisticated.

Traditionally a rocking horse only rocks back and forth, but this horse has a base which also enables users to spin. Because the horse was made in Spain, it was naturally named after Don Quixote’s world famous horse, Rosinante.

Another lighthearted collection by Aarino is The Roulette Collection. These undeniably bold chairs are perfect for a relaxed gathering or an afternoon outside. The designer had a concept of the chair’s leg being part of the body in his mind. Aarino ended up with a design that rocks in all directions and also spins because of its contact with the ground at one point.

The high armrests give a sense of security when spinning the chair around and also provides support while sitting. Wanting to find an international name for the chair, which also would immediately give the association for the spinning motion, Aarino ended up with the name ”Roulette.”

The Peacock collection fits in perfectly among Aarino’s other designs or stands alone to make a adventurous statement. The planter is in the shape of a peacock but the image isn’t complete without the addition of a plant to serves as the tail. The collection was inspired by the designer’s own childhood memories of the animals, which fascinated and scared him.

Photos courtesy of VONDOM

Well-designed luxury garages are a far cry from the cluttered, dusty rooms where most standard vehicles are kept. For high-end homeowners, their garage upholds the elegant aesthetic found in the main home; but instead of sheltering people, the garage protects their luxury vehicles.

Widely considered to be the perfect extension to a dream home among car enthusiasts, luxury garages are strategically designed to show off the homeowner’s collection of vehicles and related items. Some manufacturers have developed materials specifically to be used for cabinetry in luxury garages, removing the need for kitchen-like cabinets to ruin the sleek, yet rugged vibe of the space. This cabinetry can be complimented by a stainless steel sink and counter space to increase functionality.

Slatwall panels are another popular storage strategy — they double as a finished wall covering and place to store tools and accessories. Similarly, a polyaspartic floor coating not only contributes to the polished look, but also serves as a durable protective layer to prevent damage due to abrasions, spills or moisture.

When designing a luxury garage, consider shades of blue, gray, red and black. Metallic accents, such as a diamond plate backsplash, add depth to this look. Choosing a color scheme that mirrors that of the luxury vehicles will help you achieve a put-together, distinguished design.

Some luxury garage owners choose to install a car lift. This can help homeowners store more vehicles in an area with limited space, or keep seasonal vehicles out of the way during the winter. Other popular amenities include upgraded garage doors that can be controlled remotely via smartphone, as well as year-round climate control. Especially in climate-controlled garages, many hobbyists choose to include a workshop, as well as a TV or sound system to turn their luxury garage into the ultimate leisure space.

Photos courtesy of BIR Luxury Garages.

Timbers Resorts, the leading developer and operator of luxury boutique properties around the globe, recently announced the opening of the highly anticipated Timbers Kiawah – Ocean Club & Residences, the first new residential development on Kiawah Island’s oceanfront in over 30 years.

Made up of 21 thoughtfully designed residences across three oceanfront buildings, the new development is the first and only residence club on Kiawah Island, offering buyers a completely new way to approach home ownership on the sought-after island.

“Timbers Kiawah is the front row seat to the best beach on the Eastern Seaboard,” says David Burden, Executive Chairman and Founder of Timbers Resorts. “Developed with families in mind, we believe it provides the ideal setting for generations – it captures the spirit of the Lowcountry and showcases the ultimate in oceanfront living. We are excited to be a part of the tight-knit community of Kiawah and we look forward to welcoming all of our new owners to the Timbers family.”

Featuring coastal interiors by J. Banks Design and architecture by Poss Architecture + Planning, Timbers Kiawah – Ocean Club & Residences features resort-like amenities including a private clubhouse with a central lounge area, temperature-controlled owners’ wine storage, private bar and state-of-the art fitness facility. Also available exclusively to Timbers residents and their guests is a private beach club with an oceanfront pool and beach services, as well as an array of family and children’s programming.

“The Timbers Kiawah experience is unlike any other in the Lowcountry,” says Greg Spencer, CEO of Timbers Resorts. “We curated a team of the most talented professionals to provide a fresh and exclusive experience on Kiawah Island. From the interiors to the roster of activities, we work diligently to provide a carefree setting for owners to relax and enjoy what Kiawah has to offer.”

With sales on track for sell-out, Timbers Kiawah’s sales success proves the continued strength of Timbers Resorts’ fractional ownership model. The Timbers concept affords owners a hassle-free owning experience—both on and off the island—by providing year-round onsite management as well as pre-arrival provisioning, on-island concierge services, owner storage, valet parking and daily housekeeping.

Currently for sale, Timbers Kiawah residences are housed in three separate buildings connected by the property’s exclusive beach club and pool deck. Each home features panoramic views of the ocean and spacious interiors fit for families. Recognized as some of the most prized real estate on Kiawah Island the 18 three-bedroom homes total over 2,200 sq. ft. each, while the development’s marquee listings—its three four-bedroom penthouses—boast over 3,600 sq. ft. of interior space. All residences feature floor-to-ceiling windows, expansive outdoor terraces and a host of high-quality finishes and furnishings – most of which were custom crafted by J. Banks Design, an international firm recognized by Interior Design as among the best in hospitality design.

Timbers Kiawah also features a clubhouse and lounge, owner services team, temperature-controlled wine storage, kids play room and a state-of-the-art fitness facility. Here, residents can send postcards custom designed by Charleston artist Rick Sargent to their families and friends; request any service ranging from meal delivery to babysitting; and book dining reservations and daytime excursions. Upon purchasing a residence, Timbers Kiawah will commission a caricature portrait of the family, which will hang in the clubhouse’s main room.

Timbers Kiawah provides owners with private access to a dedicated set of luxury amenities and personalized services. The heart of the resort is the beach club, where the oceanfront pool, residents-only restaurant and beach services are all located.

Throughout the property, Timbers Kiawah only uses bamboo cutlery and straws to help protect Kiawah Island’s threatened sea turtles. Conservation is a large part of the company’s DNA, and new programs dedicated to this cause will continue rolling out throughout the next year.

Photos courtesy of Timbers Kiawah.

A London-based online marketplace dubbed “Amazon for millionaires” has launched, offering the world’s super-rich the chance to buy the finest luxury items across all categories, all on a single website.

The site offers fine art, jewelry, watches, property and even yachts, all delivered to your door (or mooring) direct from the seller.

With a catalog of more than 200,000 luxury goods from all around the world, brought together in hand curated collections and categories, HushHush.com launches as the largest collection of luxury goods and services, all available in one trusted and secure place.

“We wanted to create the leading destination for millionaires and billionaires to buy the finest things in life, all conveniently on one website,” says founder and CEO Aaron Harpin.

A list of the most expensive items appearing on the site includes a £2 million jewel-encrusted Rubik’s Cube, a range of luxury superyachts, a selection of the most sought after hypercars, some of the world’s finest watches, fine art and more.

The most expensive item currently on sale on the marketplace is a £41.3 million Admiral Explorer yacht, but with a regularly updating catalogue of items, this is likely to change.

Offering the most exclusive luxury marketplaces and VIP concierge services to affluent buyers, HushHush.com helps customers from around the world access all the luxury products and services they want, all on one site.

HushHush.com aims to collate the best of the best available around the world and partners with sellers to reach their audience. With a VIP personal shopping concierge service, the discerning team promises to find anything for its buyers, at any hour of the day.

With a focus on customer service and delivering the best possible buyer experience, the site is targeting the world’s wealthiest consumers. HushHush claims the internet’s largest collection of luxury products and experiences, delivered with first class service and support, all in one place.

Photos courtesy of HushHush.

Usually, it’s possible to sum up the outlook with a pithy phrase, but this year the luxury landscape is nuanced. Some markets sizzle; others simmer. Dynamic outside forces are at play and will potentially exert even more influence in 2019. In the background, the words recession and bubble are whispered, but most experts don’t see either in the cards, particularly for residential real estate in 2019.

“In most markets, I think it’s a case of ‘from great to good,’” says Stephanie Anton, president of Luxury Portfolio International.

“We’ve left a crazy market, and we’re moving into a more normal market,” shares John Brian Losh, chairman of Who’s Who in Luxury Real Estate. “We are beginning to see a more normalized market where supply is more equal to demand. Even in the luxury market, there are fewer bidding situations.”

According to Redfin, the number of competitive offers fell from 45 percent to 32 percent in 2018. Still, some ZIP codes in busy markets such as Boston, Washington, D.C., and the Bay Area remain hotbeds of competition, with the number of multi-bid scenarios increasing in the third quarter.

© istockphoto.com/JZHUK

Concerns about potential bubbles continue to percolate, but economists and other experts caution that fundamentals are strong and for real estate the next downturn will be different. “The recent tax reform and increased government spending have been a shot in the arm of the U.S. economy,” Tim Wang, head of investment research at Clarion Partners, explained to journalists at the Urban Land Institute’s fall conference. Wang and other experts expect the current expansion of the economy to continue through 2019, tapering to 2.5 percent next year.

“The housing market is following the trend in the overall economy, which needs to be noted because housing led the last downturn,” comments Marci Rossell, chief economist for Leading Real Estate Companies of the World, citing politics and global uncertainty as factors affecting real estate. This time, she says, “the casualties will be a little bit different, and because of that I don’t anticipate a meltdown.”

A cooling period is how Craig Hogan, vice president of luxury at Coldwell Banker Real Estate, characterizes the luxury climate, particularly in the second half of 2018. It’s a change Coldwell Banker has anticipated. “For any of us to think it was always going to be incredible is a little naive. The market is always going to fluctuate.” Hogan says it’s important not to interpret cooling as a market decline. “Cooling is a normal fluctuation, while a decline happens when the value of homes begins dipping.”

“There hasn’t been any great price suppression. Houses are staying on the market a little longer, but demand is still healthy,” says Losh.

“I think we’re still going to have a very strong year overall. I do believe we’re seeing price adjustments, and that’s okay. I think the key is watching how long properties are staying on the market and watching the size of the price adjustments,” observes Lesli Akers, president of Keller Williams Luxury International.

The average sales price for Sotheby’s transactions is up year over year. “From a luxury point of view, many of our companies are having a record year,” says Philip White, president and CEO of Sotheby’s International Realty. “Revenues are up, and in some cases pretty significantly,” he shares, noting that this number also reflects significant recruiting and/or acquisitions by some companies.

Recent stats show prices for upscale properties still increasing, but at a slower pace than past years. The number of sales in many places has dipped, but that differs by location, and in more than a few instances sales still exceed 2017.

Data from the Institute for Luxury Home Marketing (ILHM) shows median prices for single family luxury homes climbing 8.5 percent in November over October, while the number of sales fell 11.7 percent. For attached luxury properties, sales rose 2.6 percent with a 2.3 percent hike in prices.

Putting the current market for real estate overall into perspective, Lawrence Yun, chief economist for the National Association of Realtors, said, “2017 was the best year for home sales in 10 years, and 2018 is only down 1.5 percent year to date. Statistically, it is a mild twinge in the data and a very mild adjustment compared to the long-term growth we’ve been experiencing over the past few years.” Yun and other housing economists are quick to point out that new construction still hasn’t caught up with demand and foreclosure levels are at historic lows, factors which make the current climate different than the run up to the recession. NAR’s forecast calls for an overall price increase of about 3 percent in 2019 while the number of sales flattens or edges up very slightly.

Tale of Two Markets

Luxury’s story is a little different. “This year the luxury market has been a tale of two markets, for sure. Some areas are struggling, but most have been stronger than many realize, particularly in the first half of the year. As median prices have been slowing (and getting lots of media attention), the top 5 percent of many major metro markets nationally have been growing, with sales over $1 million up over 5 percent year over year and prices breaking records, in some cases by double digits. In the majority of markets, inventory has been selling faster. This is happening simply because of the health of the affluent,” observes Anton.

What sets this year’s outlook apart is that some places are having a strong, dynamic market, while others are seeing a softening, often only in specific price brackets. “The slowdown that started on the East Coast is having some effect on the West Coast. But it’s not a typical slowdown,” says Mike Leipart, managing partner of new development at The Agency. “Good product that has relative value is continuing to transact.”

The top three sales nationally in the third quarter, each over $30 million, occurred in Laguna, and seven out of the top 10 were in Southern California.

Rather than a general market malaise, Leipart characterizes the slowdown as more of a spec home problem. “It’s just too much has been built too fast, and not all of it is very good. The people who thought they could build a house for $15 million and sell it for $30 million are struggling.”

The higher price points in L.A. may see an even stronger downturn in the near future, suggests Bob Hurtwitz, owner of Hurwitz James Company, who typically works in the very high end. “There is a lot of inventory on the higher end, and luxury home buyers are usually in a position to wait and see. The drops in price are a lot more dramatic on property at $15 million and above, and buyers are aware of the benefit in waiting to see how it plays out. At the ultra-high end of $100 million or more, you are going to see and already are seeing huge reductions in price.” What’s hot in L.A.? Luxury penthouses in full 24-hour security buildings in prime areas, according to Hurwitz. “High-end penthouses will continue to be in-demand from foreign buyers purchasing as a part time home or for housing for their children.” Other price brackets, notably the $1.5-million to $3.5-million range, are busy, and, Hurwitz says, his agents are doing a lot of deals.

Perceptions of prices in Manhattan can be skewed, since recent closings are often for new construction for which contracts (and prices) were written a couple of years prior. Even though stats show sales decreasing, Ellie Johnson, president of Berkshire Hathaway HomeServices New York Properties, says, “There is still a healthy but steady group of buyers that are still out there in the high-end luxury landscape.” Additionally, New York is particularly keyed to Wall Street, and volatility in the stock market often means more money gets transferred into brick and mortar. “We’ve seen an uptick that we didn’t have at the beginning of the fall season,” Johnson observes. Despite a less than stellar real estate market at year end, New York remains a global gateway and the top city for global wealth.

Manhattan

© istockphoto.com/CreativeImages1900

Los Angeles

© istockphoto.com/SeanPavonePhoto

St. Petersburg

© istockphoto.com/SeanPavonePhoto

In other locations, particularly those with lower prices for upscale properties compared to California, Florida or New York, reports show strong interest and price growth. An acre in one of Atlanta’s prime addresses in Buckhead can demand as much as $1 million. It’s just one indication that luxury here continues to reach new price levels with considerable demand coming from outside the region, including buyers from California and Florida. Some relocate simply because they want a home in the city; others follow corporate moves. The city has also become a favorite for the film industry, which has become a $4 million industry. “It’s changing everything about this city,” says Debra Johnston with Berkshire Hathaway HomeServices Georgia Properties. Luxury really doesn’t begin until the $5 million threshold, says Johnston, but prices compared to Florida and California are reasonable.

At one time, it was thought it might take more than 20 years for Florida real estate to recoup from the recession. In October, the state tracked 82 consecutive months of price hikes for both single-family and condo-townhouse properties, with many cities showing double-digit increases in the number of sales. “The overall market in Florida, particularly higher-end areas such as Sarasota, Naples and Palm Beach, is definitely strong and stable. Maybe not as robust as say 2013 and 2014, but we haven’t had any major slide — except the economists talking about the market slowing down,” says Pam Charron with Berkshire Hathaway HomeServices Florida Realty in Sarasota.

“The St. Petersburg market seems to be performing differently than other Florida markets and other national trends,” observes Tami Simms with Coastal Properties Group, noting November sales skyrocketed over the prior year. “We have developed into a year-round market with luxury downtown condominiums in high steady demand.” Another sign of consumer confidence is lack of defaults on pre-construction sales. “When we experienced the crash, those buildings that had been sold out prior to completion experienced a significant number of defaults. We see none of that in this instance.”

Florida is one of several states including Texas and Nevada benefiting from changes in tax law. Tax changes not only force some to reevaluate where they live, but they also impact the margins of price brackets. “While it doesn’t mean people wholesale leave New York or San Francisco, marginal changes tickle up and trickle down to the next closest price level,” and it will take several years for that to be felt, says Rossell.

The New Market

“So many trends have taken place they are no longer trends, they are the new market,” observes Hogan, using new construction as one example. “It doesn’t matter where you go or who you talk to, new construction is part of the conversation.”

Global demographics will have a long-term impact. “What luxury is adjusting to is a different demographic worldwide. Those aging baby boomers are kind of done with big homes and the following demographic is 50-percent smaller,” Rossell says.

Changing demographics affect location and property type. “I think we’ll see increased demand for primary residences in traditional second home and resort markets. We are seeing this trend in select markets, as individuals who have the freedom to work remotely are opting to live in places where they feel their quality of life will be the best,” observes Anthony Hitt, president and CEO, Engel & Völkers Americas.

Summer 2019 will mark the most prolonged economic recovery since World War II, but wild cards including interest rates, a trade war and further instability could easily derail this expectation. However, there is a silver lining to the current market. Increasing inventories will bring some buyers back to the market and create more demand. “I think it’s going to a be a great opportunity. People will buy things that they haven’t considered, and they’re going to buy more of them. I think that’s been a big challenge. We’ve not had the inventory, and a lot of buyers kind of just fell out of the market because they didn’t feel like there really was one,” explains Akers.

ILHM President Diane Hartley believes 2019 will be a year of opportunity for both buyers and sellers provided they remain agile, innovative and adaptable to their local market influence.

This story originally appeared in the Winter 2019 edition of Unique Homes Magazine.

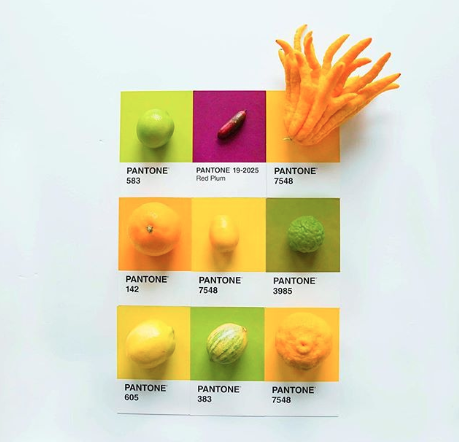

Appetizing images creatively pair color and food.

When social media marketer Lucia Litman moved to California, she was blown away by the colorful variety of fresh produce that was now available to her. Pleasantly surprised by her new normal, Litman, who also goes by her nickname Lucy, began to document her encounters with fruits and vegetables on her Instagram page.

“There were fruits I hadn’t heard of and vegetables that came in colors I didn’t know was even possible,” she says.

In search of a way to get a larger audience excited about healthy food, she started a series of “#PantonePosts” — a blend of design, nutrition and lighthearted appreciation for everyday luxuries.

Lucy aims to match fruits, vegetables and other foods to Pantone swatches as closely as possible. Captivating her followers with strikingly similar pairings, she not only features superfoods, but some treats as well. Everything from leafy greens to chocolate-covered fortune cookies has made an appearance, as well as some inedible, but naturally beautiful phenomena like sunsets and flowers.

“I don’t try and push any sort of diet on people, which I think is important,” she says. “There are so many people out there who say that ‘x diet’ is the best, when in reality, it really depends on your body. So I just hope that my photos can bring people together and make them appreciate food and be able to enjoy it online without being preached at about a certain diet or lifestyle.”

Despite her carefully curated page that suggests she’s a professional artist, Lucy describes her popularity as “a big surprise.”

“It started off as just a hobby, but I get so excited anytime someone shares my work and it makes me so happy to know that people enjoy it,” she says.

Photos courtesy of Lucia Litman via Instagram.