With prices for residential real estate hitting and then exceeding $250 million, stratosphere was the word often used in recent years to characterize the pinnacle of the market. This year, prices for the most expensive in the U.S. are holding steady, perhaps moderating slightly (Refer here for last year’s lists). With the ultimate price remaining at $500 million and the lowest of the top 10 at $135 million, down from 2018’s $138.8 million, it would seem “holding steady” would be an appropriate sobriquet this year.

When the first edition of Ultimate Homes was published 14 years ago, the highest-priced property in the U.S., an extensive estate in the Hamptons with a huge array of amenities including a golf course, was $75 million. The prospect of a $100 million home was denitely on the horizon, but anything nearing a billion was not even on the radar. Yet, for the last two years, the reported asking price for a mega mansion touted as “the most expensive home in America,” has been $500 million; the lowest price among the top 10 exceeded $100 million for the last four years. Geographically, Ultimate stars have appeared in many of the country’s top luxury locales. Recent years have seen a move toward the West with L.A.’s million-dollar meccas dominating the top group. Timeless blue chip estates, many with extensive pedigrees including notable architects, owners and visitors, comprised most of the top 10 in the initial years.

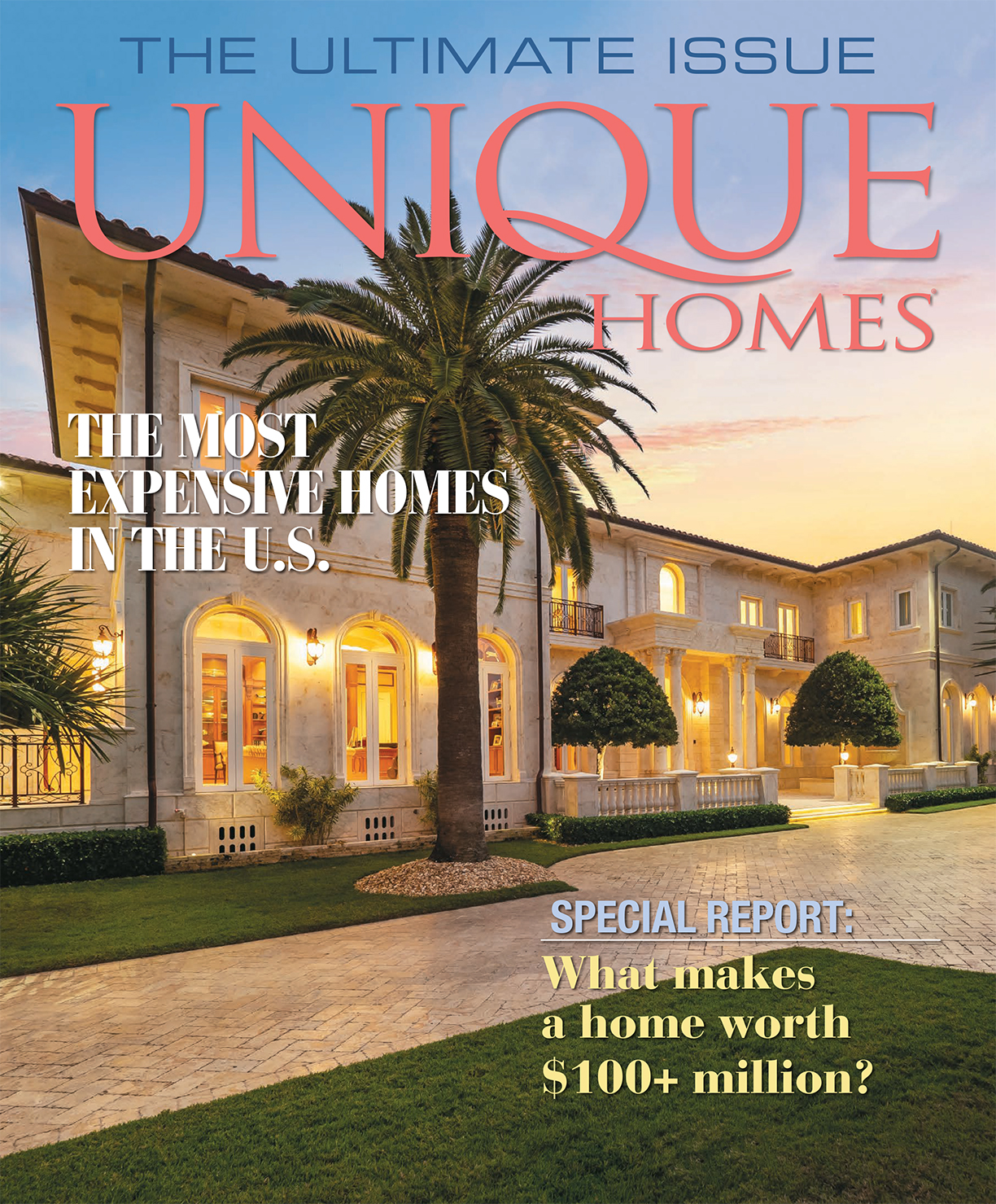

La Follia, Palm Beach, Florida. Photo courtesy of Giles Bradford

Billion-Dollar Building Lot?

Undeveloped land without a house does not qualify for the Ultimate list, but it’s worth noting that last summer a $1 billion listing was posted in the multiple listing service for a 157-acre mountaintop spread in Beverly Hills. Since then, the price has been reduced by 35 percent to $650 million. Also, not on the Ultimate list is a $150 million parcel, One Enchanted Hill, that was the estate of Paul Allen, also in Beverly Hills. The property has many improvements including roads and two entrances, but the main house was razed.

Many see prospects for the premier market, particularly in L.A., as positive. Three years ago, Gary Gold with Hilton & Hyland sold the Playboy Mansion for $100 million, a record at the time for Los Angeles county. “Ever since then, we’ve seen more really big sales than ever before,” he observes. “The reason I think the ultra-luxury market is going to do well this year is there happens to be product worthy of big numbers. If there is no product available, nothing is going to trade, just because there’s nothing available. And there happens to be enough really nice, expensive big houses that are going to trade.”

Over the last 10 years, wealth globally has had a remarkable surge. Stephanie Anton sees growth in the number of ultra wealthy as a driver pushing the evolution of luxury, particularly in the highest-priced echelons. As buyer profi les evolved, luxe penthouses in new super towers along with newly constructed mega mansions created new residential categories and pushed prices upward. Properties with provenance such as Chartwell and Beverly House, along with classic estates, still have a place among best of the best. The “ultimate trophy and legend cherished for generations” is the way Beverly Hills broker Jade Mills characterizes Chartwell, a Bel Air legend designed by Summer Spaulding in 1930. A French Neo Classical exterior comprised of symmetrical cut limestone imparts a timeless presence. Henri Samuel, whose work includes estates owned by the Vanderbilts, Rothschilds and Valentino, refurbished the interior in the late 1980s. Located in the heart of Bel Air, Chartwell sits on 10.3 acres and is often described as the crown jewel of

Bel Air.

The property also includes a guesthouse designed by Wallace Neff and acres of manicured gardens. Multiple agents including Jeff Hyland and Gary Gold of Hilton & Hyland; Joyce Rey, Jade Mills and Alexandra Allen with Coldwell Banker Residential Brokerage; and Drew Gitlin with Berkshire Hathaway Home Services California Properties are representing the property. “Chartwell certainly ranks as one of the most prestigious and beautiful properties I have ever represented. Additionally, the acreage is most unusual with four separate parcels and the exceptional panoramic views of downtown Los Angeles and the Pacific,” comments Rey. This property would appeal to a very specific buyer, explains Jeff Hyland, “one who has class, sophistication and taste.”

Prime Assets

Steller architecture along with extensive and amazing amenities are a prerequisite for every top property. They add value and promote an over-the-top lifestyle, but architecture and amenities alone will not merit prices at the very top. Where they are located still matters and almost every property this year has a prime address.

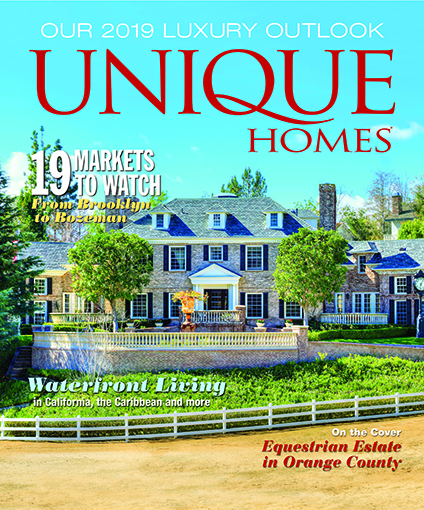

“Location is still a top consideration for potential buyers,” says Rey. Also important for long-term value, according to Rey, is the land. Just five minutes from the Beverly Hills Hotel, with over seven acres, Villa Firenze is the largest single property in Beverly Park, the largest collection of single-family mansions to be built in the U.S. in the last 50 years. With its own street, the property is its own Italianate village and includes two guest houses in additional to a 20,000-square-foot mansion.

Meadow Lane in Southampton, New York, priced at $150 million, offers 14 acres, four separate lots and a 12,000-square-foot main residence as well as a tennis court with a tennis house, two golf greens with golf houses, and a pool and spa house. Harold Grant with Sotheby’s International Realty says the views up and down the Atlantic, in addition to unobstructed views across the bay, will “take your breath away.” In Palm Beach, only a handful of homes reach from the ocean to Lake Worth. La Follia, priced at $135 million, is the only direct ocean-to-lake estate on the entire island, according to Ashley McIntosh, executive director of luxury sales at Douglas Elliman in Palm Beach. “It is one of the most signifi cant properties on the island of Palm Beach,” she says. Italian Renaissance in style, the home is entirely wrapped in cream Coquina coral stone that extends into the two-story foyer. The top fl oor was designed for the master suite, which has “staggering views” of the ocean, along with his and hers baths, each with a balcony and dressing room, overlooking the ocean.

Villa Firenze, Beverly Hills, California. Photo courtesy of Tyler Hogan.

Irreplaceable

In nearby Manalapan, a 15-acre estate dubbed Gemini offers approximately 1,200 feet of dune-lined beach on the Atlantic and 1,300 feet on Lake Worth. A series of tunnels, including one that is a 15-foot-wide gallery, connects the two. The site, perched on top of a dune, offers 360-degree views, yet it’s only minutes to Worth Avenue in Palm Beach. In addition to the main house, it offers two, four-bedroom beachside cottages, a seven-bedroom house, and an additional staff or guesthouse, making it a true family compound with more than 30 bedrooms. Like Gemini, many Ultimate properties would be diffi cult to replicate. Agents call them “once-in-a-lifetime opportunities.” Mesa Vista, a massive ranch in East Texas, is another such property. Billionaire Boone Pickens has devoted more than 50 years to transform this 100-square-mile expanse of Texas panhandle into an unmatched oasis and wildlife habitat.

Improvements include 20 lakes over the course of 20 miles. In addition to a 12,000-square-foot main lodge, there is a 33,000-square-foot lodge and several other houses, plus housing for staff. The chapel, a site for both weddings and funerals, is stunning, and a 6,000-foot runway and hangar facilitates getting there. The ranch is listed at $250 million.

“It seems impossible to comprehend all of the improvement made to this property, whether it is structural improvements, water enhancements, landscape or wildlife conservation features. To our knowledge, no other ranch can replicate Boone’s Mesa Vista Ranch,” says Monte Lyons, managing director of Hall and Hall, who is representing the property along with Chas. S. Middleton and Son.

Super-Sizing Luxury

In addition to being the most expensive, The One is also one of the largest homes in the country, with an estimated 100,000 square feet. The estate is nearing the end of a half-decade-long construction process, and agents expect completion in the next few months. It also reflects a new bent for ultra properties, particularly in Los Angeles, which takes the term “trophy property” to a completely new level. In addition to expansive views, a huge number of very premium amenities from multiple pools and elevators to garages, these estates include almost everything a newly minted billionaire might want, taking the idea of a turnkey home to a new level.

Billionaire, once again No. 6 on the Ultimate list, is priced at $150 million after a $38.8 million price reduction. It’s completely furnished, staffed and decked out with a huge array of indulgent features and additions, including more than 100 curated art installations, two stocked wine/champagne cellars, a multi-million dollar collection of cars in a custom design gallery and a 40-seat 4K Dolby Atmos Theater. Unlike custom homes which are designed for an individual buyer, new mega spec homes are geared toward a group of buyers with a great deal of specificity.

What hasn’t changed over the years are the diverse features of every Ultimate home, although what were once perks are now considered a “must-have,” including all of the tech bells and whistles, as well as privacy and state-of-the-art security. Wellness has always been a consideration, but now expands beyond space for gyms, yoga and massage. Priced at $135 million, 2571 Wallingford Drive is located in another prime Beverly Hills location and offers a one-of-a-kind indoor sports complex with basketball, pickleball, gym, a boxing ring, sports bar and outdoor lounging, according to Ginger Glass with Coldwell Banker Residential Brokerage.

Meadow Lane Oceanfront, Southampton, New York. Photo courtesy of Sotheby’s International Realty.

“These are consumers who can afford anything they want, but that is nothing new. Ultra high-net-worth consumers want it all, and they can afford it all,” says Anton. “Today in the ultra premium category, we are seeing demand for a lot of square footage in a beautiful setting, and/or view lots with fabulous outdoor space for entertaining and plenty of room to entertain guests, among other things. People are looking for homes that meet the needs of their busy, over-the-top, social, connected lives, but also for their home to be a safe refuge to get away from it all.”

On three occasions Joyce Rey sold the most expensive home in the nation, establishing multiple benchmarks for price — in 1978 for $4.2 million, 1990 for $19.9 million, and 2010’s $50 million record. Last year, the highest priced sale was a $110 million oceanfront compound in Malibu, which was also the most expensive sale ever in Los Angeles. So far, 2019 could be seen as a record-setting year, with the sale of a $238 million penthouse residence at 220 Central Park South in New York, which was an Ultimate top property last year. The sale set a record for a U.S. residential property. Designed by Robert Stern and located adjacent to Central Park, the building has become one of Manhattan’s most renowned properties. The price is more than impressive and surpasses other records for the U.S., which include a $147 million estate in the Hamptons that sold in 2014 and Copper Beech in Greenwich, which sold for $120 million also in 2014. Both eclipsed previous records, including a Woodside, California, estate that sold for $117.5 million in 2012.

When it comes to indications of what might occur in the future, and even the correct context within which to understand the present market, a look back doesn’t always provide the best insights. Regarding this year’s recent record sale price, appraiser Jonathan Miller cautions in his blog that the price may not be an indication of future trends because the contract was finalized in 2015, at the height of Manhattan’s supertall and super-luxurious building craze. However, Jeffrey Hyland believes there are several good indicators that bode well for future ultra-luxury sales in California. He estimates a large number of IPOs this year. “All these people are going to have so much money they will be looking to dispose of.”