10 Years Later

Our year-long look at what’s changed in U.S. luxury real estate since the 2008 recession.

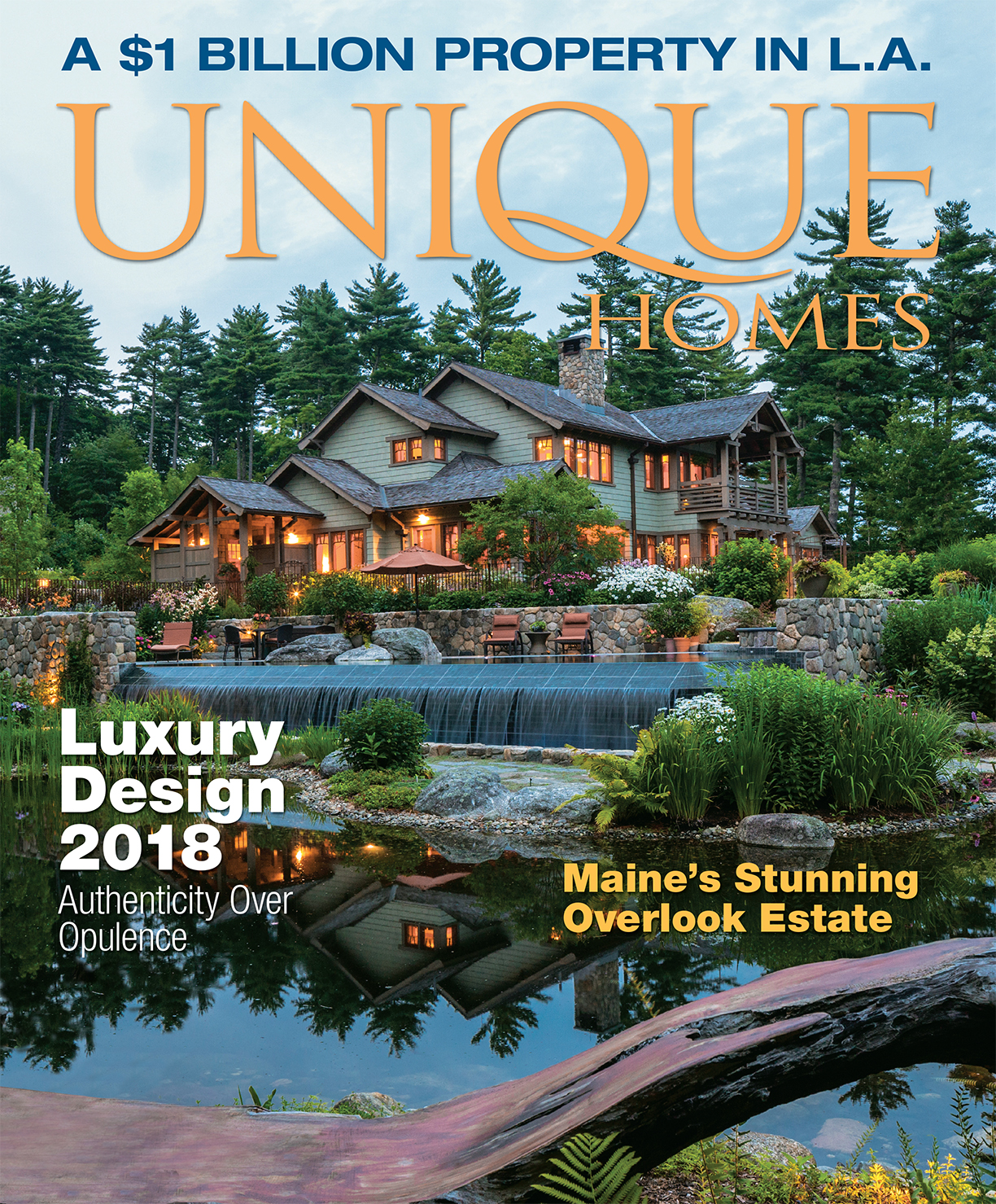

When it comes to architectural styles and design trends, authenticity — not opulence — is what consumers want today.

Contemporary … modern … innovative … intentional … authentic … flexible … sum up residential real estate today. During the recession and early recovery, expectations focused on the “new normal,” what real estate and life, in general, would be like following such a seminal event. But real change is often subtle yet inexorable, and that is the story of residential architecture and design over the last 10 years.

After almost a decade, the much hyped new normal has finally arrived. Almost suddenly, it seems everything — architecture, design, outdoor connections, consumer attitudes — has been revamped in ways that entirely transform luxury homes. “It’s not just about how beautiful the building is, but what’s the experience. That’s a big evolution from where we were pre-recession,” observes Bruce Wright, AIA, vice president and principal at SB Architects.

Architecture

“Before the recession, I would say of the 60 to 70 homes we design a year, we would get one contemporary request and maybe a transitional request from clients. Now it’s flat-out contemporary. We’re talking flat roofs, pools on the roofs, outdoor screened rooms up on the upper levels,” says

Michigan architect Wayne Visbeen, AIA. “The resurgence of mid-century modern has also been a big, big part of our business.” Even when clients want homes that reflect regional architecture and connections, he says, “it’s with a contemporary edge, definitely with more simplicity and less frou-frou.” Visbeen’s firm works in 48 states and 10 countries, and he sees the move toward contemporary, notably a warm contemporary, playing out nationwide. Also in demand, even in locations as diverse as Beverly Hills and Miami, is an interpretation of contemporary dubbed “modern farmhouse.”

In the South, Stephanie Gentemann, AIA, a partner at g2Design in Savannah and director of Palmetto Bluff’s design review board, a transitional aesthetic, which she sees as a blend between contemporary and traditional, is gaining prominence. Gentemann also sees modern farmhouse garnering interest. Preferences for contemporary, transitional and modern farmhouse are not restricted to upscale homes, but range across all age groups and income levels.

For luxury, Gentemann says, “The more expensive the house, the more eclectic we get in terms of architectural style. There isn’t one predominant style that I see that is dictated by price point.”

©2018 Ciro Coelho / CiroCoelho.com

“What we see now is driven by a better- educated consumer. We’re seeing an appreciation for contemporary architecture with a warm material palette that is accessible and friendly, but not thematic, that is not an interpretation of another culture. It’s really about creating this kind of transparency, layered architecture that has rich materials and more materials communicated in a more contemporary format,” says Wright.

“I think it’s an interesting place where we are design wise,” says Ken Bassman of Bassman Blaine Home, who helps owners turn Montage residences into dream homes in Maui. “People want things to be more streamlined, clean and neutral. But it doesn’t mean that it’s bland or boring. There’s actually more color with artwork,” pillows and accessories. Wall coverings are back along with textural finishes and even a touch of glamour.

On the Big Island, designer Gina Willman says, “everyone is looking to ‘lighten and brighten’ their surroundings. We are lightening up walls by plastering or painting with hues significantly brighter than the ‘50 shades of beige’ phase of the 2000s. New homes are exploring lighter wood tones and cabinets.”

Revamped Interiors

Exterior architecture and elevations are only one transformation for homes. Inside, floor plans are being revamped as interiors undergo substantive alternations. “If I pull out a floor plan from 10 years ago, it would seem like a total disaster. There are things we would never do now,” shares Chris S. Texter, AIA, a principal at KTGY Architecture + Planning.

Open floor plans continue to define interiors. Living rooms are passé, often replaced by smaller rooms owners can configure however they want. And the jury is still out on separate dining rooms. James Rill, principal of an eponymous Washington, D.C. architectural firm, says dining rooms are often designed for alternate or dual uses such as a library.

Open plans are evolving to be more functional and nuanced. The intentional piece in open-concept design, observes Chicago designer Mary Cook, is the way these spaces are “high-performing, multitasking and they share their functions across rooms. People want the spaces to live better; they just don’t want to fill empty space.”

A variety of materials, warm hues and stone are contemporary hallmarks as shown in the Marmol Radziner designed inspiration home at Ascaya in Las Vegas.

Photo courtesy Boulderback 5.

Currently a dining room, this space is equally adaptable as an office, studio or play area. Pocket doors add to this versatility without interrupting the flow.

©David Tonnes dba. PanaViz Photography / Courtesy of Ken Bassman

Open to Innovation

Even in large homes, Visbeen says his firm looks for opportunities for more creative uses and more innovation. “If I had to say anything was the real trend, it would be innovation for us.”

“Creating spaces where the kitchen, living and dining all seamlessly merge together supports a more contemporary style of architecture,” Wright explains, adding, “we are doing it on a grand scale, but also in an intimate way to help support the cadence of a daily routine.”

Kitchens, particularly in upscale homes, capture even more square footage. “People are spending a lot more money in their kitchens,” says

Pamela Harvey, owner of Pamela Harvey Interiors in Washington, D.C.

In lieu of luxury mainstays such as Wolfe or Viking, many opt for even higher-end appliances including La Cornue, AGA and Bertazzoni. Colors are another growing preference for both cabinetry and appliances. And clients now want range hoods to be powder coated to match the cooking appliance. What’s trending for colors in kitchens is dark blue, Harvey adds.

Pantries are back and are more like those from 100 years ago. “Pantries are taking on a life of their own,” says Texter, referring to the need for more storage along with additional functionality in kitchens. Open-concept designs mean the kitchen is always on display, so back kitchens or a second kitchen area tucked out of the way (once a nice-to-have amenity) are now a luxury “must-have.”

They can range from an expanded pantry with additional counter space to corral counter clutter to a fully outfitted butler’s pantry, which at the highest price points might morph into a full-on catering kitchen.

More square footage is devoted to kitchens and pantries.

Photo by Stacy Zarin Goldberg / Courtesy Pam Harvey Interiors

New Connections

One of the most transformative changes in floor plans, the orientation of kitchens and great rooms and the experience of the home overall, comes from the way interiors now relate to the surrounding landscape. “Outdoor living spaces are an enormous part of our business and have been for years, but it has taken an even greater level,” observes Visbeen.

Ten years ago, outdoor living referred to patios, gardens and decks. Today, thresholds are blurred, and the division between inside and outside is almost nonexistent. “It used to be enough to have a sliding glass door or a French door that went to the backyard. And now it’s about how that indoor space expands and takes advantage of the fenestration. Then, there is the desire to have a room outside, and that wall just disappears, and the space doubles in size,” says Texter. “Now we’re practically designing the backyard to go with the home. That space is part of the home, and the design is integral.”

New technology is also a catalyst for this transformation. The cost of large windows and disappearing doors is much lower than before the recession. New products include more sizable expanses of glass, broader doors, doors that pivot, and windows and doors that wrap around corners, greatly expanding options to integrate inside and outside areas, visually and literally. Having sightlines that directly extend to an outside patio or room visually expand smaller rooms.

Metal frames also mean less weight and larger panes of glass, according to Rill. In traditional homes, renovations and additions almost always address the indoor/outdoor synergy. Rill says they use metal framed glass more frequently and, in some rooms, disappearing doors are replacing sliders and French doors. “People are moving toward something that’s a little sleeker, a little cleaner and a little more playfully modern, but still within traditional proportions and shapes.”

Today, thresholds are blurred, and the division between inside and outside is almost nonexistent.

©David Tonnes dba. PanaViz Photography / Courtesy of Ken Bassman

Authenticity, Not Opulence

A decade ago, luxury homes were often considered a testimony to status, and ostentatious demonstrations of affluence were acceptable. “During that era, it was in vogue that the more money you spend, the better it was. And after the recession, people came away from all of that. That heavy, goopy, layered, gilded aesthetic just evaporated. There was this yearning for authenticity,” explains Cook.

“Because of knowledge and images and travel that people are exposed to, they are more willing to be authentic to what they want instead of what is considered the norm. Also, people are moving away from that and it’s become more about what they want in their home and how they want their home to feel,” says Harvey. “They want their home to reflect who they are, whether they have a designer help them get there or not.”

Are homes getting smaller? Yes and no. Overall home sizes have seesawed since the recession, according to data from the National Association of Home Builders, but designers say how a space functions and is finished trumps size. “People are rightsizing more, so we’re seeing higher-end finishes in smaller square footage and the desire to use rooms more efficiently,” says Visbeen.

Rightsizing might be a trend, but signs that home sizes are beginning to creep up — especially for luxury properties — are prevelant. Since the recession, Gentemann sees the range of home sizes expanding. “Not only are there smaller homes, but larger homes as well.”

What has changed is the way additional square footage is used. “As square footage is going up, the walls are coming down and those spaces are opening up to each other. So those core areas where people come together are most important; I think what’s driving that is the casualness of life today and wanting to be able to come together,” explains Cook.

“People are looking for a graciousness of space, which is different than size,” says Ann Thompson, senior vice president of architecture and design at Related Midwest. “Consumers are very savvy now in a way we didn’t see 10 or 15 years ago. I think people are much more cautious and careful in their decision making. They are really assessing value.”

In the higher end, the more affluent the buyer, the more astute they are. “These are people who are very accomplished in their own field, and often that means they’re great decision makers. They’re researchers; they educate themselves about things in their life that are important to them and certainly their home is one of the most important decisions that they make,” shares Thompson.

Homes Are Resorts, and Resorts Are Homes

Increasingly home is seen as a refuge, a place to regroup and connect with families, which means primary homes are becoming more like resorts. Following resort trends, wellness is growing as a desired attitude, which means exercise spaces, a high level of air and water purification, steam showers and saunas are all desired amenities. “I think the overall trends in hospitality design and high-end residential continue to be largely influenced by travel, social media and the accessibility of high-end design that is reaching the consumer in general. There is a continual elevation of expectations,” shares Wright. On the other hand, second homes are becoming more like primary homes, with larger master closets and the addition of any needed features to equip the homes for year-round living. Offices are also another potential addition, as are larger kitchens.

Also, sustainable and energy-saving features, along with smart home technology, are no longer amenities. Rather, they are expected. Looking ahead, designers have a raft of features they see as most desirable. They include: hidden rooms, gun safe rooms, his and hers master baths, diverse wine storage areas, multiple detached structures, storm preparedness, backup generators, outdoor living on multiple levels of homes, and future elevator shafts. One innovative use in a Palmetto Bluff home, until the elevator is required, is to convert the space into a climbing wall, which keys into Visbeen’s observation that innovation might be the overarching trend.